Kanawha County Wv Taxes

Kanawha County, nestled in the heart of West Virginia, is a vibrant community with a rich history and a unique tax landscape. Understanding the tax system of this county is essential for both residents and businesses, as it directly impacts their financial obligations and planning. In this comprehensive guide, we will delve into the specifics of Kanawha County's tax structure, exploring the various taxes imposed, their rates, and the processes involved.

Unraveling the Tax Landscape of Kanawha County

The tax system in Kanawha County is multifaceted, encompassing a range of taxes designed to fund essential public services and infrastructure. From property taxes to sales taxes, each component plays a crucial role in shaping the financial landscape of the county.

Property Taxes: A Key Revenue Stream

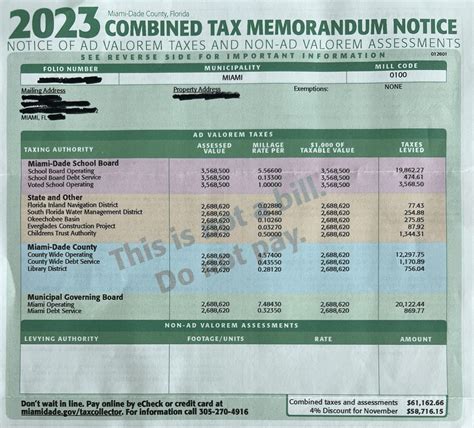

Property taxes are a significant source of revenue for Kanawha County, contributing to the maintenance and improvement of local services and amenities. The county assesses property values annually, and the tax rate is applied to the assessed value. Here’s a breakdown of the property tax system:

- Assessment Process: Properties in Kanawha County are assessed by the county’s assessor’s office. The assessment considers factors such as location, property type, and market value.

- Tax Rate: The tax rate for Kanawha County is set by the county commission and can vary from year to year. As of [year], the tax rate stands at [rate per $100 of assessed value].

- Payment Schedule: Property owners typically receive their tax bills annually, with payments due by a specified deadline. Late payments may incur penalties and interest.

- Exemptions and Deductions: Kanawha County offers certain exemptions and deductions to eligible property owners. These may include homestead exemptions, veteran’s exemptions, and senior citizen tax relief programs.

| Property Tax Statistics | Data |

|---|---|

| Average Assessment Value | $[average assessment] |

| Median Property Tax Paid | $[median tax] |

| Number of Exemptions Granted | [exemption count] |

Sales and Use Taxes: Supporting Local Businesses

Sales and use taxes are another significant component of Kanawha County’s tax system, impacting both businesses and consumers. These taxes are imposed on the sale of goods and services within the county and are vital for funding local projects and initiatives.

- Sales Tax Rate: Kanawha County imposes a sales tax rate of [rate]%, which is applicable to most retail transactions. This rate is in addition to the state sales tax rate.

- Use Tax: The county also levies a use tax on goods purchased outside the county but used or consumed within Kanawha County. This tax ensures fairness and prevents tax evasion.

- Taxable Items: Sales and use taxes are applied to a wide range of goods and services, including clothing, electronics, groceries, and restaurant meals. However, certain essentials like prescription drugs and food staples are often exempt.

- Collection and Remittance: Businesses operating within Kanawha County are responsible for collecting and remitting sales taxes to the county tax office. Failure to comply may result in penalties and legal consequences.

| Sales and Use Tax Data | Details |

|---|---|

| Total Sales Tax Revenue | $[revenue] |

| Average Sales Tax Paid per Transaction | $[average tax] |

| Number of Registered Businesses | [business count] |

Other Taxes and Fees: A Comprehensive Overview

In addition to property and sales taxes, Kanawha County imposes various other taxes and fees to support specific services and infrastructure. These taxes often target specific industries or activities and are designed to ensure fairness and equity.

- Lodging Tax: A lodging tax is applied to hotel and motel stays within the county, with the revenue often dedicated to tourism promotion and development.

- Vehicle Registration Fee: Vehicle owners in Kanawha County are required to pay a registration fee, which contributes to road maintenance and improvement projects.

- Business Privilege Tax: Businesses operating within the county may be subject to a business privilege tax, which varies based on factors such as gross receipts and employee count.

- Excise Taxes: Certain activities, such as tobacco and alcohol sales, are subject to excise taxes, with the revenue allocated to public health and safety initiatives.

Tax Administration and Compliance

Effective tax administration is crucial to ensure fair and accurate collection of taxes in Kanawha County. The county tax office plays a vital role in this process, providing guidance, support, and resources to taxpayers.

- Online Services: Kanawha County offers an array of online services, including tax payment portals, tax record searches, and access to tax forms and publications.

- Assistance and Support: Taxpayers can reach out to the county tax office for assistance with tax-related inquiries, forms, and payment methods. The office provides guidance on tax obligations and compliance.

- Audit and Enforcement: The tax office conducts audits to ensure compliance and may initiate enforcement actions for non-compliance, including late payment penalties and interest charges.

Future Outlook and Potential Reforms

As Kanawha County continues to evolve, its tax system is likely to undergo changes and reforms to adapt to economic shifts and community needs. Here are some potential future developments:

- Tax Rate Adjustments: To maintain a balanced budget and fund critical services, the county may consider adjusting tax rates, either increasing or decreasing them based on economic conditions.

- Tax Base Expansion: As the county’s economy diversifies, efforts may be made to expand the tax base by attracting new businesses and industries, thus reducing reliance on a few sectors.

- Tax Reform Initiatives: The county may explore tax reform initiatives to simplify the tax system, reduce administrative burdens, and ensure fairness and transparency.

- Community Engagement: Engaging with the community and seeking feedback on tax policies can help shape future decisions, ensuring that the tax system aligns with the needs and priorities of residents and businesses.

Conclusion: A Comprehensive Tax Guide for Kanawha County

Understanding the tax landscape of Kanawha County is essential for residents, businesses, and taxpayers alike. By unraveling the complexities of the county’s tax system, individuals and entities can navigate their financial obligations with confidence and contribute to the growth and development of the community. This guide aims to provide a comprehensive overview, empowering taxpayers with the knowledge they need to make informed decisions.

What is the current sales tax rate in Kanawha County?

+The current sales tax rate in Kanawha County is [rate]%, which includes both the state and county sales tax rates.

Are there any property tax exemptions available for seniors in Kanawha County?

+Yes, Kanawha County offers a senior citizen tax relief program, providing eligible seniors with a partial or full exemption from property taxes. The eligibility criteria and application process can be found on the county’s website.

How can I pay my property taxes online in Kanawha County?

+To pay your property taxes online, you can visit the Kanawha County Treasurer’s Office website and navigate to the online payment portal. You’ll need your property tax account information to complete the transaction securely.