Ma State Tax Refund Status

The Massachusetts Department of Revenue provides various methods for taxpayers to check the status of their state tax refunds, ensuring transparency and accessibility. This article aims to provide a comprehensive guide to help taxpayers navigate the process of tracking their MA state tax refund status, offering an in-depth analysis of the available options and the necessary steps.

Online Methods for MA State Tax Refund Status

Massachusetts taxpayers have the convenience of online options to check their refund status. These methods offer real-time updates and provide a user-friendly experience.

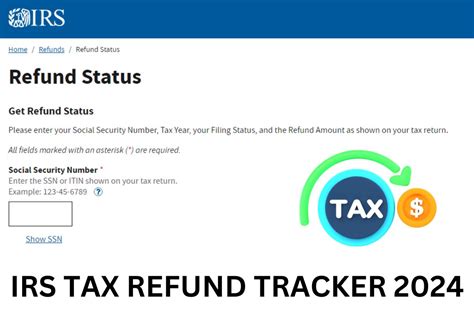

Official Website Tracker

The primary method is through the Massachusetts Department of Revenue’s official website, which offers a dedicated refund status tracker. Taxpayers can access this tool by visiting the refund status page on the MA DOR website. Here, they can input their Social Security Number (SSN), date of birth, and refund amount to retrieve their refund status.

| Category | Details |

|---|---|

| Website | www.mass.gov |

| Refund Status Page | https://www.mass.gov/guides/refund-status |

| Information Required | SSN, Date of Birth, Refund Amount |

The tracker provides an estimated refund date and the current processing stage of the taxpayer's refund. It also offers helpful messages and updates, such as when a refund is sent or if there are any delays.

MyTax Online Portal

For a more comprehensive view of their tax information, taxpayers can utilize the MyTax portal. This secure online platform allows users to view their tax returns, track refunds, and manage their tax accounts. To access MyTax, taxpayers need to create an account and provide their personal details, including their SSN, name, and address.

| Portal Name | MyTax |

|---|---|

| Account Creation | Required |

| Information Required | SSN, Name, Address |

| Features | View Tax Returns, Track Refunds, Manage Tax Accounts |

Once logged in, taxpayers can navigate to the "Refund Status" section to view the progress of their refund. The portal provides detailed information, including the refund amount, refund date, and any updates or notifications from the MA DOR.

Telephone Inquiries for MA State Tax Refund Status

For those who prefer verbal communication or encounter issues with online methods, the MA DOR offers a telephone assistance line.

MA DOR Telephone Assistance

Taxpayers can reach out to the Massachusetts Department of Revenue’s dedicated telephone assistance line to inquire about their refund status. The phone number is 1-800-392-6089, and it is toll-free within the state. Callers will be guided through an automated system to provide their taxpayer information and retrieve their refund status.

| Telephone Assistance Line | 1-800-392-6089 |

|---|---|

| Toll-Free Within MA | Yes |

| Automated System | Guides callers to provide taxpayer information |

If callers require further assistance or encounter complex issues, they can connect with a live customer service representative during business hours. The MA DOR aims to provide prompt and accurate assistance to ensure taxpayers receive the support they need.

Written Inquiries for MA State Tax Refund Status

In certain situations, taxpayers may prefer to communicate via written correspondence. The MA DOR offers a mailing address for such inquiries.

MA DOR Mailing Address

Taxpayers can write to the Massachusetts Department of Revenue at the following address to inquire about their refund status:

| Department | Massachusetts Department of Revenue |

|---|---|

| Address | PO Box 7010, Boston, MA 02204 |

| Purpose | Inquire about refund status |

In their correspondence, taxpayers should include their full name, address, SSN, and a clear description of their refund inquiry. It's essential to allow sufficient time for a response, as written inquiries may take longer to process compared to online or telephone methods.

Conclusion: A Comprehensive Guide to MA State Tax Refund Status

Massachusetts taxpayers have several reliable options to check their state tax refund status. The online methods, including the official website tracker and the MyTax portal, offer convenience and real-time updates. For those who prefer verbal communication, the MA DOR’s telephone assistance line is available, while written inquiries can be sent via mail. By utilizing these methods, taxpayers can stay informed about their refund status and receive the necessary support from the Massachusetts Department of Revenue.

How long does it typically take to receive a MA state tax refund?

+The processing time for MA state tax refunds can vary. Generally, it takes approximately 4 to 6 weeks from the date of filing for the refund to be processed and issued. However, factors such as the method of filing (paper or electronic) and the complexity of the tax return can impact the processing time.

What if my MA state tax refund status shows a delay or error message?

+If your refund status indicates a delay or an error, it’s important to review the information provided carefully. Common issues include incorrect taxpayer information, missing forms or documents, or errors in the tax return. In such cases, it’s advisable to contact the MA DOR for further assistance and guidance on resolving the issue.

Can I receive notifications about my MA state tax refund status via email or text?

+Yes, you can receive notifications about your MA state tax refund status via email or text. To enable these notifications, you need to set up an account on the MyTax portal. Once logged in, navigate to the “Settings” section and select your preferred notification method. This way, you’ll receive real-time updates on your refund status directly to your email or phone.