Baltimore Real Property Tax

In the city of Baltimore, Maryland, real property taxes play a significant role in the local economy and are an essential aspect of property ownership. These taxes contribute to the city's revenue, funding various public services and infrastructure projects. Understanding the intricacies of Baltimore's real property tax system is crucial for both residents and investors alike. This comprehensive guide aims to shed light on the subject, covering everything from tax rates and assessments to payment options and potential tax relief measures.

Understanding Baltimore’s Real Property Tax System

The City of Baltimore assesses real property taxes annually, ensuring that property owners contribute fairly to the city’s operations and development. The tax is based on the assessed value of the property, which is determined by the Baltimore City Department of Finance through a comprehensive assessment process.

Tax Assessment Process

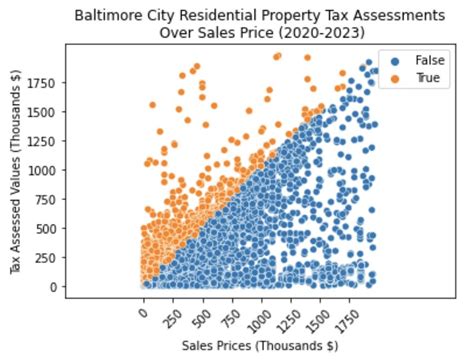

Baltimore’s Department of Finance employs a team of professional assessors who regularly evaluate properties throughout the city. This process involves examining various factors, including recent sales of comparable properties, the cost of replacing or rebuilding the property, and the income potential of the property. The assessed value is then used as the basis for calculating the real property tax.

Property owners have the right to appeal their assessments if they believe the value assigned to their property is inaccurate. The appeal process is detailed and involves submitting relevant evidence and justifications to support the claim. An independent review board then considers the appeal, ensuring a fair and transparent system.

Tax Rates and Calculations

The real property tax rate in Baltimore is set annually by the city’s government and is expressed as a percentage of the property’s assessed value. The tax rate is influenced by various factors, including the city’s budget requirements and the need to maintain essential services. For the current fiscal year, the tax rate stands at 0.8858 per every $100 of assessed value, which is a slight increase from the previous year’s rate.

To illustrate, consider a residential property with an assessed value of $250,000. Using the current tax rate, the annual real property tax liability would amount to $2,214.50 (0.8858 * $250,000 / 100). This calculation provides a clear understanding of the financial obligation associated with property ownership in Baltimore.

| Tax Year | Tax Rate |

|---|---|

| 2023 | 0.8858 |

| 2022 | 0.8744 |

| 2021 | 0.8630 |

Tax Exemptions and Relief Programs

Baltimore offers several tax relief programs and exemptions to eligible property owners, aimed at easing the tax burden and encouraging homeownership. These programs include the Homestead Tax Credit, which provides a tax credit for owner-occupied residential properties, and the Senior Citizen Property Tax Credit, benefiting senior citizens with limited incomes.

Additionally, the city offers tax exemptions for certain types of properties, such as those owned by charitable organizations, religious institutions, and government entities. These exemptions are designed to support community development and provide essential services to Baltimore's residents.

Payment Options and Due Dates

Baltimore provides property owners with multiple options for paying their real property taxes, ensuring convenience and flexibility. The primary methods include:

- Online Payments: Property owners can make secure online payments through the city's official website, which offers a user-friendly interface and real-time transaction tracking.

- Mail-In Payments: Owners can mail their tax payments to the designated address, ensuring timely receipt and processing. The city provides detailed instructions on the required payment methods and necessary documentation.

- In-Person Payments: Baltimore City offers in-person payment options at various locations, including the Department of Finance's main office and select satellite offices. This allows property owners to interact directly with tax officials and receive immediate assistance if needed.

The due dates for real property tax payments are established annually and are typically divided into two installments. The first installment is due by September 30, while the second installment is due by March 31 of the following year. Property owners who fail to make timely payments may be subject to interest charges and potential penalties.

Late Payment Penalties and Interest

Baltimore imposes interest and penalties on late real property tax payments to ensure compliance and timely revenue collection. The interest rate is currently set at 1.5% per month, with a minimum interest charge of $10. Penalties are applied to unpaid taxes, and the rate varies depending on the amount of tax due and the duration of the delinquency.

For instance, if a property owner fails to pay the first installment by the due date, they will be subject to a 1.5% interest charge for the first month of delinquency, which amounts to $37.50 for a property with a tax liability of $2,500. The interest continues to accrue monthly until the payment is made in full.

Appealing Property Assessments and Disputes

Property owners who believe their assessment is inaccurate or unfair have the right to appeal through a formal process. The appeal process involves the following steps:

- Preliminary Review: Property owners can initiate the appeal process by requesting a preliminary review of their assessment. This step allows the Department of Finance to consider any errors or discrepancies in the initial assessment.

- Informal Hearing: If the preliminary review does not result in a satisfactory resolution, the property owner can request an informal hearing. This hearing provides an opportunity to present evidence and arguments to a designated hearing officer.

- Formal Appeal: If the informal hearing does not yield a favorable outcome, property owners can file a formal appeal with the Maryland Tax Court. This court is an independent body that reviews tax-related disputes and makes binding decisions.

Throughout the appeal process, property owners are encouraged to gather relevant documentation, such as recent property sales data, appraisals, and photographs, to support their case. The Department of Finance provides detailed guidelines and resources to assist property owners in preparing their appeals.

Common Reasons for Assessment Appeals

Property owners often appeal their assessments for various reasons, including:

- Overvaluation: If the assessed value of the property is significantly higher than its fair market value, property owners may appeal to have the assessment reduced.

- Inequitable Assessment: When a property's assessment is disproportionately higher compared to similar properties in the area, owners may appeal to ensure equitable taxation.

- Changes in Property Condition: If the property has undergone significant improvements or damage since the last assessment, owners may appeal to reflect the current condition in the assessment.

Future Outlook and Potential Reforms

Baltimore’s real property tax system is subject to ongoing review and potential reforms to ensure fairness, efficiency, and sustainability. Here are some key considerations for the future:

Fair Assessment Practices

The city aims to maintain a transparent and equitable assessment process, ensuring that property values are accurately reflected. This involves continuous training and development of assessment professionals, as well as the adoption of advanced technologies to enhance data accuracy and consistency.

Tax Relief Programs

Baltimore recognizes the importance of tax relief programs in supporting homeownership and community development. The city plans to expand and promote existing relief programs, making them more accessible to eligible property owners. Additionally, there are discussions to introduce new initiatives, such as tax credits for energy-efficient improvements and incentives for affordable housing development.

Digital Transformation

Baltimore is committed to leveraging technology to streamline the tax payment process and enhance overall efficiency. The city aims to develop a comprehensive online platform that integrates tax assessment, payment, and dispute resolution services, providing a one-stop solution for property owners.

How often are property assessments conducted in Baltimore?

+

Property assessments in Baltimore are conducted every three years. However, new construction, significant improvements, or other changes to a property may trigger a reassessment outside of this cycle.

Can I estimate my real property tax liability before receiving my assessment notice?

+

Yes, you can estimate your real property tax liability by multiplying your property’s assessed value by the current tax rate. This provides a rough estimate, but it’s important to note that the actual tax amount may vary based on any applicable exemptions or credits.

What happens if I disagree with my property assessment?

+

If you disagree with your property assessment, you have the right to appeal. The appeal process involves submitting an appeal form, providing supporting evidence, and attending a hearing. An independent review board will consider your case and make a decision.

Are there any tax incentives for energy-efficient improvements in Baltimore?

+

Currently, Baltimore offers a Green Tax Credit for properties that meet specific energy-efficient standards. This credit reduces the property’s taxable value, resulting in lower real property taxes. It’s important to consult with the Department of Finance to understand the eligibility criteria and application process.

Can I pay my real property taxes in installments?

+

Yes, Baltimore allows property owners to pay their real property taxes in two installments. The first installment is due by September 30, and the second installment is due by March 31 of the following year. This provides flexibility for property owners to manage their tax payments.