Michigan Sales Tax Exemption Form

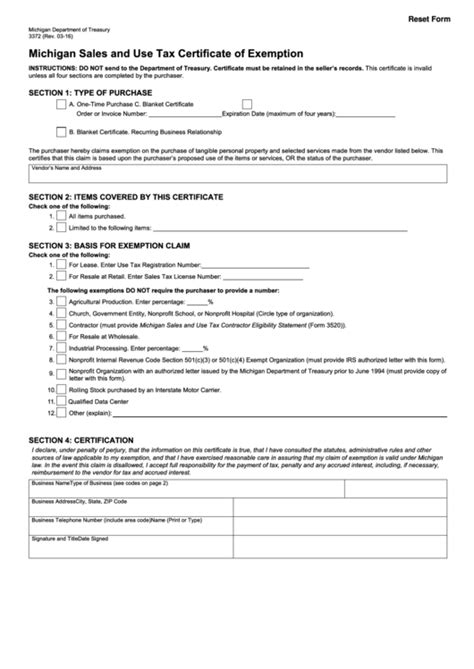

The Michigan Sales Tax Exemption Form is a crucial document for businesses and individuals in the state of Michigan. This form, also known as the Form ST-13, plays a vital role in determining whether a transaction is subject to sales tax or qualifies for exemption. In this comprehensive guide, we will delve into the intricacies of the Michigan Sales Tax Exemption Form, exploring its purpose, eligibility criteria, completion process, and the benefits it offers to taxpayers.

Understanding the Michigan Sales Tax Exemption Form

The Michigan Department of Treasury has designed the Sales Tax Exemption Form to streamline the process of claiming sales tax exemptions for eligible entities. This form is a legal document that provides a framework for businesses and individuals to demonstrate their eligibility for specific sales tax exemptions.

Sales tax is a crucial revenue source for the state, contributing to the funding of various public services and infrastructure. However, certain transactions are exempt from sales tax to promote economic growth, support specific industries, and provide relief to certain segments of the population. The Sales Tax Exemption Form ensures that these exemptions are applied accurately and in compliance with state regulations.

Eligibility Criteria

Not all entities are eligible for sales tax exemptions in Michigan. The eligibility criteria vary based on the nature of the transaction, the status of the purchaser, and the specific exemption category. Here are some key eligibility factors to consider:

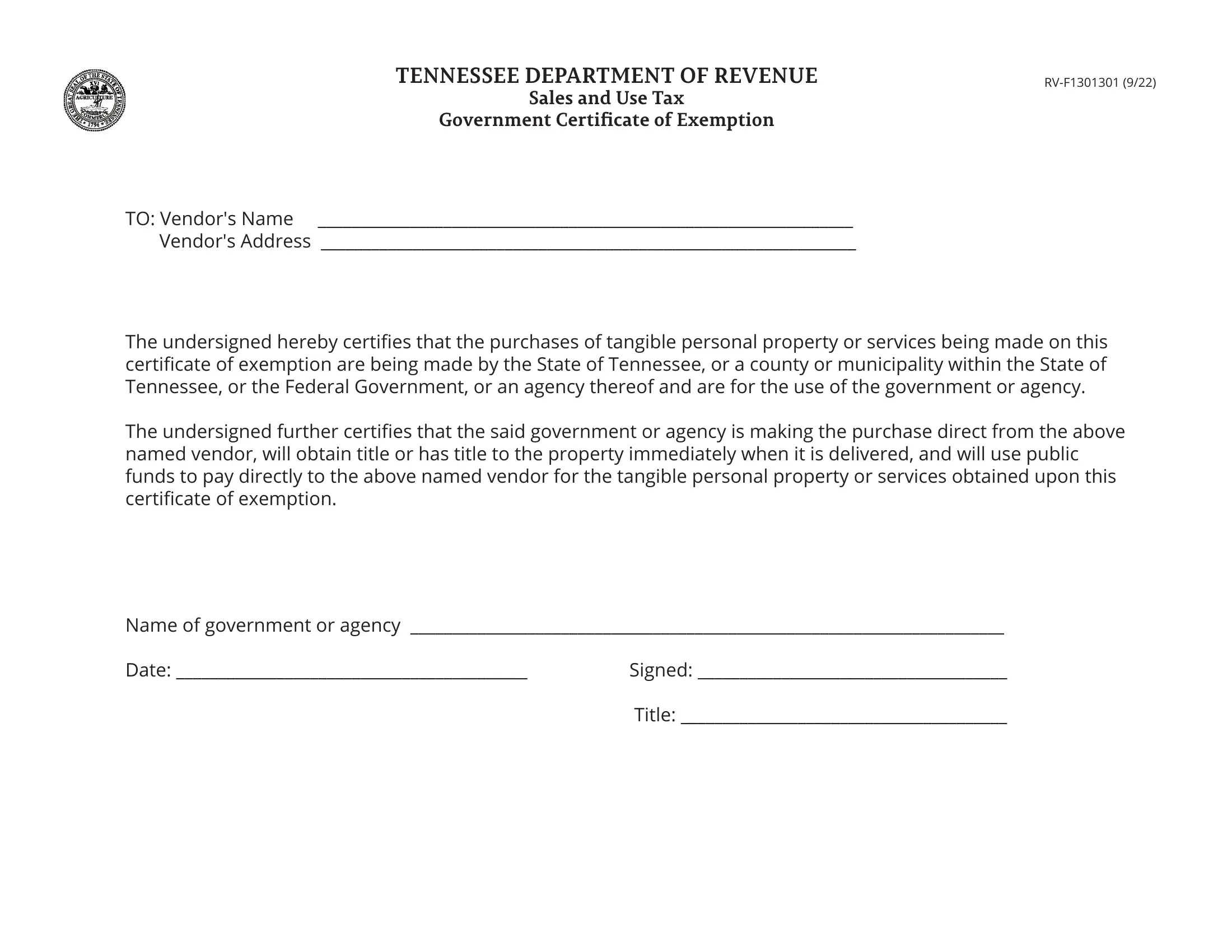

- Purchaser Type: The status of the purchaser plays a significant role in determining eligibility. For instance, certain government entities, non-profit organizations, and educational institutions may be eligible for exemptions.

- Transaction Type: Sales tax exemptions are often tied to specific types of transactions. Common exemptions include purchases for resale, purchases for manufacturing or production, and purchases for research and development.

- Industry-Specific Exemptions: Michigan offers exemptions for certain industries, such as agriculture, construction, and tourism. These exemptions are designed to support economic growth and promote specific sectors.

- Resale Certificate: If you are purchasing goods for resale, you may be eligible for a sales tax exemption by presenting a valid Resale Certificate. This certificate serves as proof that the goods will be resold and not subject to sales tax at the point of purchase.

Completing the Form ST-13

Completing the Michigan Sales Tax Exemption Form requires careful attention to detail. Here is a step-by-step guide to ensure accuracy and compliance:

- Obtain the Form: The Form ST-13 is available on the Michigan Department of Treasury's website. You can download it directly or request a hard copy by mail.

- Read the Instructions: Before filling out the form, thoroughly read the instructions provided. These instructions explain the requirements, eligibility criteria, and specific information needed for each section.

- Complete the Header: Start by providing your basic information, including your name, address, and contact details. Ensure that the information is accurate and up-to-date.

- Identify the Exemption Category: The form includes various exemption categories. Select the category that applies to your transaction. Common categories include resale, manufacturing, government, and charitable organizations.

- Provide Supporting Documentation: Depending on the exemption category, you may need to attach supporting documents. This could include a Resale Certificate, a government ID, or a letter from a non-profit organization.

- Sign and Date: Once you have completed the form and provided all necessary information and documentation, sign and date the form. This signature confirms your eligibility and responsibility for the exemption claim.

Benefits of Sales Tax Exemptions

Sales tax exemptions offer a range of benefits to eligible entities. Here are some key advantages:

- Cost Savings: Sales tax exemptions directly reduce the financial burden on businesses and individuals. By claiming eligible exemptions, you can save on sales tax expenses, which can significantly impact your bottom line.

- Competitive Advantage: Sales tax exemptions can provide a competitive edge to businesses. When competitors are subject to sales tax, exempt businesses may be able to offer more competitive pricing, attracting more customers and increasing market share.

- Support for Specific Industries: Michigan's sales tax exemptions are strategically designed to support specific industries. By taking advantage of these exemptions, businesses in sectors like agriculture, construction, and tourism can thrive and contribute to the state's economic growth.

- Compliance and Peace of Mind: Accurately claiming sales tax exemptions ensures compliance with Michigan tax laws. By understanding and utilizing the Sales Tax Exemption Form, businesses can avoid penalties and maintain a positive relationship with the Department of Treasury.

Real-World Example: Agriculture Exemption

Let’s consider a real-world example to illustrate the impact of sales tax exemptions. Imagine a Michigan-based farming operation that purchases agricultural equipment and supplies. Without the sales tax exemption, the farmer would incur significant sales tax expenses on these purchases, impacting their profitability.

However, by claiming the agricultural exemption, the farmer can avoid these sales tax costs. This exemption, designed to support the state's agricultural industry, allows the farmer to invest more in their operation, purchase advanced equipment, and potentially expand their business. The exemption not only benefits the farmer but also contributes to the state's food production and economic growth.

| Agricultural Exemption | Eligible Purchases |

|---|---|

| Sales Tax Exemption | Tractors, Harvesters, Irrigation Equipment |

| Exemption for Seeds | Seed Corn, Vegetable Seeds, Fruit Tree Seeds |

| Fuel Exemption | Diesel Fuel for Agricultural Machinery |

Future Implications and Changes

The landscape of sales tax exemptions is dynamic, and changes in state regulations or economic conditions can impact eligibility and processes. It is essential for taxpayers to stay informed about any updates or modifications to the Sales Tax Exemption Form and the exemption criteria.

The Michigan Department of Treasury regularly reviews and updates tax regulations to align with changing economic realities and legislative priorities. As a result, taxpayers should anticipate potential adjustments to exemption categories, eligibility requirements, and the form itself. Staying engaged with tax professionals, industry associations, and the Department of Treasury ensures access to the latest information and guidance.

Additionally, advancements in technology and digital transformation are shaping the future of tax administration. Michigan, like many states, is exploring ways to streamline the sales tax exemption process through digital tools and platforms. These innovations aim to simplify form completion, enhance data accuracy, and provide real-time updates on exemption criteria.

As we look ahead, it is crucial for businesses and individuals to embrace these technological advancements and adapt their tax strategies accordingly. By staying proactive and informed, taxpayers can continue to leverage sales tax exemptions effectively and contribute to Michigan's thriving economy.

Frequently Asked Questions

How often should I renew my sales tax exemption certificate?

+The renewal frequency for sales tax exemption certificates varies based on the specific exemption and the issuing authority. Some certificates may need to be renewed annually, while others may be valid for multiple years. It is essential to review the instructions provided with your exemption certificate and stay informed about any renewal requirements.

Can I apply for multiple sales tax exemptions at once?

+Yes, you can apply for multiple sales tax exemptions simultaneously if you meet the eligibility criteria for each. However, it is crucial to carefully review the requirements and ensure that you provide the necessary documentation for each exemption category. Each exemption may have specific supporting documents or evidence required for approval.

Are there any penalties for claiming ineligible sales tax exemptions?

+Claiming ineligible sales tax exemptions can result in penalties and interest charges. It is crucial to carefully review the eligibility criteria and consult with tax professionals or the Michigan Department of Treasury if you have any doubts about your eligibility. Accurate and honest reporting is essential to maintain compliance and avoid penalties.

Can I claim a sales tax exemption for online purchases?

+The eligibility for sales tax exemptions for online purchases depends on various factors, including the nature of the transaction, the purchaser’s status, and the state’s specific regulations. In some cases, online purchases may be eligible for exemptions, especially if they align with the state’s exemption criteria. It is advisable to consult the Michigan Department of Treasury’s guidelines or seek professional advice for online purchase scenarios.

How can I stay updated on changes to sales tax exemption regulations in Michigan?

+Staying informed about changes to sales tax exemption regulations is crucial for maintaining compliance. The Michigan Department of Treasury regularly publishes updates and announcements on its website. Subscribing to their email notifications or following their social media channels can provide real-time updates on any changes or new developments. Additionally, engaging with tax professionals and industry associations can offer valuable insights and guidance on tax matters.