Tax Percentage 2017

The year 2017 brought significant changes to the tax landscape in many countries, with new tax laws and reforms impacting individuals and businesses alike. In this comprehensive guide, we will delve into the tax percentages for the year 2017, exploring the variations across different regions and providing an in-depth analysis of the key changes and their implications.

Global Perspective on Tax Percentages in 2017

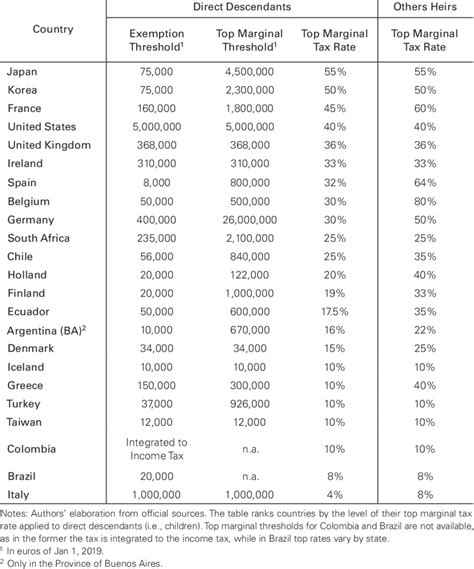

Tax policies vary greatly from one country to another, and understanding these differences is crucial for businesses and individuals with international operations. Let’s take a closer look at the tax scenarios in some key regions during 2017.

United States: The Impact of the Tax Cuts and Jobs Act

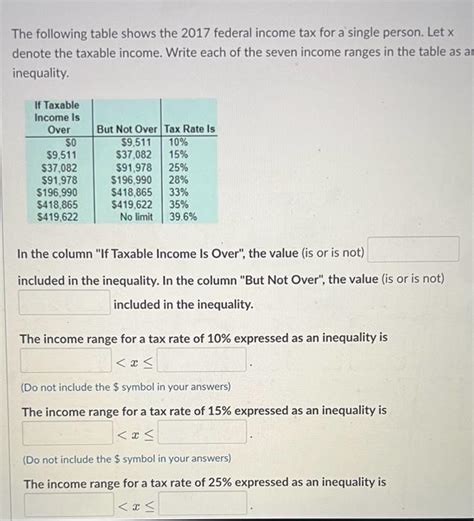

The United States witnessed a significant tax reform in 2017 with the enactment of the Tax Cuts and Jobs Act (TCJA). This legislation brought about notable changes to the federal income tax structure, including:

- Reduced individual income tax rates: The TCJA introduced a new tax bracket system with seven brackets ranging from 10% to 37%. These changes provided tax relief for many Americans.

- Altered tax brackets for corporations: The corporate tax rate was reduced from 35% to 21%, a substantial change that aimed to boost business competitiveness.

- Modified tax deductions and credits: The Act introduced or modified various deductions and credits, such as the increased standard deduction and the elimination of personal exemptions.

| Tax Bracket | Tax Rate |

|---|---|

| 10% | $0 - $9,525 for single filers, $19,050 for married filing jointly |

| 12% | $9,526 - $38,700 for single filers, $19,051 - $77,400 for married filing jointly |

| 22% | $38,701 - $82,500 for single filers, $77,401 - $157,500 for married filing jointly |

| 24% | $82,501 - $157,500 for single filers, $157,501 - $237,950 for married filing jointly |

| 32% | $157,501 - $200,000 for single filers, $237,951 - $300,000 for married filing jointly |

| 35% | $200,001 - $500,000 for single filers, $300,001 - $600,000 for married filing jointly |

| 37% | $500,001 and above for single filers, $600,001 and above for married filing jointly |

The TCJA also made significant changes to business tax laws, impacting pass-through entities, international taxation, and depreciation rules.

European Union: A Diverse Landscape

The European Union (EU) consists of 27 member states, each with its own tax system. Here’s an overview of some key EU countries and their tax percentages for 2017:

- United Kingdom: The UK had a progressive income tax system with rates ranging from 20% to 45%. The standard rate of VAT was 20%.

- Germany: Germany’s income tax rates for 2017 ranged from 14% to 45%, with a top rate of 45% for income above €254,490. The standard VAT rate was 19%.

- France: French income tax rates varied from 0% to 45%, with a top rate of 45% for income over €155,788. The standard VAT rate was 20%.

- Italy: Italy’s income tax rates for 2017 ranged from 23% to 43%, with a top rate of 43% for income above €75,000. The standard VAT rate was 22%.

Asia: A Wide Range of Tax Policies

Asia is home to a diverse array of tax systems. Here’s a glimpse at some Asian countries and their tax percentages in 2017:

- Japan: Japan had a progressive income tax system with rates ranging from 5% to 45%, with a top rate of 45% for income over ¥19,500,000. The standard consumption tax rate was 8%.

- China: China’s income tax rates for 2017 ranged from 3% to 45%, with a top rate of 45% for income over ¥800,000. The value-added tax (VAT) rate was 16% for most goods and services.

- India: India’s income tax rates varied from 5% to 30%, with a top rate of 30% for income above ₹10,000,000. The Goods and Services Tax (GST) replaced various indirect taxes, with rates ranging from 0% to 28%.

The Implications of Tax Percentages for Businesses and Individuals

The variations in tax percentages across different regions have significant implications for businesses and individuals. Let’s explore some of these impacts.

International Business Strategies

For multinational corporations, understanding the tax landscape in different countries is crucial for effective tax planning and strategy development. Companies may need to consider factors such as transfer pricing, tax treaties, and the establishment of subsidiary companies to optimize their tax positions.

Individual Tax Planning

Individuals with international incomes or investments also face unique tax challenges. They may need to navigate double taxation agreements, understand foreign tax credits, and plan their financial strategies accordingly. The differences in tax percentages can significantly impact their overall tax liabilities.

Economic Growth and Investment

Tax policies can play a pivotal role in economic growth and investment patterns. Lower tax rates, particularly for corporations, can encourage business expansion and investment, potentially leading to job creation and economic development. Conversely, higher tax rates may discourage investment and impact economic growth.

Analyzing the Long-Term Effects of Tax Reforms

Tax reforms, such as the TCJA in the United States, often have long-term implications. Let’s examine some of these effects and their potential consequences.

Economic Impact

Reduced corporate tax rates can lead to increased business profitability, potentially boosting stock prices and shareholder returns. Additionally, lower tax rates may encourage businesses to reinvest profits, leading to expanded operations and job creation.

Budgetary Implications

While tax cuts can stimulate economic growth, they also impact government revenues. Lower tax rates may result in reduced government income, potentially affecting public spending and budget allocations. Governments may need to adjust their fiscal policies to maintain financial stability.

International Competition

Tax reforms can also trigger a race to the bottom in tax rates as countries compete to attract businesses and investments. This dynamic can lead to a reduction in overall tax revenues and potentially impact the provision of public goods and services.

The Future of Tax Percentages: Trends and Predictions

As we look ahead, several trends and predictions shape the future of tax percentages:

- Digitalization and Tax: The rise of the digital economy is prompting governments to consider new tax measures, such as digital services taxes, to ensure fair taxation of tech giants.

- Environmental Taxes: With a growing focus on sustainability, we may see an increase in environmental taxes to discourage polluting activities and promote green initiatives.

- Simplification and Harmonization: Some countries may aim to simplify their tax systems and harmonize tax rates to reduce administrative burdens and improve compliance.

- International Tax Cooperation: Efforts to combat tax evasion and tax avoidance through international cooperation, such as the Base Erosion and Profit Shifting (BEPS) project, are likely to continue.

The tax landscape is dynamic, and staying informed about the latest developments is essential for businesses and individuals alike. Understanding tax percentages and their variations across regions is a crucial aspect of financial planning and strategic decision-making.

What was the average income tax rate in the United States in 2017?

+The average income tax rate in the United States for 2017 varied based on income levels and filing status. For single filers, the average rate was approximately 14.5%, while for married filing jointly, it was around 12.5%.

How did the Tax Cuts and Jobs Act impact businesses in 2017?

+The TCJA significantly reduced corporate tax rates, making the United States more competitive globally. It also provided incentives for businesses to repatriate overseas profits and invest in research and development.

What are the potential long-term effects of tax reforms on government revenues?

+Tax reforms, especially those involving significant rate reductions, can lead to reduced government revenues in the short term. However, over the long term, economic growth stimulated by lower tax rates may boost government income through increased economic activity.