San Francisco Sales Tax Rate

The sales tax rate in San Francisco, California, is a topic of interest for both locals and visitors alike, as it can significantly impact one's spending and budgeting. Understanding the sales tax system is crucial when making purchases, as it ensures compliance with local regulations and helps individuals and businesses manage their financial obligations effectively. In this comprehensive guide, we will delve into the specifics of the San Francisco sales tax rate, exploring its historical context, current rates, and the impact it has on various industries and consumers.

The Historical Context of San Francisco’s Sales Tax

San Francisco’s sales tax structure has evolved over the years, reflecting the city’s economic growth and changing fiscal needs. In the early 20th century, sales taxes were a relatively new concept, and their implementation varied greatly across the United States. California, being at the forefront of economic development, introduced its first sales tax in 1933, with San Francisco quickly adopting the state’s framework.

Initially, the sales tax rate in San Francisco was set at a modest 2.5%, primarily to generate revenue for the state and local governments. This rate was applicable to most goods and services, providing a steady income stream during the Great Depression. Over time, as the city's economy diversified and expanded, the sales tax rate gradually increased to keep pace with the growing demand for public services and infrastructure development.

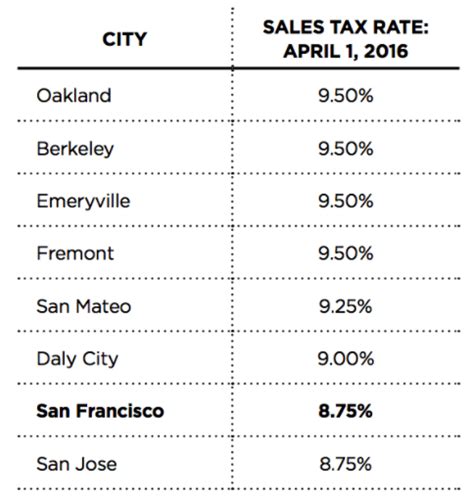

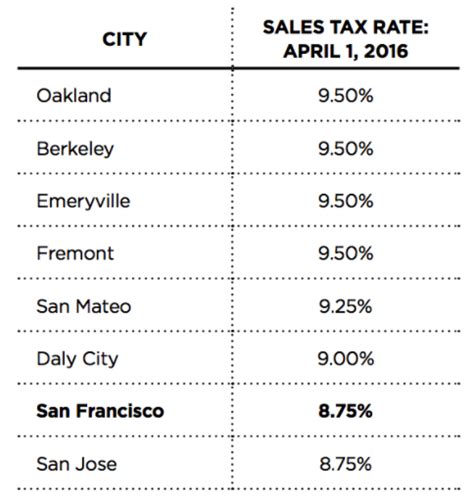

Current Sales Tax Rates in San Francisco

As of January 2024, the sales tax rate in San Francisco consists of several components, each serving a specific purpose:

- State Sales Tax: The state of California imposes a 7.25% sales tax rate, which is applicable across the state. This rate is used to fund various state-wide initiatives, including education, healthcare, and infrastructure projects.

- City Sales Tax: San Francisco, as a city, levies an additional 1.5% sales tax. This tax is crucial for funding city-specific projects and services, such as public transportation, local healthcare, and community development programs.

- District Sales Tax: Certain areas within San Francisco, known as special assessment districts, may have their own sales tax rates to finance specific improvements or projects. These rates can vary, but typically range from 0.25% to 1.0%, depending on the district's needs and approved initiatives.

To illustrate, a purchase of a $1000 laptop in San Francisco would incur the following sales taxes:

| Tax Component | Rate | Amount |

|---|---|---|

| State Sales Tax | 7.25% | $72.50 |

| City Sales Tax | 1.5% | $15.00 |

| District Sales Tax (example) | 0.5% | $5.00 |

| Total Sales Tax | $92.50 |

As a result, the total cost of the laptop, including sales tax, would be $1092.50.

Impact on Different Industries

The sales tax rate in San Francisco has a significant impact on various industries, shaping their business strategies and consumer behaviors. Here are a few key sectors and their experiences:

- Retail Sector: Retailers in San Francisco play a crucial role in the local economy, and the sales tax rate directly affects their pricing strategies and profit margins. To remain competitive, retailers often absorb a portion of the sales tax, which can impact their profitability. Additionally, the city's diverse population and tourism industry create a unique dynamic, with retailers catering to a wide range of tastes and budgets.

- E-commerce and Online Retailers: Online retailers, both local and national, face unique challenges when it comes to sales tax compliance in San Francisco. They must navigate the complex web of tax regulations, ensuring they collect and remit the correct taxes based on the customer's location. This can be a significant administrative burden, especially for smaller businesses.

- Hospitality and Tourism: San Francisco's vibrant tourism industry is a major contributor to its economy. The sales tax rate directly affects the pricing of hotel stays, restaurant meals, and various tourism-related services. To remain competitive and attract visitors, businesses in this sector often offer value-added experiences or discounts to offset the tax impact.

- Manufacturing and Wholesale: Manufacturers and wholesalers in San Francisco face different sales tax considerations. While they may not directly interact with consumers, they are responsible for collecting and remitting sales taxes on their B2B transactions. Additionally, the sales tax rate can influence their pricing strategies and impact their competitiveness in the market.

Sales Tax Exemptions and Special Considerations

While the sales tax rate in San Francisco applies to a wide range of goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions can significantly impact the overall tax burden and provide opportunities for savings.

Exemptions for Essential Goods

San Francisco, like many other jurisdictions, recognizes the importance of making certain essential goods and services more accessible to its residents. As a result, specific items are exempt from sales tax, ensuring that these necessities remain affordable.

- Grocery Items: Basic grocery staples, including non-prepared foods, are generally exempt from sales tax. This exemption encourages healthy eating habits and ensures that residents can afford essential groceries without the added tax burden.

- Prescription Medications: To promote access to healthcare, sales tax is not applied to prescription medications. This exemption is particularly beneficial for individuals with chronic conditions or those requiring ongoing medical treatment.

- Over-the-Counter Medications: Certain over-the-counter medications, such as pain relievers and allergy medications, are also exempt from sales tax. This exemption ensures that residents can easily access these essential healthcare items without additional costs.

Sales Tax Holidays

In an effort to stimulate the economy and provide relief to consumers, San Francisco, along with other cities and states, occasionally declares sales tax holidays. During these designated periods, specific items are exempt from sales tax, encouraging shoppers to make larger purchases. Sales tax holidays are typically announced well in advance and often coincide with major shopping events, such as back-to-school season or holiday sales.

For example, in 2023, San Francisco offered a sales tax holiday for clothing and footwear items priced under $100. This allowed residents to purchase these items without incurring the usual sales tax, providing a significant savings opportunity.

Special Considerations for Businesses

Businesses operating in San Francisco must navigate a complex sales tax landscape, ensuring they comply with all regulations. Here are a few special considerations for businesses:

- Use Tax: San Francisco imposes a use tax on goods purchased out-of-state but used or consumed within the city. This tax is applicable when businesses bring inventory into the city or when individuals purchase items online from out-of-state retailers. The use tax ensures that businesses and consumers contribute to the city's revenue stream, regardless of where the purchase was made.

- Sales Tax Registration and Remittance: Businesses selling taxable goods or services in San Francisco must register with the California Department of Tax and Fee Administration (CDTFA). They are then responsible for collecting and remitting sales taxes on a regular basis. Failure to comply with these regulations can result in significant penalties.

- Sales Tax Exemptions for Business-to-Business Transactions: Certain business-to-business transactions may be exempt from sales tax, particularly when the goods or services are used for production or resale. This exemption is crucial for businesses operating within the city, as it helps them manage their costs and remain competitive.

Sales Tax Compliance and Enforcement

Ensuring compliance with sales tax regulations is a critical aspect of doing business in San Francisco. The city, along with the state of California, has implemented robust enforcement mechanisms to ensure that businesses and individuals adhere to the sales tax laws.

Sales Tax Audits

The California Department of Tax and Fee Administration (CDTFA) conducts regular sales tax audits to verify that businesses are accurately collecting and remitting sales taxes. These audits can be complex and time-consuming, often requiring businesses to provide detailed records and documentation.

During an audit, the CDTFA may examine a business's sales records, purchase orders, and tax returns to ensure compliance. If discrepancies are found, businesses may face penalties, interest charges, and even legal consequences.

Voluntary Disclosure Program

Recognizing that mistakes can happen, the CDTFA offers a Voluntary Disclosure Program for businesses and individuals who have underreported or failed to report sales taxes. This program allows taxpayers to come forward, disclose their errors, and work with the CDTFA to resolve the issue. By participating in this program, taxpayers can minimize penalties and avoid legal complications.

The Voluntary Disclosure Program is a win-win situation, as it provides an opportunity for taxpayers to correct their mistakes while also ensuring that the city receives the revenue it is due.

Impact of Non-Compliance

Non-compliance with sales tax regulations can have severe consequences for businesses and individuals alike. Penalties for underreporting or failing to remit sales taxes can be substantial, often amounting to hundreds or even thousands of dollars. Additionally, interest charges may accrue on the outstanding tax amount, further increasing the financial burden.

In extreme cases, non-compliance can lead to legal action, including civil lawsuits and criminal charges. Businesses found guilty of willful tax evasion may face significant fines and even jail time. It is therefore crucial for businesses to prioritize sales tax compliance and seek professional guidance when needed.

Future Implications and Potential Changes

The sales tax landscape in San Francisco is dynamic and subject to change, influenced by various factors such as economic conditions, political decisions, and technological advancements. As the city continues to evolve, there are several potential developments that could impact the sales tax rate and its administration.

Economic Factors

The economic health of San Francisco plays a significant role in determining the sales tax rate. During periods of economic growth and prosperity, the city may choose to maintain or even reduce the sales tax rate to encourage consumer spending and business investment. Conversely, during economic downturns, the sales tax rate may be increased to generate additional revenue and support public services.

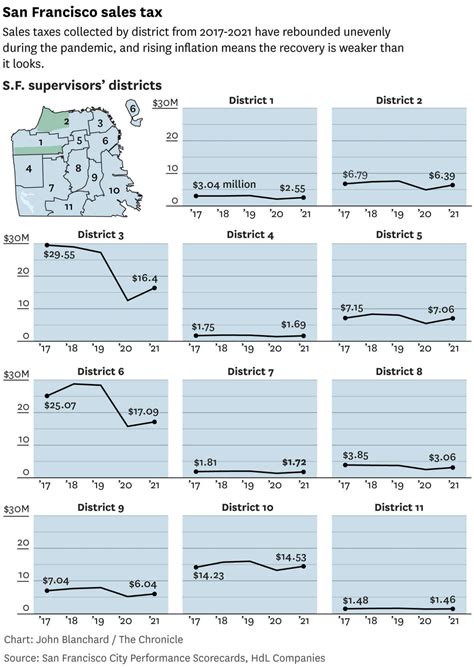

For instance, during the COVID-19 pandemic, San Francisco, like many other cities, experienced a significant decline in tax revenue due to business closures and reduced consumer spending. In response, the city may have considered temporary sales tax increases to offset the revenue loss and fund essential services.

Political Decisions

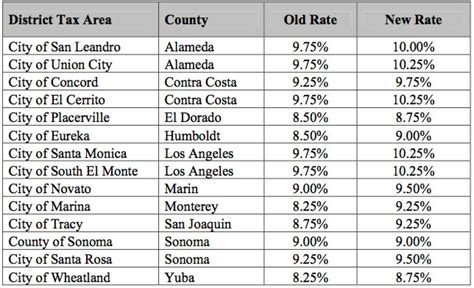

Political decisions at the local, state, and federal levels can also influence the sales tax rate in San Francisco. Elected officials may propose changes to the sales tax structure to address specific policy goals or respond to changing economic conditions. These decisions are often the result of careful analysis and public input, aiming to strike a balance between revenue generation and the impact on consumers and businesses.

For example, in recent years, there has been a growing movement to reform sales tax laws to address the rise of e-commerce and online sales. As more transactions move online, policymakers are exploring ways to ensure that these sales are subject to the appropriate sales taxes, preventing revenue loss for the city.

Technological Advancements

The rapid advancement of technology is transforming the way sales taxes are administered and enforced. San Francisco, along with other cities, is leveraging technology to streamline the sales tax collection process and enhance compliance.

One notable development is the use of electronic filing and payment systems, which allow businesses to submit their sales tax returns and payments online. This not only simplifies the process for businesses but also enables the city to efficiently process and analyze the data, identifying potential compliance issues more quickly.

Additionally, the rise of digital marketplaces and e-commerce platforms has prompted the development of new tax software and tools to assist businesses in accurately calculating and remitting sales taxes. These technologies help businesses stay compliant and reduce the risk of errors.

Potential Future Changes

Looking ahead, there are several potential changes that could impact the sales tax rate in San Francisco:

- Expansion of Sales Tax Base: As the economy evolves, new industries and services may emerge, presenting opportunities to expand the sales tax base. This could include the taxation of digital products, streaming services, or even certain financial transactions.

- Sales Tax Reform: There is ongoing discussion about the fairness and efficiency of the current sales tax system. Future reforms may focus on simplifying the tax structure, improving compliance, and ensuring that the tax burden is distributed equitably among consumers and businesses.

- Use of Technology for Compliance: San Francisco may continue to invest in technology to enhance sales tax compliance. This could involve the use of advanced data analytics, artificial intelligence, and machine learning to identify potential tax evasion or non-compliance, allowing for more targeted audits and enforcement actions.

Regardless of the changes that lie ahead, the sales tax rate in San Francisco will remain a critical component of the city's fiscal framework, shaping the economic landscape and influencing the daily lives of residents and businesses alike.

What is the current sales tax rate in San Francisco as of 2024?

+As of 2024, the sales tax rate in San Francisco consists of a 7.25% state sales tax, a 1.5% city sales tax, and varying district sales tax rates ranging from 0.25% to 1.0%.

Are there any sales tax exemptions in San Francisco?

+Yes, certain essential goods are exempt from sales tax, including grocery items, prescription medications, and over-the-counter medications. Additionally, there may be sales tax holidays for specific items during designated periods.

How do sales tax audits work in San Francisco?

+The California Department of Tax and Fee Administration (CDTFA) conducts sales tax audits to verify compliance. Audits may involve examining sales records, purchase orders, and tax returns. Non-compliance can result in penalties, interest charges, and legal consequences.

What is the Voluntary Disclosure Program in San Francisco?

+The Voluntary Disclosure Program allows businesses and individuals who have underreported sales taxes to come forward, disclose their errors, and work with the CDTFA to resolve the issue. It provides an opportunity to minimize penalties and avoid legal complications.

How might the sales tax rate in San Francisco change in the future?

+Future changes to the sales tax rate could include expanding the sales tax base to include new industries, sales tax reform to improve fairness and compliance, and increased use of technology for efficient tax administration and enforcement.