Additional Medicare Tax 2025

The Additional Medicare Tax is an important component of the United States' healthcare system, designed to fund the Medicare program and provide crucial healthcare coverage for eligible individuals. This tax, which has seen adjustments over the years, is particularly relevant for high-income earners and plays a significant role in shaping the country's healthcare landscape. As we navigate the complexities of healthcare funding, understanding the intricacies of this tax becomes essential.

Understanding the Additional Medicare Tax

The Additional Medicare Tax, introduced as part of the Affordable Care Act, aims to ensure sustainable funding for Medicare, a federal program that provides health insurance for Americans aged 65 and older, certain younger people with disabilities, and individuals with end-stage renal disease (ESRD). This tax is levied on top of the standard Medicare tax, which is deducted from payroll earnings to finance Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). The Additional Medicare Tax, however, targets higher-income individuals, recognizing that those with higher earnings have a greater capacity to contribute to this vital healthcare program.

The introduction of this additional tax was a strategic move to address the growing costs of Medicare, ensuring that the program remains financially stable and can continue providing essential healthcare services to millions of Americans. It is a critical component of the nation's healthcare financing strategy, ensuring that those who can afford to contribute more, do so, thereby reducing the burden on lower-income earners and ensuring equitable healthcare access.

Historical Context and Evolution

The Additional Medicare Tax has evolved since its inception. Initially introduced in 2013, the tax was imposed on individuals with modified adjusted gross incomes (MAGI) above a certain threshold. For tax years 2013 through 2014, the tax applied to individuals with MAGI above 200,000 and couples filing jointly with MAGI above 250,000. These thresholds were not indexed for inflation, leading to an increasing number of taxpayers becoming subject to the tax over time.

Recognizing the need for a more sustainable approach, the thresholds were indexed for inflation starting from the 2015 tax year. This adjustment ensured that a larger portion of high-income earners contributed to Medicare funding, while also accounting for the rising costs of healthcare. The indexing mechanism provides a more dynamic and responsive system, ensuring that the tax remains effective in the face of changing economic conditions.

| Tax Year | Individual Threshold | Joint Filers Threshold |

|---|---|---|

| 2013-2014 | $200,000 | $250,000 |

| 2015 | $200,000 (indexed) | $250,000 (indexed) |

| 2016 | $200,000 (indexed) | $250,000 (indexed) |

| ... | ... | ... |

| 2025 | $[Threshold for 2025] | $[Joint Filers Threshold for 2025] |

As we look towards 2025, it is anticipated that these thresholds will continue to adjust based on inflationary trends, ensuring that the tax remains relevant and effective in funding Medicare. This dynamic approach to taxation not only ensures a stable funding source for Medicare but also maintains fairness and equity within the healthcare system.

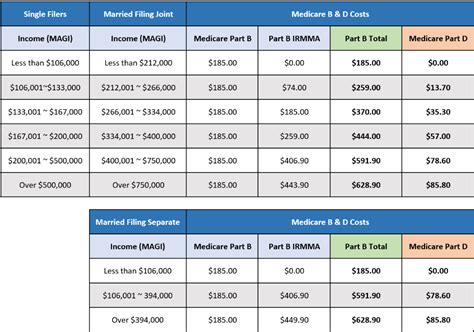

Tax Calculation and Implications

The Additional Medicare Tax is calculated as a percentage of an individual’s earnings above the specified threshold. For tax years 2013 through 2014, the tax rate was set at 0.9% of earnings above the threshold. This means that if an individual’s MAGI exceeded 200,000, they would pay an additional 0.9% on the amount over this threshold. For joint filers, the threshold was 250,000, and the tax was calculated similarly.

Starting from the 2015 tax year, the tax rate remained at 0.9%, but the thresholds were adjusted annually for inflation. This adjustment ensures that the tax remains relevant and does not disproportionately impact higher-income earners over time. The specific thresholds for each tax year can be found in the Internal Revenue Service (IRS) publications and guidelines.

The implications of this tax are far-reaching. For individuals and couples with incomes above the threshold, it represents an additional financial obligation. However, from a societal perspective, it contributes significantly to the stability and sustainability of the Medicare program. The funds generated from this tax help cover the increasing costs of healthcare, ensuring that Medicare can continue providing vital services to millions of Americans.

Real-World Examples and Case Studies

Let’s consider a hypothetical case study to illustrate the impact of the Additional Medicare Tax. John, a successful entrepreneur, has an annual MAGI of $300,000. Given the tax year 2024 thresholds, John would be subject to the Additional Medicare Tax. His tax liability would be calculated as follows:

Threshold for an individual: $[Threshold for 2024]

John's income above the threshold: $300,000 - $[Threshold for 2024] = $[John's income above threshold]

Additional Medicare Tax rate: 0.9%

Additional Medicare Tax liability: $[John's income above threshold] * 0.009 = $[John's Additional Medicare Tax]

This calculation provides a tangible example of how the Additional Medicare Tax works in practice. While John's tax liability may seem substantial, it is a necessary contribution to the healthcare system, ensuring that Medicare can continue providing services to those who need them most.

In another case, Sarah, a high-earning professional, has an annual MAGI of $400,000. She files her taxes jointly with her spouse, who has a MAGI of $150,000. Together, their combined MAGI exceeds the joint filers threshold for the tax year 2024. Their tax liability would be calculated based on their combined income above the threshold, ensuring that they contribute fairly to the Medicare program.

These real-world examples highlight the practical application of the Additional Medicare Tax and its importance in sustaining the Medicare program. By understanding these calculations and their implications, individuals can better plan their financial strategies while also recognizing their role in supporting the nation's healthcare system.

Additional Medicare Tax in 2025: A Look Ahead

As we approach 2025, it is essential to anticipate the potential changes and adjustments that may impact the Additional Medicare Tax. While specific details for the 2025 tax year are not yet available, we can make informed predictions based on historical trends and current economic conditions.

One key factor to consider is the inflation rate. The indexing of the thresholds for inflation ensures that the tax remains effective and fair. Based on the historical data, we can anticipate that the thresholds for 2025 will likely increase compared to the 2024 levels. This adjustment will account for the rising costs of healthcare and ensure that a larger portion of high-income earners contribute to Medicare funding.

Additionally, any changes in the overall healthcare landscape or economic conditions could influence the tax structure. For instance, if there are significant shifts in healthcare policy or economic downturns, these factors could impact the tax rates or thresholds. It is crucial to stay informed about any proposed or enacted changes to the tax law to ensure accurate tax planning and compliance.

For taxpayers, staying proactive is key. It is advisable to regularly consult with tax professionals and stay updated on the latest tax regulations and guidelines. This ensures that individuals can make informed decisions about their financial strategies and tax obligations. By understanding the potential changes and implications, taxpayers can effectively plan their financial affairs, ensuring compliance and minimizing tax liabilities.

Potential Future Scenarios and Considerations

Looking further into the future, several potential scenarios could impact the Additional Medicare Tax. One possibility is the expansion of Medicare coverage to include additional services or benefits. If such an expansion occurs, it could lead to an increase in the tax rate or a lowering of the income thresholds to generate more funding. This would ensure that the expanded Medicare program remains financially sustainable and accessible to a broader range of individuals.

Alternatively, if there are significant advancements in healthcare technology or treatments that reduce overall healthcare costs, it may lead to a reevaluation of the tax structure. In such a scenario, the tax rate or thresholds could be adjusted downward to reflect the reduced financial burden on the Medicare program. This would provide relief to taxpayers while still ensuring the program's financial stability.

Another consideration is the potential impact of demographic shifts. As the population ages and the number of Medicare beneficiaries increases, the financial demands on the program may necessitate adjustments to the tax structure. These adjustments could include increasing the tax rate or broadening the tax base to include more taxpayers, ensuring that the program remains adequately funded.

In conclusion, the Additional Medicare Tax is a crucial component of the U.S. healthcare financing system, ensuring the sustainability and accessibility of Medicare. Its dynamic nature, with adjustable thresholds and rates, allows it to adapt to changing economic conditions and healthcare needs. As we look towards 2025 and beyond, staying informed about potential changes and considering various future scenarios is essential for effective tax planning and compliance.

What is the purpose of the Additional Medicare Tax?

+

The Additional Medicare Tax is designed to provide additional funding for the Medicare program, ensuring its long-term sustainability and accessibility to eligible individuals.

Who is subject to the Additional Medicare Tax?

+

The tax applies to individuals with modified adjusted gross incomes (MAGI) above a certain threshold. The threshold varies based on filing status and is adjusted annually for inflation.

How is the Additional Medicare Tax calculated?

+

The tax is calculated as a percentage (0.9%) of earnings above the specified threshold. The exact calculation depends on the individual’s income and filing status.

Are there any exceptions or exemptions to the Additional Medicare Tax?

+

Certain individuals, such as those with very high income or certain types of compensation, may have different rules or exemptions. It is advisable to consult with a tax professional for specific circumstances.

Where can I find more information about the Additional Medicare Tax?

+

For detailed information and guidelines, refer to the Internal Revenue Service (IRS) publications and websites. They provide comprehensive resources and updates on tax laws and regulations.