Pennsylvania Sales Tax

Pennsylvania, a state rich in history and economic diversity, implements a sales tax system that plays a significant role in its revenue generation and impacts various industries and consumers alike. This article delves into the intricacies of the Pennsylvania Sales Tax, offering an in-depth analysis of its structure, applicability, and implications.

Understanding Pennsylvania Sales Tax

Pennsylvania’s sales tax is a consumption tax levied on the sale of goods and certain services within the state. It is a crucial component of Pennsylvania’s tax system, contributing significantly to state revenue and funding essential services and initiatives.

The state sales tax rate in Pennsylvania is set at 6%, which is applicable to most tangible personal property and certain services. However, it's important to note that this is not a flat rate across the state, as local municipalities and counties often add their own local sales taxes, resulting in varying effective tax rates.

Sales Tax Jurisdiction in Pennsylvania

Pennsylvania operates on a destination-based sales tax system, which means the sales tax rate is determined by the location where the goods are delivered or the services are rendered, not the location of the seller. This jurisdiction-based approach ensures that sales taxes are collected and allocated appropriately based on the geographic location of the transaction.

For instance, if a retailer based in Philadelphia sells goods to a customer in Pittsburgh, the sales tax would be calculated based on the tax rate in Pittsburgh, not Philadelphia. This ensures that local communities benefit from the sales taxes generated within their jurisdictions.

| City | Sales Tax Rate |

|---|---|

| Philadelphia | 8% |

| Pittsburgh | 7% |

| Erie | 6% |

Taxable Goods and Services

Pennsylvania’s sales tax applies to a broad range of goods and services. Here’s an overview of the categories typically subject to sales tax:

- Tangible Personal Property: This includes items like clothing, electronics, furniture, and appliances.

- Vehicles: Sales of cars, motorcycles, and other motor vehicles are subject to sales tax.

- Groceries: While some food items are exempt, most groceries are taxable in Pennsylvania.

- Services: Certain services, such as repairs, installations, and rentals, are also subject to sales tax.

- Entertainment and Recreation: This includes tickets for movies, concerts, sporting events, and amusement parks.

It's important to note that there are exemptions and special rules for specific industries and items. For instance, sales tax may not apply to certain agricultural products, prescription drugs, and manufacturing equipment.

Exemptions and Special Cases

Pennsylvania provides various sales tax exemptions and special cases to accommodate different industries and consumer needs. Here are a few notable examples:

- Food for Home Consumption: Most unprepared foods are exempt from sales tax when purchased for home consumption.

- Prescription Drugs: Sales tax does not apply to prescription medications.

- Manufacturing Equipment: Certain machinery and equipment used in manufacturing processes are exempt from sales tax.

- Educational Materials: Sales tax is often waived for textbooks and other educational resources.

These exemptions aim to support specific sectors, promote certain behaviors (like healthy eating), and reduce the tax burden on essential goods and services.

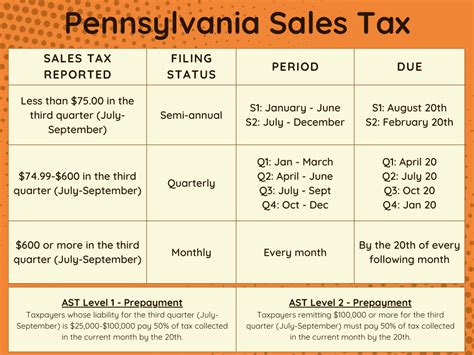

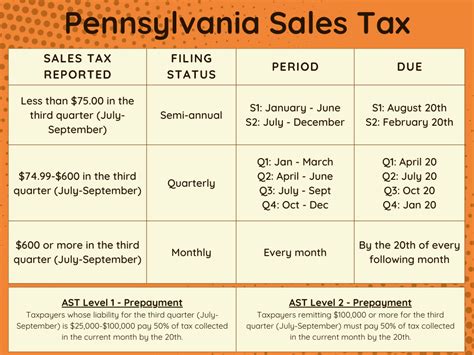

Compliance and Collection

Ensuring compliance with Pennsylvania’s sales tax regulations is crucial for businesses and consumers alike. Here’s an overview of the key compliance aspects:

Registration and Remittance

Businesses engaged in taxable sales or services in Pennsylvania are required to register with the Pennsylvania Department of Revenue. This registration process involves obtaining a Sales and Use Tax Permit, which allows businesses to collect and remit sales taxes.

Registered businesses are responsible for collecting the appropriate sales tax from customers and remitting it to the state on a regular basis, typically monthly or quarterly. Failure to register or remit sales taxes can result in penalties and interest charges.

Record-Keeping and Audits

Maintaining accurate records is essential for sales tax compliance. Businesses must keep detailed records of sales transactions, including the date, amount, and type of goods or services sold, as well as the applicable tax rate and any exemptions claimed.

The Pennsylvania Department of Revenue may conduct audits to ensure compliance. During an audit, businesses must be able to provide supporting documentation for their sales tax calculations and remittances. Non-compliance can lead to significant penalties and additional tax liabilities.

Remote Sellers and Marketplace Facilitators

With the rise of e-commerce, Pennsylvania has implemented regulations for remote sellers and marketplace facilitators. These regulations require out-of-state sellers who make significant sales into Pennsylvania to collect and remit sales tax, even if they don’t have a physical presence in the state.

Marketplace facilitators, such as Amazon and eBay, are also responsible for collecting and remitting sales tax on behalf of their third-party sellers. This ensures that online transactions are taxed appropriately and that the state receives its due revenue.

Impact and Analysis

Pennsylvania’s sales tax system has a profound impact on the state’s economy, businesses, and consumers. Let’s explore some of these implications:

Economic Impact

The sales tax is a significant revenue generator for Pennsylvania, contributing billions of dollars to the state’s budget annually. This revenue supports essential services like education, healthcare, infrastructure development, and public safety.

Additionally, the sales tax can influence consumer behavior. Higher sales tax rates may discourage certain purchases, leading to a potential decline in retail sales. On the other hand, lower sales tax rates can stimulate consumer spending and boost economic activity.

Business Impact

For businesses, the sales tax system adds complexity to their operations. Businesses must stay updated on changing tax rates, exemptions, and compliance regulations to avoid penalties and maintain a positive relationship with the state.

The sales tax can also impact pricing strategies. Businesses may need to absorb some of the tax burden to remain competitive or pass it on to consumers, potentially affecting their market share and profitability.

Consumer Impact

Consumers in Pennsylvania directly bear the brunt of the sales tax. Higher sales tax rates can increase the cost of living, especially for lower-income households. On the other hand, sales tax holidays or exemptions on certain goods can provide temporary relief and encourage spending.

Understanding the sales tax rates and exemptions can empower consumers to make more informed purchasing decisions and potentially save money.

Conclusion and Future Implications

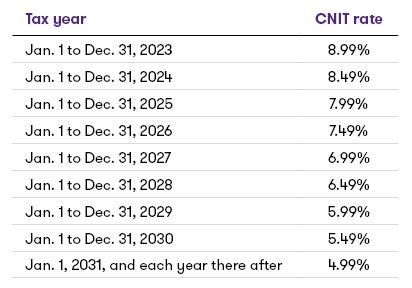

Pennsylvania’s sales tax system is a complex yet essential component of the state’s fiscal landscape. It provides a significant source of revenue for the state while impacting businesses and consumers in various ways.

As the state continues to evolve and adapt to changing economic conditions, the sales tax system may undergo further modifications. These could include adjustments to tax rates, the introduction of new exemptions, or the expansion of remote seller regulations.

Staying informed about Pennsylvania's sales tax regulations is crucial for businesses and consumers alike. By understanding the intricacies of the system, stakeholders can navigate the complexities and make informed decisions that benefit their operations and the state as a whole.

What is the current sales tax rate in Pennsylvania?

+The state sales tax rate in Pennsylvania is currently set at 6%. However, it’s important to note that local municipalities and counties often add their own local sales taxes, resulting in varying effective tax rates.

Are there any sales tax exemptions in Pennsylvania?

+Yes, Pennsylvania provides various sales tax exemptions. Some notable examples include food for home consumption, prescription drugs, manufacturing equipment, and educational materials. These exemptions aim to support specific sectors and reduce the tax burden on essential goods and services.

How often do businesses need to remit sales tax in Pennsylvania?

+Registered businesses in Pennsylvania are typically required to remit sales tax on a monthly or quarterly basis. The frequency of remittance depends on the business’s sales volume and can be adjusted based on the business’s preferences and compliance history.