Occupational Privilege Tax

The Occupational Privilege Tax (OPT), also known as the Occupational Tax or the License Tax, is a revenue-generating mechanism implemented by various jurisdictions across the United States. This tax targets individuals engaged in specific occupations or professions, and its primary purpose is to raise funds for local government operations and public services. While the concept of an occupational tax is not new, its implementation and structure can vary significantly from one region to another, leading to a complex and sometimes confusing landscape for professionals and entrepreneurs.

This comprehensive guide aims to demystify the Occupational Privilege Tax, providing an in-depth analysis of its nature, its historical context, and its practical implications for those subject to it. By understanding the intricacies of this tax, professionals can better navigate their financial obligations and contribute effectively to the communities they serve.

Historical Context and Purpose of Occupational Privilege Taxes

The roots of occupational taxes can be traced back to ancient civilizations, where various forms of taxation were levied on specific trades and professions. In modern times, these taxes have evolved to become an essential component of local government funding strategies, particularly in the United States.

The primary purpose of Occupational Privilege Taxes is to ensure that those who benefit from the services and infrastructure provided by local governments contribute to their maintenance and development. This tax is seen as a fair and equitable way to distribute the financial burden of public services among those who directly utilize them. By targeting specific occupations, jurisdictions can tailor their tax policies to the local economic landscape and the needs of their communities.

Key Characteristics of Occupational Privilege Taxes

Occupational Privilege Taxes are typically flat taxes, meaning they apply uniformly to all individuals engaged in a particular occupation, regardless of their income or earnings. This differs from progressive income taxes, which are structured to increase the tax rate as income rises. OPTs are often seen as a way to simplify the tax system for certain professions, reducing administrative burdens for both taxpayers and tax authorities.

One of the unique aspects of Occupational Privilege Taxes is their localized nature. These taxes are typically imposed by municipalities, counties, or other local governing bodies, allowing for flexibility in tax rates and policies to suit the specific needs and economic conditions of the region. This local control can lead to significant variations in tax rates and requirements from one jurisdiction to another, even within the same state.

| Jurisdiction | Tax Rate | Taxable Occupations |

|---|---|---|

| City of Denver | 0.22% of gross receipts | Contractors, Salespeople, Consultants |

| Montgomery County, MD | $20 per person per year | All employees working in the county |

| City of Houston | $50 per person per year | Peddlers, Solicitors, Canvassers |

The table above provides a glimpse into the diversity of OPT structures. Each jurisdiction may have unique requirements, exemptions, and enforcement mechanisms, making it crucial for professionals to understand the specific rules applicable to their location.

Occupational Privilege Tax in Practice: Real-World Examples

To illustrate the practical implications of Occupational Privilege Taxes, let’s explore two real-world scenarios involving different occupations and jurisdictions.

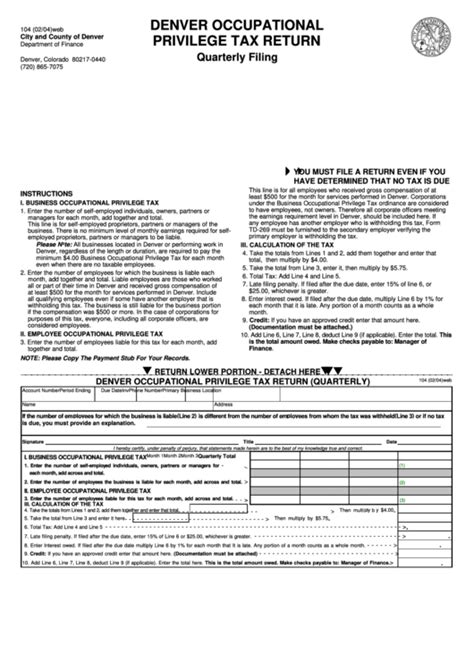

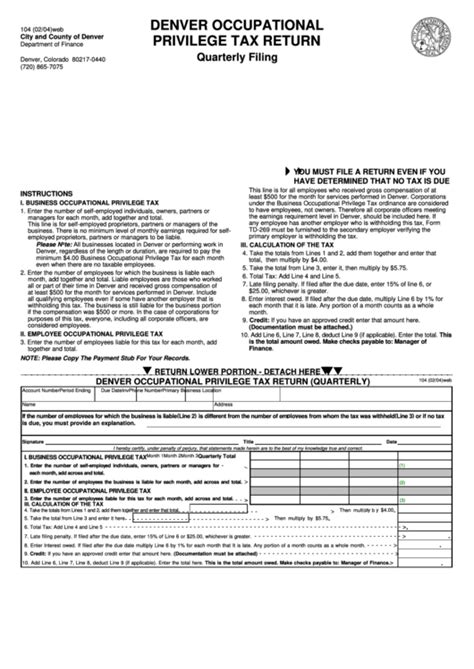

Scenario 1: Self-Employed Contractor in Denver, CO

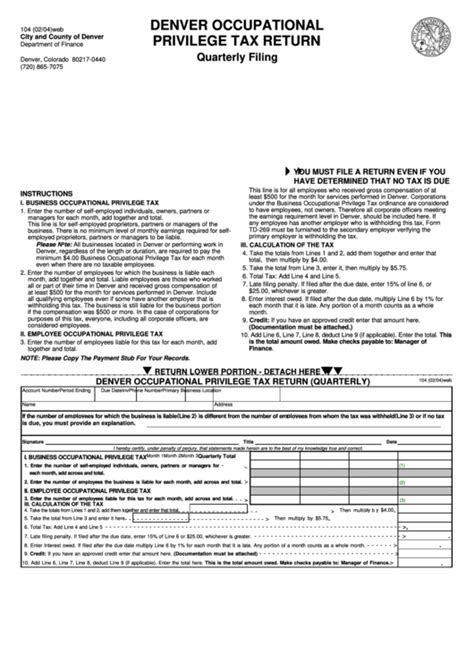

John, a self-employed general contractor in Denver, Colorado, faces an Occupational Privilege Tax obligation based on the city’s tax ordinance. Denver’s OPT is calculated as 0.22% of the contractor’s gross receipts from all sources. This tax applies to a wide range of occupations, including construction workers, salespeople, and consultants.

For John, this means that a significant portion of his income is subject to the OPT. As a self-employed individual, he must not only pay the tax but also manage the administrative tasks associated with it, such as tracking his gross receipts and making timely payments to the city. Failure to comply with these obligations can result in penalties and interest, impacting John's financial stability and business reputation.

Scenario 2: Employee Working in Montgomery County, MD

Sarah, an office worker employed by a local company in Montgomery County, Maryland, is subject to the county’s Occupational Privilege Tax. In this case, the OPT is a flat rate of $20 per person per year, applicable to all employees working in the county. This tax is typically paid by the employer on behalf of the employee and is included as a line item on the employee’s annual wage and tax statement (W-2 form).

While the tax amount is relatively small, it is a mandatory contribution that Sarah, along with all other employees in the county, must make to support local government operations. This tax ensures that everyone who benefits from the county's services, such as infrastructure, public safety, and social programs, contributes to their upkeep.

Implications for Taxpayers and the Community

The implementation of Occupational Privilege Taxes has significant implications for both taxpayers and the communities they live in.

Financial Obligations for Taxpayers

For individuals and businesses subject to OPT, the tax represents an additional financial burden. This burden can be particularly significant for self-employed individuals, who may already face challenges in managing their finances and tax obligations. OPTs can also impact pricing strategies, as businesses may need to factor in the tax when setting their rates or fees.

The administrative tasks associated with OPT compliance can also be time-consuming and complex. Taxpayers may need to track their income, file regular tax returns, and stay updated with any changes in tax laws and regulations. Failure to comply with these obligations can lead to penalties and legal issues, further complicating the tax landscape for professionals.

Benefits for the Community

On the other hand, Occupational Privilege Taxes provide a crucial source of revenue for local governments, enabling them to fund essential public services and infrastructure. These taxes ensure that the cost of maintaining roads, schools, emergency services, and other community amenities is distributed fairly among those who benefit from them.

By contributing to the OPT, taxpayers like John and Sarah are directly supporting their local communities. This tax system allows for a more equitable distribution of financial responsibilities, ensuring that everyone who benefits from local services contributes to their upkeep. The revenue generated from OPTs can lead to improved public services, enhanced infrastructure, and a higher quality of life for residents.

Navigating Occupational Privilege Taxes: Strategies and Tips

Given the complexity and diversity of Occupational Privilege Taxes, professionals and businesses subject to these taxes must adopt strategic approaches to manage their financial obligations effectively.

Stay Informed and Updated

The first step in managing OPT obligations is to stay informed about the tax laws and regulations applicable to your occupation and jurisdiction. This involves regularly checking for updates and changes in tax policies, as well as understanding the specific requirements and exemptions associated with your profession.

Many local governments provide online resources, including tax guides, FAQs, and contact information for tax-related inquiries. Utilizing these resources can help you stay updated and ensure compliance with the latest tax regulations.

Seek Professional Advice

Navigating the intricacies of OPTs can be challenging, especially for those who are new to self-employment or have complex tax situations. Seeking professional advice from tax consultants or accountants can provide valuable insights and guidance tailored to your specific circumstances.

Tax professionals can help you understand the financial implications of OPTs, advise on strategies to minimize tax burdens, and ensure that you meet all your tax obligations in a timely and accurate manner. This can be especially beneficial when dealing with complex tax scenarios or when there is a high risk of non-compliance due to the specific nature of your occupation.

Implement Efficient Tax Management Systems

To manage OPT obligations effectively, it’s crucial to implement efficient tax management systems. This includes keeping accurate records of income, expenses, and tax payments. Utilizing accounting software or spreadsheets can help you track your financial transactions and calculate your tax liabilities accurately.

Additionally, consider setting aside a portion of your income specifically for tax payments. This can help you manage your cash flow more effectively and ensure that you have the necessary funds to meet your OPT obligations without impacting your business operations or personal finances.

The Future of Occupational Privilege Taxes: Trends and Predictions

As the landscape of taxation continues to evolve, it’s essential to consider the potential future developments and trends related to Occupational Privilege Taxes.

Increasing Digitalization of Tax Systems

The digitalization of tax systems is a global trend, and it is likely to impact the administration of OPTs as well. Many jurisdictions are already moving towards digital tax filing and payment systems, which can simplify the tax process for taxpayers and tax authorities alike.

Digital tax systems can provide real-time updates on tax obligations, enable secure online payment options, and streamline the tax filing process. This shift towards digitalization can make OPT compliance more accessible and efficient, reducing administrative burdens for taxpayers and tax administrators.

Potential Expansion of Taxable Occupations

With the evolving nature of the gig economy and the increasing diversification of the workforce, there may be a trend towards expanding the range of occupations subject to OPTs. This could include professionals in the gig economy, such as rideshare drivers, freelance writers, and other independent contractors, who may not have traditionally been subject to such taxes.

As the gig economy continues to grow, jurisdictions may seek to broaden their tax base by including more occupations under the OPT umbrella. This expansion could provide additional revenue for local governments while ensuring that a larger portion of the workforce contributes to the financial upkeep of their communities.

Focus on Tax Fairness and Equity

There is a growing emphasis on tax fairness and equity, particularly in the context of OPTs. Jurisdictions are increasingly recognizing the need to ensure that tax obligations are distributed fairly among different occupations and income levels. This may lead to adjustments in tax rates or the introduction of progressive tax structures within the OPT framework.

By implementing fair and equitable tax policies, local governments can maintain public trust and ensure that their tax systems align with the principles of social justice and economic sustainability.

Are Occupational Privilege Taxes the same across all states and jurisdictions?

+No, Occupational Privilege Taxes can vary significantly from one state to another and even within different jurisdictions within a state. Each locality has the power to set its own tax rates, applicable occupations, and enforcement mechanisms. This localized approach allows for tax policies to be tailored to the specific needs and economic conditions of the region.

Who is typically responsible for paying the Occupational Privilege Tax?

+The responsibility for paying the OPT depends on the specific tax structure and occupation. In some cases, the tax is paid directly by the individual engaged in the occupation. For example, self-employed professionals or independent contractors often have to pay the OPT themselves. In other cases, particularly for employees, the tax may be paid by the employer on behalf of the employee, with the cost incorporated into the overall business expenses.

How can I find out if I am subject to an Occupational Privilege Tax in my area?

+To determine whether you are subject to an OPT in your area, you can start by checking with your local tax authority or municipality. They will have information on the specific tax laws and regulations applicable to your occupation and jurisdiction. Additionally, many localities provide online resources, including tax guides and FAQs, which can help you understand your tax obligations.