How to Complete the Form for Tax Exempt Status

Navigating the labyrinthine process of obtaining tax-exempt status can resemble a journey through a dense forest—full of hidden pathways, subtle signals, and unforeseen obstacles. For nonprofit organizations, charitable institutions, and advocacy groups, successfully completing the form to achieve tax-exempt status is more than a bureaucratic checkbox; it is a crucial step toward fulfilling their mission with financial credibility and legal standing. This intricate process intertwines legal requirements, detailed documentation, strategic presentation, and a nuanced understanding of tax law. This article delves into the comprehensive roadmap necessary to master the submission of this vital form, demystifying complexities with precision, clarity, and expert insight.

Understanding the Importance of Tax-Exempt Status and the Underlying Legal Framework

Securing tax-exempt status under provisions such as 501©(3) of the Internal Revenue Code transforms a nonprofit entity from a simple organization into a recognized public benefit that can operate without federal income tax liability. This status not only confers potential savings but also enhances credibility with donors, grants, and partners. The legal framework surrounding this process hinges on compliance with specific statutory conditions, including organizational purpose, operational limitations, and reporting transparency.

Legal Foundations and Regulatory Standards

The Internal Revenue Service (IRS) delineates rigorous standards for eligibility, emphasizing the organization’s primary purpose, activities, and governance structure. The application process involves meticulous record-keeping and policy formulation to demonstrate alignment with these standards. Failure to adhere to legal requirements can result in delays or denial, making a thorough understanding of the statutory provisions and regulatory expectations essential for a successful qualification.

| Relevant Category | Substantive Data |

|---|---|

| Tax Code Reference | Section 501(c)(3) of the Internal Revenue Code |

| Minimum Asset Requirement | No explicit minimum; focus on organizational purpose and operational activities |

| Application Fee | Varies, typically ranging from $275 to $600 depending on organization size and complexity |

Navigating the Form: Detailed Steps for an Accurate Submission

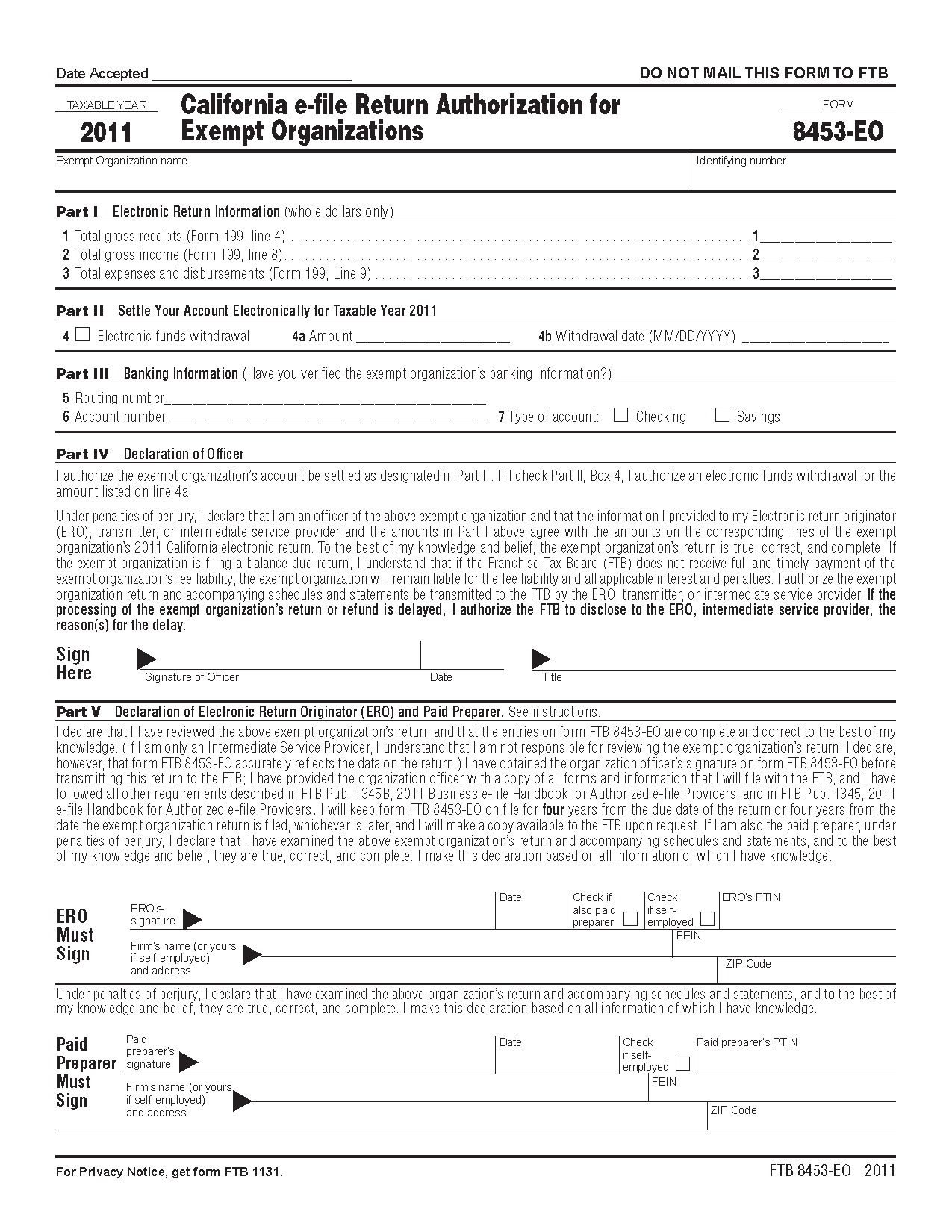

The core of the process resides in the submission of IRS Form 1023, or the streamlined Form 1023-EZ for qualifying smaller organizations. Each form type demands distinct levels of detail, but both share foundational requirements that must be meticulously addressed. Here we break down the core components essential to crafting a robust application.

Preparing Organizational Documentation

Before diving into the form itself, ensure all foundational documents—articles of incorporation, bylaws, conflict of interest policies, and financial statements—are in impeccable order. These documents serve as the backbone for the application, providing the IRS with tangible proof of compliance and organizational legitimacy. For instance, articles of incorporation must explicitly state the nonprofit’s purpose and include a dissolution clause aligning with public benefit standards.

Completing the Core Sections of Form 1023

Detailed attention to each section is crucial—to prevent delays or inadvertent omissions. These sections include:

- Part I: Identification and Basic Information—Clear articulation of the organization’s legal name, address, Employer Identification Number (EIN), and structure.

- Part II: Organizational Structure—In-depth description of membership, governance, and operational structure, ensuring consistency with legal documents.

- Part III: Narrative Description of Activities—A comprehensive narrative that paints a vivid picture of activities, demonstrating alignment with charitable purposes, drawing on specific, measurable efforts, and contextual examples.

- Part IV: Compensation and Fundraising—Transparency with detailed compensation policies, donor solicitation procedures, and fundraising activities.

- Part V: Financial Data—Providing detailed financial statements, projections, and sources of income, reflecting operational sustainability.

Supporting Attachments and Appendices

Supplemental documentation enhances credibility. Attachments should include:

- Articles of incorporation and amendments

- Bylaws and conflict of interest policies

- Financial statements (audits, if applicable)

- Detailed program descriptions with outcome metrics

Key Points

- Comprehensive documentation ensures the IRS can verify compliance with statutory requirements.

- Precision in the narrative description clarifies organizational purpose and activities.

- Consistent alignment across all documents and forms reduces revision risk.

- Legal and financial transparency fosters trust and expedites approval.

- Understanding technical terminology empowers accurate completion of complex sections.

Common Pitfalls and How to Avoid Them

Despite best intentions, applicants often encounter pitfalls that delay or derail processed applications. Recognizing these challenges early can conserve time and resources:

Ambiguous Purpose Statements

Vague or overly broad objectives undermine the application. Be specific about the mission, including measurable goals and specific programs intended to fulfill that purpose.

Inconsistent Documentation

Disparities between organizational documents and the information provided in the form invite scrutiny. Cross-check for alignment, especially between articles of incorporation and the narrative description.

Failure to Demonstrate Public Benefit

The IRS requires evidence that the organization’s activities primarily benefit the public, not private interests. Incorporating narrative examples and data-driven outcomes can substantiate this claim.

Overlooking State and Local Compliance

Federal status is complemented by adherence to state registration, charitable solicitation permits, and local licensing laws, which collectively influence the application’s success.

Post-Submission Process and Ongoing Compliance

Once submitted, the review process involves multiple stages, including potential rejections requiring clarifications or amendments. Staying proactive involves:

- Responding promptly to IRS correspondence, especially requests for additional information.

- Preparing for an in-person or telephonic interview, if requested, by rehearsing clear, concise, and evidence-supported responses.

- Establishing a robust compliance framework for ongoing reporting, including annual Form 990 filings and record-keeping.

Reconsideration and Appeals

If denied, organizations have the right to appeal or submit a revised application addressing IRS concerns. Reviewing rejection reasons carefully and consulting legal or tax advisors can improve future submissions.

Key Points

- Timely and thorough responses to IRS inquiries can significantly influence approval outcomes.

- Implementing a comprehensive compliance system ensures sustained eligibility and avoids future penalties.

- Engaging experienced legal and tax professionals enhances accuracy and mitigates risk.

Emerging Trends and Future Outlook in Tax-Exempt Applications

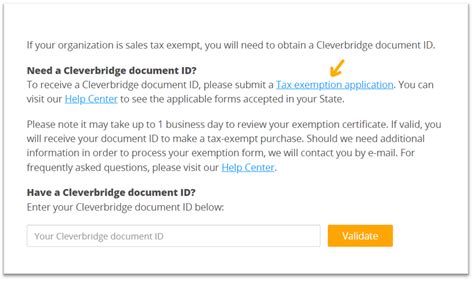

Technological advancements are transforming the application landscape. Online filing platforms, AI-driven review tools, and improved guidance docs streamline submission processes. Meanwhile, evolving regulations—particularly concerning donor transparency and reporting standards—necessitate ongoing education and strategic adaptation. The increasing emphasis on environmental, social, and governance (ESG) criteria reflects societal shifts toward accountability, influencing how organizations articulate their public benefit missions in application narratives.

Digital Transformation and Its Impact

With digital portals now replacing paper submissions, applicants benefit from real-time tracking and interactive guidance. Automated pre-screening tools assist in identifying common errors before submission, reducing rejection rates.

Regulatory Developments and Policy Considerations

Recent proposals aim to tighten oversight, demanding more detailed disclosures and heightened transparency. Organizations preparing for future compliance should integrate these considerations into their planning process, emphasizing adaptability and strategic foresight.

Meta Description Suggestion

Discover a step-by-step guide to completing the form for tax-exempt status, including legal standards, documentation tips, common pitfalls, and future trends to ensure successful approval.

What is the primary form used to apply for tax-exempt status?

+The main form is IRS Form 1023, though eligible organizations may use Form 1023-EZ for simplified processing.

What key documents should accompany the application?

+Attorneys recommend including articles of incorporation, bylaws, conflict of interest policies, and current financial statements to support the application.

How long does the review process usually take?

+Processing times vary but typically range from 3 to 6 months, depending on the completeness and complexity of the submitted documentation.

What common mistakes should be avoided in the application?

+Vague objectives, inconsistent documentation, and failure to demonstrate public benefit are frequent pitfalls that can be mitigated through thorough review and expert consultation.

What are the ongoing reporting requirements after approval?

+Organizations must file annual Form 990 or 990-EZ returns and maintain transparent financial and operational records to sustain their tax-exempt status.