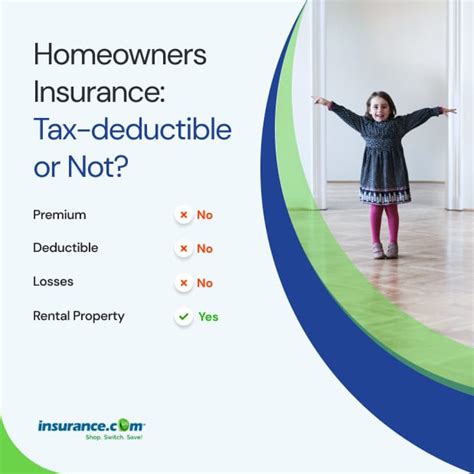

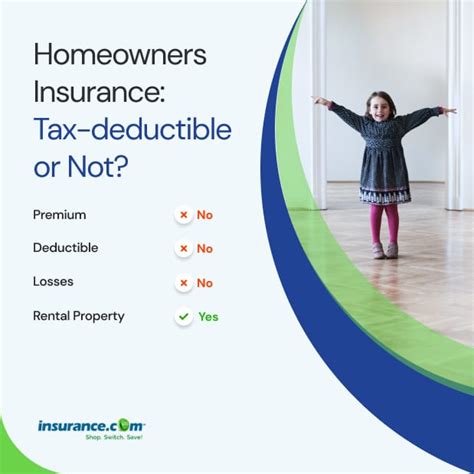

Is Home Insurance Tax Deductible

When it comes to managing your finances and maximizing your tax benefits, understanding the deductibility of home insurance is crucial. Many homeowners wonder if the cost of their home insurance premiums can be claimed as a tax deduction, and the answer lies within the intricacies of tax laws and insurance regulations. Let's delve into the specifics to provide a comprehensive understanding of this matter.

Home Insurance and Tax Deductibility: An Overview

In the realm of tax deductions, the treatment of home insurance premiums can vary depending on several factors, including the nature of the insurance policy, the purpose of the property, and individual tax regulations. It’s important to note that tax laws are complex and subject to change, so it’s always advisable to consult with a qualified tax professional for personalized advice.

Primary Residence vs. Secondary Properties

The deductibility of home insurance often differs based on whether the property is your primary residence or a secondary home. For homeowners with a primary residence, the rules are generally more straightforward. In many countries, including the United States, homeowners can claim their mortgage interest and property taxes as deductions on their federal income tax returns. This means that the cost of home insurance premiums, when part of the mortgage escrow, can indirectly be considered deductible.

However, for secondary properties or rental homes, the rules become more complex. While mortgage interest and property taxes for these properties are often deductible as business expenses, the deductibility of home insurance premiums may be limited to the portion of the policy that covers liability and certain types of losses. It's crucial to carefully review the tax guidelines and consult a tax advisor to ensure compliance.

Casualty and Theft Losses

In the unfortunate event of a casualty loss or theft affecting your primary residence, the Internal Revenue Service (IRS) in the United States allows taxpayers to claim a deduction for these losses. This includes losses from fires, storms, and other unforeseen events. However, there are specific rules and thresholds to meet before these deductions can be claimed. For instance, the loss must exceed a certain percentage of your adjusted gross income, and you may need to reduce the amount of the loss by any insurance reimbursement received.

Rental Properties and Business Use

If you own a rental property or use your home for business purposes, the deductibility of home insurance takes on a different dimension. In such cases, the insurance premiums are often treated as business expenses and can be fully deductible. This includes coverage for liability, damage, and losses incurred during the course of business activities. However, it’s essential to maintain accurate records and separate personal and business expenses to support these deductions during tax audits.

Maximizing Tax Benefits: Strategies and Considerations

To make the most of tax deductions related to home insurance, it’s beneficial to adopt a strategic approach. Here are some considerations to keep in mind:

- Review Your Policy: Understand the specific coverages and limits of your home insurance policy. Ensure that you have adequate coverage for your needs and consider any additional riders or endorsements that may be beneficial.

- Itemize Deductions: When preparing your tax returns, consider itemizing your deductions instead of taking the standard deduction. This allows you to claim eligible expenses, including home insurance premiums, to potentially reduce your taxable income.

- Keep Accurate Records: Maintain organized records of your insurance premiums, policy documents, and any claims made. These records are essential for supporting your deductions and can be valuable during tax audits or when filing insurance claims.

- Consult a Professional: Tax laws can be complex, and the deductibility of home insurance may vary based on your individual circumstances. Consulting a qualified tax advisor or accountant can provide personalized guidance and ensure you maximize your tax benefits while remaining compliant with the law.

Real-World Example: Deducting Home Insurance Premiums

Let’s consider a practical scenario to illustrate the deductibility of home insurance premiums. Imagine you are a homeowner with a primary residence valued at 500,000. Your annual home insurance premium is 1,500, and you pay an additional 500 for flood insurance. In this case, you can potentially claim a deduction for the 1,500 premium as part of your mortgage interest and property tax deductions.

However, if you own a rental property valued at $300,000 and pay an annual home insurance premium of $1,200, the deductibility becomes more complex. You can likely claim the portion of the premium that covers liability and certain types of losses as a business expense. Additionally, if the property experiences a casualty loss, you may be able to claim a deduction for that loss, subject to the IRS guidelines and thresholds.

| Property Type | Insurance Premium | Potential Deduction |

|---|---|---|

| Primary Residence | $1,500 | Mortgage Interest & Property Taxes |

| Rental Property | $1,200 | Business Expense (Liability & Losses) |

Conclusion

Understanding the deductibility of home insurance premiums is a critical aspect of financial planning for homeowners. By navigating the complexities of tax laws and insurance regulations, you can maximize your tax benefits and ensure compliance. Whether you own a primary residence or rental properties, a strategic approach, accurate record-keeping, and professional guidance can help you make the most of your home insurance deductions.

Can I deduct home insurance premiums for my primary residence on my tax return?

+In many countries, including the United States, homeowners can claim their mortgage interest and property taxes as deductions. As part of these deductions, the cost of home insurance premiums can indirectly be considered deductible.

Are there any limitations to deducting home insurance premiums for secondary properties or rental homes?

+Yes, the deductibility of home insurance premiums for secondary properties or rental homes may be limited to the portion of the policy that covers liability and certain types of losses. It’s important to review the tax guidelines and consult a tax advisor for specific details.

Can I claim a deduction for casualty or theft losses on my primary residence?

+Yes, the Internal Revenue Service (IRS) allows taxpayers to claim deductions for casualty and theft losses on their primary residence. However, there are specific rules and thresholds to meet, and insurance reimbursements may impact the deductibility.