Best Credit Card To Pay Taxes

In the realm of personal finance, managing your tax obligations efficiently is crucial. One often-overlooked strategy is utilizing credit cards to pay taxes, a method that can offer significant advantages, especially when it comes to earning rewards and managing cash flow. This comprehensive guide will delve into the best credit cards for tax payments, exploring the key features and benefits that make them ideal for this specific purpose.

Understanding the Benefits of Using Credit Cards for Tax Payments

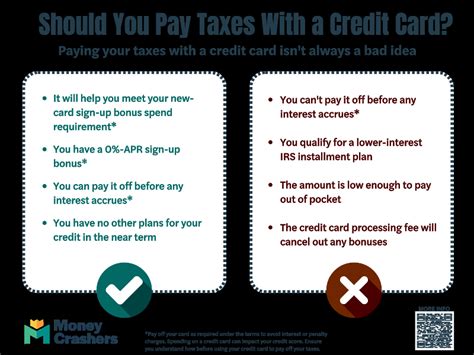

Before delving into the specific credit cards, it’s essential to grasp the advantages of paying taxes with credit cards. This strategy provides an opportunity to earn valuable rewards points or cash back, which can offset the cost of the tax payment. Additionally, it offers a convenient way to manage cash flow, especially for businesses or individuals with large tax liabilities. By paying taxes with a credit card, you can extend your payment timeline and potentially avoid late fees or penalties.

The Top Credit Cards for Tax Payments

When selecting a credit card for tax payments, several factors come into play, including rewards structure, introductory offers, and flexibility in payment terms. Here are some of the best credit cards currently available for this purpose, each offering unique advantages.

1. American Express Business Platinum Card

The American Express Business Platinum Card is an excellent choice for businesses looking to maximize their tax payment strategy. This card offers a 5x points on flights and hotels booked through American Express Travel, which can be incredibly valuable for businesses with significant travel expenses. Additionally, it provides a 35% rebate on U.S. purchases of 5,000 or more</strong>, making it an attractive option for large tax payments.</p> <p>Key Features:</p> <ul> <li><strong>Rewards:</strong> 5x points on eligible purchases.</li> <li><strong>Introductory Offer:</strong> Up to 150,000 bonus points after spending 15,000 in the first 3 months.

2. Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card is a popular choice for individuals and businesses alike. It offers a 2x points on dining and travel, which can be particularly beneficial for businesses with entertainment or travel-related expenses. The card also provides a sign-up bonus of 80,000 points after spending $4,000 in the first 3 months, making it an attractive option for those with upcoming tax payments.

Key Features:

- Rewards: 2x points on dining and travel, 1x on all other purchases.

- Introductory Offer: 80,000 bonus points after meeting the spending requirement.

- Flexibility: 0% intro APR for 15 months on purchases.

3. Capital One® Spark Miles for Business

The Capital One® Spark Miles for Business is designed specifically for small businesses. It offers an unlimited 2x miles on every purchase, providing a straightforward rewards structure. The card also comes with a sign-up bonus of 20,000 miles after spending $3,000 in the first 3 months, which can significantly offset the cost of tax payments.

Key Features:

- Rewards: 2x miles on all purchases.

- Introductory Offer: 20,000 bonus miles after meeting the spending requirement.

- Flexibility: No foreign transaction fees and easy redemption for travel expenses.

4. Citi® Double Cash Card

The Citi® Double Cash Card is a simple yet effective option for tax payments. It offers 1% cash back on purchases and an additional 1% when you pay for those purchases, providing a straightforward rewards structure. With no annual fee and a 0% intro APR for 18 months on balance transfers, this card is ideal for managing cash flow.

Key Features:

- Rewards: 2% cash back on all purchases.

- Introductory Offer: 0% intro APR on balance transfers for 18 months.

- Flexibility: No annual fee and a long 0% intro APR period.

5. U.S. Bank Business Edge Platinum Card

The U.S. Bank Business Edge Platinum Card is tailored for small businesses with its 2x points on gas and office supply store purchases, which can be advantageous for businesses with high operational expenses. It also offers a 0% intro APR for 12 months on purchases and balance transfers, providing a significant cash flow advantage.

Key Features:

- Rewards: 2x points on gas and office supply store purchases, 1x on all other purchases.

- Introductory Offer: 0% intro APR on purchases and balance transfers for 12 months.

- Flexibility: No annual fee and a generous intro APR period.

Comparative Analysis and Key Considerations

When choosing the best credit card for tax payments, it’s crucial to consider your specific needs and circumstances. Here’s a comparative analysis of the highlighted cards:

| Credit Card | Rewards | Introductory Offer | Flexibility |

|---|---|---|---|

| American Express Business Platinum Card | 5x points on flights and hotels | Up to 150,000 bonus points | Extended payment terms |

| Chase Sapphire Preferred Card | 2x points on dining and travel | 80,000 bonus points | 0% intro APR for 15 months |

| Capital One® Spark Miles for Business | 2x miles on all purchases | 20,000 bonus miles | No foreign transaction fees |

| Citi® Double Cash Card | 2% cash back on all purchases | 0% intro APR on balance transfers | No annual fee |

| U.S. Bank Business Edge Platinum Card | 2x points on gas and office supplies | 0% intro APR on purchases and balance transfers | No annual fee |

Each of these cards offers unique advantages, and the best choice will depend on your specific tax payment needs and preferences. For instance, if you're a frequent traveler, the American Express Business Platinum Card might be ideal, while the Citi® Double Cash Card could be a straightforward option for those seeking a simple rewards structure.

Future Implications and Industry Trends

The use of credit cards for tax payments is an evolving strategy, and several industry trends are worth noting. Firstly, the increasing adoption of digital payment methods by tax authorities is making it more convenient and secure to pay taxes with credit cards. Additionally, the introduction of new credit card features, such as extended payment terms and flexible rewards structures, is making this strategy even more appealing.

Looking ahead, we can expect to see continued innovation in credit card offerings, with an emphasis on providing greater value and flexibility for tax payments. This could include the introduction of specialized tax payment cards with tailored rewards and benefits. Moreover, the integration of credit cards with tax software and platforms is likely to streamline the process further, making it even more accessible and efficient for businesses and individuals.

What are the potential risks of using a credit card to pay taxes?

+

Using a credit card for tax payments carries the risk of incurring high interest charges if you cannot repay the balance in full. Additionally, some tax authorities may charge a convenience fee for credit card payments, which can offset the rewards earned. It’s crucial to carefully consider your financial situation and the terms of your credit card before choosing this method.

Can I use any credit card to pay taxes, or are there specific requirements?

+

Most credit cards can be used for tax payments, but some tax authorities may have specific requirements or preferred payment methods. It’s essential to check with your tax authority to ensure you’re complying with their guidelines. Additionally, certain credit cards offer more favorable terms or rewards for tax payments, as highlighted in this article.

Are there any alternative methods to pay taxes without using a credit card?

+

Absolutely! There are several alternative payment methods for taxes, including direct bank transfers, wire transfers, and electronic funds transfers. These methods often come with lower fees and can be more convenient for large payments. However, the availability of these methods may vary depending on your location and tax authority.

How can I maximize the rewards when paying taxes with a credit card?

+

To maximize rewards, choose a credit card with a rewards structure that aligns with your spending habits. For instance, if you have significant travel expenses, a card like the American Express Business Platinum Card might be ideal. Additionally, take advantage of sign-up bonuses and introductory offers to earn a substantial number of points or cash back right from the start.