Saline County Property Tax

Understanding the intricacies of property taxes is essential for homeowners, especially when it comes to navigating the specific regulations and assessments in each county. This article aims to delve into the world of property taxes in Saline County, providing a comprehensive guide to help residents and property owners comprehend their obligations and rights.

Saline County Property Tax: A Comprehensive Guide

Property taxes in Saline County, Kansas, play a significant role in funding essential public services and infrastructure. This system, while essential for the county’s financial stability, can be complex and often raises numerous questions for property owners. From assessment processes to payment deadlines, every aspect requires a clear understanding to ensure compliance and minimize potential penalties.

Property Assessment and Valuation

The process of property assessment is a critical component of the taxation system in Saline County. Each year, the county’s Appraiser’s Office is tasked with determining the value of all properties within its jurisdiction. This value, known as the assessed value, forms the basis for calculating property taxes. The appraiser considers various factors, including:

- Real estate market trends and sales data.

- Physical characteristics of the property, such as size, age, and condition.

- Improvements made to the property, like renovations or additions.

- Comparisons with similar properties in the area.

The assessed value is not the same as the market value. It is typically a percentage of the property's full value, determined by the county's assessment ratio. For instance, if the assessment ratio is 20%, the assessed value would be 20% of the property's market value.

| Assessment Ratio | Calculated Assessed Value |

|---|---|

| 20% | $200,000 (20% of $1,000,000) |

Tax Rate Calculation

Once the assessed value is determined, the next step is to calculate the property tax rate. This rate is established by various taxing entities within the county, including the county government, school districts, cities, and special taxing districts. Each entity determines its own mill levy, which is then applied to the assessed value.

A mill levy is essentially a tax rate expressed in mills, where one mill is equal to one-tenth of a cent. For instance, a mill levy of 100 mills would be equivalent to $1.00 per $1,000 of assessed value. The total tax rate for a property is the sum of all the mill levies that apply to that property.

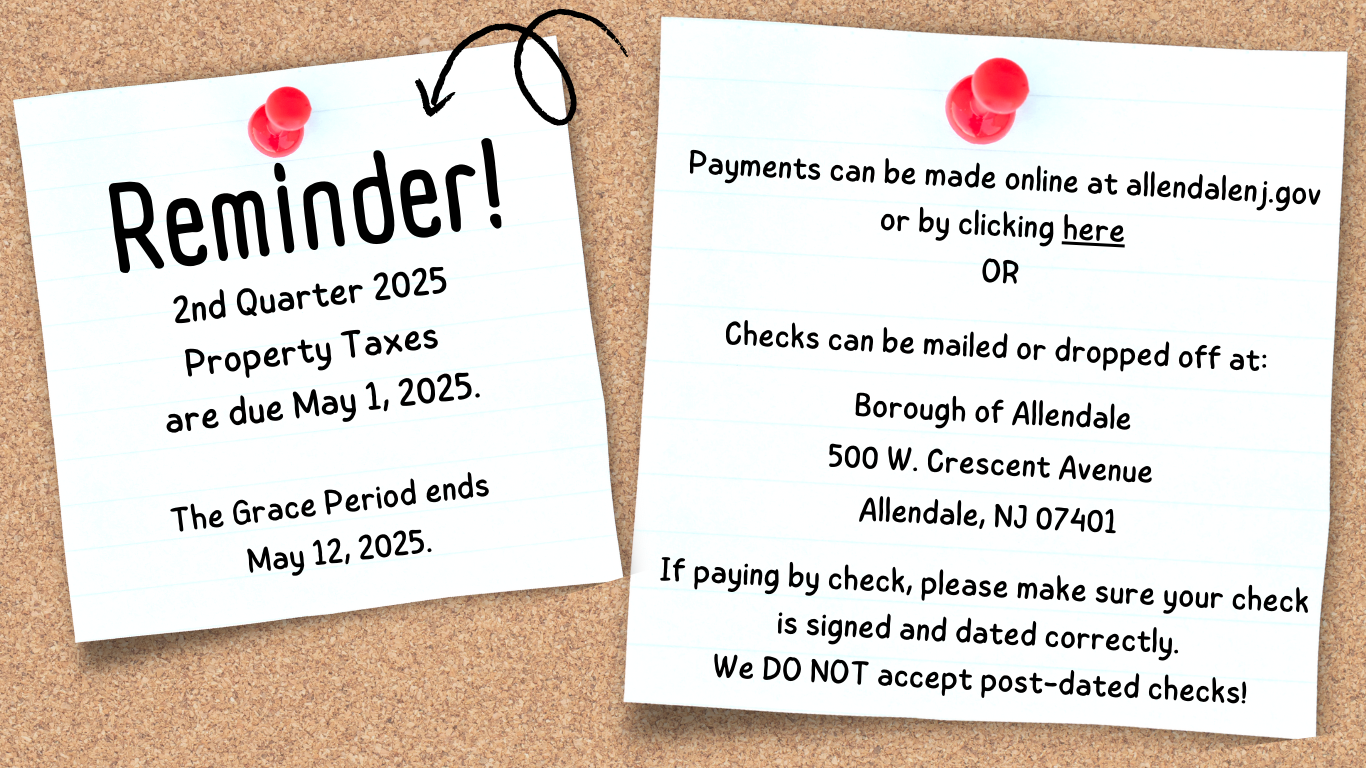

Property Tax Payment Process

In Saline County, property taxes are typically due in two installments. The first installment is due by December 20th of each year, while the second installment is due by May 10th of the following year. However, these dates can vary slightly depending on the specific year and any changes in the county’s tax calendar.

Property owners can pay their taxes through various methods, including online payments, in-person payments at the county treasurer's office, or by mail. Late payments may incur penalties and interest, so it's crucial to stay informed about the payment deadlines.

Exemptions and Deductions

Saline County offers several exemptions and deductions that can reduce the property tax burden for eligible property owners. These include:

- Homestead Exemption: Provides a reduction in the taxable value of a property if it is the owner's primary residence.

- Senior Citizen Exemption: Available to homeowners aged 65 or older, this exemption can significantly reduce property taxes.

- Veteran's Exemption: Eligible veterans and their surviving spouses may qualify for tax exemptions based on their service.

- Disabled Veteran's Exemption: Veterans with service-connected disabilities may be eligible for a full or partial exemption.

It's essential for property owners to research and understand the specific requirements and application processes for these exemptions.

Tax Relief Programs

Saline County recognizes the financial challenges that property taxes can pose, especially for low-income homeowners. To address this, the county offers various tax relief programs, including:

- Tax Abatement Programs: These programs provide temporary reductions in property taxes for eligible properties, often to encourage development or investment.

- Low-Income Tax Relief: Designed to assist low-income homeowners, this program can reduce property taxes based on income and assessed value.

- Payment Plan Options: Property owners facing financial difficulties can explore payment plans to manage their tax obligations over time.

Online Resources and Assistance

Saline County offers a range of online resources to help property owners navigate the tax process. These include:

- Property Tax Lookup: An online tool that allows property owners to view their tax information, including assessed values, tax rates, and payment history.

- Exemption Application Forms: Online forms for applying for various exemptions, making the process more accessible and efficient.

- Tax Calendar and Deadlines: A comprehensive guide to all important tax-related dates, ensuring property owners stay on top of their obligations.

- Frequently Asked Questions (FAQ) Section: A dedicated section addressing common queries about property taxes, assessments, and payment processes.

Additionally, the county provides contact information for its tax offices and offers personalized assistance for those who require further guidance.

Conclusion

Understanding and managing property taxes in Saline County is a crucial aspect of homeownership. By familiarizing themselves with the assessment process, tax rates, payment schedules, and available exemptions and relief programs, property owners can ensure compliance, minimize potential penalties, and take advantage of financial benefits tailored to their circumstances.

How often are properties reassessed in Saline County?

+Saline County reassesses all properties every odd-numbered year. This means that in years ending with an odd number (e.g., 2023, 2025), every property within the county is subject to a reassessment.

Can I appeal my property’s assessed value?

+Yes, if you disagree with your property’s assessed value, you have the right to appeal. The first step is to contact the Saline County Appraiser’s Office to discuss your concerns. If the issue remains unresolved, you can file a formal appeal with the Board of Tax Appeals. It’s important to provide detailed evidence and documentation to support your case.

What happens if I miss the property tax payment deadline?

+Late payments are subject to penalties and interest. The specific penalty amount depends on how late the payment is. It’s advisable to pay on time to avoid these additional costs and potential legal consequences.

Are there any online tools to estimate my property taxes before the assessment is finalized?

+Yes, the Saline County Appraiser’s Office provides an online Property Tax Estimator tool. This tool allows property owners to estimate their taxes based on the current assessed value and tax rates. However, it’s important to note that this is an estimate and may not reflect the final assessed value or tax rate.