Do Puerto Ricans Pay Federal Taxes

The relationship between Puerto Rico and the United States in terms of taxation is a complex and unique one, often leading to questions and misconceptions. Understanding the tax obligations of Puerto Ricans provides insight into the island's economic landscape and its connection to the U.S. federal system.

The Tax Landscape in Puerto Rico

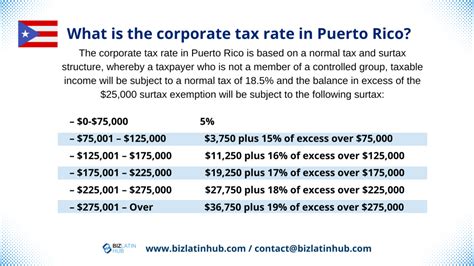

Puerto Rico, an unincorporated territory of the United States, operates within a distinct tax framework that sets it apart from the 50 states. This framework is governed by the U.S. Internal Revenue Code (IRC), yet it also incorporates unique provisions under the Puerto Rico Internal Revenue Code (PRIRC). These codes, combined with various federal laws, determine the tax obligations of Puerto Ricans.

One of the most notable differences is that Puerto Rico has its own tax system, which is administered by the Puerto Rico Department of Treasury. This system, while aligned with certain federal tax laws, has its own set of rules and regulations, including different tax rates and filing requirements.

Paying Federal Taxes

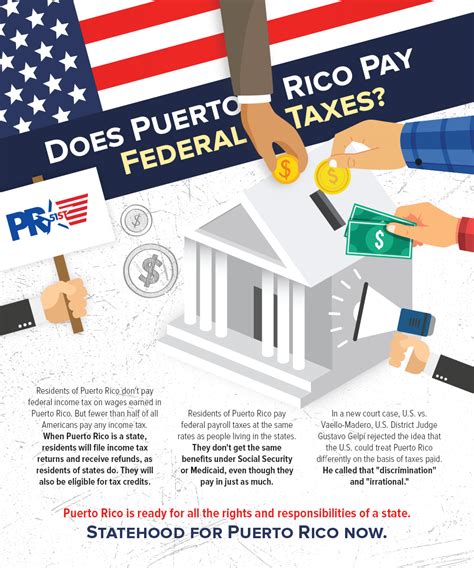

The question of whether Puerto Ricans pay federal taxes is a nuanced one. While Puerto Ricans are indeed U.S. citizens, their tax obligations differ significantly from those of residents of the mainland U.S. territories.

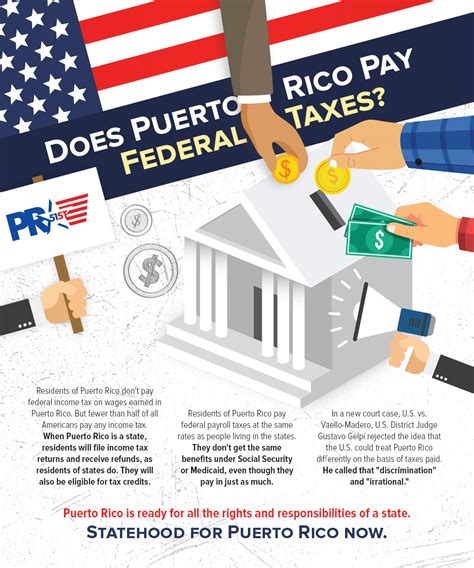

Puerto Ricans are subject to a variety of federal taxes, including payroll taxes for Social Security and Medicare, as well as federal excise taxes on certain goods. Additionally, they pay into the federal highway trust fund through gasoline taxes.

However, one of the most significant differences lies in the treatment of federal income tax. While residents of U.S. states pay federal income tax on their worldwide income, Puerto Ricans are subject to a special provision under the U.S. tax code known as the "Puerto Rican possession tax credit." This credit effectively eliminates the federal income tax liability for most Puerto Rican residents.

Under this provision, individuals and businesses in Puerto Rico pay taxes to the Puerto Rican government, and in return, they receive a credit against their potential federal income tax liability. This means that, in practice, most Puerto Ricans do not pay federal income tax, despite being U.S. citizens.

| Tax Type | Obligation for Puerto Ricans |

|---|---|

| Federal Income Tax | Subject to a possession tax credit, effectively eliminating federal income tax liability for most residents. |

| Payroll Taxes | Pay Social Security and Medicare taxes. |

| Excise Taxes | Pay federal excise taxes on specific goods and services. |

| Gasoline Taxes | Contribute to the federal highway trust fund through gasoline taxes. |

The Impact of Tax Policy on Puerto Rico’s Economy

The tax policies that apply to Puerto Rico have a profound impact on its economy and development. The lack of a federal income tax burden has been a key factor in attracting businesses and investment to the island, particularly in sectors like manufacturing and pharmaceuticals.

However, the complex tax landscape has also led to challenges. For instance, the expiration of certain tax incentives in 2006 led to a significant loss of jobs and investment, highlighting the fragility of the economy's reliance on tax incentives. Additionally, the island's unique tax status has made it a subject of scrutiny and reform proposals, with some arguing for greater integration into the U.S. tax system.

The Future of Puerto Rico’s Tax Landscape

The future of Puerto Rico’s tax system is a subject of ongoing debate and reform efforts. In recent years, there have been proposals to revise the island’s tax code to make it more aligned with the U.S. federal system, with the aim of providing greater clarity and stability for businesses and residents alike.

These proposals often focus on balancing the need for economic growth and development with the island's unique status as a U.S. territory. Some suggest a transition to a system more akin to that of U.S. states, while others advocate for maintaining the current system with improvements to make it more efficient and equitable.

Regardless of the path forward, the tax landscape in Puerto Rico is expected to remain a critical factor in shaping the island's economic future, impacting everything from investment and job creation to the standard of living for its residents.

Do Puerto Ricans pay state taxes like residents of U.S. states do?

+No, Puerto Rico does not have a state-level government like the U.S. states, so there are no state taxes. Instead, Puerto Rico has its own tax system, which is administered by the Puerto Rico Department of Treasury.

Why are Puerto Ricans exempt from federal income tax, while U.S. state residents are not?

+Puerto Rico’s exemption from federal income tax is a result of its unique status as a U.S. territory. The U.S. tax code provides a possession tax credit for Puerto Rico, which effectively eliminates the federal income tax liability for most residents. This is a historical provision aimed at supporting the island’s economy.

How does the tax system in Puerto Rico affect its economic development?

+The tax system in Puerto Rico, particularly the lack of federal income tax, has been a key factor in attracting businesses and investment to the island. It has helped foster economic growth in sectors like manufacturing and pharmaceuticals. However, it also creates challenges, such as the island’s reliance on tax incentives and the need for ongoing reform to ensure a stable and equitable tax system.