Michigan Property Taxes

Understanding property taxes is an essential aspect of homeownership, especially in a state as diverse as Michigan. The property tax system in Michigan can be quite intricate, with rates varying significantly across counties and even municipalities. This article aims to provide a comprehensive guide to Michigan property taxes, shedding light on how they work, how they're calculated, and how they impact homeowners across the state.

The Basics of Michigan Property Taxes

Michigan’s property tax system is a vital source of revenue for local governments, including counties, cities, townships, and school districts. These taxes fund various services like education, police and fire protection, road maintenance, and more. Understanding the system is crucial for homeowners, as it directly impacts their financial planning and overall cost of living.

The property tax rate in Michigan is typically expressed as a millage rate. One mill is equivalent to one-tenth of a cent, or $1 for every $1,000 of taxable value. The millage rate is set by local governments and can vary based on the services provided and the budget required to fund those services.

Property Tax Assessment Process

Property tax assessments in Michigan are conducted at the local level, with each county’s equalization department responsible for ensuring fair and accurate assessments. The process involves evaluating a property’s value based on various factors, including its location, size, age, condition, and recent sales of similar properties.

Once the assessed value is determined, it is multiplied by the state's Constitutional Tax Limit of 0.6000 (or 60%) to arrive at the taxable value. This limit is designed to prevent excessive taxation and provide a level of consistency across the state. However, this taxable value can increase by up to 5% annually, or by the Consumer Price Index (CPI), whichever is lower.

| Taxable Value Calculation | Example |

|---|---|

| Assessed Value | $200,000 |

| Constitutional Tax Limit | 0.6000 |

| Taxable Value | $120,000 |

It's important to note that the assessed value can be higher than the market value, especially if property values in the area have declined since the last assessment.

Taxable Value vs. State Equalized Value (SEV)

The State Equalized Value (SEV) is another important term in Michigan’s property tax system. It’s essentially half of the property’s true cash value (TCV), which is the probable price the property would sell for at a fair, voluntary sale. The SEV is calculated by the county and then reviewed and adjusted by the State Tax Commission to ensure uniformity across the state.

| SEV Calculation | Example |

|---|---|

| True Cash Value (TCV) | $400,000 |

| SEV (TCV divided by 2) | $200,000 |

While the SEV is an important benchmark, it's the taxable value that is used to calculate property taxes. However, in certain cases, such as when a property is sold, the taxable value can be "uncapped" and reset to the SEV, leading to a potential increase in taxes.

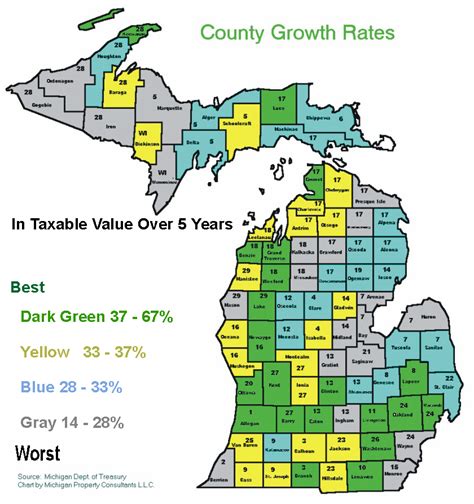

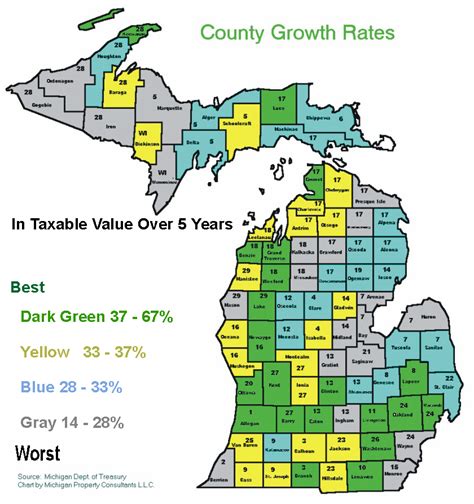

Property Tax Rates and Variations

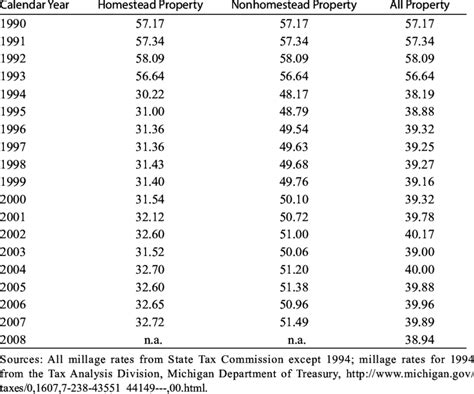

Michigan’s property tax rates can vary significantly depending on the location and the services provided by local governments. The millage rates are set by local authorities and approved by voters, which can lead to a wide range of tax rates across the state.

Local Millage Rates

Each local government, including counties, cities, townships, and school districts, sets its own millage rate based on its budget requirements. For instance, a county might set a millage rate to fund general operations, while a school district might have a separate millage rate to fund education. These rates are typically approved by voters during local elections.

| Local Government | Millage Rate | Services Funded |

|---|---|---|

| County | 5 mills | General operations, police and fire protection |

| City | 3 mills | Road maintenance, local services |

| School District | 10 mills | Education, school operations |

Statewide Property Tax Rates

In addition to local millage rates, Michigan also has a statewide property tax of 6 mills, which is dedicated to funding local governments and the Michigan State Police. This rate is set by the state government and is applied uniformly across the state.

Combining the local and statewide millage rates provides the total effective property tax rate for a given area. This rate is then multiplied by the taxable value of a property to calculate the annual property taxes owed by the homeowner.

Taxable Value Caps and Uncaps

As mentioned earlier, Michigan’s taxable value is capped at a maximum annual increase of 5% or the CPI, whichever is lower. This cap helps prevent sudden, large increases in property taxes, especially in areas with rapidly rising property values. However, there are certain situations where the taxable value can be “uncapped” and reset to the SEV.

One such situation is when a property is sold. In Michigan, the taxable value of a property is uncapped and reset to the SEV when the property changes ownership. This can lead to a significant increase in property taxes for the new owner, especially if the SEV is higher than the previous taxable value.

Property Tax Payment and Due Dates

Property taxes in Michigan are typically paid in two installments, with the due dates varying slightly across counties. The first installment is usually due in the summer, around July or August, while the second installment is due in the winter, typically around February or March.

Tax Bills and Payment Options

Property owners receive tax bills from their local government, which outline the total amount owed, the due dates, and the payment options available. These bills are typically mailed out a few weeks before the due dates.

Property owners have several payment options, including paying by check, money order, or credit card. Many counties also offer online payment portals, which provide a convenient and secure way to pay property taxes. Some counties even offer payment plans or deferment options for eligible homeowners who may be facing financial difficulties.

Late Payment Penalties and Interest

Late payment of property taxes can result in penalties and interest charges. The specific penalties and interest rates vary by county, but they generally start accruing shortly after the due date. It’s important for homeowners to stay informed about their payment deadlines and to make timely payments to avoid these additional costs.

| Late Payment Penalties | Example County |

|---|---|

| 1% interest per month on unpaid taxes | Wayne County |

| 1.5% interest per month on unpaid taxes | Oakland County |

Property Tax Exemptions and Credits

Michigan offers various property tax exemptions and credits to eligible homeowners, which can significantly reduce their tax obligations. These exemptions and credits are designed to support specific groups of homeowners, such as seniors, veterans, and homeowners with disabilities, and to encourage homeownership and community development.

Homestead Exemption

The Homestead Exemption is one of the most significant property tax exemptions in Michigan. It reduces the taxable value of a homeowner’s primary residence by up to $40,100, resulting in lower property taxes. To qualify, homeowners must own and occupy the property as their primary residence, and they must apply for the exemption with their local assessor’s office.

| Homestead Exemption Example | Taxable Value |

|---|---|

| Before Homestead Exemption | $120,000 |

| After Homestead Exemption ($40,100 reduction) | $79,900 |

Poverty Exemption

The Poverty Exemption is designed to assist low-income homeowners by reducing their property taxes. To qualify, homeowners must meet certain income and asset limits, and they must apply with their local assessor’s office. The exemption can reduce the taxable value of the property, resulting in lower taxes.

Veteran’s Exemption

Michigan offers several property tax exemptions for veterans, including a Principal Residence Exemption (PRE) for veterans with service-connected disabilities, a Totally and Permanently Disabled Veterans’ Exemption, and a Surviving Spouse Exemption. These exemptions can provide significant tax relief for veterans and their families.

Property Tax Credits

In addition to exemptions, Michigan also offers property tax credits to eligible homeowners. The Homestead Property Tax Credit, for instance, provides a credit to homeowners with low to moderate incomes, helping to offset the cost of their property taxes. The credit is typically applied as a reduction on the homeowner’s tax bill.

Appealing Property Tax Assessments

If a homeowner believes their property tax assessment is incorrect or unfair, they have the right to appeal the assessment. The appeal process involves several steps, including an informal review with the local assessor’s office, a formal appeal to the local board of review, and, if necessary, an appeal to the Michigan Tax Tribunal.

Informal Review

The first step in the appeal process is an informal review with the local assessor’s office. This is an opportunity for the homeowner to discuss their concerns and provide evidence or information that may support a change in the assessment. The assessor may agree to adjust the assessment based on the provided information.

Board of Review Appeal

If the informal review does not result in a satisfactory outcome, the homeowner can file a formal appeal with the local board of review. The board of review is a group of local residents appointed to review and adjust property assessments. The homeowner will need to present their case and evidence at a hearing before the board.

Michigan Tax Tribunal Appeal

If the homeowner is still dissatisfied with the assessment after the board of review process, they can appeal to the Michigan Tax Tribunal. The Tribunal is an independent administrative body that hears and decides tax disputes, including property tax assessments. The appeal process to the Tribunal involves filing a petition, paying a fee, and presenting evidence and arguments before a hearing officer or a panel of judges.

It's important for homeowners to understand that appealing a property tax assessment can be a complex and time-consuming process. It's advisable to seek professional guidance or legal representation if the assessment has a significant impact on the homeowner's finances.

Future Implications and Trends

The property tax system in Michigan is subject to ongoing changes and reforms, driven by economic factors, political decisions, and evolving community needs. Understanding these trends and potential future developments can help homeowners anticipate and prepare for changes that may impact their property tax obligations.

Economic Factors and Property Values

Economic factors, such as the housing market, inflation, and local economic conditions, can significantly influence property values and, consequently, property tax assessments. For instance, during periods of economic growth and rising property values, homeowners may see an increase in their taxable value and, subsequently, their property taxes. Conversely, during economic downturns or in areas with declining property values, homeowners may benefit from lower assessments and reduced taxes.

Political Decisions and Policy Changes

Political decisions and policy changes at the state and local levels can also have a substantial impact on property taxes. For example, changes to the state’s Constitutional Tax Limit, which caps the taxable value of properties, or alterations to the statewide property tax rate, can directly affect the tax obligations of homeowners across Michigan.

At the local level, decisions made by county boards, city councils, and school boards regarding budget allocations and millage rates can also influence property taxes. These decisions are often influenced by the need to fund specific services or projects, and they can result in increased or decreased tax rates for homeowners.

Community Development and Property Tax Incentives

Community development initiatives and property tax incentives are another aspect to consider. Many local governments and community organizations offer incentives, such as tax abatements or credits, to encourage economic development, attract businesses, and promote homeownership. These incentives can provide significant tax savings for homeowners and businesses, but they may also be subject to certain conditions or eligibility criteria.

Potential Reforms and Modernization

There is ongoing discussion and debate about potential reforms to Michigan’s property tax system. Some proposed reforms aim to simplify the system, make it more equitable, or provide additional relief to homeowners. For instance, proposals have been made to adjust the Constitutional Tax Limit, expand existing tax exemptions or credits, or implement new ones to support specific groups of homeowners.

Additionally, there is a growing focus on modernizing the property tax assessment process, including exploring the use of technology and data analytics to enhance accuracy and efficiency. These modernization efforts aim to ensure that assessments reflect the true value of properties and that the system remains fair and transparent.

Conclusion

Understanding Michigan’s property tax system is crucial for homeowners across the state. From the assessment process and tax calculation methods to exemptions, credits, and appeal processes, there are many factors to consider. By staying informed and engaged, homeowners can effectively manage their property tax obligations and ensure they are treated fairly within the system.

As Michigan's property tax landscape continues to evolve, it's essential for homeowners to stay updated on the latest developments and to actively participate in the democratic processes that shape these taxes. By doing so, homeowners can contribute to a fair and sustainable property tax system that supports local communities and provides essential services while minimizing the financial burden on individuals.

How often are property tax assessments conducted in Michigan?

+Property tax assessments in Michigan are typically conducted every 18 months to 2 years, with the exact timing varying by county. This periodic assessment ensures that property values remain up-to-date and that taxes are based on current market conditions.

Can homeowners appeal their property tax assessments online?

+Yes, many counties in Michigan offer online appeal systems, allowing homeowners to initiate the appeal process and submit supporting documentation electronically. However, the specific appeal procedures may vary by county, so it’s essential to check with the local assessor’s office for detailed information.

Are there any online tools to estimate property taxes in Michigan?

+Yes, several online tools and calculators are available to help homeowners estimate their property taxes. These tools consider