Does Puerto Rico Pay Taxes

Puerto Rico's unique tax status and relationship with the United States have often sparked curiosity and confusion among residents, investors, and those considering a move to the island. One of the most common questions is whether Puerto Rico pays taxes and, if so, how its tax system works.

In this comprehensive guide, we'll delve into the intricacies of Puerto Rico's tax system, shedding light on its benefits, challenges, and implications for individuals and businesses. By understanding the tax landscape, we can navigate the opportunities and obligations that come with living and operating in this vibrant Caribbean jurisdiction.

The Puerto Rico Tax System: A Unique Model

Puerto Rico, as an unincorporated territory of the United States, operates under a distinct tax system that differs significantly from the federal tax structure applied to the 50 states. This system, known as the Puerto Rico Internal Revenue Code (PR Code), was established in 2011 and has undergone various modifications, most notably with the enactment of Act 73 in 2020.

One of the key aspects of Puerto Rico's tax system is its territorial approach. Unlike the federal system, which follows a citizenship-based taxation model, Puerto Rico adopts a residence-based system. This means that individuals and businesses with ties to Puerto Rico are subject to taxation based on their income sourced within the island, excluding income earned outside its jurisdiction.

Key Features of Puerto Rico's Tax System

The PR Code offers a range of tax incentives and benefits designed to attract investment, foster economic growth, and create jobs. Some of the notable features include:

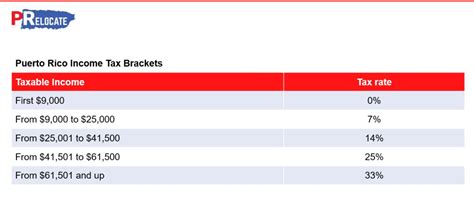

- Individual Income Tax Rates: Puerto Rico imposes a progressive income tax with seven brackets ranging from 0% to 33%. The lowest bracket applies to taxable income up to $6,000, while the highest bracket kicks in for incomes exceeding $80,001.

- Corporate Income Tax: Corporations doing business in Puerto Rico are subject to a flat tax rate of 30% on their taxable income. However, there are various tax incentives available for eligible businesses, which we will explore further.

- Tax Incentives and Exemptions: The PR Code provides a wide array of tax incentives and exemptions aimed at specific industries and activities. These incentives are designed to promote economic development, encourage entrepreneurship, and attract foreign investment. We will delve into these incentives in more detail.

Taxation for Individuals and Businesses

Let's explore how the tax system impacts individuals and businesses in Puerto Rico.

Individual Taxation

Individuals residing in Puerto Rico are required to file an annual income tax return. The tax liability is calculated based on the individual's worldwide income, including wages, salaries, dividends, interest, capital gains, and other forms of income. However, as mentioned earlier, only income sourced within Puerto Rico is subject to taxation.

One notable advantage for individuals is the absence of federal income tax on their Puerto Rico-sourced income. This means that residents of Puerto Rico do not have to file federal income tax returns, a significant distinction from residents of the 50 states.

Furthermore, individuals who meet certain residency requirements and qualify for the Act 20 or Act 22 tax incentives can benefit from significant tax exemptions and reduced tax rates on their Puerto Rico-sourced income. These incentives, designed to attract high-net-worth individuals and entrepreneurs, have been instrumental in boosting the island's economy.

| Tax Incentive | Description |

|---|---|

| Act 20 (Export Services Act) | Offers a 4% fixed tax rate on Puerto Rico-sourced income for eligible businesses engaged in export services. |

| Act 22 (Individual Investors Act) | Grants a 0% tax rate on Puerto Rico-sourced investment income for qualified individuals who meet residency and investment criteria. |

Business Taxation

Businesses operating in Puerto Rico are subject to the corporate income tax, as outlined earlier. However, there are several tax incentives available to encourage business growth and investment.

One of the most significant incentives is the Act 20 tax exemption, which offers eligible businesses engaged in export services a 4% fixed tax rate on their Puerto Rico-sourced income. This incentive has attracted numerous tech startups, software development companies, and other export-oriented businesses to the island.

Additionally, Act 22 provides tax benefits for individuals who establish qualifying businesses in Puerto Rico. These benefits include a 0% tax rate on certain business income and capital gains.

Navigating the Puerto Rico Tax Landscape

Understanding and navigating Puerto Rico's tax system requires careful consideration and professional guidance. The unique nature of the island's tax laws, combined with the availability of various incentives, means that individuals and businesses can significantly reduce their tax liabilities by strategically planning their financial activities.

For individuals, it's essential to assess their eligibility for tax incentives like Act 20 and Act 22. These incentives can provide substantial tax savings and create opportunities for wealth accumulation. Working with tax advisors who specialize in Puerto Rico's tax laws is crucial to ensure compliance and maximize benefits.

Businesses, too, can benefit from the island's favorable tax environment. By leveraging incentives like Act 20, companies can establish a competitive edge and boost their profitability. However, navigating the eligibility criteria and compliance requirements demands expertise and a thorough understanding of the tax landscape.

Tax Compliance and Reporting

Compliance with Puerto Rico's tax laws is a critical aspect of doing business on the island. The Department of Treasury, through its Bureau of Internal Revenue (BIR), enforces tax regulations and ensures compliance. It's essential for individuals and businesses to adhere to the filing deadlines and maintain accurate records to avoid penalties and legal issues.

The BIR provides resources and guidance to help taxpayers understand their obligations. It's advisable for individuals and businesses to consult with tax professionals who are familiar with Puerto Rico's tax laws to ensure accurate and timely compliance.

Future Outlook and Implications

Puerto Rico's tax system continues to evolve, and its future outlook is closely tied to the island's economic development and its relationship with the United States. The recent modifications to the PR Code, including Act 73, have aimed to enhance the tax incentives and create a more stable and attractive environment for investment.

As Puerto Rico works to rebuild its economy post-hurricane and address its financial challenges, the tax system plays a crucial role in attracting investment and fostering economic growth. The incentives and reduced tax rates offered by the PR Code are expected to continue attracting individuals and businesses, contributing to the island's economic recovery and long-term sustainability.

Frequently Asked Questions

How does Puerto Rico's tax system differ from that of the 50 states?

+Puerto Rico's tax system is distinct from that of the 50 states in several ways. Firstly, it follows a territorial tax system, meaning only income sourced within Puerto Rico is subject to taxation. In contrast, the federal system follows a citizenship-based approach, taxing worldwide income. Additionally, Puerto Rico offers a range of tax incentives and reduced tax rates, which are not available in the 50 states.

<div class="faq-item">

<div class="faq-question">

<h3>What are the tax rates for individuals in Puerto Rico?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Individual income tax rates in Puerto Rico range from 0% to 33%, with seven brackets based on taxable income. The lowest bracket applies to incomes up to $6,000, while the highest bracket applies to incomes exceeding $80,001. However, individuals can benefit from tax incentives like <em>Act 20</em> and <em>Act 22</em>, which offer reduced tax rates or exemptions.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How does Puerto Rico's corporate income tax compare to other jurisdictions?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Puerto Rico's corporate income tax rate of 30% is relatively competitive when compared to other jurisdictions. However, the availability of tax incentives, such as <em>Act 20</em>, can significantly reduce the effective tax rate for eligible businesses, making Puerto Rico an attractive destination for corporate entities.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax incentives for businesses in Puerto Rico?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Puerto Rico offers a range of tax incentives for businesses, including <em>Act 20</em>, which provides a 4% fixed tax rate on Puerto Rico-sourced income for eligible export services businesses. <em>Act 22</em> also offers tax benefits for individuals who establish qualifying businesses on the island.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are the compliance requirements for individuals and businesses in Puerto Rico?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Individuals and businesses in Puerto Rico must adhere to tax filing deadlines and maintain accurate records. The Bureau of Internal Revenue (BIR) enforces tax regulations and provides guidance. Consulting with tax professionals who specialize in Puerto Rico's tax laws is recommended to ensure compliance.</p>

</div>

</div>

</div>