Cross River Bank Tax Refund

Welcome to a comprehensive guide on the topic of tax refunds and the role played by Cross River Bank, a leading financial institution. In this article, we will delve into the intricacies of tax refunds, explore how Cross River Bank facilitates this process, and provide valuable insights for individuals seeking to navigate the world of tax refunds efficiently and securely.

Understanding Tax Refunds

Tax refunds are a vital aspect of financial management, offering individuals and businesses an opportunity to reclaim overpaid taxes from the government. This process typically occurs when the amount of taxes withheld from an individual’s income exceeds the actual tax liability for the year. Tax refunds can be a significant financial boost, providing individuals with extra funds to manage their financial goals, investments, or unforeseen expenses.

The Internal Revenue Service (IRS) in the United States is responsible for processing tax returns and issuing refunds. The IRS aims to process tax returns within 21 days of receipt, provided there are no errors or issues with the return. However, the actual timeline can vary based on factors such as the complexity of the return, the method of filing, and the volume of returns received by the IRS.

Tax refunds are a critical financial tool, and understanding the process, timelines, and potential issues is essential for effective financial planning. This guide aims to provide a comprehensive overview, with a particular focus on the role of Cross River Bank in facilitating tax refund processes.

Cross River Bank: A Trusted Financial Partner

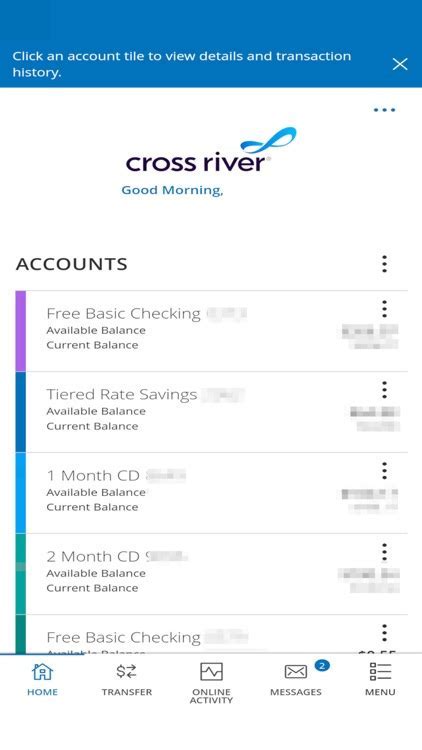

Cross River Bank, a federally chartered bank headquartered in Fort Lee, New Jersey, has established itself as a trusted financial institution with a focus on innovation and customer-centric services. With a strong presence in the digital banking space, Cross River Bank offers a range of financial solutions, including tax refund processing, that cater to the evolving needs of its customers.

The bank's commitment to security, regulatory compliance, and customer satisfaction has positioned it as a reliable partner for individuals and businesses seeking efficient tax refund solutions. Cross River Bank's digital platforms and robust infrastructure ensure a seamless experience, from the initial filing of tax returns to the swift processing and disbursement of refunds.

The bank's expertise in tax refund processing extends to various refund scenarios, including those related to personal income taxes, business taxes, and even specialized refund situations such as stimulus checks. Cross River Bank's comprehensive approach to tax refund management ensures that its customers receive their refunds promptly and securely.

Key Features of Cross River Bank’s Tax Refund Services

- Efficient Processing: Cross River Bank leverages advanced technology and a streamlined process to ensure swift tax refund processing. The bank’s digital platforms enable customers to track their refund status in real-time, providing transparency and peace of mind.

- Secure Transactions: Security is a top priority for Cross River Bank. The institution employs robust encryption protocols and multi-factor authentication to safeguard customer data and transactions. This ensures that tax refunds are processed securely, protecting customers from potential fraud or identity theft.

- Direct Deposit Convenience: Cross River Bank offers direct deposit as a preferred method for tax refund disbursement. This option eliminates the need for physical checks and provides customers with immediate access to their funds, making it a convenient and efficient choice.

- Customer Support: The bank’s dedicated customer support team is readily available to assist with any tax refund-related inquiries or issues. Whether it’s tracking a refund, understanding the status of a return, or resolving any potential delays, Cross River Bank’s support staff provide timely and knowledgeable assistance.

Tax Refund Timelines and Factors

The timeline for receiving a tax refund can vary based on several factors. While the IRS aims to process returns within a specified timeframe, delays can occur due to various reasons, including:

- Return Complexity: Returns with complex transactions or deductions may require additional review, leading to potential delays.

- Filing Method: Electronic filing typically results in faster processing times compared to paper returns.

- Error or Issue Detection: If the IRS identifies errors or discrepancies in the return, it may trigger a delay to ensure accuracy and compliance.

- Refund Type: Different refund types, such as those related to specific tax credits or programs, may have varying processing timelines.

To illustrate the potential variations in refund timelines, consider the following table, which provides estimated processing times for different refund scenarios based on data from the IRS:

| Refund Scenario | Estimated Processing Time |

|---|---|

| Simple Return with Direct Deposit | 7-10 days |

| Complex Return with Paper Filing | 4-6 weeks |

| Stimulus Check Refund | 2-4 weeks |

| Business Tax Refund | 6-8 weeks |

It's important to note that these estimates are based on typical scenarios and may vary based on individual circumstances. Cross River Bank's tax refund services are designed to navigate these variables efficiently, ensuring that customers receive their refunds as promptly as possible.

Tips for Expediting Tax Refunds

While the IRS and financial institutions like Cross River Bank work diligently to process tax refunds efficiently, there are steps individuals can take to potentially expedite the process. Here are some tips to consider:

- Electronic Filing: Opt for electronic filing whenever possible. It's faster, more secure, and reduces the risk of errors compared to paper returns.

- Direct Deposit: Choose direct deposit as the preferred method for refund disbursement. It eliminates the wait time associated with receiving a physical check and provides immediate access to funds.

- Review for Accuracy: Carefully review your tax return before filing to ensure accuracy. Errors or discrepancies can trigger delays and potential audits, prolonging the refund process.

- Monitor Status: Utilize online tools provided by the IRS and your financial institution to track the status of your refund. This allows you to stay informed and take action if any issues arise.

Specialized Tax Refund Scenarios

While the majority of tax refunds relate to personal income taxes, there are specialized refund scenarios that require unique consideration. Cross River Bank’s expertise extends to these specialized cases, ensuring that customers receive the support and guidance they need.

Stimulus Checks and Economic Impact Payments

In response to economic challenges, the US government has issued stimulus checks or economic impact payments to eligible individuals and families. These payments, intended to provide financial relief, are processed and distributed through the tax refund system. Cross River Bank plays a crucial role in facilitating the distribution of these payments, ensuring that eligible individuals receive their stimulus checks promptly.

Business Tax Refunds

Businesses, too, are eligible for tax refunds, particularly if they have overpaid their taxes or have qualifying tax credits. Cross River Bank’s tax refund services are tailored to meet the needs of businesses, providing a seamless process for filing and receiving business tax refunds. This includes efficient handling of complex business tax returns and prompt disbursement of refunds.

Refund Anticipation Loans (RALs)

Refund Anticipation Loans (RALs) are a financial product offered by some tax preparation companies and financial institutions. RALs provide taxpayers with an advance on their expected tax refund, typically within 24 hours of filing their return. While RALs can be a convenient option for those in need of immediate funds, it’s important to note that these loans come with associated fees and interest rates. Cross River Bank does not offer RALs directly but provides customers with alternative options to access their refunds promptly and securely.

The Future of Tax Refunds: Digital Innovation

The tax refund landscape is evolving, driven by technological advancements and a growing emphasis on digital solutions. Cross River Bank, at the forefront of digital banking, is actively shaping the future of tax refund processes.

Digital Tools and Enhanced Security

Cross River Bank continues to invest in digital tools and technologies to enhance the tax refund experience. This includes the development of secure online platforms that provide real-time refund tracking, instant notifications, and seamless integration with tax preparation software. By leveraging these digital innovations, Cross River Bank ensures that customers have a convenient, secure, and transparent tax refund process.

Data Analytics and Predictive Modeling

Cross River Bank is exploring the use of advanced data analytics and predictive modeling to optimize tax refund processes. By analyzing historical data and identifying patterns, the bank can anticipate potential delays or issues, allowing for proactive interventions. This approach not only enhances the efficiency of refund processing but also strengthens the bank’s ability to provide accurate refund timelines and customer support.

Blockchain and Smart Contracts

Cross River Bank is investigating the potential of blockchain technology and smart contracts to revolutionize tax refund processes. Blockchain, with its inherent security and transparency, could streamline refund transactions, reduce the risk of fraud, and provide an immutable record of refund activities. Smart contracts, self-executing contracts with predefined rules, could automate various stages of the refund process, further enhancing efficiency and accuracy.

Conclusion: Empowering Financial Freedom

Tax refunds represent an essential aspect of financial management, offering individuals and businesses an opportunity to reclaim overpaid taxes and achieve their financial goals. Cross River Bank, with its commitment to innovation and customer-centric services, plays a pivotal role in facilitating tax refund processes, ensuring that customers receive their refunds promptly and securely.

From its efficient processing capabilities to its emphasis on security and customer support, Cross River Bank has established itself as a trusted partner in the tax refund journey. As the tax refund landscape continues to evolve, driven by digital innovation and technological advancements, Cross River Bank remains at the forefront, shaping a future where tax refunds are seamlessly integrated into the financial lives of its customers.

Whether it's navigating the complexities of personal income taxes, managing business tax refunds, or providing support for specialized refund scenarios, Cross River Bank stands ready to empower individuals and businesses to achieve financial freedom and security.

How long does it typically take to receive a tax refund through Cross River Bank’s services?

+The timeline for receiving a tax refund can vary based on several factors, including the complexity of the return, the filing method, and any potential issues with the return. However, Cross River Bank’s efficient processing capabilities and direct deposit option can significantly expedite the process. On average, customers can expect to receive their tax refund within 7-10 days when filing electronically and opting for direct deposit.

What happens if there’s an issue with my tax return, and it triggers a delay in the refund process?

+If the IRS identifies an issue or discrepancy with your tax return, it may trigger a delay in the refund process to ensure accuracy and compliance. In such cases, the IRS will typically send a notice or letter explaining the issue and requesting additional information. It’s important to promptly respond to such notices to resolve the issue and expedite the refund process. Cross River Bank’s customer support team can provide guidance and assistance throughout this process.

Can I track the status of my tax refund online through Cross River Bank’s platforms?

+Yes, Cross River Bank provides online tools and platforms that allow customers to track the status of their tax refund in real-time. By logging into their account, customers can access up-to-date information on the progress of their refund, including the processing stage and estimated disbursement date. This transparency ensures that customers stay informed and can take action if any issues arise.

Are there any fees associated with receiving a tax refund through Cross River Bank’s services?

+Cross River Bank does not charge any fees for processing tax refunds. However, it’s important to note that if you opt for a tax preparation service or utilize a third-party platform for filing your taxes, they may charge fees for their services. Additionally, if you choose to receive your refund through a Refund Anticipation Loan (RAL), there may be associated fees and interest rates. Cross River Bank does not offer RALs directly, but provides alternative options for prompt refund access.