Arkansas Income Tax Refund

The Arkansas income tax refund is a financial benefit that Arkansas residents may receive if they overpay their state income taxes during a given tax year. This refund is a key aspect of the state's tax system, offering a form of relief to taxpayers who have paid more than they owe. In this comprehensive guide, we delve into the intricacies of the Arkansas income tax refund, exploring its mechanics, eligibility, calculation methods, and strategies for maximizing refunds.

Understanding the Arkansas Income Tax Refund

The Arkansas income tax system operates on a self-assessment basis, where taxpayers are responsible for calculating and paying their taxes accurately. When a taxpayer’s tax liability is lower than the amount paid, they are entitled to a refund. This refund represents the difference between the taxes paid and the actual liability, providing a financial incentive for accurate tax calculations.

Eligibility and Key Criteria

To be eligible for an Arkansas income tax refund, taxpayers must meet several criteria. Firstly, they must have filed their tax returns accurately and on time. The Arkansas Department of Finance and Administration (DFA) strictly enforces filing deadlines, and late submissions can result in penalties and interest charges.

Secondly, taxpayers must have overpaid their taxes. This overpayment can occur for various reasons, including changes in income, deductions, or tax credits. For instance, if a taxpayer's income decreases during the year, they may be entitled to a refund as their tax liability will be lower than the amount already paid.

Additionally, taxpayers must ensure they claim all applicable deductions and credits. Common deductions in Arkansas include the standard deduction, itemized deductions, and tax credits for education, dependents, and certain business expenses. By claiming these deductions and credits, taxpayers can reduce their taxable income and potentially increase their refund.

Calculation of the Refund

The calculation of the Arkansas income tax refund involves a straightforward process. Taxpayers start by determining their taxable income, which is the income subject to state income tax after deductions and exemptions. This amount is then multiplied by the applicable tax rate, which varies based on income brackets. The resulting figure represents the taxpayer’s tax liability.

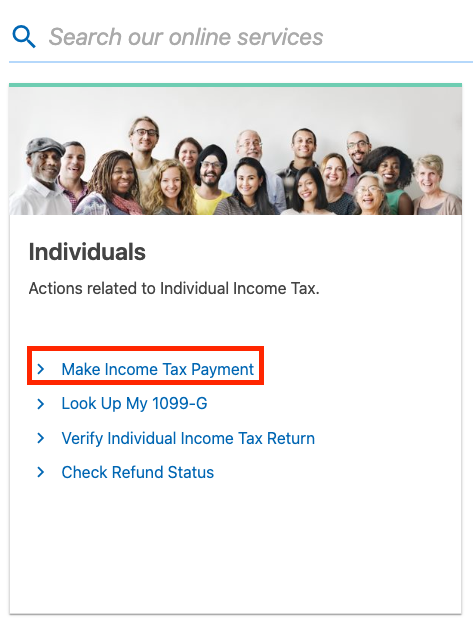

Next, taxpayers compare their tax liability with the amount they have already paid through withholdings or estimated tax payments. If the tax liability is lower than the payments made, the difference is the refund amount. The DFA processes these refunds and issues them to taxpayers through direct deposit or check, depending on the taxpayer's preference.

| Tax Year | Taxable Income ($) | Tax Rate | Tax Liability ($) | Payments Made ($) | Refund Amount ($) |

|---|---|---|---|---|---|

| 2022 | 40,000 | 5% | 2,000 | 2,500 | 500 |

| 2023 | 50,000 | 6% | 3,000 | 2,800 | 200 |

Maximizing Your Arkansas Income Tax Refund

Maximizing your Arkansas income tax refund involves a combination of accurate record-keeping, strategic planning, and claiming all eligible deductions and credits. Here are some key strategies to consider:

Keep Detailed Records

Maintaining meticulous records is crucial for maximizing your refund. This includes keeping track of all income sources, expenses, deductions, and credits. By doing so, you can ensure you have all the necessary information to accurately calculate your taxable income and claim all eligible deductions.

Understand Deductions and Credits

Arkansas offers a range of deductions and credits that can significantly reduce your taxable income. These include the standard deduction, which is available to all taxpayers, and itemized deductions for specific expenses like medical costs, charitable contributions, and state and local taxes. Additionally, Arkansas provides tax credits for various expenses, such as education, childcare, and certain business-related costs.

Familiarize yourself with the eligibility criteria and documentation requirements for each deduction and credit. This will ensure you can maximize your refund by claiming all applicable benefits.

Optimize Your Tax Withholdings

Throughout the year, your employer withholds a certain amount from your paycheck to cover your expected tax liability. If you consistently overpay your taxes due to excessive withholdings, you may receive a larger refund. However, it’s essential to strike a balance, as underpaying your taxes can result in penalties and interest charges.

Consider using the IRS's Tax Withholding Estimator to ensure your withholdings align with your expected tax liability. This tool can help you adjust your W-4 form to optimize your withholdings and potentially increase your refund.

Consider Tax Preparation Services

For complex tax situations or if you’re unsure about claiming certain deductions or credits, it may be beneficial to seek professional assistance. Tax preparation services can provide expert guidance, ensuring you maximize your refund while complying with all applicable tax laws.

Timely Filing and Avoiding Penalties

While the focus is often on maximizing refunds, it’s equally important to file your tax returns on time to avoid penalties and interest charges. Arkansas typically has a filing deadline of April 15th, but this can vary depending on the day of the week and certain circumstances.

Filing your return early not only ensures you receive your refund promptly but also reduces the risk of errors and potential audits. If you're unable to file by the deadline, you can request an extension, but it's important to note that an extension only applies to the filing of your return, not the payment of any taxes owed.

Future Implications and Changes

The Arkansas income tax system is subject to ongoing changes and updates. The state regularly reviews its tax laws and regulations to ensure fairness and alignment with economic trends. These changes can impact tax rates, deductions, and credits, potentially affecting the size of refunds.

Staying informed about these changes is crucial for taxpayers. The Arkansas DFA provides regular updates and announcements on its website, ensuring taxpayers can stay abreast of any modifications to the tax system. Additionally, tax professionals and reputable tax preparation services can provide valuable insights into these changes and their potential impact on refunds.

When will I receive my Arkansas income tax refund?

+

The timing of your refund depends on when you file your tax return. If you file electronically and choose direct deposit, you can expect your refund within 7–14 days. For paper returns, it may take up to 6–8 weeks. However, delays can occur due to various factors, so it’s best to check the DFA’s website for the latest updates.

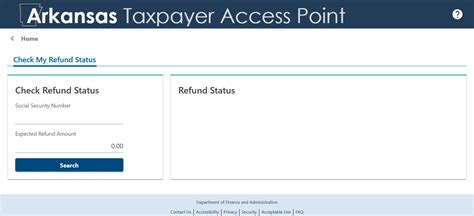

Can I track the status of my Arkansas income tax refund online?

+

Yes, the Arkansas DFA provides an online tool called “Where’s My Refund?” on its website. You can use this tool to track the status of your refund by entering your Social Security number, refund type, and the amount of your refund.

What should I do if my Arkansas income tax refund is incorrect or hasn’t arrived?

+

If you believe your refund is incorrect or haven’t received it, contact the Arkansas DFA’s taxpayer assistance line. They can help resolve issues related to refunds, including verifying the status of your refund and addressing any discrepancies.

Are there any deductions or credits specific to Arkansas that I should be aware of?

+

Yes, Arkansas offers several state-specific deductions and credits. These include the Arkansas College Tuition Credit, the Arkansas Child Care Credit, and the Arkansas Military Service Credit. It’s essential to research and understand these credits to ensure you’re claiming all eligible benefits.