Illinois State Sales Tax

The Illinois State Sales Tax is a vital component of the state's revenue system, playing a significant role in funding various public services and infrastructure projects. With a complex structure and a range of applicable rates, understanding the Illinois State Sales Tax is crucial for both businesses and consumers. This article aims to provide an in-depth analysis of this tax, covering its history, current status, and future implications.

A Comprehensive Overview of Illinois State Sales Tax

The Illinois State Sales Tax, a vital revenue source for the state, has a rich history and a unique structure that sets it apart from many other states. Let’s delve into the intricacies of this tax system.

The Historical Context

The journey of the Illinois State Sales Tax began in the 1930s, during the Great Depression. It was introduced as a means to generate much-needed revenue for the state without imposing heavy burdens on individuals and businesses. The initial rate was set at 2%, making it one of the first states in the nation to implement a sales tax.

Over the years, the tax has undergone several significant changes. In the 1960s, a major reform was implemented, shifting the focus from a purely state-controlled tax to one with more local control. This reform allowed municipalities and counties to impose their own additional sales taxes, a system that is still in place today.

The Current Landscape

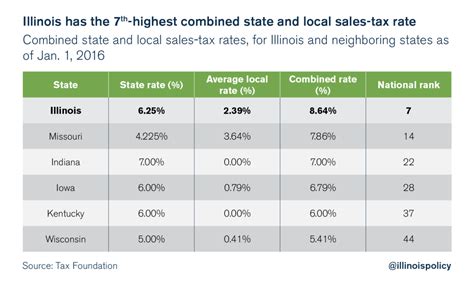

As of [current date], the Illinois State Sales Tax operates on a two-tiered system. The base state tax rate is currently set at 6.25%, which is applicable to most tangible goods and certain services. However, this is just the beginning of the story, as the tax landscape in Illinois is far more complex.

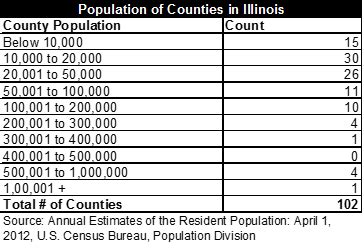

In addition to the state tax, local governments have the authority to impose their own sales taxes. These local taxes can vary significantly, with rates ranging from 0% to 3.75% across the state. This means that the total sales tax rate can differ considerably depending on the location of the transaction.

| County/Municipality | Local Sales Tax Rate | Combined Rate |

|---|---|---|

| Cook County | 1.25% | 7.5% |

| DuPage County | 1.75% | 8% |

| Will County | 1% | 7.25% |

| Kane County | 1.75% | 8% |

| Lake County | 1.25% | 7.5% |

The table above provides a glimpse into the varying rates across different counties. These local taxes are often used to fund specific projects or initiatives, such as transportation improvements or public safety enhancements.

Exemptions and Special Considerations

While the majority of goods and services are subject to the Illinois State Sales Tax, there are certain exemptions and special cases to be aware of. These include:

- Groceries: Essential food items are exempt from the sales tax, providing some relief to households on a budget.

- Prescription Drugs: Medications purchased with a valid prescription are not taxed, making healthcare more accessible.

- Clothing: Most clothing items are exempt, with the exception of certain luxury apparel.

- Manufacturing: Sales tax is not applicable to the purchase of raw materials and equipment for manufacturing purposes.

- Agricultural Products: Farmers and agricultural businesses benefit from sales tax exemptions on their purchases.

Compliance and Administration

For businesses, navigating the Illinois State Sales Tax can be a complex task. The Illinois Department of Revenue is responsible for administering and enforcing the tax. Businesses are required to register with the Department, collect the appropriate taxes, and remit them on a regular basis.

The compliance process involves a series of steps, including:

- Registering for a Sales Tax Permit: This permit allows businesses to collect and remit sales taxes.

- Determining the Applicable Tax Rate: Businesses must be aware of the state tax rate and any local taxes applicable to their location.

- Collecting and Remitting Taxes: Sales taxes are collected from customers at the point of sale and must be remitted to the Department on a regular basis.

- Filing Returns: Businesses are required to file sales tax returns, usually on a monthly or quarterly basis.

Non-compliance can result in penalties and interest charges, making it crucial for businesses to stay informed and up-to-date with their sales tax obligations.

Economic Impact and Future Outlook

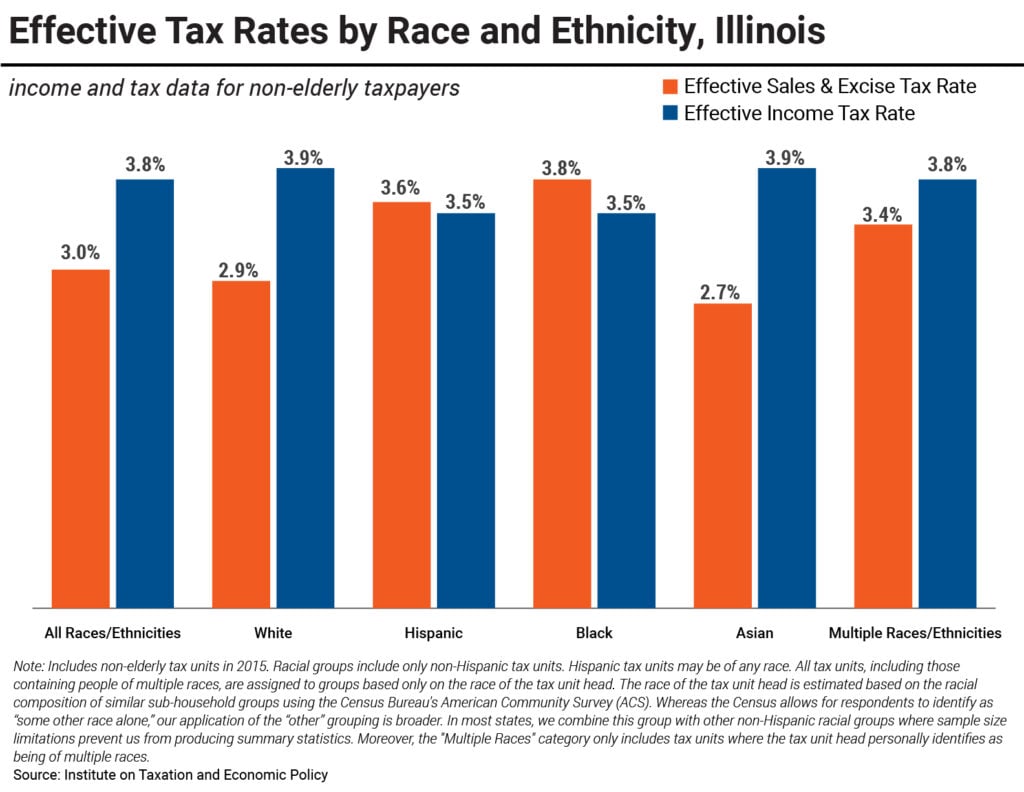

The Illinois State Sales Tax has a significant impact on the state’s economy. It provides a stable source of revenue, funding essential public services and infrastructure. However, the tax also has its critics, with some arguing that it can disproportionately affect lower-income households and small businesses.

Looking ahead, the future of the Illinois State Sales Tax is likely to be shaped by a number of factors. These include economic trends, political decisions, and the evolving nature of consumer spending. As online shopping continues to grow, the state may need to adapt its tax policies to ensure a fair and efficient system.

Frequently Asked Questions

What is the current state sales tax rate in Illinois?

+

The current state sales tax rate in Illinois is 6.25%.

Are there any counties or municipalities with higher sales tax rates than the state rate?

+

Yes, several counties and municipalities in Illinois have higher sales tax rates. For instance, Cook County has a local sales tax rate of 1.25%, resulting in a combined rate of 7.5%.

What are the consequences of not complying with sales tax obligations in Illinois?

+

Non-compliance with sales tax obligations in Illinois can result in penalties, interest charges, and potential legal consequences. It is important for businesses to stay informed and fulfill their sales tax responsibilities.

Are there any plans to reform the Illinois State Sales Tax system in the near future?

+

While there have been discussions and proposals for sales tax reform in Illinois, no concrete plans have been announced as of [current date]. The future of the tax system remains a topic of debate and speculation.

How can businesses stay updated on changes to the Illinois State Sales Tax regulations?

+

Businesses can stay informed by regularly checking the Illinois Department of Revenue’s website for updates and announcements. They can also subscribe to relevant newsletters and consult with tax professionals for expert guidance.