Whats The Property Tax In Houston

Houston, Texas, is a bustling metropolis known for its diverse economy, vibrant culture, and ever-growing population. One of the key considerations for residents and property owners in this dynamic city is understanding the property tax landscape. Property taxes in Houston contribute significantly to the local economy and funding of essential services. This comprehensive guide aims to shed light on the intricacies of property taxes in Houston, providing valuable insights for homeowners, investors, and those curious about the city's financial ecosystem.

Property Tax Rates and Assessments in Houston

Property taxes in Houston are primarily determined by the assessed value of a property and the tax rates set by various taxing authorities. These taxing entities include the City of Houston, Harris County, and local school districts, among others. The property tax system in Houston, as in many other U.S. cities, operates on an ad valorem basis, meaning taxes are levied in proportion to the assessed value of the property.

The property tax rate, often expressed as a percentage, is applied to the taxable value of the property. This taxable value is typically determined by the Harris County Appraisal District (HCAD), which conducts regular property appraisals. HCAD assesses properties based on factors such as location, improvements, and market conditions. Property owners receive their appraisal notices, which detail the assessed value and any changes from the previous year.

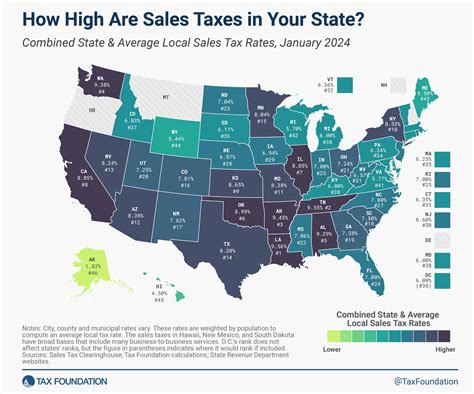

It's important to note that property tax rates can vary significantly across different areas of Houston due to the presence of multiple taxing entities. Each entity, including the city, county, and school districts, sets its own tax rate to fund its operations and services. These rates are typically expressed as a dollar amount per $100 of assessed property value.

Residential Property Tax Rates

For residential properties in Houston, the tax rates can fluctuate based on the specific location and the services provided by the taxing authorities. As of the latest data available, the effective tax rate for residential properties in Houston was approximately 2.15%. This rate represents the combined tax rates of all applicable taxing entities.

For example, in a hypothetical neighborhood within Houston, the City of Houston's tax rate might be $0.50 per $100 of assessed value, while the Harris County tax rate could be $0.35 per $100. School districts, such as the Houston Independent School District (HISD), may have additional tax rates to support local education. These rates are often determined through public hearings and budget approvals.

| Taxing Entity | Tax Rate ($/100) |

|---|---|

| City of Houston | $0.50 |

| Harris County | $0.35 |

| Houston Independent School District (HISD) | $0.40 |

| Total Effective Tax Rate | $1.25 |

Commercial Property Tax Rates

Commercial properties in Houston face similar tax structures but with potentially higher tax rates. The effective tax rate for commercial properties can be significantly higher than residential rates due to the additional services and infrastructure required to support business activities.

As an illustration, consider a commercial property located in downtown Houston. The City of Houston's tax rate for commercial properties might be $0.60 per $100 of assessed value, while Harris County could levy a tax rate of $0.45 per $100. Specialized taxing entities, such as the Houston Port Authority, may also apply additional taxes to support specific infrastructure projects.

| Taxing Entity | Tax Rate ($/100) |

|---|---|

| City of Houston | $0.60 |

| Harris County | $0.45 |

| Houston Port Authority | $0.20 |

| Total Effective Tax Rate | $1.25 |

Factors Influencing Property Taxes in Houston

Property taxes in Houston are influenced by a multitude of factors, including property value, tax rates, and any applicable exemptions or abatements. Understanding these factors is crucial for property owners to accurately estimate their tax liabilities.

Property Value and Assessment

The assessed value of a property is a key determinant of property taxes. HCAD conducts regular appraisals to ensure that property values are accurately reflected in the tax system. Property owners can dispute their appraised values if they believe the assessment is inaccurate. The process for disputing assessments typically involves providing evidence to support a lower valuation, such as recent sales data or comparative market analyses.

Tax Rates and Budget Allocations

Taxing entities in Houston set their tax rates annually to fund their budgets. These budgets cover a wide range of services, including police and fire departments, public works, education, and more. The tax rates are determined through a combination of public input, budgetary needs, and the entity’s financial goals. Property owners can stay informed about tax rate changes by attending public hearings and engaging with their local government representatives.

Exemptions and Abatements

Houston, like many other cities, offers various exemptions and abatements to reduce the property tax burden for certain property owners. These incentives aim to encourage specific activities or support vulnerable populations.

- Homestead Exemptions: Property owners who use their property as their primary residence may be eligible for homestead exemptions. These exemptions reduce the taxable value of the property, resulting in lower tax bills. To qualify, homeowners must meet certain criteria, such as ownership and occupancy requirements.

- Senior Citizen Exemptions: Houston offers exemptions for senior citizens who meet age and income criteria. These exemptions provide relief to older residents by reducing their property taxes.

- Economic Development Abatements: To attract businesses and stimulate economic growth, Houston may offer tax abatements to new or expanding businesses. These abatements reduce the property taxes for a specified period, encouraging investment and job creation.

Property Tax Payment and Due Dates

Property owners in Houston are responsible for paying their property taxes annually. The payment due dates are typically in January, with a discount offered for early payment. Property tax bills are sent to property owners by the Harris County Tax Assessor-Collector’s Office, which handles the collection and distribution of property taxes on behalf of the various taxing entities.

Property owners have the option to pay their taxes in full by the deadline or choose to pay in installments. Failure to pay property taxes by the due date can result in penalties, interest, and potential tax liens. Property owners should carefully review their tax bills and ensure timely payments to avoid these consequences.

Payment Options and Discounts

Houston offers a range of payment options to accommodate different preferences and financial situations. Property owners can pay their taxes online, by mail, or in person at designated locations. Additionally, early payment discounts are available to encourage timely payments and help manage cash flow for property owners.

The discount structure may vary, but it typically offers a reduced tax rate for payments made within a specified timeframe. For instance, a 5% discount may be available for payments made by the end of February, while payments made by the end of March might receive a 2.5% discount. These discounts provide an incentive for property owners to settle their tax liabilities early.

Appealing Property Tax Assessments

Property owners who believe their property tax assessment is inaccurate have the right to appeal the valuation. The process for appealing property tax assessments in Houston involves several steps and requires careful preparation and documentation.

Steps to Appeal

- Review the Appraisal Notice: Property owners should carefully examine their appraisal notice, which details the assessed value and any changes from the previous year. If they disagree with the assessment, they can initiate the appeal process.

- Informal Protest: The first step is often an informal protest, where property owners can meet with HCAD appraisers to discuss their concerns. This provides an opportunity to present evidence and argue for a lower valuation.

- Formal Protest: If the informal protest is unsuccessful, property owners can file a formal protest with the Appraisal Review Board (ARB). The ARB is an independent body that reviews and makes decisions on property tax appeals. Property owners must provide detailed evidence and arguments to support their case.

- Hearing with the ARB: The ARB conducts hearings to consider the evidence presented by both the property owner and HCAD. These hearings provide a forum for property owners to present their case and challenge the assessed value.

- ARB Decision: After the hearing, the ARB will issue a decision, either upholding the original assessment or adjusting the value based on the evidence presented. Property owners who are not satisfied with the ARB’s decision can further appeal to district court.

Property Tax Trends and Forecasts in Houston

Understanding the trends and forecasts for property taxes in Houston is essential for long-term financial planning. Property tax rates and assessments can fluctuate based on various economic and political factors, impacting the financial obligations of property owners.

Recent Trends

In recent years, Houston has experienced fluctuations in property tax rates and assessments. The city’s rapid growth and development have led to increased demand for services, which can influence tax rates. Additionally, changes in state laws and local government policies can impact the tax landscape.

For instance, the Texas Legislature has implemented measures to limit the growth of property tax rates, such as requiring voter approval for certain tax increases. These legislative actions aim to provide property tax relief and ensure transparency in the tax-setting process.

Future Forecasts

Forecasting property tax trends in Houston involves analyzing various economic indicators and local government plans. While it is challenging to predict exact tax rates and assessments, certain factors can provide insights into the future direction of property taxes.

- Economic Growth: Houston's dynamic economy, driven by industries such as energy, healthcare, and aerospace, can influence property values and tax revenues. Continued economic growth may lead to increased property values and, subsequently, higher tax assessments.

- Infrastructure Development: Investments in infrastructure, such as transportation projects and public works, can impact tax rates. These projects require funding, which may be supported by increased tax revenues.

- Political and Legislative Changes: Changes in local government leadership and state legislation can affect property tax policies. New initiatives or reforms may impact tax rates and assessments, providing either relief or increased obligations for property owners.

Conclusion: Navigating Property Taxes in Houston

Understanding the intricacies of property taxes in Houston is essential for property owners and investors in the city. The property tax system, with its varying tax rates and assessment processes, plays a crucial role in funding essential services and infrastructure. By staying informed about tax rates, assessments, and available exemptions, property owners can effectively manage their financial obligations.

The process of appealing property tax assessments, while challenging, provides an avenue for property owners to ensure fair valuations. Additionally, staying updated on economic and political developments can help property owners anticipate potential changes in the tax landscape. As Houston continues to thrive and evolve, property taxes will remain a vital component of the city's financial ecosystem.

How often are property tax rates updated in Houston?

+Property tax rates in Houston are typically updated annually. Taxing entities, such as the City of Houston and Harris County, hold public hearings and budget approvals to determine the tax rates for the upcoming fiscal year.

Are there any online tools to estimate property taxes in Houston?

+Yes, the Harris County Appraisal District (HCAD) provides an online property tax estimator tool. This tool allows property owners to estimate their taxes based on their property’s assessed value and the current tax rates.

What happens if I miss the property tax payment deadline in Houston?

+Missing the property tax payment deadline can result in penalties and interest. The Harris County Tax Assessor-Collector’s Office may also place a tax lien on the property, which can impact the owner’s credit rating and ability to sell the property.