Ira Distribution Tax Calculator

The Ira Distribution Tax Calculator

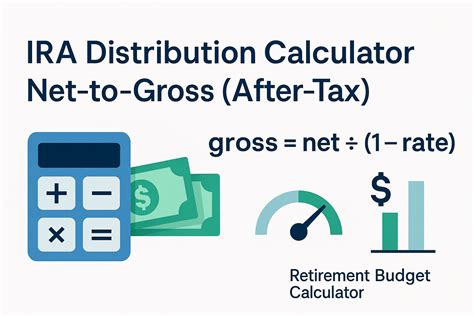

is a valuable tool for individuals planning their retirement savings and distributions. This calculator offers a comprehensive analysis of the tax implications associated with withdrawing funds from an Individual Retirement Account (IRA). By inputting specific details about your IRA and distribution plans, you can gain insights into the potential tax liabilities, helping you make informed decisions about your retirement finances. This article will delve into the intricacies of the Ira Distribution Tax Calculator, its features, benefits, and how it can assist you in navigating the complex world of retirement tax calculations.Understanding the Ira Distribution Tax Calculator

The Ira Distribution Tax Calculator is an advanced online tool designed to provide accurate estimates of the federal income taxes you may owe on your IRA distributions. It considers various factors, including your income, filing status, and the type of IRA from which you are withdrawing funds. This calculator is particularly useful for individuals approaching retirement or those already enjoying their retirement years, as it helps them plan their finances effectively and optimize their tax strategies.

The calculator works by simulating the tax calculation process, considering both ordinary income tax rates and potential tax penalties for early withdrawals, if applicable. It offers a step-by-step approach, guiding users through the process of entering their financial details and providing a clear breakdown of the estimated taxes.

Key Features of the Calculator

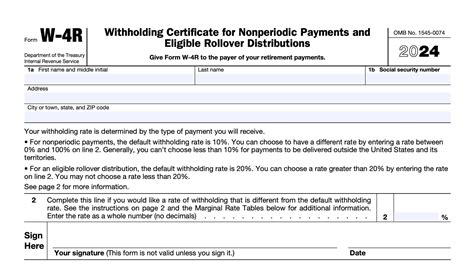

- Income and Filing Status Input: Users can input their annual income and select their filing status (single, married filing jointly, etc.), which are crucial factors in determining tax rates.

- IRA Type Selection: The calculator supports various IRA types, including Traditional IRAs, Roth IRAs, and SEP IRAs, each with its own tax treatment.

- Distribution Amount Entry: You can input the specific amount you plan to withdraw from your IRA, allowing for precise tax estimation.

- Tax Bracket Estimation: The calculator estimates the tax bracket you may fall into based on your income and distribution amount, providing an understanding of the applicable tax rates.

- Penalty Calculation (if applicable): For early withdrawals, the calculator considers potential penalties, such as the 10% early withdrawal penalty for Traditional IRAs, ensuring accurate tax estimates.

- Detailed Tax Report: Upon completion, the calculator generates a comprehensive report outlining the estimated taxes, potential penalties, and any applicable tax credits or deductions.

| IRA Type | Tax Treatment |

|---|---|

| Traditional IRA | Tax-deductible contributions, taxed upon distribution |

| Roth IRA | After-tax contributions, tax-free distributions |

| SEP IRA | Tax-deductible contributions, taxed upon distribution, with higher contribution limits |

How to Maximize the Benefits of the Calculator

To get the most out of the Ira Distribution Tax Calculator, consider the following best practices:

Accurate Data Input

Enter precise and up-to-date financial information, including your current income, IRA balances, and any applicable deductions or credits. Accurate data ensures the calculator provides reliable estimates.

Explore Different Scenarios

Use the calculator to run various distribution scenarios. Experiment with different withdrawal amounts and timing to understand the tax impact on your overall retirement strategy.

Seek Professional Advice

While the calculator offers valuable insights, consulting a financial advisor or tax professional can provide personalized guidance based on your unique circumstances. They can help you navigate complex tax laws and ensure compliance.

Stay Informed on Tax Laws

Tax laws and regulations can change over time. Regularly update yourself on any changes that may affect your IRA distributions and tax obligations. The calculator’s developers often update the tool to reflect the latest tax codes.

Real-World Examples and Case Studies

To illustrate the practical use of the Ira Distribution Tax Calculator, let’s examine a few case studies:

Case Study 1: Early Withdrawal Penalty Avoidance

Imagine a 35-year-old individual with a Traditional IRA. They plan to withdraw 10,000 to cover an emergency expense. By using the calculator, they discover that an early withdrawal would incur a 10% penalty, resulting in an additional tax liability of 1,000. This insight helps them explore alternative options to avoid the penalty.

Case Study 2: Optimizing Retirement Income

A retired couple, aged 65, wants to understand the tax implications of their retirement income, including Social Security benefits and IRA distributions. By inputting their details into the calculator, they can estimate their overall tax liability and adjust their distribution strategy to minimize taxes and maximize their retirement income.

Case Study 3: Roth IRA Conversion

An individual with a Traditional IRA considers converting it to a Roth IRA to take advantage of tax-free distributions in retirement. The calculator helps them understand the potential tax impact of the conversion, allowing them to make an informed decision based on their long-term financial goals.

The Future of Retirement Tax Calculations

As retirement planning becomes increasingly complex, the Ira Distribution Tax Calculator and similar tools will play a vital role in helping individuals navigate the tax landscape. With ongoing advancements in technology and an evolving tax system, these calculators are expected to become even more sophisticated, offering personalized recommendations and strategies.

Additionally, the integration of machine learning and artificial intelligence may enhance the calculator's ability to provide tailored advice, considering an individual's unique financial journey and goals. As more people embrace digital tools for financial planning, the accessibility and usability of such calculators will likely improve, empowering individuals to take control of their retirement finances.

Conclusion

The Ira Distribution Tax Calculator is a powerful resource for anyone seeking to understand the tax implications of their IRA distributions. By offering accurate estimates and guiding users through the tax calculation process, this tool empowers individuals to make informed decisions about their retirement finances. Whether you’re planning for the future or currently enjoying retirement, the calculator provides valuable insights to optimize your tax strategies and ensure a secure financial future.

How accurate are the tax estimates provided by the calculator?

+The calculator provides highly accurate estimates based on the information you input. However, it’s important to note that tax laws can be complex, and individual circumstances may vary. For precise calculations, consult a tax professional.

Can I use the calculator for multiple IRA accounts?

+Yes, the calculator allows you to input details for multiple IRA accounts, providing a comprehensive view of your tax obligations across different accounts.

Are there any limitations to the calculator’s functionality?

+While the calculator is designed to handle most common IRA scenarios, it may not account for highly complex tax situations. In such cases, seeking professional advice is recommended.