Personal Property Tax Virginia

The concept of personal property tax is an essential aspect of the taxation system in Virginia, contributing significantly to the state's revenue stream. This tax is levied on various types of personal property owned by individuals and businesses, and it plays a crucial role in funding essential public services and infrastructure projects.

In Virginia, personal property tax is a critical component of the state's comprehensive tax system. It is a vital source of revenue for local governments, including counties, cities, and towns, allowing them to provide essential services to their residents. Understanding the nuances of personal property tax in Virginia is key to comprehending the financial landscape of the state and the responsibilities of property owners.

Understanding Personal Property Tax in Virginia

Personal property tax in Virginia is a tax assessed annually on tangible personal property owned by individuals or businesses as of January 1st of each year. This tax is an essential revenue source for local governments, including counties, cities, and towns, and is used to fund a wide range of public services and initiatives.

The tax applies to various types of personal property, including motor vehicles, boats, motorcycles, recreational vehicles, and business equipment. It is calculated based on the assessed value of the property, with the tax rate varying depending on the jurisdiction in which the property is located. Each locality sets its own tax rate, and these rates can differ significantly across the state.

Taxable Personal Property

The scope of taxable personal property in Virginia is quite broad. It includes not only the aforementioned vehicles but also furniture, fixtures, machinery, tools, and other business-related items. However, there are certain exclusions and exemptions that property owners should be aware of. For instance, personal property used exclusively for religious, charitable, or educational purposes may be exempt from taxation.

| Category | Taxable Personal Property |

|---|---|

| Vehicles | Cars, trucks, motorcycles, boats, trailers, and other motor vehicles |

| Equipment | Machinery, tools, and fixtures used in business operations |

| Recreational Items | Recreational vehicles, campers, and similar items |

| Miscellaneous | Furniture, jewelry, and other personal belongings (with some exclusions) |

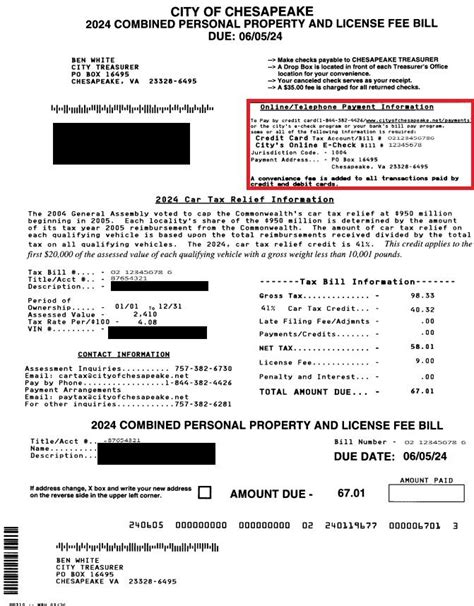

Assessment and Tax Rates

The assessment process for personal property tax in Virginia involves determining the fair market value of the property. This value is then subject to a specified percentage, known as the assessment ratio, to arrive at the assessed value. The assessed value is the basis on which the tax is calculated.

The tax rates, expressed in dollars per hundred dollars of assessed value ($100), are set by each locality and can change annually. These rates are often influenced by the budgetary needs of the locality and the types of services it provides. It's essential for property owners to stay informed about the tax rates in their area to understand their tax obligations accurately.

Filing and Payment Procedures

The filing and payment procedures for personal property tax in Virginia are designed to be straightforward and efficient. Property owners are typically sent a personal property tax form by their local tax office, which must be completed and returned by a specified deadline.

This form requires detailed information about the personal property owned, including make, model, year, and value. Once the form is processed, the tax office will issue a tax bill, outlining the amount due and the payment due date. Property owners have the option to pay their tax bill in full or choose a payment plan, depending on the policies of their locality.

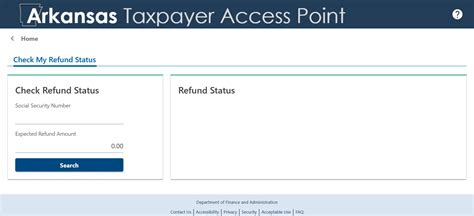

Online Filing and Payment Options

To enhance convenience and efficiency, many localities in Virginia offer online filing and payment options for personal property tax. Property owners can access their local tax office’s website to complete the tax form electronically and submit it securely. Online payment portals also allow for quick and easy payment of the tax bill using various methods, including credit cards, debit cards, and electronic checks.

These online services provide real-time updates on tax balances and payment statuses, ensuring that property owners can stay informed about their tax obligations at all times. Additionally, many localities offer email or text alerts to notify property owners about upcoming deadlines and tax-related matters.

Exemptions and Relief Programs

Virginia offers various exemptions and relief programs to assist certain property owners with their personal property tax obligations. These programs aim to provide financial relief to eligible individuals and businesses, ensuring that the tax burden is fair and equitable.

Homestead Exemption

The Homestead Exemption program provides tax relief to Virginia residents who own and occupy their primary residence. Eligible homeowners can apply for this exemption, which can reduce the assessed value of their home by up to $6,000, resulting in lower property taxes. This exemption is particularly beneficial for low- and middle-income households, helping them manage their tax liabilities effectively.

Senior Citizen and Disabled Person Relief

Virginia also offers tax relief programs specifically tailored for senior citizens and disabled individuals. These programs can provide significant reductions in personal property tax liability for eligible individuals. The criteria for eligibility and the extent of relief vary based on the individual’s income, assets, and disability status.

Other Exemptions

In addition to the aforementioned exemptions, Virginia offers various other exemptions for personal property tax. These include exemptions for military personnel, charitable organizations, and agricultural and forestry equipment. Each exemption has its own set of criteria and requirements, and property owners should consult the relevant guidelines to determine their eligibility.

Appeals and Dispute Resolution

If a property owner disagrees with the assessed value of their personal property or believes they have been incorrectly assessed, Virginia provides a formal appeals process. This process allows property owners to challenge the assessment and seek a fair resolution.

Filing an Appeal

To initiate an appeal, property owners must first contact their local tax office to discuss their concerns. If the issue cannot be resolved informally, the owner can file a formal appeal with the local commissioner of the revenue or the board of equalization. This appeal must be filed within a specified timeframe, typically within a few months of receiving the tax assessment notice.

The appeal process involves presenting evidence and arguments to support the owner's position. This may include comparative market data, appraisals, or other relevant documentation. The commissioner or board will then review the appeal and make a determination, which can result in a change to the assessed value or a confirmation of the original assessment.

Dispute Resolution

In cases where an appeal is unsuccessful or the property owner is still dissatisfied with the outcome, Virginia provides additional avenues for dispute resolution. This may involve appealing to higher authorities, such as the Virginia Department of Taxation, or seeking legal counsel to further pursue the matter.

It's important for property owners to understand their rights and responsibilities throughout the appeals process. This includes knowing the timelines for filing appeals, the documentation required, and the potential outcomes. Being well-informed can help property owners navigate this process effectively and increase their chances of a favorable resolution.

Conclusion

Personal property tax in Virginia is a vital component of the state’s tax system, playing a crucial role in funding essential public services and maintaining local infrastructure. Understanding the assessment process, tax rates, filing procedures, and available exemptions is key to navigating this tax obligation successfully.

By staying informed about the personal property tax landscape in Virginia, property owners can ensure they are compliant with their tax obligations and take advantage of any applicable exemptions or relief programs. This knowledge empowers individuals and businesses to contribute effectively to their local communities while managing their financial responsibilities.

FAQ

What happens if I don’t pay my personal property tax in Virginia?

+Failure to pay personal property tax in Virginia can result in penalties, interest, and potential legal consequences. The specific penalties may vary depending on the locality, but they typically include late payment fees and accrued interest on the outstanding amount. In some cases, non-payment can lead to a lien being placed on the property, which could affect its sale or transfer.

Are there any discounts or incentives for early payment of personal property tax?

+Some localities in Virginia offer discounts or incentives for early payment of personal property tax. These incentives can include reduced interest rates or waivers on certain fees. It’s advisable to check with your local tax office to determine if any such programs are available in your area.

Can I deduct personal property tax from my federal or state income tax returns?

+Yes, personal property tax paid in Virginia can be deducted from your federal and state income tax returns. This deduction can help reduce your overall tax liability. However, it’s important to consult with a tax professional or refer to the relevant tax guidelines to ensure you meet all the requirements for claiming this deduction.

How often do personal property tax rates change in Virginia?

+Personal property tax rates in Virginia can change annually. Each locality sets its own tax rate based on its budgetary needs and the services it provides. It’s advisable to stay updated with the tax rates in your locality to accurately calculate your tax liability each year.