Colorado Springs Sales Tax

Colorado Springs, nestled at the foot of the majestic Rocky Mountains, is a vibrant city with a thriving business landscape. One of the key considerations for both residents and businesses here is the sales tax, a crucial component of the city's revenue stream and economic framework. This article aims to provide an in-depth analysis of the Colorado Springs Sales Tax, covering its structure, rates, implications, and future prospects.

Understanding the Colorado Springs Sales Tax Landscape

The sales tax in Colorado Springs operates within a complex yet well-defined system, contributing significantly to the city’s financial stability and economic growth. Let’s delve into the intricacies of this tax structure.

The City’s Tax Structure: A Multi-Tiered Approach

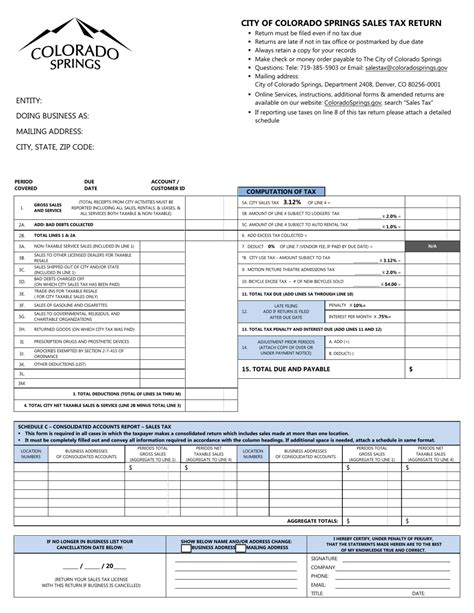

Colorado Springs, like many other municipalities in Colorado, employs a multi-tiered sales tax system. This system comprises several layers, each with its own unique rate and purpose. Understanding these tiers is crucial for businesses and consumers alike, as it provides insight into the economic framework of the city.

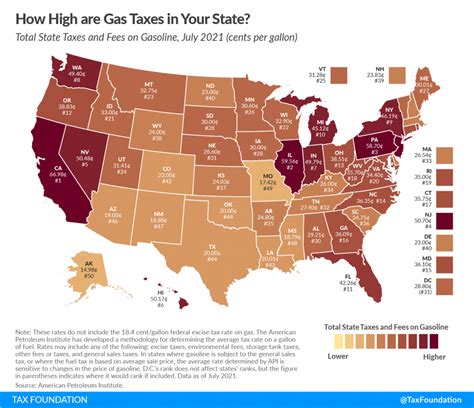

At the top level, we have the state sales tax, which is a uniform rate applied across the state of Colorado. This tax is levied on a wide range of goods and services and is a primary source of revenue for the state government. Currently, the state sales tax rate stands at 2.9%, one of the lower rates among U.S. states.

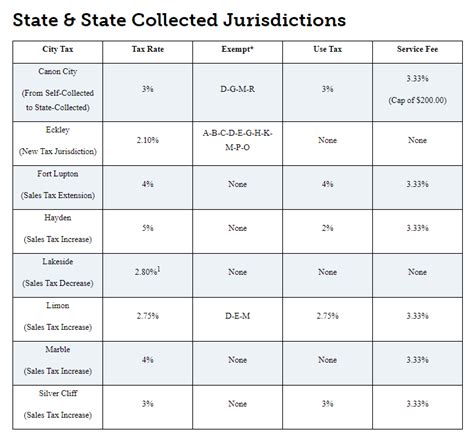

Below the state sales tax, we find the local sales tax, which is specific to Colorado Springs and is set by the city's governing body. This tax rate varies across different jurisdictions within the state, allowing cities like Colorado Springs to tailor their tax structure to their unique needs and economic goals. In Colorado Springs, the local sales tax rate is 3.1%, bringing the total sales tax rate in the city to 6%.

However, the tax structure doesn't stop there. Colorado Springs, like many other cities, also imposes a special district sales tax, which is designed to fund specific projects or services within the city. These special districts can be for a wide range of purposes, from transportation improvements to cultural initiatives. The rate of this tax varies depending on the district and its specific funding needs. For instance, the Colorado Springs Stadium District, which oversees the management and development of the city's sports facilities, levies an additional 0.1% sales tax, bringing the total sales tax rate within this district to 6.1%.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 2.9% |

| Local Sales Tax | 3.1% |

| Special District Sales Tax (e.g., Stadium District) | 0.1% |

The Impact on Businesses and Consumers

The sales tax structure in Colorado Springs has a significant impact on both businesses and consumers within the city. For businesses, the sales tax rate influences their pricing strategies, competitive positioning, and overall profitability. A higher sales tax rate can potentially drive up the cost of doing business and affect a company’s bottom line. However, it also provides a stable source of revenue for the city, which can be reinvested into the local economy through infrastructure development, job creation, and other economic initiatives.

From a consumer perspective, the sales tax rate directly affects their purchasing power and spending decisions. A higher sales tax can make goods and services more expensive, potentially influencing consumer behavior and preferences. However, the city's multi-tiered tax structure, with its varying rates for different districts and purposes, also offers a level of transparency and choice for consumers. They can make informed decisions about where to shop and spend, based on the tax rates in different areas of the city.

Analysis of Colorado Springs Sales Tax Performance

The sales tax in Colorado Springs has shown consistent growth and stability over the years, playing a pivotal role in the city’s economic development. Let’s take a closer look at its performance and the factors contributing to its success.

Historical Trends and Future Projections

According to recent data, the sales tax revenue in Colorado Springs has experienced a steady upward trajectory. In the last fiscal year, the city collected over $120 million in sales tax revenue, marking a 5% increase from the previous year. This growth can be attributed to several factors, including the city’s thriving tourism industry, robust local businesses, and the overall strength of the regional economy.

Looking ahead, experts project that the sales tax revenue in Colorado Springs will continue to grow at a healthy pace. The city's strategic location, coupled with its diverse economy and proactive business development initiatives, positions it well for future growth. Projections estimate that sales tax revenue could reach $135 million within the next five years, indicating a 12.5% growth rate over the period.

Comparative Analysis with Other Cities

When compared to other cities of similar size and economic profile, Colorado Springs stands out for its effective tax management and revenue generation. For instance, the city’s total sales tax rate of 6% is lower than that of many other major cities in the region, including Denver (7.62%) and Albuquerque (7.688%). This competitive tax rate makes Colorado Springs an attractive destination for businesses and consumers alike, contributing to its economic vibrancy.

Furthermore, the city's multi-tiered tax structure, with its ability to allocate tax revenue to specific districts and projects, sets it apart from many other municipalities. This approach ensures that tax revenue is directed towards the most pressing needs and initiatives within the city, fostering a sense of community and investment in the local economy.

Implications and Future Prospects

The sales tax in Colorado Springs has wide-ranging implications for the city’s economy, businesses, and residents. As we look towards the future, several key trends and considerations come into focus.

Economic Impact and Revenue Generation

The sales tax plays a pivotal role in funding essential city services and infrastructure projects. With a steady stream of revenue, Colorado Springs can invest in initiatives that drive economic growth and enhance the quality of life for its residents. These investments can range from improving transportation networks to supporting local businesses and promoting tourism.

Moreover, the sales tax provides a significant boost to the city's overall economic health. By generating substantial revenue, the tax helps to stabilize the city's finances, allowing for better planning and management of resources. This, in turn, can attract further investment and business opportunities, creating a positive cycle of economic growth and development.

Potential Challenges and Opportunities

While the sales tax has been a successful revenue generator for Colorado Springs, there are potential challenges on the horizon. The evolving landscape of e-commerce and online sales presents a unique set of considerations. As more consumers shift their purchasing habits online, the traditional sales tax model may need to adapt to capture this revenue stream effectively.

However, this challenge also presents an opportunity. By embracing innovative tax solutions and exploring new avenues for revenue generation, Colorado Springs can position itself at the forefront of economic development. The city can leverage its strong business environment, skilled workforce, and strategic location to attract e-commerce businesses and online platforms, further bolstering its economic prospects.

Conclusion: A Robust and Forward-Thinking Approach

In conclusion, the sales tax in Colorado Springs is a well-structured and effective revenue stream, contributing significantly to the city’s economic vitality and future prospects. With a multi-tiered approach, the city has the flexibility to allocate resources efficiently and meet the diverse needs of its residents and businesses.

As Colorado Springs continues to thrive and evolve, its sales tax system will play a crucial role in shaping the city's economic landscape. By staying adaptive and forward-thinking, the city can ensure that its tax structure remains a powerful tool for economic growth and community development.

How often are sales tax rates reviewed and adjusted in Colorado Springs?

+

Sales tax rates in Colorado Springs, like in many other jurisdictions, are typically reviewed on an annual basis. This review process involves a comprehensive assessment of the city’s economic health, projected revenue needs, and other relevant factors. Based on this analysis, the city’s governing body may decide to adjust the tax rates to align with the city’s financial goals and priorities.

Are there any sales tax exemptions or special considerations for specific industries in Colorado Springs?

+

Yes, Colorado Springs, like many other cities, offers certain sales tax exemptions and special considerations for specific industries. These exemptions are typically designed to support economic development and stimulate growth in targeted sectors. For instance, some cities provide sales tax incentives for new businesses, renewable energy projects, or certain types of manufacturing activities.

How does Colorado Springs compare to other cities in terms of its overall tax burden on businesses and consumers?

+

Colorado Springs is often considered to have a relatively competitive tax environment, especially when compared to other major cities in the region. The city’s total sales tax rate of 6% is lower than that of many neighboring cities, making it an attractive destination for businesses and consumers. This competitive tax rate contributes to the city’s economic vibrancy and can drive investment and growth.