Unrealized Tax Gains

In the world of finance and investment, the concept of unrealized tax gains often comes into play, especially when discussing long-term investment strategies and tax planning. These gains, which are not yet recognized for tax purposes, can have a significant impact on an investor's portfolio and overall financial health. This article aims to delve into the intricacies of unrealized tax gains, exploring their nature, implications, and strategic considerations.

Understanding Unrealized Tax Gains

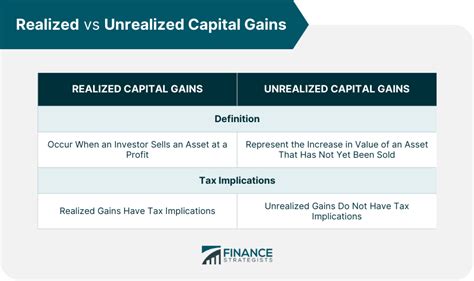

Unrealized tax gains, also known as paper gains, refer to the increase in the value of an asset held by an investor, but which has not yet been realized through the sale or disposal of that asset. In simpler terms, it is the profit an investor would make if they sold their asset at the current market price, minus the original purchase price. These gains are unrealized because the investor has not yet triggered any tax implications by liquidating the asset.

For instance, consider an investor who purchased 100 shares of a company's stock for $50 per share, totaling $5,000. If the stock price appreciates to $70 per share, the investor now has an unrealized tax gain of $2,000, as the current value of their investment is $7,000. However, until the investor sells the shares, the gain remains unrealized, and no tax liability is incurred.

Tax Implications and Strategies

Tax Liability and Timing

The primary consideration with unrealized tax gains is the eventual tax liability. When an investor realizes the gain by selling the asset, they become subject to capital gains tax. The tax rate and applicable rules vary based on factors like the investor’s tax jurisdiction, the type of asset, and the holding period.

For example, in the United States, capital gains are taxed at either long-term or short-term rates, depending on whether the asset was held for more than a year. Long-term capital gains typically enjoy more favorable tax rates, which can significantly impact the investor's after-tax returns.

Strategic Decisions

Investors often face a dilemma when it comes to unrealized tax gains: when to realize the gains and incur the tax liability. This decision is influenced by various factors, including the investor’s financial goals, risk tolerance, and market conditions.

One strategy is to harvest gains by selling a portion of the appreciated asset and realizing the gain. This allows the investor to take advantage of the increased value while potentially minimizing tax liability by staying within certain tax brackets. For instance, an investor might sell enough shares to bring their total gain within the lower capital gains tax bracket, thus reducing their overall tax burden.

Alternatively, investors might choose to defer gains by holding onto the asset. This strategy can be beneficial if the investor anticipates further appreciation or if they wish to avoid triggering a large tax liability in the current year. However, it's important to note that the risk of a market correction or unforeseen events should also be considered when deferring gains.

Tax Loss Harvesting

In contrast to unrealized tax gains, investors may also face unrealized tax losses. These losses can be strategically used to offset gains and reduce tax liability. The process, known as tax loss harvesting, involves selling an asset at a loss to realize the loss for tax purposes.

For instance, an investor might have a portfolio with both unrealized gains and losses. By strategically selling the assets with losses, they can offset their gains and potentially reduce their overall tax bill. However, it's crucial to adhere to the wash sale rule, which disallows claiming a loss if the same or a substantially identical asset is repurchased within a specified period.

Real-World Examples and Case Studies

The Impact of Unrealized Gains on Retirement Planning

Unrealized tax gains can play a significant role in retirement planning. For instance, consider a retiree with a substantial portfolio of appreciated assets. By strategically realizing gains and managing their tax liability, they can ensure a steady income stream while minimizing the impact of taxes on their retirement savings.

A well-planned retirement withdrawal strategy might involve a combination of withdrawing from taxable accounts and realizing gains in a controlled manner to ensure a balanced tax liability. This approach allows retirees to maintain their desired standard of living while optimizing their tax efficiency.

Market Volatility and Unrealized Gains

Market volatility can have a significant impact on unrealized tax gains. During periods of market growth, unrealized gains can accumulate rapidly, presenting both opportunities and challenges. Investors must carefully consider their risk tolerance and financial goals to determine the best course of action.

In a rapidly appreciating market, an investor might choose to realize a portion of their gains to lock in profits and diversify their portfolio. Conversely, during market downturns, an investor might opt to defer gains, waiting for the market to recover before realizing any profits. The decision depends on the investor's assessment of the market and their long-term financial plan.

Performance Analysis and Portfolio Management

Tracking Unrealized Gains

Effective portfolio management involves regularly tracking and analyzing unrealized gains. This allows investors to make informed decisions about their investments and tax strategies. Many investment platforms and portfolio management tools provide detailed reports on unrealized gains, helping investors stay informed.

| Asset | Purchase Price | Current Value | Unrealized Gain |

|---|---|---|---|

| Stock A | $1000 | $1200 | $200 |

| Stock B | $800 | $950 | $150 |

| Mutual Fund C | $5000 | $5800 | $800 |

The table above illustrates the unrealized gains for three different assets in an investor's portfolio. By tracking these gains, the investor can make strategic decisions about when to realize gains, rebalance their portfolio, or make other adjustments to optimize their investment strategy.

Optimizing Tax Efficiency

Tax efficiency is a key consideration in portfolio management. Investors can employ various strategies to optimize their tax liability, such as tax-loss harvesting, as mentioned earlier, or utilizing tax-advantaged accounts like retirement accounts. By minimizing tax drag, investors can maximize their after-tax returns.

Rebalancing and Risk Management

Unrealized gains can also influence an investor’s risk management strategy. As an asset appreciates, it might increase the overall risk exposure in the portfolio. Regular rebalancing, which involves selling appreciated assets and reinvesting in underperforming assets, can help maintain the desired asset allocation and manage risk.

Future Implications and Strategic Considerations

As tax laws and market conditions evolve, investors must stay informed and adapt their strategies accordingly. Here are some key considerations for the future:

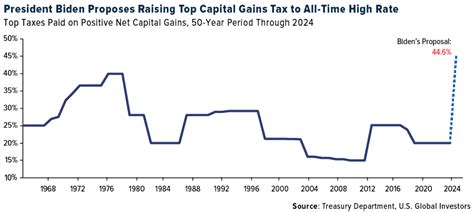

- Tax Reform: Changes in tax laws can significantly impact the treatment of capital gains. Investors should stay updated on any proposed or enacted tax reforms that might affect their investment strategies.

- Market Trends: Understanding long-term market trends can help investors anticipate potential gains and losses. By analyzing historical data and market cycles, investors can make more informed decisions about when to realize gains or defer them.

- Risk Management: As unrealized gains can influence an investor's risk profile, it's crucial to regularly assess and manage risk. This includes monitoring asset allocation, diversifying portfolios, and considering risk-mitigating strategies such as hedging.

- Retirement Planning: For retirees and those approaching retirement, managing unrealized gains becomes even more critical. A well-planned retirement strategy should consider the tax implications of realized gains and ensure a sustainable income stream.

How often should I review my unrealized gains and losses?

+It’s recommended to review your unrealized gains and losses at least annually, or more frequently if market conditions change significantly. Regular reviews allow you to stay informed about the performance of your investments and make timely decisions about realizing gains or losses.

Can unrealized gains affect my investment strategy?

+Absolutely! Unrealized gains can influence your investment strategy by impacting your risk profile and potential tax liability. As such, it’s important to consider these gains when making decisions about buying, selling, or rebalancing your portfolio.

What is the difference between short-term and long-term capital gains?

+Short-term capital gains refer to gains realized from the sale of an asset held for one year or less. Long-term capital gains, on the other hand, are gains from the sale of an asset held for more than one year. The tax rates for these gains typically differ, with long-term capital gains often benefiting from more favorable tax treatment.

How can I minimize the tax impact of my unrealized gains?

+There are several strategies to minimize the tax impact of unrealized gains. These include tax-loss harvesting, which involves selling assets at a loss to offset gains, and utilizing tax-advantaged accounts like retirement accounts. Additionally, strategic portfolio rebalancing and staying informed about tax laws can help minimize tax liability.