Does Washington Have Sales Tax

When discussing the fiscal landscape of the United States, it is crucial to delve into the intricacies of taxation, especially sales tax, as it significantly impacts both consumers and businesses. In this comprehensive analysis, we will explore the sales tax situation in Washington, a state known for its diverse economy and vibrant industries. We will uncover the specific details, real-world implications, and unique aspects of Washington's sales tax policies.

The Sales Tax Landscape in Washington

Washington, officially known as the State of Washington, has a unique approach to sales tax that sets it apart from many other states. Unlike a majority of U.S. states, Washington does not impose a general sales tax on its residents and visitors. This means that, at the state level, there is no additional tax added to the purchase price of goods and services, which is a significant departure from the norm.

However, this does not mean that all transactions in Washington are tax-free. The state has implemented a different system, often referred to as a use tax, which is applied to certain types of transactions. This use tax is levied on the storage, use, or consumption of tangible personal property in Washington, including items purchased online or from out-of-state vendors.

The use tax rate in Washington mirrors the state's Business & Occupation (B&O) tax rate, which is a gross receipts tax imposed on businesses operating within the state. The B&O tax is a complex system, with rates varying based on the type of business activity. For example, the B&O tax rate for manufacturing is 0.484%, while for retailing, it is 0.471%.

| B&O Tax Activity | Tax Rate |

|---|---|

| Manufacturing | 0.484% |

| Retailing | 0.471% |

| Wholesaling | 0.448% |

| Services & Other Activities | Varies |

Local Sales Tax in Washington

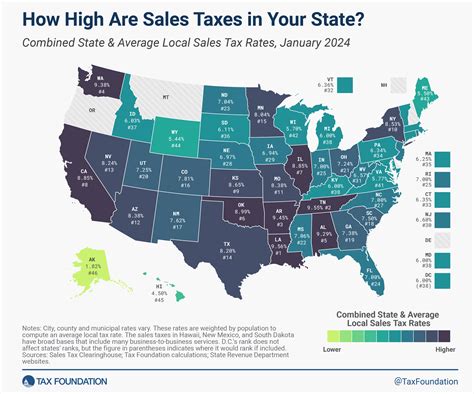

While the state of Washington does not impose a general sales tax, many of its cities and counties do have their own sales tax rates. These local sales taxes, often referred to as city or county option taxes, are additional to the use tax and can significantly impact the total cost of goods and services for consumers.

The local sales tax rates vary widely across Washington, with some areas having no additional tax, while others can have rates as high as 3.90% on top of the use tax. This variability is due to the fact that each city or county has the autonomy to set its own sales tax rate, subject to certain limitations and approval processes.

| City/County | Sales Tax Rate |

|---|---|

| Seattle | 2.25% |

| Spokane | 1.00% |

| Tacoma | 2.00% |

| Pierce County | 2.00% |

| Clark County | 3.90% |

| King County | 1.00% |

It's important to note that these local sales tax rates are in addition to the use tax, which is calculated based on the B&O tax rate. Therefore, a purchase made in Seattle, for example, would be subject to a total tax rate of 2.25% (local sales tax) plus the applicable B&O tax rate, which could vary depending on the nature of the business making the sale.

Impact on Consumers and Businesses

Washington’s sales tax structure has a significant impact on both consumers and businesses. For consumers, the absence of a general sales tax can make the state an attractive destination for shopping, as they can potentially save on the overall cost of goods. However, the presence of local sales taxes and the use tax can still add a considerable amount to the final bill, especially for higher-value items.

Businesses operating in Washington also face a unique set of challenges and opportunities. The state's complex B&O tax system, combined with local sales taxes, requires careful consideration when pricing goods and services. Businesses must ensure they are compliant with all tax regulations, which can be particularly challenging for those with multiple locations or online sales.

Additionally, the variability in local sales tax rates can create a competitive advantage or disadvantage for businesses, depending on their location. A business operating in a city with a higher sales tax rate may find it challenging to compete with similar businesses in lower-tax areas, especially for online sales where customers can easily compare prices.

Online Sales and Tax Collection

With the rise of e-commerce, the collection of sales tax on online purchases has become a critical issue. In Washington, businesses that sell goods or services online to Washington residents are responsible for collecting and remitting the use tax, which is based on the B&O tax rate. This can be a complex process, especially for businesses that are not physically located in the state.

To simplify this process, Washington has implemented a Marketplace Fairness Act, which allows the state to collect sales tax from out-of-state retailers who sell to Washington residents through online marketplaces or referral sites. This act aims to level the playing field for in-state businesses and ensure that all retailers are complying with the state's tax laws.

However, the implementation of this act has not been without controversy. Some businesses argue that it places an additional burden on them, especially smaller online retailers, as they must now navigate the complexities of Washington's tax system. Additionally, there have been concerns about the potential impact on consumer behavior, as some may choose to shop from out-of-state retailers to avoid the use tax.

The Future of Sales Tax in Washington

As the economy continues to evolve, especially with the growing influence of e-commerce, the sales tax landscape in Washington is likely to face further changes and challenges. The state’s unique approach to sales tax, with its reliance on a use tax and local option taxes, has proven to be both a benefit and a challenge for consumers and businesses alike.

One potential future development is the implementation of a statewide sales tax, which would simplify the tax system and provide a more consistent experience for consumers and businesses. However, such a move would require significant political will and could face opposition from those who benefit from the current system, especially localities with higher local sales tax rates.

Alternatively, Washington could continue to refine and improve its current system, focusing on streamlining the tax collection process for businesses, especially those operating online. This could involve further simplifying the B&O tax rates and ensuring that the use tax is easily understood and applied by both businesses and consumers.

Regardless of the path Washington chooses, it is clear that the state's sales tax policies will continue to be a topic of discussion and debate. The balance between providing a fair and competitive business environment, ensuring adequate revenue for the state and local governments, and maintaining a positive experience for consumers is a delicate one, and Washington's approach will undoubtedly continue to evolve in response to these challenges.

Is there a sales tax in Washington state for online purchases?

+Yes, Washington imposes a use tax on online purchases, which is based on the Business & Occupation (B&O) tax rate. This means that when you buy goods or services online from a vendor that does not collect sales tax, you are responsible for paying the use tax directly to the state.

How do I calculate the use tax in Washington?

+The use tax is calculated based on the B&O tax rate, which varies depending on the type of business activity. For example, if the B&O tax rate for a specific business activity is 0.471%, the use tax would be calculated at that rate on the total purchase amount.

Are there any exceptions to the use tax in Washington?

+Yes, there are certain exceptions and exemptions to the use tax in Washington. For example, purchases made for business use or resale are typically exempt from the use tax. Additionally, some specific types of goods, such as food and prescription drugs, are also exempt.

How does Washington ensure compliance with the use tax for online sales?

+Washington has implemented the Marketplace Fairness Act, which allows the state to collect sales tax from out-of-state retailers who sell to Washington residents through online marketplaces or referral sites. This act ensures that online retailers are complying with the state’s tax laws and that consumers are paying the appropriate taxes.