Are Medical Expenses Tax Deductible

Tax deductions for medical expenses can be a crucial aspect for individuals and families, especially when healthcare costs can be significant. Understanding whether and how medical expenses are tax deductible is essential for effective financial planning. This article aims to provide a comprehensive guide on the topic, covering the rules, requirements, and strategies for potentially reducing your tax liability through medical expense deductions.

Understanding Tax Deductions for Medical Expenses

In many jurisdictions, including the United States, certain qualified medical and dental expenses may be deducted from your taxable income. This means you can potentially lower the amount of income that is subject to tax, which can result in a reduced tax burden. However, it’s important to note that the rules and eligibility for medical expense deductions can vary widely based on the specific tax jurisdiction and the individual’s circumstances.

Qualified Medical Expenses

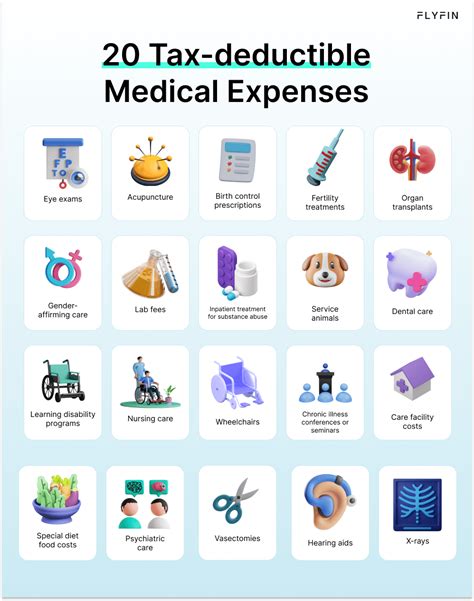

A qualified medical expense typically refers to the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, as well as expenses for individuals with disabilities to improve or maintain functional capabilities. This can include a wide range of expenses such as:

- Doctor's fees, including specialist consultations.

- Hospital costs for inpatient and outpatient treatments.

- Prescription medications and medical devices.

- Diagnostic tests and lab work.

- Surgical procedures and anesthesia.

- Dental and vision care, including orthodontics and eye exams.

- Mental health services and counseling.

- Transportation costs directly related to medical care (e.g., ambulance fees, mileage for medical appointments).

- Health insurance premiums, including coverage for you, your spouse, and your dependents.

- Long-term care services for chronic conditions.

It's important to note that not all medical expenses are deductible. Some expenses, such as cosmetic procedures, are generally not considered qualified medical expenses. Additionally, certain expenses may only be deductible if they exceed a certain threshold.

Tax Deduction Thresholds and Limits

In most cases, to claim a tax deduction for medical expenses, you must meet a specified threshold, often referred to as the medical expense deduction threshold. This threshold is a certain percentage of your adjusted gross income (AGI) and varies by jurisdiction. For instance, in the United States, the threshold was 7.5% of AGI for tax year 2021 and prior, but it increased to 10% for tax years 2022 and beyond.

This means that if your total qualified medical expenses for the year exceed 7.5% (or 10%) of your AGI, you may be eligible to deduct the amount that is above this threshold from your taxable income.

| Year | Medical Expense Deduction Threshold |

|---|---|

| 2021 and prior | 7.5% of AGI |

| 2022 and beyond | 10% of AGI |

It's worth noting that there are some exceptions and special rules that may apply, particularly for individuals with high medical expenses or those who itemize deductions. For instance, individuals who are 65 years or older can use the 7.5% threshold for tax years 2022 and beyond.

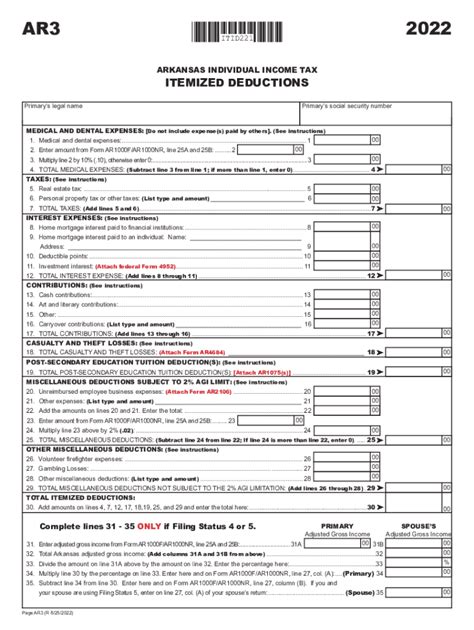

Itemizing Medical Expenses

To claim a tax deduction for medical expenses, you generally need to itemize your deductions on your tax return. This means that you list each eligible expense individually, rather than taking the standard deduction. Whether itemizing is beneficial depends on the total amount of your eligible expenses and whether they exceed the standard deduction amount for your filing status.

For instance, in the United States, if your total eligible medical expenses for the year, along with other itemized deductions like mortgage interest and charitable contributions, exceed the standard deduction amount for your filing status, it may be advantageous to itemize.

Record-Keeping for Medical Expenses

Effective record-keeping is crucial when it comes to claiming tax deductions for medical expenses. You should keep detailed records of all eligible expenses, including dates, amounts, and the purpose of each expense. This can include:

- Receipts from healthcare providers.

- Prescription drug receipts.

- Statements from insurance companies.

- Records of transportation costs for medical appointments.

- Documentation of health insurance premiums.

It's a good practice to maintain a dedicated file or digital folder for these records, as you may need to provide supporting documentation if your tax return is selected for an audit.

Maximizing Tax Benefits for Medical Expenses

When it comes to tax deductions for medical expenses, there are several strategies you can employ to potentially maximize your tax benefits. Here are some key considerations:

Plan Your Medical Expenses Strategically

If you know you have significant medical expenses coming up, such as a planned surgery or a major dental procedure, consider timing these expenses to maximize your tax benefits. For instance, if you’re close to the medical expense deduction threshold for the current tax year, you might benefit from accelerating these expenses into the current year rather than delaying them into the next.

Explore Tax-Advantaged Health Savings Accounts (HSAs)

A Health Savings Account (HSA) is a tax-advantaged savings account designed to help individuals save for qualified medical expenses. Contributions to an HSA are typically tax-deductible (up to certain limits), and the funds can be used tax-free for eligible medical expenses. HSAs offer a triple tax benefit: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

To be eligible for an HSA, you must be enrolled in a High Deductible Health Plan (HDHP). HSAs can be a powerful tool for managing medical expenses and reducing your overall tax liability.

Consider Flexible Spending Accounts (FSAs)

A Flexible Spending Account (FSA) is another tax-advantaged account that can help cover eligible medical expenses. FSAs allow you to set aside a portion of your pre-tax income to pay for qualified medical expenses. The key difference between HSAs and FSAs is that FSAs typically operate on a “use-it-or-lose-it” basis, meaning any funds remaining at the end of the year are forfeited. However, some FSAs offer a grace period or the ability to roll over a limited amount into the next year.

Utilize Tax Credits and Other Benefits

In addition to tax deductions, there may be other tax benefits available for medical expenses. For instance, in the United States, the Premium Tax Credit (PTC) is a refundable tax credit that can help offset the cost of health insurance premiums for individuals and families who purchase coverage through the Health Insurance Marketplace. There may also be state-specific tax credits and deductions for medical expenses, so it’s worth exploring these options.

Common Misconceptions and Pitfalls

While medical expense deductions can be a valuable tax strategy, it’s important to be aware of some common misconceptions and potential pitfalls:

Overestimating Eligible Expenses

It’s crucial to understand which expenses are eligible for deduction and which are not. As mentioned earlier, cosmetic procedures and certain other expenses are generally not deductible. It’s also important to keep in mind that the deduction is based on the amount of expenses that exceed the specified threshold, so you need to have sufficient eligible expenses to make the deduction worthwhile.

Missing the Deduction Deadline

In most jurisdictions, there is a specific deadline for filing tax returns, and you must claim your medical expense deductions within this timeframe. Missing the deadline can result in penalties and may prevent you from taking advantage of these deductions. Be sure to plan ahead and gather all necessary documentation well in advance of the filing deadline.

Assuming All Medical Expenses are Eligible

Not all medical expenses are created equal when it comes to tax deductions. It’s important to carefully review the eligibility criteria for each expense. For instance, over-the-counter medications generally need a prescription to be deductible, and expenses for non-medical items (even if purchased at a medical supply store) are typically not eligible.

Conclusion: Navigating Tax Deductions for Medical Expenses

Understanding the rules and requirements for medical expense deductions can be complex, but with careful planning and record-keeping, you may be able to significantly reduce your tax liability. It’s always a good idea to consult with a qualified tax professional or financial advisor who can provide personalized guidance based on your specific circumstances and the latest tax regulations.

By staying informed and proactive, you can make the most of the tax benefits available for medical expenses, potentially saving you money and easing the financial burden of healthcare costs.

Can I deduct medical expenses for my entire family, including dependents?

+Yes, you can typically deduct qualified medical expenses for yourself, your spouse, and your dependents. This includes children, elderly parents, and other qualifying dependents. It’s important to keep detailed records for each family member’s expenses.

Are there any limits on the amount of medical expenses I can deduct?

+Yes, there are typically limits based on a threshold percentage of your adjusted gross income (AGI). As of my last update in January 2023, the threshold was 10% of AGI for most taxpayers in the United States. However, it’s important to check the latest regulations for your specific jurisdiction.

Can I deduct health insurance premiums as a medical expense?

+Yes, health insurance premiums, including those for you, your spouse, and your dependents, are typically considered qualified medical expenses and can be deducted. This includes premiums for policies obtained through the Health Insurance Marketplace or private insurance providers.

Are there any tax advantages for long-term care expenses?

+Yes, long-term care expenses can be deducted as medical expenses if they meet certain criteria. These expenses include the cost of care for individuals with chronic conditions or disabilities that require assistance with daily activities. It’s important to consult with a tax professional to ensure you’re meeting the eligibility requirements.