Deferred Taxes

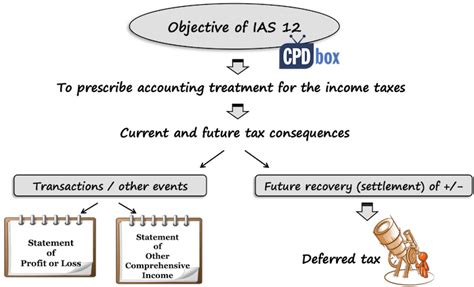

In the complex world of finance and accounting, the concept of deferred taxes plays a pivotal role, impacting businesses' financial strategies and overall tax liabilities. Deferred taxes arise from the differences between accounting profits and taxable income, often due to temporary discrepancies in the recognition of revenue and expenses under different accounting standards. This article aims to delve into the intricacies of deferred taxes, exploring their definition, significance, calculation methods, and practical implications for businesses and investors.

Understanding Deferred Taxes

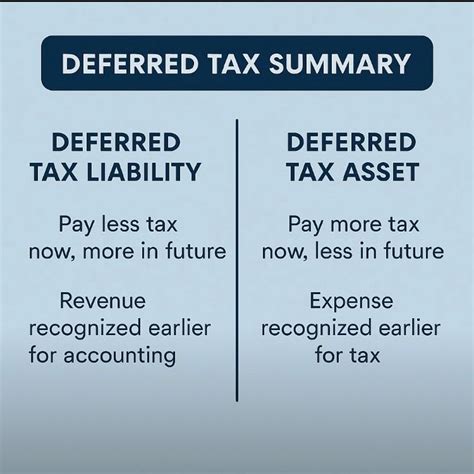

Deferred taxes, a fundamental component of corporate tax planning, represent the temporal difference between the recognition of income and expenses for tax purposes versus financial reporting purposes. This difference can lead to a disparity in the timing of tax payments, resulting in either deferred tax assets (DTAs) or deferred tax liabilities (DTLs). Understanding deferred taxes is crucial as they directly affect a company’s financial health, cash flow, and overall tax efficiency.

The Importance of Deferred Taxes

Deferred taxes hold significant importance in the corporate landscape for several reasons. Firstly, they provide a buffer for businesses, allowing them to manage their tax liabilities more efficiently. By recognizing deferred tax assets, companies can anticipate future tax savings, which can be a valuable asset, especially during periods of financial strain. Conversely, deferred tax liabilities can be a reminder of impending tax obligations, prompting businesses to plan their cash flows accordingly.

Furthermore, deferred taxes are a critical factor in financial reporting and analysis. They impact key financial metrics such as earnings, cash flow, and return on investment. Accurate reporting of deferred taxes is essential for maintaining investor confidence and ensuring compliance with regulatory bodies. Mismanagement or misrepresentation of deferred taxes can lead to severe consequences, including regulatory penalties and loss of investor trust.

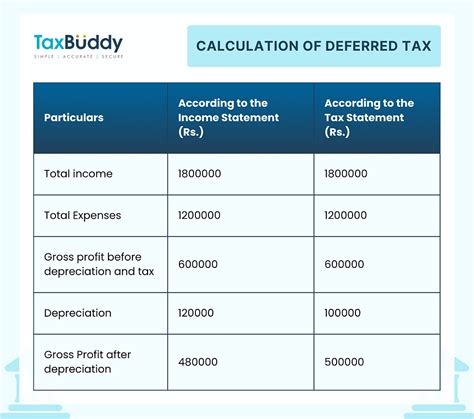

Calculation and Recognition of Deferred Taxes

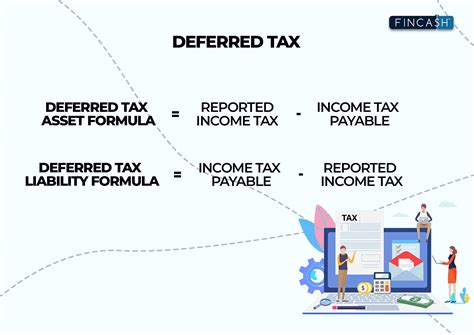

The calculation of deferred taxes involves a meticulous process that considers various factors, including the tax jurisdiction, applicable tax rates, and the specific accounting methods employed by the company. Generally, deferred taxes are calculated using the temporary difference method, which compares the taxable income with the reported income in the financial statements.

For instance, let's consider a scenario where a company reports a pre-tax profit of $1 million in its financial statements but has a taxable income of $800,000 due to certain tax deductions and allowances. In this case, the company would recognize a deferred tax asset of $200,000 ($1 million - $800,000) on its balance sheet, indicating the potential tax savings it can expect in the future.

Similarly, if a company's taxable income exceeds its reported income, it would recognize a deferred tax liability. This situation often arises when companies incur non-deductible expenses or receive tax-exempt income. In such cases, the company's balance sheet would reflect the deferred tax liability, representing the additional tax payment expected in the future.

| Scenario | Deferred Tax Asset/Liability |

|---|---|

| Reported Income > Taxable Income | Deferred Tax Asset |

| Taxable Income > Reported Income | Deferred Tax Liability |

Practical Implications and Considerations

When dealing with deferred taxes, businesses and investors must navigate a series of practical considerations to ensure optimal tax strategies and financial health.

Impact on Financial Statements

Deferred taxes have a direct impact on a company’s financial statements, particularly the balance sheet and income statement. On the balance sheet, deferred tax assets and liabilities are typically presented under the heading of “non-current assets” and “non-current liabilities,” respectively. These items represent the future tax consequences of temporary differences and carryforward losses.

On the income statement, deferred taxes are recognized as an expense or income, depending on whether the company has a deferred tax asset or liability. This recognition affects the company's reported earnings, potentially influencing investor perceptions and stock performance.

Tax Planning Strategies

Deferred taxes offer a unique opportunity for tax planning. Businesses can leverage their deferred tax assets to reduce their current tax liabilities, optimize cash flow, and improve their overall financial position. Strategies such as accelerating revenue recognition or deferring expenses can be employed to maximize the benefits of deferred taxes.

Conversely, companies with significant deferred tax liabilities may need to carefully manage their cash flow to ensure they can meet their future tax obligations. This may involve adjusting pricing strategies, negotiating tax settlements, or implementing cost-cutting measures to free up cash for tax payments.

Regulatory and Compliance Considerations

Proper accounting for deferred taxes is not just a matter of financial strategy but also a legal and regulatory obligation. Regulatory bodies, such as the Internal Revenue Service (IRS) in the United States, have specific guidelines and requirements for the recognition and reporting of deferred taxes. Non-compliance with these regulations can lead to penalties, fines, and even legal action.

Additionally, deferred taxes can impact a company's eligibility for certain tax incentives and credits. Understanding the intricate relationship between deferred taxes and tax regulations is essential for businesses to maximize their tax benefits and avoid unnecessary complications.

Future Implications and Uncertainties

While deferred taxes provide a degree of certainty in tax planning, they also come with inherent uncertainties. Changes in tax laws, economic conditions, or even a company’s financial performance can significantly impact the value and realization of deferred tax assets and liabilities.

For instance, a sudden change in tax rates or the introduction of new tax incentives can alter the value of deferred taxes. Similarly, economic downturns or unforeseen events can impact a company's ability to utilize its deferred tax assets, potentially leading to write-downs or impairments.

As such, businesses must continually monitor and assess the potential risks and opportunities associated with their deferred taxes, ensuring that their financial strategies remain agile and adaptable.

Case Studies: Real-World Examples

To illustrate the practical implications of deferred taxes, let’s examine a few real-world examples.

Case Study 1: Tech Giant’s Tax Strategy

A leading tech company, known for its innovative products and services, has consistently reported high profits. However, due to its aggressive tax planning strategies, it has been able to minimize its tax liabilities by leveraging deferred tax assets. By strategically recognizing revenue and expenses, the company has accumulated substantial deferred tax assets, allowing it to reduce its current tax payments.

This approach has not only saved the company millions in taxes but has also improved its cash flow, enabling it to invest in research and development and expand its operations. The effective management of deferred taxes has been a key factor in the company's success and has allowed it to maintain a competitive edge in the market.

Case Study 2: Manufacturing Company’s Challenge

In contrast, a manufacturing company faced significant challenges due to its deferred tax liabilities. The company, operating in a highly competitive industry, had incurred substantial losses in the previous year due to market fluctuations and increased competition. As a result, it accumulated deferred tax liabilities, indicating potential future tax payments.

The company's financial health was already strained, and the prospect of having to pay additional taxes in the future added to its concerns. To navigate this situation, the company had to carefully manage its cash flow, deferring certain expenses and negotiating with suppliers to free up cash. Additionally, it explored tax planning strategies to minimize its tax liabilities and maximize its cash reserves.

Expert Insights and Best Practices

Given the critical role of deferred taxes in corporate finance, it is essential to seek expert advice and implement best practices to optimize tax strategies.

Seeking Professional Guidance

Engaging the services of experienced tax professionals and financial advisors is crucial for businesses navigating the complex world of deferred taxes. These experts can provide valuable insights into tax planning strategies, help identify potential tax savings, and ensure compliance with regulatory requirements.

Additionally, tax professionals can assist in evaluating the realizability of deferred tax assets and liabilities, providing a more accurate assessment of their impact on the company's financial health. This expertise can be particularly beneficial during times of economic uncertainty or when the company is considering major strategic decisions.

Implementing Best Practices

To effectively manage deferred taxes, businesses should consider the following best practices:

- Regularly Review Tax Strategies: Stay updated with changing tax laws and regulations to ensure compliance and maximize tax benefits.

- Maintain Accurate Records: Proper documentation and record-keeping are essential for supporting deferred tax calculations and justifying tax positions.

- Assess Realizability: Regularly evaluate the realizability of deferred tax assets and liabilities to ensure they are accurately reflected in the financial statements.

- Monitor Cash Flow: Keep a close eye on cash flow to ensure sufficient funds are available to meet future tax obligations, especially in the case of deferred tax liabilities.

- Consider Tax Incentives: Explore available tax incentives and credits to reduce tax liabilities and optimize cash flow.

Conclusion

In conclusion, deferred taxes are a critical aspect of corporate finance, offering both opportunities and challenges for businesses. By understanding the intricacies of deferred taxes and implementing effective tax planning strategies, companies can optimize their tax liabilities, improve cash flow, and enhance their overall financial performance.

However, the management of deferred taxes is not without its complexities and uncertainties. Businesses must remain vigilant, regularly reviewing their tax strategies and seeking expert guidance to navigate the ever-changing tax landscape. With careful planning and a proactive approach, companies can leverage deferred taxes to their advantage, contributing to their long-term success and sustainability.

Frequently Asked Questions

How do deferred taxes affect a company’s financial health?

+

Deferred taxes can significantly impact a company’s financial health by influencing its tax liabilities, cash flow, and overall financial position. Effective management of deferred taxes can lead to tax savings, improved cash flow, and better financial performance. Conversely, mismanaged deferred taxes can result in unexpected tax payments, straining a company’s cash reserves and potentially impacting its operations.

What are the key factors to consider when calculating deferred taxes?

+

When calculating deferred taxes, key factors include the tax jurisdiction, applicable tax rates, temporary differences between accounting profits and taxable income, and the company’s specific accounting methods. It’s crucial to consider the impact of these factors on both the company’s financial statements and its tax obligations to ensure accurate reporting and compliance.

How do deferred taxes impact a company’s earnings and investor perceptions?

+

Deferred taxes can directly impact a company’s reported earnings, which in turn affects investor perceptions. Recognition of deferred tax assets as an expense can reduce reported earnings, potentially leading to a negative impact on stock performance. Conversely, effective management of deferred taxes can improve a company’s financial position, boosting investor confidence and market valuation.

What are some common tax planning strategies related to deferred taxes?

+

Common tax planning strategies related to deferred taxes include accelerating revenue recognition to increase current tax savings, deferring expenses to reduce current tax liabilities, and exploring tax incentives and credits to minimize tax obligations. These strategies can help companies optimize their tax positions and improve their financial performance.

How do regulatory changes impact the management of deferred taxes?

+

Regulatory changes, such as tax law amendments or the introduction of new tax incentives, can significantly impact the management of deferred taxes. Companies must stay updated with these changes to ensure compliance and maximize tax benefits. Regulatory changes can influence the value and realizability of deferred tax assets and liabilities, requiring businesses to adapt their tax strategies accordingly.