State Of Idaho Income Tax

Welcome to an in-depth exploration of the State of Idaho's Income Tax system. This comprehensive guide will delve into the intricacies of Idaho's tax landscape, providing a clear understanding of its unique features, rates, and implications for individuals and businesses. With a focus on accuracy and depth, we aim to offer an expert-level analysis, ensuring that you have all the information you need to navigate the Idaho tax system with confidence.

The Idaho Income Tax System: An Overview

Idaho’s income tax system operates as a crucial component of the state’s revenue generation strategy, playing a significant role in funding essential public services and infrastructure development. Established under the Idaho State Tax Commission, the income tax system is designed to levy taxes on the earnings of individuals, businesses, and other entities based within the state’s borders or deriving income from sources within Idaho.

One of the notable features of Idaho's income tax system is its adherence to a progressive tax structure. This means that as taxable income increases, the tax rate also increases, ensuring that those with higher earnings contribute a larger proportion of their income to the state's coffers. This progressive approach is in line with the principles of fairness and equitable tax distribution, aiming to balance the tax burden across different income levels.

Key Components of Idaho’s Income Tax System

Idaho’s income tax system is governed by a set of regulations and guidelines that define the parameters for tax calculation, payment, and compliance. Here are some of the key components that make up the system:

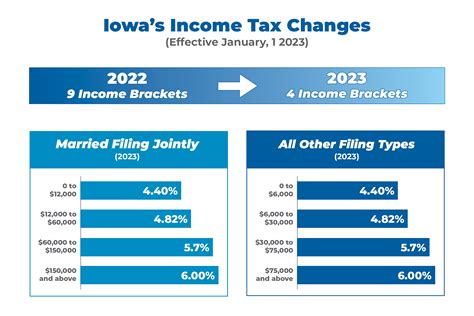

- Tax Rates and Brackets: Idaho employs a series of tax rates and brackets, each corresponding to a specific income range. As an individual's or business's taxable income falls within a particular bracket, the applicable tax rate is applied to calculate the tax liability.

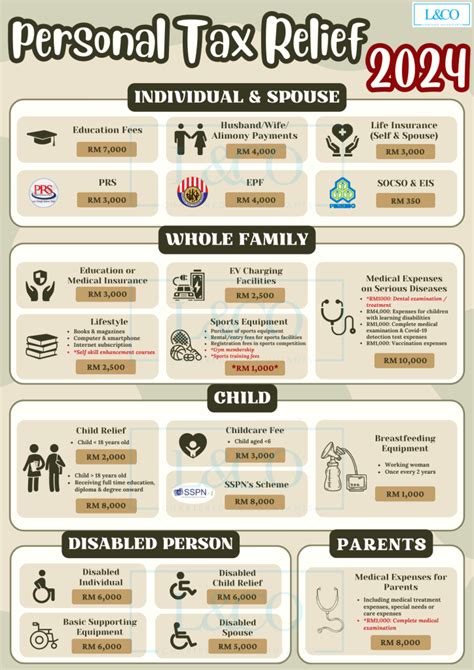

- Personal Exemptions and Deductions: The state offers various personal exemptions and deductions that can reduce taxable income, thereby lowering an individual's or business's overall tax burden. These exemptions and deductions are designed to provide relief to taxpayers in specific circumstances, such as for dependents, education expenses, or certain business-related costs.

- Taxable Income Calculation: The process of determining taxable income involves a careful consideration of an individual's or business's gross income, followed by the application of allowable deductions and exemptions. This calculation is a critical step in determining the appropriate tax rate and the final tax liability.

- Filing and Payment Options: Idaho provides a range of filing and payment options to accommodate the diverse needs of taxpayers. These options include electronic filing through the Idaho State Tax Commission's website, traditional paper filing, and various payment methods such as direct debit, credit/debit card, and electronic funds transfer.

- Tax Credits and Incentives: To encourage certain behaviors or support specific industries, Idaho offers a variety of tax credits and incentives. These can include credits for energy-efficient investments, research and development activities, or job creation initiatives. These incentives are designed to stimulate economic growth and promote desirable outcomes within the state.

| Tax Rate | Income Bracket |

|---|---|

| 1.6% | Up to $2,100 |

| 2.4% | $2,101 - $4,200 |

| 4.4% | $4,201 - $8,400 |

| 6.4% | $8,401 - $12,600 |

| 6.9% | Over $12,600 |

Taxable Entities and Exemptions

Idaho’s income tax system applies to a wide range of entities, including individuals, corporations, partnerships, limited liability companies (LLCs), trusts, and estates. However, not all income is subject to taxation. The state offers a variety of exemptions and deductions that can reduce or eliminate tax liability for certain types of income.

Individuals and Personal Income Tax

Idaho imposes an income tax on the earnings of individuals, with rates varying based on filing status and income level. Single individuals, married couples filing jointly, heads of household, and qualifying widows/widowers all have unique tax brackets and rates. Additionally, Idaho offers personal exemptions and deductions to reduce taxable income, such as the standard deduction, dependent exemptions, and deductions for certain expenses like medical costs or charitable contributions.

Business Entities and Corporate Income Tax

Businesses operating in Idaho, including corporations, LLCs, partnerships, and sole proprietorships, are subject to the state’s corporate income tax. The tax rate for corporations is 6.9%, while LLCs and partnerships are taxed at the individual member or partner level. These entities can take advantage of various business deductions, such as depreciation, business expenses, and certain tax credits, to lower their tax liability.

Exempt Organizations and Tax-Exempt Income

Certain organizations, such as charitable institutions, religious organizations, and educational entities, may be exempt from Idaho’s income tax. To qualify for tax-exempt status, these organizations must meet specific criteria and register with the Idaho State Tax Commission. Additionally, certain types of income, such as interest earned on municipal bonds or qualified retirement plan distributions, may be exempt from state income tax.

Tax Filing and Payment Process

Idaho’s income tax filing and payment process is designed to be straightforward and accessible for taxpayers. The state offers various options for filing tax returns, including online filing through the Idaho State Tax Commission’s website, paper filing, and electronic filing through authorized tax preparers or software providers.

Online Filing and Payment

The Idaho State Tax Commission’s website provides a user-friendly platform for online tax filing. Taxpayers can create an account, access their tax records, and file their returns securely online. The website also offers a payment portal, allowing taxpayers to make payments using credit/debit cards, electronic checks, or direct bank transfers. This option is particularly convenient for those who prefer the ease and speed of online transactions.

Paper Filing and Payment

For those who prefer a more traditional approach, Idaho accepts paper tax returns. Taxpayers can download and print tax forms from the Idaho State Tax Commission’s website or obtain them from authorized tax preparers. Once completed, the forms can be mailed to the designated address along with the required payment. This method provides an alternative for individuals who may not have access to or prefer not to use online filing systems.

Electronic Filing and Payment through Authorized Providers

Idaho has partnered with several authorized tax preparation software providers and tax professionals who offer electronic filing services. These providers can assist taxpayers in completing and filing their tax returns electronically, often with additional support and guidance. Payment for taxes owed can also be facilitated through these authorized providers, who may offer various payment options, including credit/debit card payments and direct bank transfers.

Tax Compliance and Enforcement

Ensuring tax compliance and enforcing tax regulations are critical aspects of Idaho’s income tax system. The Idaho State Tax Commission is responsible for administering and enforcing the state’s tax laws, including income tax regulations. They work to educate taxpayers about their responsibilities, provide guidance on tax matters, and enforce compliance through audits and other enforcement actions.

Audits and Tax Examinations

The Idaho State Tax Commission conducts audits and tax examinations to verify the accuracy of tax returns and ensure compliance with tax laws. These audits can be random or targeted based on specific criteria, such as high-risk factors or discrepancies identified during the tax filing process. During an audit, taxpayers are required to provide supporting documentation for the income and deductions reported on their tax returns.

Tax Penalties and Interest

Idaho imposes penalties and interest on taxpayers who fail to file their tax returns on time, underreport their income, or make late payments. These penalties are designed to discourage non-compliance and ensure that taxpayers fulfill their tax obligations. The specific penalties and interest rates vary based on the nature and severity of the infraction, with higher penalties for willful violations or repeated non-compliance.

Appeals and Dispute Resolution

Taxpayers who disagree with the outcome of an audit or have other tax-related disputes can pursue an appeals process. Idaho provides administrative and judicial avenues for resolving tax disputes. Administrative appeals are typically handled by the Idaho State Tax Commission’s Appeals Division, while judicial appeals are filed in the Idaho Tax Board of Appeals or the Idaho State Supreme Court, depending on the nature and complexity of the case.

Future Outlook and Potential Changes

As with any tax system, Idaho’s income tax structure is subject to potential changes and reforms. The state’s tax policies are influenced by economic conditions, political dynamics, and the evolving needs of its residents and businesses. Here are some factors that could shape the future of Idaho’s income tax system:

Economic Conditions and Revenue Needs

The state’s economic performance and revenue requirements play a significant role in shaping tax policies. During periods of economic growth, Idaho may consider adjusting tax rates or introducing new tax incentives to stimulate investment and job creation. Conversely, economic downturns may prompt the state to explore ways to increase revenue, potentially through tax rate adjustments or the introduction of new taxes.

Political Landscape and Policy Changes

Idaho’s political environment can drive changes in tax policies. Elections, shifts in political power, and the priorities of elected officials can all influence tax reforms. For example, a new administration or a change in political party control may result in proposals for tax cuts, tax increases, or the implementation of new tax incentives to align with their policy agenda.

Population Growth and Demographic Shifts

Changes in Idaho’s population, such as growth or shifts in demographics, can impact the state’s tax base and revenue needs. As the population expands or the demographic makeup changes, the state may need to adjust its tax policies to accommodate these changes and ensure adequate funding for public services and infrastructure.

National and Global Tax Trends

Idaho’s tax policies are not isolated from broader national and global tax trends. The state may consider adopting or adapting tax reforms implemented in other jurisdictions, particularly if these reforms are shown to be effective in stimulating economic growth or addressing specific policy objectives. Additionally, changes in federal tax laws can have indirect impacts on Idaho’s tax system, especially in areas where state and federal tax policies are intertwined.

Tax Reform Proposals and Initiatives

Idaho’s tax system is continually evaluated and assessed for potential reforms. The Idaho State Tax Commission, in collaboration with policymakers, may propose and implement changes to simplify the tax system, improve efficiency, or address specific concerns raised by taxpayers or stakeholders. These reforms could include adjustments to tax rates, the introduction of new tax brackets, or the modification of existing tax incentives and exemptions.

Conclusion

Idaho’s income tax system is a dynamic and evolving entity, designed to meet the state’s revenue needs while promoting economic growth and fairness. By understanding the key components of the system, including tax rates, brackets, exemptions, and filing processes, taxpayers can navigate the system with confidence. The state’s commitment to tax compliance and enforcement ensures that taxpayers fulfill their obligations, while also providing avenues for dispute resolution and appeals.

As Idaho's tax landscape continues to evolve, staying informed about potential changes and reforms is essential for individuals and businesses. By staying engaged with the state's tax policies and staying up-to-date on any proposed or implemented reforms, taxpayers can adapt their financial strategies and planning accordingly. With a comprehensive understanding of Idaho's income tax system, taxpayers can contribute to the state's economic prosperity while ensuring compliance with its tax laws.

What is the current tax rate for individuals in Idaho?

+The tax rate for individuals in Idaho varies based on income and filing status. For single individuals, the tax rate ranges from 1.6% to 6.9%, depending on income brackets. Married couples filing jointly and heads of household have similar tax rates, while qualifying widows/widowers may have slightly different rates.

How often must I file my Idaho income tax return?

+You are required to file an Idaho income tax return annually if your income exceeds the minimum filing threshold. The due date for filing is typically April 15th of the year following the tax year in question. However, if you are due a refund, you have three years from the original due date to file and claim your refund.

Are there any tax credits or incentives available for businesses in Idaho?

+Yes, Idaho offers a range of tax credits and incentives to businesses. These include credits for research and development activities, job creation, energy efficiency investments, and more. Businesses can explore these incentives to potentially reduce their tax liability and support their growth strategies.

What happens if I don’t file my Idaho income tax return on time?

+If you fail to file your Idaho income tax return by the due date, you may be subject to penalties and interest. The Idaho State Tax Commission may assess a late filing penalty, which can range from 5% to 25% of the tax due, depending on the severity of the infraction. Additionally, interest may accrue on any unpaid tax balance.