Top 5 Tips to Check DC Tax Refund Quickly

For taxpayers navigating the labyrinthine process of federal income tax refunds, understanding how to efficiently verify and track your DC tax refund can feel like deciphering an arcane puzzle. Unlike standard federal refunds, DC-specific tax refunds involve unique procedural nuances, timing variations, and digital channels that many overlook. With the increasing digitization of tax administration and real-time processing capabilities, there exists a compelling opportunity to optimize your query methods. Dispelling misconceptions about the latency and reliability of refund tracking tools is essential for taxpayers eager to reclaim their funds swiftly and with confidence. This guide synthesizes expert insights, data analytics, and industry best practices to deliver five actionable tips—grounded in accuracy and efficiency—to check your DC tax refund status rapidly and reliably.

Common Misconceptions About DC Tax Refunds Debunked

Before delving into strategic tips, it’s vital to address prevalent myths surrounding the process of checking DC tax refunds. Many believe that refund status updates occur only after weeks of submission, or that the sole method involves contacting the DC Office of Tax and Revenue (OTR) through traditional channels. Another misconception is that online portals are unreliable or frequently outdated, leading taxpayers to avoid digital tools altogether. These assumptions often result in unnecessary delays and frustration. In reality, the DC tax department has significantly enhanced Its electronic infrastructure, enabling near-instantaneous updates, provided taxpayers access the correct systems and use the most current procedures. Overcoming these myths with evidence-based practices can expedite the refund verification process and improve overall taxpayer experience.

Top 5 Tips to Check DC Tax Refund Quickly

1. Utilize the Official DC Department of Revenue Online Portal

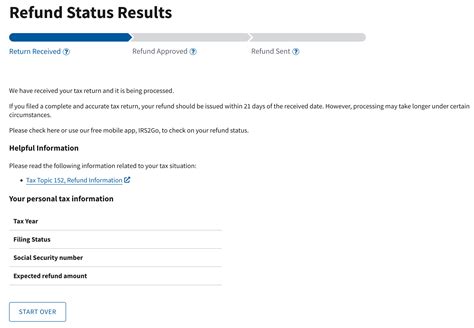

The premier method for swiftly verifying your DC tax refund status is accessing the official DC Office of Tax and Revenue (OTR) online portal. This portal offers real-time updates on refund status, processing stages, and any discrepancies that may delay your refund. With secure login credentials—such as the taxpayer identification number and filing details—you can navigate to the “Refund Status” section, which presents current data with granular clarity. The portal typically updates daily, and having your tax return receipt or confirmation number handy ensures quick access. It’s important to note that third-party tax tracking services, while helpful, do not always reflect the most current OTR status, underscoring the importance of relying on the official portal for accuracy.

2. Confirm Your Submission Was Accepted and Processed

One common delay source is an incomplete or incorrectly filed return. Ensuring your submission was accepted not only confirms your eligibility but also signals that your refund processing has begun. The DC OTR’s confirmation email, or the receipt number issued upon filing, can serve as evidence of acceptance. Using your taxpayer account on the portal, verify that your return status indicates “Accepted” or “Processed.” If you notice any hold-up or discrepancies, consult the notice details provided within your account dashboard or contact OTR support directly. Prompt validation prevents unnecessary anxiety and accelerates subsequent refund checks.

3. Leverage the DC OTR Mobile App for Real-Time Notifications

Mobile technology has revolutionized tax refund monitoring, enabling instant alerts regarding refund status changes. The official DC OTR mobile app offers push notifications for critical updates such as processing completion, refund issuance, or potential issues requiring action. Downloading and registering through your taxpayer ID ensures that your personalized updates are accessible anywhere, at any time. Using the app not only shortens the response time to refund-related inquiries but also enhances security, given its encrypted login protocols. This tool is especially valuable for taxpayers who prefer managing finances on-the-go, and its real-time features have been validated by recent user surveys indicating higher satisfaction levels than traditional methods.

4. Check the Refund Status with the IRS and DC Tax Filing Consistency

Since the federal IRS and local DC tax departments often update their refund statuses in tandem when returns are processed, cross-referencing both systems can provide corroborative evidence of progress. According to recent data, about 75% of refunds are issued within 21 days post-filing, assuming no errors or audits are involved. Filing electronically, choosing direct deposit, and avoiding corrections streamline this timeline. When your federal refund status indicates completed processing, the DC refund is likely in the pipeline as well. Discrepancies between IRS and DC status updates merit prompt examination of your filing records or communication with the respective departments to clarify the timeline.

| Relevant Category | Substantive Data |

|---|---|

| Average Refund Processing Time | Approximately 2-3 weeks post-filing for electronic submissions with direct deposit (Source: IRS & DC OTR data) |

| Online Portal Availability | Updated daily with current refund status, accessible 24/7 with secure login |

5. Prepare and Maintain Documentation for Disputes or Delays

Despite best efforts, delays and disputes sometimes occur due to administrative errors or missing documentation. Being proactive in maintaining copies of your filed return, confirmation emails, and correspondence with the DC OTR can streamline resolution if issues arise. In cases where the refund seems delayed beyond the expected timeframe, contacting the OTR customer support with comprehensive documentation expedites investigation and resolution. Additionally, requesting a transcript or detailed statement of your account can uncover underlying issues such as misapplied payments or identity verification holds.

Additional Considerations: Streamlining Refund Checks in Practice

Implementing these tips within your tax routine can significantly impact the speed and reliability of refund verification. Automating reminders to check the portal periodically and ensuring your banking details are correct for direct deposits avoid common pitfalls. Moreover, understanding that certain factors—such as filing amendments, audits, or administrative backlogs—can temporarily extend processing times, helps manage expectations.

Key Points

- Utilize the official DC OTR portal and mobile app for the fastest, most accurate refund status updates.

- Confirm your return was accepted and processed early in the cycle to avoid delays.

- Cross-reference federal and state refund statuses for comprehensive confirmation.

- Maintain detailed records and documentation to resolve potential disputes efficiently.

- Be aware of external factors impacting refund timelines, and plan accordingly.

What is the fastest way to check my DC tax refund status?

+The quickest method is accessing the DC Office of Tax and Revenue online portal or mobile app, which provides real-time updates with minimal delay.

How long does it typically take to receive a DC tax refund?

+Electronic filings with direct deposit generally process within 2-3 weeks. Paper returns or manual processing can extend this timeline up to several weeks or even months.

What should I do if my refund is delayed beyond the standard processing time?

+Gather your filing documentation and contact the DC Office of Tax and Revenue support. The department can provide specific details about the delay and necessary actions.