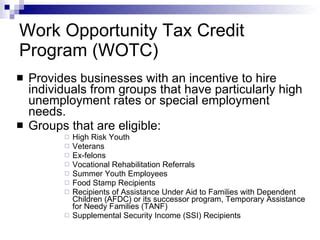

Work Opportunity Tax Credit Program

The Work Opportunity Tax Credit (WOTC) program is a significant initiative designed to encourage businesses to hire individuals who face barriers to employment, promoting diversity, inclusion, and economic growth. Established by the United States federal government, the WOTC program offers tax credits to eligible employers who hire qualified candidates from targeted groups. This initiative not only supports job creation but also plays a crucial role in reducing unemployment rates and empowering marginalized communities. In this article, we will delve into the intricacies of the WOTC program, exploring its benefits, eligibility criteria, and the impact it has on employers and employees alike.

Unveiling the Work Opportunity Tax Credit Program

The Work Opportunity Tax Credit program was introduced as part of the Small Business Job Protection Act of 1996, with the primary goal of incentivizing employers to broaden their hiring practices and embrace a more inclusive workforce. By offering tax incentives, the government aims to foster economic opportunities for individuals who may face challenges in securing employment due to various factors such as lack of recent work experience, disability, or socioeconomic background.

The WOTC program is administered by the Internal Revenue Service (IRS) and is subject to specific guidelines and regulations. Employers who meet the criteria and hire eligible individuals can claim tax credits, which can significantly reduce their tax liability and contribute to the financial health of their businesses. This incentive-based approach has proven to be an effective tool in promoting employment growth and social inclusion.

Benefits of the WOTC Program for Employers

The Work Opportunity Tax Credit program offers a range of advantages to employers who actively participate and meet the eligibility requirements. These benefits extend beyond the tax incentives and contribute to the overall success and growth of their businesses.

- Financial Savings: Employers can claim tax credits ranging from $1,200 to $9,600 per eligible employee, depending on the target group and the employee's qualifications. These credits can be utilized to offset federal income taxes, resulting in substantial financial savings for businesses.

- Talent Acquisition: The WOTC program provides access to a diverse talent pool, enabling employers to hire skilled individuals who may have been previously overlooked. This expands the pool of qualified candidates and enhances the overall quality of the workforce.

- Improved Community Relations: By actively participating in the WOTC program, employers demonstrate their commitment to social responsibility and community development. This positive image can enhance their reputation and foster stronger relationships with local communities and stakeholders.

- Government Support: The program receives support from various government agencies, ensuring that employers have access to resources and guidance throughout the hiring process. This includes assistance with screening and selecting eligible candidates, streamlining the hiring process, and ensuring compliance with regulations.

Eligibility Criteria for Employers and Employees

Both employers and employees must meet specific criteria to qualify for the Work Opportunity Tax Credit program. Understanding these eligibility requirements is crucial for businesses aiming to take advantage of this incentive.

Employer Eligibility

To be eligible for the WOTC program, employers must meet the following criteria:

- Registered Business: The employer must be a private or public corporation, partnership, sole proprietorship, or a tax-exempt organization. Government entities are generally not eligible.

- Qualified Hiring Practices: Employers must demonstrate that they have implemented qualified hiring practices, which involve actively seeking and hiring individuals from targeted groups. This includes advertising job openings and conducting interviews with eligible candidates.

- Tax Identification Number: A valid Employer Identification Number (EIN) is required for tax purposes.

- Compliance with Labor Laws: Employers must adhere to all applicable federal, state, and local labor laws, including minimum wage regulations, overtime pay, and employment discrimination laws.

Employee Eligibility

Employees must belong to one or more of the following targeted groups to qualify for the WOTC program:

- Qualified Veterans: This includes veterans who have served on active duty in the U.S. military and have been discharged or released under specific conditions, such as receiving a Purple Heart or being a member of the Selected Reserve.

- Qualified Ex-Felons: Individuals who have been convicted of a felony or a misdemeanor and are currently unemployed or underemployed. They must also meet certain residency requirements.

- Qualified Recipients of Assistance: This group includes individuals who receive Temporary Assistance for Needy Families (TANF) benefits, Supplemental Nutrition Assistance Program (SNAP) benefits, or certain disability benefits. They must also meet specific work requirements.

- Qualified Summer Youth Employees: Young individuals aged 16 to 24 who reside in designated high-unemployment areas and face significant barriers to employment.

- Qualified Long-Term Family Assistance Recipients: Individuals who have received long-term assistance through certain welfare programs and meet specific work and residency requirements.

Claiming the Work Opportunity Tax Credit

Employers who wish to claim the Work Opportunity Tax Credit must follow a specific process to ensure compliance and maximize their tax benefits.

- Pre-Screening and Hiring: Before hiring an eligible employee, employers should pre-screen candidates to determine their eligibility for the WOTC program. This involves verifying their membership in one of the targeted groups and ensuring they meet the necessary criteria.

- Employer Certification: Employers must complete and submit Form 8850, Pre-Screening Notice and Certification Request, to their designated state workforce agency within 28 days of hiring the employee. This form serves as an official request for certification and initiates the process.

- State Agency Review: The state workforce agency reviews the Form 8850 and determines the employee's eligibility for the WOTC program. They may request additional information or documentation from the employer to support the claim.

- Employment and Targeted Group Membership: The employee must begin work within the specified timeframe (generally 90 days) and maintain employment for a minimum period to qualify for the tax credit. Additionally, they must remain a member of the targeted group during this period.

- Claiming the Credit: Once the employee has met the employment and targeted group membership requirements, the employer can claim the tax credit on their federal income tax return using Form 5884, Work Opportunity Credit. The credit is calculated based on the employee's wages and the specific target group they belong to.

| Target Group | Maximum Tax Credit |

|---|---|

| Qualified Veterans | $9,600 |

| Qualified Ex-Felons | $2,400 |

| Qualified Recipients of Assistance | $2,400 |

| Qualified Summer Youth Employees | $1,200 |

| Qualified Long-Term Family Assistance Recipients | $2,400 |

Impact and Success Stories

The Work Opportunity Tax Credit program has had a significant impact on both employers and employees, fostering positive outcomes and success stories.

Employee Empowerment: The WOTC program has empowered individuals from targeted groups by providing them with employment opportunities and a pathway to financial stability. By offering tax incentives to employers, the program encourages businesses to create jobs specifically for these individuals, reducing unemployment rates and improving their economic prospects.

Diverse Workforces: Employers who participate in the WOTC program often benefit from a more diverse and inclusive workforce. By hiring individuals from various backgrounds, they gain access to unique skill sets, perspectives, and experiences. This diversity not only enhances creativity and innovation within the organization but also improves employee morale and engagement.

Community Development: The WOTC program contributes to the overall development and growth of local communities. By creating job opportunities for individuals who face barriers to employment, the program reduces social disparities and promotes economic equality. This, in turn, strengthens community bonds and fosters a more inclusive society.

Long-Term Benefits: The impact of the WOTC program extends beyond the initial tax credits. Employers who hire eligible individuals often find that these employees bring long-term value to the organization. Many businesses report increased productivity, improved customer satisfaction, and enhanced problem-solving capabilities as a result of their diverse workforce.

Frequently Asked Questions

How long does an employee need to work to qualify for the WOTC program?

+The minimum employment period required for an employee to qualify for the WOTC program varies depending on the target group they belong to. For most target groups, the employee must work for at least 120 hours or 4 weeks during the first 12 months of employment. However, for qualified summer youth employees, the minimum employment period is 80 hours or 2 weeks.

Can employers claim the WOTC for multiple employees from the same target group?

+Yes, employers can claim the WOTC for multiple employees from the same target group, provided they meet all the eligibility criteria. There is no limit to the number of employees from the same target group for whom an employer can claim the credit.

Are there any restrictions on the type of work for which the WOTC can be claimed?

+The WOTC program applies to a wide range of employment opportunities, including full-time, part-time, and seasonal jobs. However, certain types of work, such as domestic service in a private home, are generally not eligible for the credit. Employers should consult the IRS guidelines for specific restrictions and eligibility criteria.

Can employers claim the WOTC for existing employees who become eligible after being hired?

+No, the WOTC program is intended for newly hired employees. Employers cannot claim the credit for existing employees who become eligible for the program after their initial hiring date.

What happens if an employee leaves the job before the minimum employment period is completed?

+If an employee leaves the job before completing the minimum employment period, the employer may still be eligible for a partial credit. The amount of the credit will depend on the actual number of hours worked by the employee. It’s important to consult the IRS guidelines for specific calculations and requirements.