State Income Tax Arkansas

Arkansas, nestled in the heart of the United States, is renowned for its rich history, diverse landscapes, and thriving communities. Among the many considerations for residents and businesses alike, understanding the state's income tax landscape is paramount. In this comprehensive guide, we will delve into the intricacies of Arkansas income tax, offering a detailed analysis of its rates, brackets, deductions, and the unique features that set it apart.

Arkansas Income Tax: A Comprehensive Overview

The Arkansas income tax system is designed to generate revenue for the state, supporting vital services and infrastructure. It operates on a progressive scale, meaning that higher incomes are taxed at progressively higher rates. This approach ensures fairness and contributes to the state’s economic sustainability.

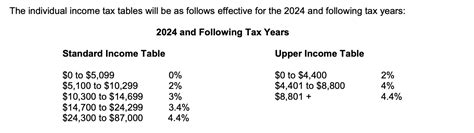

Income Tax Rates and Brackets

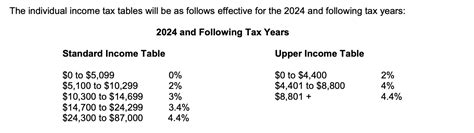

Arkansas employs a multi-bracket income tax system, categorizing taxable income into distinct brackets. As of [current year], these brackets and their corresponding tax rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0 to $2,500 | 1.0% |

| $2,501 to $4,000 | 2.0% |

| $4,001 to $6,000 | 3.0% |

| $6,001 to $8,000 | 4.0% |

| Above $8,000 | 5.9% |

These brackets are subject to periodic adjustments to account for inflation and economic changes. It's crucial for taxpayers to stay informed about any updates to ensure accurate tax calculations.

Deductions and Exemptions

Arkansas offers a range of deductions and exemptions to ease the tax burden on individuals and families. These include:

- Standard Deduction: Taxpayers can opt for a standard deduction, which simplifies the process and provides a basic level of tax relief. The standard deduction amount varies based on filing status.

- Personal Exemptions: Arkansas allows personal exemptions for taxpayers and their dependents, further reducing taxable income.

- Itemized Deductions: Taxpayers can itemize deductions for various expenses, including medical costs, charitable donations, and certain tax-related fees. This approach benefits those with significant eligible expenses.

It's important to note that the availability and specifics of deductions may change over time, so consulting the latest guidelines is essential for accurate tax planning.

Filing and Payment Options

Arkansas provides convenient options for taxpayers to file their returns and make payments. The state’s official website offers an online filing system, allowing individuals to complete the process digitally. For those who prefer traditional methods, paper forms are available for download and submission by mail.

Payment options include direct debit, credit card, and electronic funds transfer. Taxpayers can also choose to pay by check or money order, providing flexibility to suit various financial preferences.

Tax Credits and Incentives

To encourage economic growth and support specific initiatives, Arkansas provides a range of tax credits and incentives. These include:

- Earned Income Tax Credit (EITC): The EITC is a federal credit with a state counterpart, providing a refund for low- to moderate-income workers. It aims to reduce the tax burden for working families.

- Research and Development Credit: Businesses engaged in research and development activities can benefit from this credit, which incentivizes innovation and technological advancements.

- Historic Preservation Credit: Arkansas offers incentives for the restoration and preservation of historic properties, promoting the state's cultural heritage.

Exploring these credits and incentives can provide significant tax savings for eligible individuals and businesses.

Tax Refund and Processing Times

Arkansas aims to process tax refunds promptly, typically within [specific timeframe]. The state’s efficient system ensures that taxpayers receive their refunds in a timely manner.

However, it's important to note that factors like errors, missing information, or complex returns may impact processing times. Staying informed about the status of your refund through the state's official website is advisable.

Arkansas Income Tax: Key Considerations

Understanding the nuances of Arkansas income tax is essential for both individuals and businesses. Here are some key considerations to keep in mind:

- Progressive Tax System: Arkansas' progressive tax structure ensures that higher incomes contribute proportionally more to the state's revenue, promoting fairness and economic stability.

- Regular Updates: Tax laws and regulations are subject to change. Staying informed about updates is crucial to avoid surprises and ensure compliance.

- Deduction Strategies: Exploring and maximizing deductions can significantly reduce taxable income. Consulting with tax professionals can provide valuable insights into optimizing deductions.

- Online Resources: Arkansas' official website is a valuable resource, offering comprehensive information, forms, and updates. It's a reliable source for taxpayers seeking guidance.

Comparative Analysis: Arkansas vs. Other States

Arkansas’ income tax system stands out when compared to other states. While some states have higher tax rates, Arkansas’ progressive approach and various deductions make it relatively competitive. Additionally, the state’s focus on tax incentives and credits sets it apart, providing opportunities for taxpayers to optimize their financial strategies.

Conclusion: Navigating Arkansas Income Tax

Understanding and navigating Arkansas income tax is a crucial aspect of financial planning for residents and businesses. By familiarizing themselves with the state’s tax rates, brackets, deductions, and incentives, taxpayers can make informed decisions and optimize their tax strategies.

Staying informed about tax updates and utilizing the state's resources effectively are key to ensuring compliance and maximizing potential savings. Arkansas' progressive tax system, combined with its dedication to supporting economic growth through incentives, creates a unique and dynamic tax landscape.

When is the Arkansas income tax filing deadline for the current year?

+

The deadline for Arkansas income tax filing is typically April 15th, aligning with the federal deadline. However, it’s important to note that this date may vary in certain circumstances, such as weekends or state-specific holidays. Taxpayers should consult the official Arkansas tax website for the most accurate and up-to-date information.

Are there any special tax credits or deductions for homeowners in Arkansas?

+

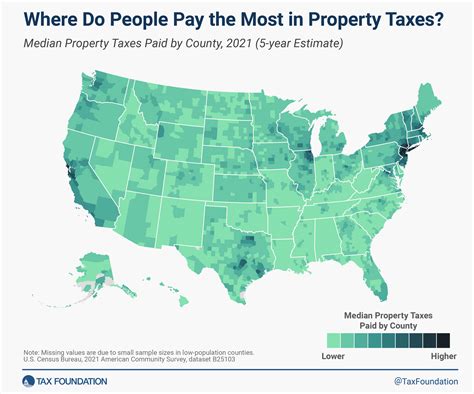

Yes, Arkansas offers several tax credits and deductions for homeowners. These include the Homestead Credit, which provides a tax credit for eligible homeowners, and the Home Improvement Credit, which encourages home improvements by offering a tax credit for qualified expenses. Additionally, Arkansas allows deductions for mortgage interest and property taxes, providing further relief for homeowners.

What are the income tax rates for corporations in Arkansas?

+

Arkansas imposes a flat corporate income tax rate of 6% on corporate taxable income. This rate applies to all corporations doing business in the state, regardless of their size or industry. However, it’s important to note that there may be additional taxes and fees applicable to specific industries or business structures.

Are there any sales tax exemptions in Arkansas for specific goods or services?

+

Arkansas does offer sales tax exemptions for certain goods and services. These include exemptions for food, prescription drugs, and certain agricultural products. Additionally, there are exemptions for educational materials, textbooks, and machinery used in manufacturing. It’s important to stay updated on the specific exemptions, as they can vary based on legislative changes.