St Louis City Personal Property Tax

The St. Louis City Personal Property Tax is an important aspect of the city's tax system, impacting both residents and businesses alike. This tax, often overlooked, plays a significant role in funding various city services and initiatives. In this comprehensive guide, we will delve into the intricacies of the St. Louis City Personal Property Tax, exploring its definition, implications, and the steps involved in its assessment and payment.

Understanding the St. Louis City Personal Property Tax

The St. Louis City Personal Property Tax is a levy imposed on tangible personal property owned by individuals or businesses within the city limits of St. Louis, Missouri. This tax is distinct from real estate taxes, as it specifically targets movable assets rather than real property. Personal property, in this context, includes a wide range of items such as vehicles, furniture, machinery, equipment, and even certain business inventory.

The tax is an essential revenue stream for the city, contributing significantly to its overall budget. It is used to fund vital services like public safety, education, infrastructure maintenance, and other public initiatives. The revenue generated from personal property taxes ensures the smooth operation and development of the city, benefiting its residents and businesses.

Assessing Personal Property for Taxation

The process of assessing personal property for taxation in St. Louis City involves a systematic approach to ensure fairness and accuracy. Here’s a breakdown of the key steps involved:

Personal Property Assessment Schedule

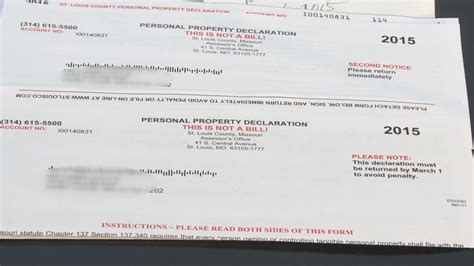

Each year, the St. Louis City Assessor’s Office issues a Personal Property Assessment Schedule to all individuals and businesses that are subject to personal property taxes. This schedule serves as a reminder and provides instructions for reporting personal property assets.

Reporting Personal Property

Taxpayers are required to report their personal property holdings accurately. This includes providing details such as the type of property, its acquisition date, purchase price, and any applicable depreciation. The reporting process is typically done through an online platform provided by the city, ensuring convenience and efficiency.

Assessment by the Assessor’s Office

Once the personal property reports are submitted, the Assessor’s Office evaluates the information provided. They verify the accuracy of the reported assets and may conduct additional research or field inspections to ensure fairness and consistency in the assessment process. This step is crucial to maintain an equitable tax system.

Notices of Assessment

After the assessment process, the Assessor’s Office issues Notices of Assessment to taxpayers. These notices detail the assessed value of the personal property and the corresponding tax liability. Taxpayers are encouraged to review these notices carefully and contact the Assessor’s Office if any discrepancies or concerns arise.

Personal Property Tax Rates and Calculations

The personal property tax rates in St. Louis City are determined by the Board of Aldermen and can vary based on the type of property and its intended use. Here’s an overview of the tax rates and how they are calculated:

Residential Personal Property Tax Rates

For residential personal property, the tax rate is typically expressed as a percentage of the assessed value. The rate can vary depending on factors such as the property’s location within the city and any applicable exemptions or abatements.

| Property Type | Tax Rate (%) |

|---|---|

| Vehicles | 0.75% |

| Furniture and Appliances | 1.25% |

| Other Personal Property | 1.5% |

Commercial Personal Property Tax Rates

Commercial personal property tax rates are typically higher than residential rates. The rates are determined based on the property’s classification and intended use. Here’s a simplified table outlining some commercial rates:

| Property Type | Tax Rate (%) |

|---|---|

| Machinery and Equipment | 2.5% |

| Inventory (Wholesale) | 1.75% |

| Inventory (Retail) | 2.0% |

It's important to note that these rates are subject to change and may vary based on specific circumstances. Taxpayers are advised to consult the official tax guidelines provided by the St. Louis City Finance Department for the most accurate and up-to-date information.

Payment of Personal Property Taxes

Once taxpayers receive their Notices of Assessment, they are responsible for paying their personal property taxes in a timely manner. Here’s an overview of the payment process:

Payment Due Dates

Personal property taxes in St. Louis City are typically due by a specific date each year. Late payments may incur penalties and interest, so it’s crucial to adhere to the designated due dates.

Payment Methods

Taxpayers have several convenient options for paying their personal property taxes. These include online payment portals, payment by mail, and in-person payments at designated city offices. The city aims to provide a user-friendly and accessible payment system to accommodate different preferences.

Discounts and Installment Plans

To encourage timely payments, the city may offer discounts for early payments. Additionally, taxpayers facing financial difficulties may be eligible for installment plans, allowing them to pay their taxes in multiple payments over a specified period.

Challenging Personal Property Tax Assessments

Taxpayers who believe their personal property tax assessment is inaccurate or unfair have the right to challenge it. The process typically involves the following steps:

Filing a Protest

Taxpayers must file a formal protest with the St. Louis City Board of Assessment Appeals within a specified timeframe. This protest should clearly state the reasons for the challenge and provide supporting documentation.

Appeal Hearing

Once a protest is filed, the Board of Assessment Appeals schedules a hearing to review the case. Taxpayers are given the opportunity to present their arguments and evidence before an independent panel.

Decision and Appeal Options

After the hearing, the Board makes a decision, which is then communicated to the taxpayer. If the taxpayer is dissatisfied with the decision, they may have the option to appeal to a higher authority, such as the Missouri State Tax Commission.

Personal Property Tax Exemptions and Abatements

St. Louis City offers certain exemptions and abatements to reduce the tax burden on specific types of personal property or for eligible taxpayers. These provisions aim to encourage economic development and support certain industries or individuals.

Common Exemptions

- Personal property owned by charitable or religious organizations may be exempt from taxation.

- Some agricultural equipment and machinery may be eligible for reduced tax rates.

- Certain types of inventory, such as raw materials or work in progress, may be exempt from personal property taxes.

Abatements and Incentive Programs

The city may offer abatements or incentive programs to attract businesses and stimulate economic growth. These programs often provide tax breaks or deferrals for a specified period to encourage investment and job creation.

Conclusion: A Vital Component of St. Louis City’s Fiscal Health

The St. Louis City Personal Property Tax is a critical component of the city’s fiscal structure, providing a stable revenue stream to fund essential services and drive economic development. By understanding the assessment process, tax rates, and payment options, taxpayers can navigate the system effectively and ensure compliance. Additionally, being aware of potential exemptions and challenges provides taxpayers with the tools to manage their tax liabilities efficiently.

Frequently Asked Questions

How often are personal property taxes assessed in St. Louis City?

+

Personal property taxes are assessed annually. Taxpayers receive a Personal Property Assessment Schedule each year, reminding them to report their personal property holdings.

Are there any penalties for late payment of personal property taxes?

+

Yes, late payments of personal property taxes may incur penalties and interest. It’s important to pay taxes by the designated due date to avoid additional charges.

Can I appeal my personal property tax assessment if I disagree with it?

+

Yes, taxpayers have the right to appeal their personal property tax assessments. The process involves filing a formal protest and attending a hearing before the Board of Assessment Appeals.

Are there any online resources available to help me understand my personal property tax obligations?

+

Yes, the St. Louis City Finance Department provides an online resource center with detailed information, guidelines, and frequently asked questions related to personal property taxes. It’s an excellent starting point for taxpayers seeking clarity.

Can I pay my personal property taxes online?

+

Absolutely! St. Louis City offers an online payment portal, allowing taxpayers to pay their personal property taxes conveniently and securely from the comfort of their homes.