Commissioner Of Income Tax

The Commissioner of Income Tax (CIT) is a pivotal figure in the taxation system of many countries, playing a crucial role in administering and enforcing income tax laws. With the complexity of modern tax systems, the CIT's responsibilities are multifaceted and highly significant to the economic well-being of nations. This article delves into the depths of their role, shedding light on the various aspects that make the CIT an indispensable part of any government's revenue collection machinery.

Understanding the Role of the Commissioner of Income Tax

The Commissioner of Income Tax is an appointed official, often a seasoned tax professional, who is responsible for overseeing the collection and management of income taxes within a specified jurisdiction. This role is not merely administrative; it involves a strategic approach to tax policy implementation, ensuring compliance, and fostering a fair and efficient tax system.

The CIT's primary mandate is to ensure that individuals and businesses comply with the country's tax laws, thereby contributing to the national revenue stream. They achieve this through a combination of education, facilitation, and enforcement. From guiding taxpayers on their obligations to taking strict measures against tax evasion, the CIT's work is diverse and demanding.

Furthermore, the CIT is often involved in policy formulation, offering insights and recommendations to shape the direction of tax laws. This role extends to representing the tax department in various forums, including legislative committees and public hearings, where they advocate for taxpayer rights and responsibilities.

Key Responsibilities and Functions

- Tax Assessment: The CIT’s office is responsible for assessing the taxable income of individuals and businesses. This involves evaluating financial records, applying tax laws, and determining the appropriate tax liability.

- Tax Collection: Ensuring timely tax payments is a critical function. The CIT employs various methods, including direct debit, electronic funds transfer, and traditional methods like cheques and cash, to facilitate tax collection.

- Tax Compliance: Promoting and enforcing tax compliance is a key priority. The CIT’s office educates taxpayers on their obligations, provides guidance, and takes necessary actions against non-compliant taxpayers.

- Tax Refund and Rebate: When applicable, the CIT’s office processes tax refunds and rebates, returning excess tax payments to taxpayers.

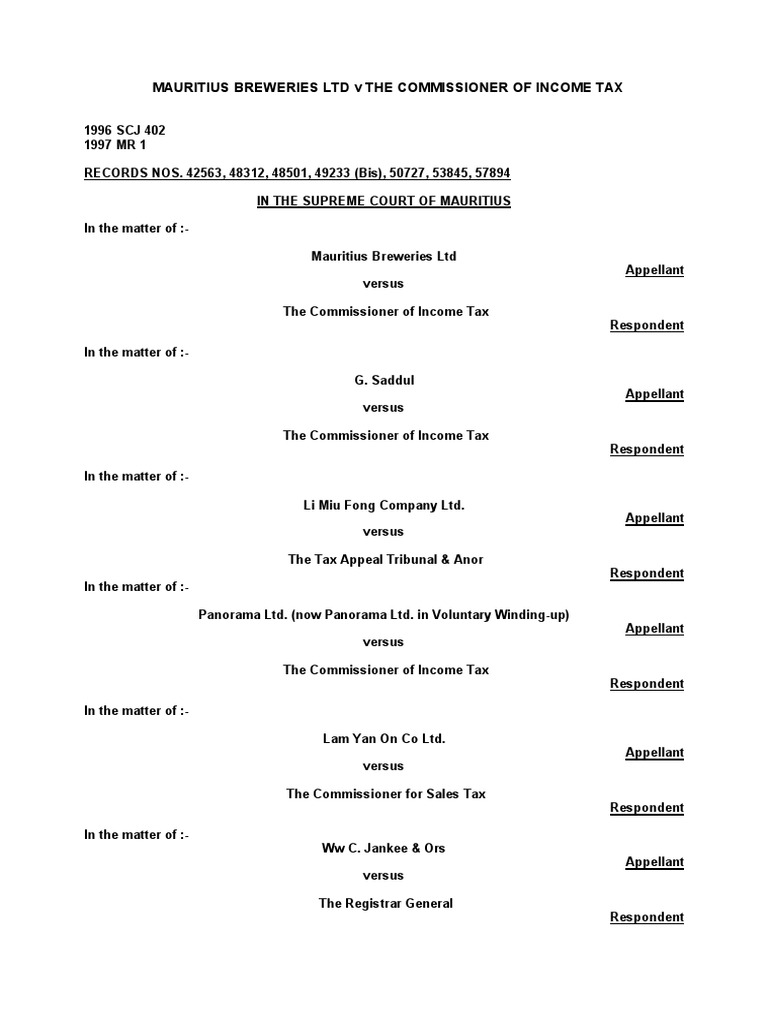

- Tax Appeals and Litigation: In cases of tax disputes, the CIT’s office handles appeals and represents the tax department in legal proceedings.

- Policy Formulation: The CIT contributes to the development of tax policies, ensuring they are practical, equitable, and in line with the government’s fiscal goals.

- Public Engagement: The CIT often engages with the public, hosting workshops, seminars, and awareness campaigns to educate taxpayers about their rights and responsibilities.

The Operational Structure of the CIT’s Office

To effectively carry out its responsibilities, the CIT’s office is organized into various departments, each with specialized functions. This structure ensures efficiency and enables the office to handle a wide range of tax-related matters.

Departments and Their Functions

- Assessment Department: Responsible for assessing the taxable income of individuals and businesses. This department evaluates financial records, applies tax laws, and determines tax liabilities.

- Collection Department: Focused on tax collection, this department employs various methods to ensure timely tax payments. It also manages the refund and rebate process.

- Compliance Department: Dedicated to promoting and enforcing tax compliance. This department educates taxpayers, provides guidance, and takes necessary actions against non-compliant entities.

- Legal Department: Handles tax-related legal matters, including appeals and litigation. This department represents the tax department in courts and tribunals.

- Policy and Research Department: Contributes to the development and refinement of tax policies. This department conducts research, analyzes data, and provides recommendations to shape tax laws.

- Public Relations Department: Engages with the public, taxpayers, and stakeholders. This department organizes awareness campaigns, workshops, and seminars to educate the public about tax matters.

| Department | Key Functions |

|---|---|

| Assessment | Evaluating financial records, applying tax laws, determining tax liabilities |

| Collection | Tax collection, managing refunds and rebates |

| Compliance | Promoting tax compliance, providing guidance, enforcing tax laws |

| Legal | Handling tax appeals and litigation, representing tax department in courts |

| Policy and Research | Contributing to tax policy formulation, conducting research and analysis |

| Public Relations | Engaging with the public, organizing awareness campaigns and workshops |

The Impact and Significance of the CIT’s Role

The Commissioner of Income Tax plays a critical role in maintaining the economic health of a nation. Their work directly impacts the government’s revenue stream, which in turn influences the country’s ability to fund public services, infrastructure development, and social welfare programs.

By ensuring fair and efficient tax collection, the CIT contributes to economic stability and growth. Their efforts in promoting tax compliance and educating taxpayers foster a culture of fiscal responsibility. Additionally, the CIT's involvement in policy formulation ensures that tax laws are practical, equitable, and aligned with the government's fiscal goals.

Case Study: Effective Tax Administration in Practice

Let’s consider the example of Country X, which has a robust tax administration system led by an effective Commissioner of Income Tax. Through a combination of efficient assessment processes, simplified tax collection methods, and a strong focus on taxpayer education, Country X has achieved high tax compliance rates.

The CIT's office in Country X has implemented an online tax assessment and payment system, making the process convenient and accessible for taxpayers. They have also launched a series of public awareness campaigns, educating taxpayers about their rights and responsibilities. As a result, Country X has seen a significant increase in voluntary tax compliance, reducing the need for enforcement actions.

Furthermore, the CIT's office in Country X has established a Taxpayer Assistance Program, providing personalized support to taxpayers with complex tax matters. This program has not only improved taxpayer satisfaction but has also increased tax revenue by ensuring accurate tax assessments and timely payments.

This case study highlights the transformative impact of an effective CIT's office. By adopting innovative approaches, focusing on taxpayer needs, and maintaining a fair and efficient tax system, the CIT can drive positive change and contribute to the overall economic well-being of a nation.

The Future of Tax Administration and the CIT’s Role

As tax systems evolve, the role of the Commissioner of Income Tax is poised to become even more critical. With advancements in technology, the CIT’s office can leverage digital tools to enhance tax administration, making it more efficient, transparent, and accessible.

The CIT will continue to play a pivotal role in shaping tax policies, ensuring they are responsive to the changing economic landscape. This includes addressing emerging issues like the gig economy, cryptocurrency, and remote work, which present new challenges and opportunities for tax administration.

Furthermore, the CIT's focus on taxpayer education and engagement will remain vital. By fostering a culture of fiscal responsibility and transparency, the CIT can build trust and ensure long-term compliance. This, in turn, will contribute to a stable and sustainable tax system, benefiting both taxpayers and the nation as a whole.

Key Takeaways and Recommendations

- The Commissioner of Income Tax is a critical figure in tax administration, ensuring compliance and contributing to the nation’s economic well-being.

- The CIT’s office is organized into specialized departments to handle various tax-related functions efficiently.

- Effective tax administration, as seen in the case of Country X, can drive positive economic outcomes and increase voluntary tax compliance.

- The future of tax administration will be shaped by technological advancements and evolving economic landscapes, presenting both challenges and opportunities.

- A focus on taxpayer education, engagement, and trust-building will be crucial for long-term compliance and a sustainable tax system.

Conclusion

In conclusion, the Commissioner of Income Tax is an indispensable part of any government’s tax machinery. Their role is multifaceted, encompassing tax assessment, collection, compliance, and policy formulation. By understanding the complexities of their role and the significance of their contributions, we can appreciate the vital work they do in maintaining the economic health of our nations.

As we look to the future, the CIT's role will only become more critical. With a focus on innovation, taxpayer engagement, and a responsive tax system, the CIT can continue to drive positive change and ensure the long-term sustainability of our tax systems.

What is the primary role of the Commissioner of Income Tax?

+The primary role of the Commissioner of Income Tax is to oversee the collection and management of income taxes within a specified jurisdiction. They ensure compliance with tax laws, promote tax education, and contribute to policy formulation, all while representing the tax department in various forums.

How does the CIT’s office promote tax compliance?

+The CIT’s office promotes tax compliance through a multi-faceted approach. This includes educating taxpayers about their obligations, providing guidance and support, and taking necessary actions against non-compliant entities. They also engage with the public through awareness campaigns and workshops.

What is the significance of the CIT’s role in policy formulation?

+The CIT’s role in policy formulation is significant as they provide practical insights and recommendations based on their understanding of taxpayer needs and the tax system’s operational realities. This ensures that tax policies are equitable, practical, and aligned with the government’s fiscal goals.

How can the CIT’s office leverage technology for improved tax administration?

+The CIT’s office can leverage technology to enhance tax administration in several ways. This includes implementing online tax assessment and payment systems, utilizing data analytics for more accurate tax assessments, and adopting digital communication channels for taxpayer engagement and education.

What are the key challenges facing the CIT in the future?

+The CIT faces several challenges in the future, including keeping pace with technological advancements, adapting tax policies to emerging economic trends like the gig economy and cryptocurrency, and maintaining a culture of trust and transparency with taxpayers.