Filing Late Taxes

Tax season is a critical time for individuals and businesses, but sometimes, despite our best intentions, circumstances arise that lead to late tax filings. This article aims to provide a comprehensive guide on the process of filing late taxes, including the potential consequences, how to navigate the process smoothly, and strategies to avoid future delays. Late tax filings can have significant implications, but with the right knowledge and preparation, you can minimize any negative impact.

Understanding Late Tax Filings

Late tax filings occur when individuals or entities fail to meet the official deadline set by their respective tax authorities. In the United States, for instance, the standard tax filing deadline is April 15th for individual taxpayers, while corporations have a March 15th deadline. However, various factors can lead to missed deadlines, such as unforeseen circumstances, complexity of tax situations, or even simple oversight.

It's important to note that late filing doesn't necessarily mean you'll face penalties. Tax authorities often understand that life can present unexpected challenges, and they provide mechanisms to handle late filings. Nonetheless, it's crucial to address the situation promptly to avoid further complications.

Consequences of Late Tax Filings

Failing to file taxes on time can result in a range of consequences, which may vary depending on your jurisdiction and the specifics of your situation. Here are some potential outcomes:

Penalties and Interest

Most tax authorities impose penalties for late filings. These penalties can be a percentage of the taxes owed or a flat fee, and they often accumulate over time. For instance, the Internal Revenue Service (IRS) in the US charges a 5% monthly fee on the unpaid taxes, with a maximum penalty of 25% of the total tax due. Additionally, interest may accrue on the unpaid tax balance, further increasing the amount owed.

Legal Consequences

In severe cases, especially when late filings are intentional or result from fraudulent activities, legal actions may be taken. This could lead to criminal charges, fines, or even imprisonment. It’s crucial to remember that tax evasion is a serious offense, and tax authorities have robust mechanisms to detect and address such activities.

Impact on Credit Rating

Late tax filings can also affect your credit rating, especially if you owe a substantial amount. Tax authorities may report your delinquent status to credit bureaus, which can result in a lower credit score. This, in turn, can impact your ability to secure loans, mortgages, or even employment opportunities.

Limited Refund Options

If you’re due a tax refund, filing late can complicate the process. Tax authorities may hold your refund until they receive your complete and accurate tax return. In some cases, you might even forfeit your refund if you don’t file within a certain timeframe.

Strategies for Filing Late Taxes

If you find yourself in a situation where you need to file late, here are some strategies to navigate the process effectively:

File as Soon as Possible

The first step is to act promptly. Tax authorities often have more leniency for taxpayers who take responsibility and file as soon as they realize their mistake. Delaying the process will only increase the penalties and interest owed.

Request an Extension

If you anticipate a delay in filing, it’s wise to request an extension. This won’t extend the deadline for paying your taxes, but it will give you more time to gather the necessary information and prepare your return. In the US, you can use Form 4868 to request an automatic six-month extension.

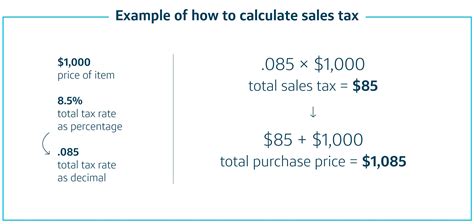

Pay Your Taxes Owed

Even if you can’t file your return immediately, it’s crucial to pay your taxes owed as soon as possible. This will help minimize the penalties and interest accrued. If you can’t pay the full amount, consider setting up a payment plan with the tax authority. Many jurisdictions offer flexible payment options to help taxpayers manage their financial obligations.

Seek Professional Help

If you’re unsure about the process or have a complex tax situation, consider consulting a tax professional. They can guide you through the late filing process, ensure you meet all the necessary requirements, and help you navigate any potential pitfalls.

Utilize Tax Software

Tax software can be a valuable tool for preparing your late tax return. These programs often provide step-by-step guidance and can help you identify potential deductions or credits you may have missed. Additionally, they can streamline the filing process and ensure accuracy.

Avoiding Late Filings in the Future

Prevention is always better than cure. Here are some tips to help you avoid late tax filings in the future:

Set Reminders

Use calendar reminders, mobile apps, or email notifications to stay on top of important tax deadlines. Setting reminders well in advance can help you plan and ensure you have all the necessary information ready.

Start Early

Begin preparing your tax return as early as possible. This gives you ample time to gather all the necessary documents, calculate your deductions, and seek professional advice if needed. Starting early also reduces the likelihood of making mistakes or overlooking important details.

Keep Accurate Records

Maintain organized records of your financial transactions throughout the year. This makes the tax preparation process much easier and reduces the chances of errors or missing information.

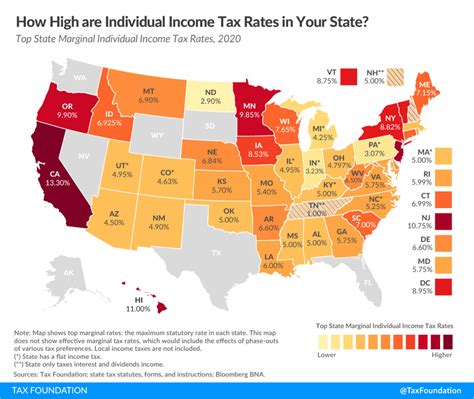

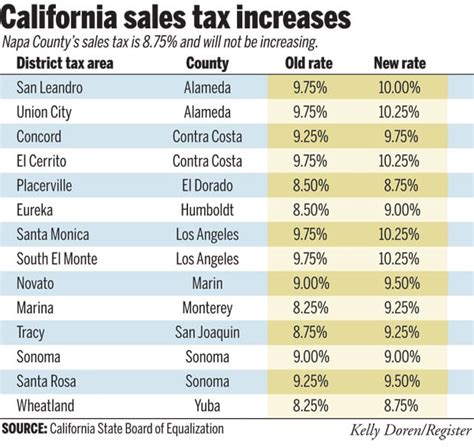

Understand Your Tax Situation

Take the time to understand your tax obligations and the specific requirements for your situation. This includes being aware of any changes in tax laws or regulations that may impact your filing. Consulting a tax professional or using reputable tax resources can help you stay informed.

Conclusion: A Smooth Late Filing Process

While filing late taxes can be a daunting prospect, it’s important to remember that many taxpayers find themselves in this situation at some point. The key is to act promptly, understand the potential consequences, and take the necessary steps to minimize any negative impact. By following the strategies outlined above and staying informed about your tax obligations, you can navigate the late filing process with confidence.

What happens if I file my taxes late without any payment or extension request?

+If you file late without paying or requesting an extension, you may face penalties and interest on the unpaid taxes. Additionally, the tax authority may initiate enforcement actions, including liens or levies, to collect the owed amount.

Can I still claim tax refunds if I file late?

+Yes, you can still claim tax refunds even if you file late. However, the tax authority may hold your refund until they receive your complete and accurate return. It’s important to file as soon as possible to avoid further delays.

Are there any circumstances where I won’t face penalties for late filing?

+In some cases, tax authorities may waive penalties if you can demonstrate reasonable cause for your late filing. This could include situations like a natural disaster, serious illness, or other unforeseen circumstances beyond your control.