San Diego County Tax

In the bustling metropolis of San Diego, California, understanding the intricacies of the tax landscape is crucial for both residents and businesses. This comprehensive guide aims to demystify the world of San Diego County taxes, providing an in-depth analysis of the various tax obligations and opportunities within this vibrant region.

Unraveling the Tax Landscape of San Diego County

San Diego County, known for its picturesque beaches, thriving tech industry, and vibrant cultural scene, boasts a diverse tax system that caters to its equally diverse population. From personal income taxes to business-specific levies, the county’s tax structure reflects its dynamic economy and the unique challenges faced by its residents.

A Deep Dive into Personal Income Taxes

For individuals residing in San Diego County, the personal income tax landscape is a critical aspect of financial planning. The state of California imposes a progressive income tax, with rates ranging from 1% to 13.3%, depending on taxable income. Additionally, San Diego County adds a 1% local income tax to support essential county services, such as public safety and infrastructure development.

Consider the example of Jane, a software engineer residing in San Diego. With a taxable income of $80,000, she would be subject to a state tax rate of 6% and an additional 1% county tax. This translates to a total personal income tax obligation of $5,200 for the year, excluding any potential federal taxes.

| Income Bracket | State Tax Rate | San Diego County Tax Rate |

|---|---|---|

| $0 - $7,759 | 1% | 1% |

| $7,760 - $19,974 | 2% | 1% |

| $19,975 - $32,499 | 4% | 1% |

| $32,500 - $58,845 | 6% | 1% |

| $58,846 - $274,999 | 8% | 1% |

| $275,000 and above | 10.3% | 1% |

Unveiling Business Taxes: A Key Component of San Diego’s Economic Ecosystem

San Diego County’s thriving business community contributes significantly to the region’s economic vitality, and understanding the business tax landscape is essential for entrepreneurs and established businesses alike.

Businesses operating within San Diego County are subject to a range of taxes, including the California Franchise Tax, which is levied on corporations, limited liability companies (LLCs), and other business entities. The rate for this tax varies based on the type of business and its revenue, with rates ranging from 1.5% to 8.84%.

Additionally, San Diego County imposes a gross receipts tax on certain businesses, which is calculated based on the total gross receipts of the business within the county. This tax, often referred to as the Business and Occupation (B&O) tax, is unique to each business and is designed to capture a portion of the economic activity generated within the county.

Let's take the example of TechSolutions, a tech startup based in San Diego. With annual gross receipts of $2 million, TechSolutions would be subject to a B&O tax rate of 0.15%, resulting in a tax obligation of $3,000 for the year. This tax contributes to the county's revenue, which is then allocated towards vital services such as healthcare, education, and economic development initiatives.

| Business Type | California Franchise Tax Rate | San Diego County B&O Tax Rate |

|---|---|---|

| Corporations | 8.84% | 0.15% |

| LLCs | 1.5% | 0.15% |

| Sole Proprietorships | 1.5% | 0.15% |

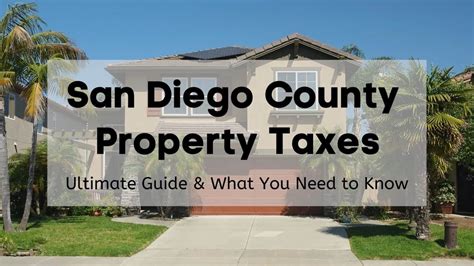

Property Taxes: A Key Pillar of San Diego’s Fiscal Health

Property taxes play a significant role in funding public services and infrastructure in San Diego County. These taxes are levied on both real property (land and buildings) and personal property (vehicles, boats, and other assets). The tax rate is determined by the assessed value of the property and is typically around 1% of the assessed value.

For homeowners in San Diego County, property taxes are a significant expense. The average property tax rate in the county is approximately 1.25%, which is slightly higher than the state average. However, San Diego County offers various property tax exemptions and relief programs to eligible homeowners, such as the Homeowners' Exemption, which reduces the assessed value of a primary residence by up to $7,000.

Consider the case of Mr. Johnson, a homeowner in San Diego County with a property valued at $500,000. With an average property tax rate of 1.25%, Mr. Johnson's annual property tax obligation would be $6,250. However, by applying for the Homeowners' Exemption, he could reduce his assessed value by $7,000, resulting in a potential savings of approximately $87.50 per year.

| Property Type | Average Tax Rate | Potential Exemptions |

|---|---|---|

| Residential Property | 1.25% | Homeowners' Exemption, Disabled Veterans' Exemption |

| Commercial Property | 1.25% | None |

| Agricultural Property | 0.67% | Land Conservation Act (Williamson Act) |

Navigating the Future: San Diego County’s Tax Landscape Evolves

As San Diego County continues to thrive and evolve, so too does its tax landscape. With a focus on sustainable development, economic growth, and social equity, the county is exploring innovative tax strategies to meet the changing needs of its residents and businesses.

One emerging trend is the exploration of green taxes, which aim to incentivize sustainable practices and reduce the county's environmental footprint. This includes proposals for carbon taxes, waste diversion incentives, and subsidies for renewable energy adoption. By encouraging environmentally conscious behaviors, San Diego County aims to create a more sustainable future while also generating revenue for critical initiatives.

Additionally, the county is actively engaging in tax reform discussions to ensure fairness and equity for all taxpayers. This includes proposals to simplify the tax code, reduce tax burdens on low- and middle-income earners, and promote tax transparency. By fostering a fair and efficient tax system, San Diego County aims to create an environment that encourages economic growth and financial stability for its residents and businesses.

As San Diego County continues to adapt and innovate, its tax landscape will undoubtedly evolve to meet the challenges and opportunities of the future. By staying informed and engaged, residents and businesses can navigate this dynamic tax environment with confidence and contribute to the county's continued prosperity.

What is the deadline for filing San Diego County taxes?

+The deadline for filing San Diego County taxes typically aligns with the federal and state tax deadlines, which is typically April 15th of each year. However, it is important to note that these deadlines may vary depending on the specific tax type and any extensions granted.

Are there any tax incentives for renewable energy adoption in San Diego County?

+Yes, San Diego County offers a variety of tax incentives for renewable energy adoption. These include property tax exemptions for solar energy systems, as well as state and federal tax credits for energy-efficient upgrades. These incentives aim to encourage sustainable practices and reduce the county’s carbon footprint.

How can I stay updated on San Diego County’s tax policies and changes?

+Staying informed about San Diego County’s tax policies is crucial for both individuals and businesses. The best way to stay updated is to regularly visit the official websites of the County of San Diego and the California Franchise Tax Board. These websites provide the latest tax information, including any changes or updates to tax laws and regulations.