Sales Tax Roseville California

Sales tax in Roseville, California, is an important consideration for both residents and businesses alike. Understanding the sales tax rates, how they are calculated, and the impact they have on the local economy is crucial for making informed financial decisions. In this comprehensive guide, we will delve into the specifics of sales tax in Roseville, exploring its rates, exemptions, and the role it plays in supporting the city's infrastructure and services.

Understanding Sales Tax in Roseville, CA

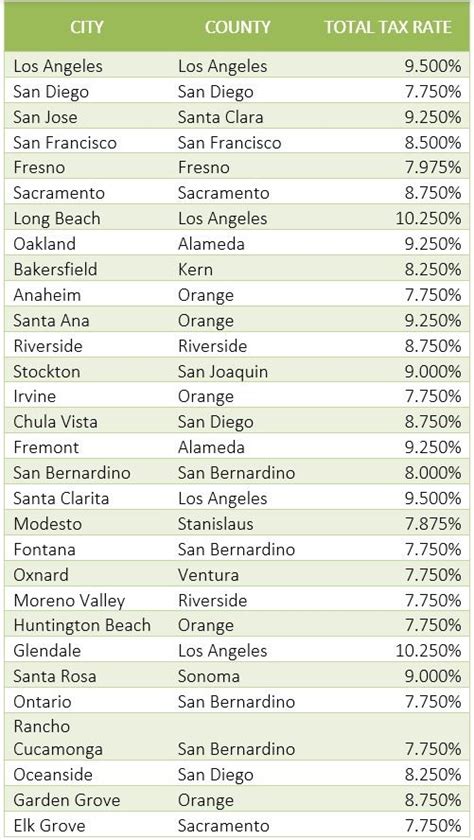

Roseville, a bustling city located in Placer County, California, operates under a complex sales tax system that consists of both state and local tax rates. As of the latest information, the sales tax rate in Roseville stands at 7.25%, which includes the state sales tax and the local sales tax specific to the city.

The Breakdown of Sales Tax Rates

The state sales tax rate in California is a uniform 7.25%, which applies to most goods and services sold within the state. However, it is important to note that there are certain exemptions and special tax rates for specific items, such as groceries and medications.

In addition to the state sales tax, Roseville imposes its own local sales tax, which is currently set at 0%. This local tax rate is determined by the city and is often used to fund specific projects or initiatives within the community. The local sales tax rate can vary across different cities and counties in California, making it essential to stay informed about the rates applicable to your specific location.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| Roseville Local Sales Tax | 0% |

| Total Sales Tax in Roseville | 7.25% |

How Sales Tax is Calculated in Roseville

Calculating sales tax in Roseville involves a straightforward process. The applicable sales tax rate is applied to the pre-tax price of the goods or services being purchased. This means that for every dollar spent, a certain percentage is collected as sales tax and remitted to the state and local government.

For example, if you purchase an item priced at $100 in Roseville, the sales tax calculated would be $7.25 (7.25% of $100). Therefore, the total cost of the item, including sales tax, would be $107.25.

Sales Tax Exemptions

It’s important to note that certain items are exempt from sales tax in California. These exemptions can vary based on the nature of the product or service and the intended use. Some common exemptions include:

- Groceries and food items for home consumption are generally exempt from sales tax.

- Prescription medications and certain medical devices are tax-free.

- Select services, such as legal and medical services, are not subject to sales tax.

- Non-profit organizations may be eligible for sales tax exemptions on certain purchases.

It's crucial to consult the official guidelines provided by the California Department of Tax and Fee Administration to understand the specific exemptions and qualifications.

Impact of Sales Tax on the Roseville Economy

Sales tax plays a significant role in funding various aspects of the Roseville community. The revenue generated from sales tax contributes to the city’s budget, supporting essential services and infrastructure development.

Funding Essential Services

A portion of the sales tax revenue collected in Roseville is allocated towards funding essential public services. This includes maintaining and improving:

- Public safety services, such as police and fire departments.

- Public schools and educational facilities.

- Parks, recreation centers, and other community amenities.

- Road maintenance and transportation infrastructure.

Economic Development Initiatives

The city of Roseville may also utilize sales tax revenue to support economic development initiatives. These initiatives can include attracting new businesses, promoting tourism, and investing in local business incentives. By doing so, the city aims to foster economic growth and create a thriving business environment.

Infrastructure Projects

Sales tax revenue is often allocated towards major infrastructure projects within the city. These projects may include:

- Upgrading water and sewer systems.

- Expanding and improving transportation networks.

- Constructing or renovating public buildings.

- Developing or enhancing public spaces and recreational areas.

These infrastructure projects not only enhance the quality of life for residents but also attract businesses and investors, further contributing to the city's economic growth.

Staying Informed: Sales Tax Updates and Changes

Sales tax rates and regulations can undergo changes over time. It is essential for residents, businesses, and consumers in Roseville to stay informed about any updates or modifications to the sales tax system. Here are some resources to keep you informed:

- The California Department of Tax and Fee Administration provides official guidelines and updates on sales tax rates and regulations. Their website offers comprehensive information and resources.

- Local news outlets and community websites often report on sales tax-related news and developments in Roseville.

- Businesses can consult with tax professionals or accountants who specialize in sales tax to ensure compliance and stay updated on any changes.

Potential Future Changes

While the current sales tax rate in Roseville is stable, it’s important to be aware of potential future changes. Cities and counties in California have the authority to propose and implement local sales tax increases to fund specific projects or address budget shortfalls. Staying informed about local politics and community initiatives can provide insights into potential sales tax changes.

What happens if I don't pay sales tax on my purchases in Roseville, CA?

+Failing to pay sales tax on your purchases can result in legal consequences. Businesses are required to collect and remit sales tax to the state and local government. If you are found to have avoided paying sales tax, you may face penalties, fines, or even legal action. It's important to ensure that sales tax is included in your purchases and paid accurately to avoid any legal issues.

Are there any online resources to help me calculate sales tax in Roseville accurately?

+Yes, there are several online tools and calculators available to assist you in calculating sales tax accurately. Websites like Sales Tax Calculator and Avvo's Sales Tax Calculator provide easy-to-use calculators that take into account the current sales tax rate in Roseville. These tools can help you estimate the total cost of your purchases, including sales tax.

How often do sales tax rates change in Roseville, and what triggers these changes?

+Sales tax rates in Roseville can change periodically, typically based on decisions made by the city government. These changes are often proposed to fund specific projects or initiatives within the community. While there is no set timeframe for these changes, they are usually announced in advance to allow residents and businesses to prepare. It's important to stay informed through local news and official channels to be aware of any upcoming sales tax rate modifications.

Understanding the sales tax system in Roseville, California, is crucial for both residents and businesses. By staying informed about the current rates, exemptions, and the impact of sales tax on the local economy, individuals can make informed financial decisions. Remember to consult official resources and local news to stay updated on any changes to the sales tax landscape in Roseville.