Fica Tax Exemption

In the world of international business and taxation, the concept of Fica Tax Exemption is a crucial aspect that warrants thorough understanding and exploration. This article aims to delve into the intricacies of Fica Tax Exemption, providing an in-depth analysis of its implications, eligibility criteria, and its role in facilitating cross-border transactions.

Understanding Fica Tax Exemption

Fica Tax Exemption, derived from the acronym for the Federal Insurance Contributions Act, is a provision within the U.S. tax system that allows certain entities or individuals to be exempted from paying Fica taxes under specific circumstances. This exemption plays a pivotal role in simplifying international business transactions and promoting economic growth.

The Fica tax, which includes Social Security and Medicare taxes, is typically levied on earned income such as salaries, wages, and self-employment income. However, through the Fica Tax Exemption, eligible entities can avoid these tax contributions, making it a significant consideration for businesses operating across borders.

Eligibility and Criteria

Determining eligibility for Fica Tax Exemption involves a nuanced understanding of various factors. While the exact criteria may vary based on specific circumstances, there are some common elements that are typically considered:

- International Agreements: Many Fica Tax Exemptions arise from bilateral or multilateral tax treaties between the U.S. and other countries. These agreements often specify the conditions under which individuals or entities from a treaty partner country are exempt from Fica taxes.

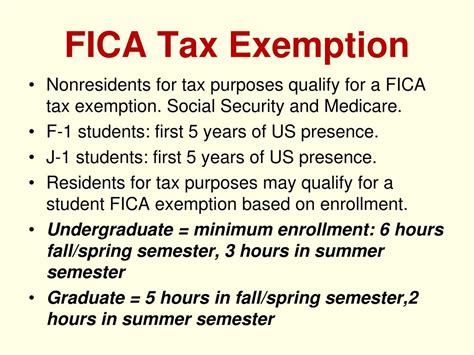

- Residence Status: The residence status of an individual or entity is crucial. Non-resident aliens or foreign entities with limited U.S. ties may qualify for Fica Tax Exemption if they meet specific requirements outlined in the Internal Revenue Code (IRC) and relevant regulations.

- Nature of Income: The type of income earned is another critical factor. Fica taxes generally apply to earned income, but certain types of income, such as investment income or certain types of compensation, may be exempt under specific conditions.

- Duration of Stay: In some cases, the duration of an individual's stay in the U.S. can impact their Fica Tax Exemption eligibility. Short-term visitors or those with temporary visas might be exempt if their stay does not exceed a certain period.

Application Process and Considerations

Obtaining Fica Tax Exemption requires a meticulous process that involves careful documentation and compliance with relevant tax laws and regulations. Here’s an overview of the key steps and considerations:

Determining Eligibility

The first step is to assess whether an individual or entity meets the eligibility criteria. This often involves a detailed analysis of tax treaties, residence status, and the nature of income. Consulting with tax professionals or legal experts specializing in international tax law is advisable during this phase.

Filing Requirements

Once eligibility is established, the next step is to understand the specific filing requirements. This may include obtaining and completing the appropriate tax forms, such as Form W-8BEN (Certificate of Foreign Status) or Form W-8ECI (Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States). The choice of form depends on the nature of the income and the entity’s specific circumstances.

Documenting Exemption

To claim Fica Tax Exemption, individuals or entities must provide supporting documentation to substantiate their eligibility. This may include copies of tax treaties, residence certificates, or other relevant legal documents. Maintaining a thorough record of these documents is essential for compliance and potential audits.

Renewal and Updates

Fica Tax Exemptions are not permanent and often require periodic renewal or updates. The renewal process may involve submitting updated forms or providing additional documentation to demonstrate continued eligibility. Staying informed about changes in tax laws and regulations is crucial to ensure compliance and avoid potential penalties.

Implications and Benefits

Fica Tax Exemption can have significant implications for businesses and individuals operating in the international arena. Here are some key benefits and considerations:

Cost Savings

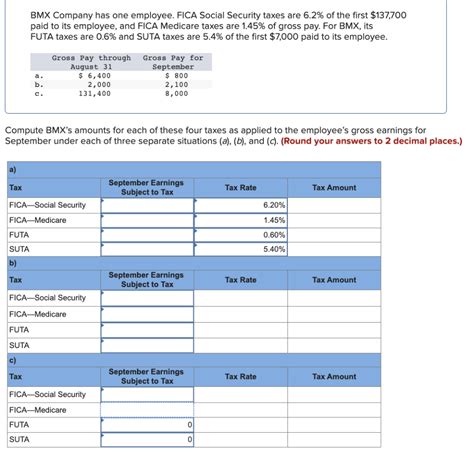

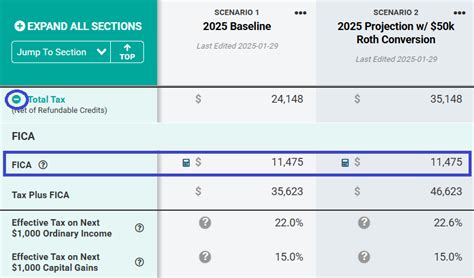

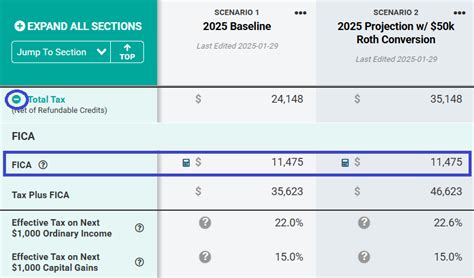

The most immediate advantage of Fica Tax Exemption is the reduction in tax liabilities. By avoiding Fica taxes, businesses and individuals can realize substantial cost savings, especially for those with significant income or a large number of employees. This can improve cash flow and profitability, particularly for startups or small businesses with limited financial resources.

Simplified Compliance

Fica Tax Exemption can simplify the tax compliance process for international entities. With reduced tax obligations, businesses can focus more on their core operations and strategic initiatives rather than navigating complex tax regulations. This simplification can enhance overall efficiency and reduce administrative burdens.

Attracting Foreign Investment

For countries seeking to attract foreign investment and talent, Fica Tax Exemption can be a powerful incentive. By offering tax exemptions, governments can make their jurisdictions more attractive to foreign businesses and professionals, fostering economic growth and innovation. This can be particularly beneficial for developing nations looking to boost their economies.

Enhanced International Relations

The existence of Fica Tax Exemption in tax treaties can strengthen international relations and foster collaboration between countries. Tax treaties often promote economic cooperation and provide a framework for resolving tax-related disputes, leading to a more harmonious global business environment.

Challenges and Considerations

While Fica Tax Exemption offers numerous benefits, it is not without its challenges and considerations. Here are some potential pitfalls and areas of caution:

Complex Eligibility Criteria

Determining eligibility for Fica Tax Exemption can be complex and may require a deep understanding of tax laws and regulations. The criteria can vary based on specific circumstances, making it essential for businesses and individuals to seek professional advice to navigate these complexities effectively.

Compliance and Audit Risks

Obtaining Fica Tax Exemption comes with the responsibility of maintaining compliance with relevant tax laws. Failure to meet the eligibility criteria or provide accurate documentation can lead to audits and potential penalties. It is crucial to stay updated with changing tax regulations and consult with tax professionals to ensure ongoing compliance.

Limited Duration and Renewal

Fica Tax Exemptions are often time-bound and require periodic renewal. The renewal process can be complex, and failing to renew in a timely manner can result in unexpected tax liabilities. Businesses and individuals must stay vigilant about renewal deadlines to avoid unnecessary complications.

Country-Specific Variations

The specific provisions and criteria for Fica Tax Exemption can vary widely between countries. Tax treaties may have different terms and conditions, and some countries may not offer Fica Tax Exemption at all. Understanding the unique requirements of each jurisdiction is essential for international businesses operating across multiple countries.

Case Study: Fica Tax Exemption in Action

To illustrate the practical application of Fica Tax Exemption, let’s consider a case study involving a multinational corporation, ABC Inc., and its subsidiary in Country X.

ABC Inc., a U.S.-based technology company, established a subsidiary in Country X to tap into the local market and expand its global presence. The subsidiary employs local talent and generates significant revenue through sales and operations in Country X.

By leveraging the tax treaty between the U.S. and Country X, ABC Inc. was able to secure Fica Tax Exemption for its subsidiary. This exemption allowed the subsidiary to avoid paying Fica taxes on the salaries of its local employees, resulting in substantial cost savings. The exemption also simplified the subsidiary's tax compliance process, allowing it to focus on its core business objectives.

The Fica Tax Exemption not only benefited ABC Inc. financially but also contributed to the subsidiary's success in Country X. With reduced tax obligations, the subsidiary was able to invest more in research and development, product innovation, and local community initiatives, further strengthening its position in the market.

| Metric | Before Fica Tax Exemption | After Fica Tax Exemption |

|---|---|---|

| Annual Fica Tax Savings | $250,000 | $0 |

| Research & Development Budget | $500,000 | $750,000 |

| Community Investment | $100,000 | $150,000 |

Conclusion: Navigating the Fica Tax Exemption Landscape

In conclusion, Fica Tax Exemption is a critical aspect of international tax law that can significantly impact businesses and individuals operating across borders. By understanding the eligibility criteria, navigating the application process, and considering the implications and benefits, entities can leverage this exemption to their advantage.

However, it is essential to approach Fica Tax Exemption with caution and a deep understanding of the associated challenges and considerations. Seeking professional guidance and staying updated with tax law changes are crucial to ensuring compliance and maximizing the benefits of this exemption.

As the global business landscape continues to evolve, Fica Tax Exemption will remain a vital tool for facilitating cross-border transactions and fostering economic growth. By staying informed and proactive, businesses can navigate this complex landscape and unlock the full potential of their international operations.

How often should Fica Tax Exemption be renewed, and what are the consequences of non-renewal?

+Fica Tax Exemption typically requires periodic renewal, and the frequency can vary depending on the specific circumstances and the tax treaty involved. In general, it is recommended to renew the exemption at least annually to ensure continued compliance. Non-renewal can lead to unexpected tax liabilities and potential penalties, so staying vigilant about renewal deadlines is crucial.

Are there any specific tax treaties that offer particularly advantageous Fica Tax Exemptions?

+While each tax treaty has its unique provisions, some treaties are known for offering more favorable Fica Tax Exemptions. For example, the U.S.-Switzerland tax treaty often provides broader exemptions for certain types of income. It’s essential to carefully review the specific terms of each treaty to understand the potential benefits and limitations.

Can Fica Tax Exemption be applied retroactively if an entity or individual becomes eligible after a period of time?

+Retroactive application of Fica Tax Exemption is generally not allowed. Tax exemptions are typically prospective and apply from the date of eligibility onwards. However, it’s important to consult with tax professionals to understand any specific provisions or exceptions that may apply in certain situations.