Gas Tax In Ga

In the state of Georgia, the gas tax is a significant factor in the cost of fuel for residents and businesses. With the rising prices of gasoline, understanding the gas tax and its implications becomes crucial for both consumers and policymakers. This article aims to provide an in-depth analysis of the gas tax in Georgia, exploring its history, current structure, impact on the economy, and potential future changes.

The Evolution of Gas Tax in Georgia

The history of the gas tax in Georgia can be traced back to the early 20th century when the state first introduced a tax on gasoline to fund road construction and maintenance. Over the years, the gas tax has undergone several revisions and adjustments to keep up with changing economic conditions and infrastructure needs.

The first gas tax in Georgia was implemented in 1923, with a rate of 1 cent per gallon. This tax primarily aimed to support the development of a robust road network as the state's automobile industry began to flourish. As time passed, the tax rate was periodically adjusted to account for inflation and rising infrastructure costs.

A significant milestone in the history of Georgia's gas tax occurred in 1980 when the state legislature passed the Motor Fuel Excise Tax Act. This act established a fixed tax rate of 7 cents per gallon, which remained unchanged for over a decade. During this period, the tax revenue primarily went towards maintaining existing roads and bridges.

Recent Changes and Updates

In recent years, the gas tax in Georgia has undergone further transformations to address the state’s evolving transportation needs. In 2015, the Georgia General Assembly passed the Transportation Funding Act, which aimed to stabilize and increase funding for transportation projects.

Under this act, the gas tax was adjusted to a rate of 26 cents per gallon, with a portion of the revenue dedicated to specific transportation projects, including road improvements, transit systems, and pedestrian and bicycle infrastructure. Additionally, the act introduced a new formula for distributing gas tax revenue to local governments, ensuring that a significant portion of the funds were allocated to counties and municipalities.

| Year | Gas Tax Rate (per gallon) |

|---|---|

| 1923 | 1 cent |

| 1980 | 7 cents |

| 2015 | 26 cents |

Economic Impact and Consumer Considerations

The gas tax in Georgia has a direct impact on the state’s economy and the purchasing power of its residents. As the tax rate increases, it adds to the overall cost of gasoline, affecting consumer spending and business operations.

Price Fluctuations and Consumer Behavior

Gasoline prices are subject to market forces, but the gas tax plays a crucial role in determining the final price at the pump. When the tax rate increases, consumers may experience a noticeable impact on their fuel expenses, especially for those who rely heavily on personal vehicles for transportation.

Research suggests that higher gas taxes can lead to changes in consumer behavior. Some individuals may opt for more fuel-efficient vehicles or explore alternative transportation options, such as public transit or carpooling. However, for those with limited alternatives, the increased tax burden can be a significant financial strain.

Impact on Businesses and the Economy

The gas tax also affects businesses, particularly those in the transportation and logistics sectors. Higher fuel costs can impact their operational expenses, potentially leading to increased prices for goods and services. This, in turn, can influence the overall economic landscape of the state.

Additionally, the gas tax revenue generated by the state is not solely directed towards transportation infrastructure. A portion of the revenue is allocated to other areas, such as education, public safety, and healthcare, demonstrating the interconnectedness of various state programs and their reliance on gas tax revenue.

Performance Analysis and Future Outlook

Evaluating the performance of the gas tax in Georgia is essential to understanding its effectiveness and identifying areas for improvement. Several key factors come into play when assessing the tax’s performance.

Revenue Generation and Allocation

The gas tax is a significant source of revenue for the state, with billions of dollars generated annually. However, it is important to analyze how this revenue is allocated and whether it aligns with the state’s transportation and infrastructure needs.

A comprehensive review of the revenue allocation process can highlight areas where funds may be underutilized or misdirected. By optimizing the allocation process, the state can ensure that the gas tax revenue is effectively utilized to address critical transportation projects and improve overall infrastructure.

Transportation Infrastructure Development

The primary purpose of the gas tax is to fund transportation infrastructure. As such, it is crucial to assess the impact of the tax on the development and maintenance of roads, bridges, and other transportation networks.

By examining the state's infrastructure projects and their progress, policymakers can determine whether the gas tax revenue is sufficient to meet the growing demands of the transportation sector. This analysis can also identify any potential bottlenecks or inefficiencies in the infrastructure development process.

Potential Future Changes and Adjustments

As the state’s transportation needs continue to evolve, so too must the gas tax policy. Several potential future changes and adjustments could be considered to ensure the tax remains effective and responsive to changing circumstances.

- Indexation: Adjusting the gas tax rate based on inflation or other economic indicators can help maintain its purchasing power over time.

- Alternative Revenue Sources: Exploring additional revenue streams, such as road usage fees or vehicle mileage taxes, could provide a more sustainable funding source for transportation infrastructure.

- Performance-Based Funding: Allocating gas tax revenue based on the performance and impact of transportation projects could incentivize efficient and effective use of funds.

- Public-Private Partnerships: Engaging private sector involvement in transportation infrastructure projects could attract additional investment and expertise.

Conclusion: A Balancing Act

The gas tax in Georgia serves as a vital component of the state’s revenue system, providing funding for essential transportation infrastructure. However, it is a delicate balancing act, as increasing the tax rate can impact consumers and businesses, while an insufficient tax rate may hinder infrastructure development.

As Georgia continues to grow and its transportation needs evolve, policymakers must carefully consider the gas tax policy and its implications. By conducting thorough analyses, seeking public input, and staying abreast of best practices, the state can ensure that its gas tax remains fair, effective, and responsive to the needs of its residents and businesses.

How does the gas tax revenue benefit local governments in Georgia?

+The Transportation Funding Act of 2015 introduced a new formula for distributing gas tax revenue to local governments. This formula ensures that a significant portion of the funds are allocated to counties and municipalities, allowing them to address their specific transportation needs, such as road repairs and transit projects.

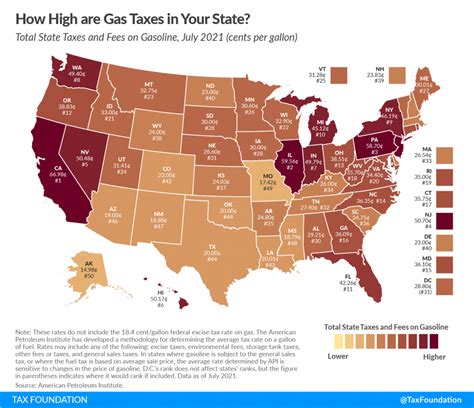

What is the current gas tax rate in Georgia, and how does it compare to other states?

+As of [current year], the gas tax rate in Georgia stands at 26 cents per gallon. This rate is relatively higher compared to some neighboring states, but it is important to note that the allocation and utilization of gas tax revenue can vary significantly between states.

Are there any plans to further increase the gas tax in Georgia?

+As of now, there are no immediate plans to increase the gas tax in Georgia. However, the state’s transportation needs are continuously assessed, and future adjustments may be considered based on infrastructure demands and economic conditions.