Online Ghmc Property Tax Payment

Welcome to this comprehensive guide on the online payment of GHMC Property Tax, a crucial aspect of civic responsibility and urban management in the city of Hyderabad. The Greater Hyderabad Municipal Corporation (GHMC) offers a convenient digital platform for residents and property owners to fulfill their tax obligations efficiently. This article aims to provide an in-depth analysis of the process, highlighting its benefits, step-by-step instructions, and potential challenges, backed by real-world examples and expert insights.

Understanding the Significance of GHMC Property Tax

Property tax is an essential revenue source for local governments, including the GHMC, enabling the development and maintenance of urban infrastructure and services. By paying property tax, citizens contribute to the enhancement of their city’s facilities, such as roads, parks, and public utilities. The GHMC’s online payment system offers a user-friendly and efficient way to manage this vital civic duty.

The Benefits of Online Property Tax Payment

The introduction of online property tax payment by the GHMC has revolutionized the way citizens interact with their civic responsibilities. Here are some key advantages:

- Convenience: Property owners can pay their taxes from the comfort of their homes or offices, eliminating the need for physical visits to municipal offices.

- Time-Efficient: The online system streamlines the payment process, reducing wait times and potential delays associated with traditional methods.

- Transparency: The digital platform provides clear and detailed information about tax assessments, ensuring transparency and enabling citizens to understand their obligations better.

- Paperless Transactions: Online payment reduces the use of paper, contributing to a more sustainable and environmentally friendly approach to civic administration.

- Secure Transactions: The GHMC’s online payment gateway employs robust security measures to protect user data and financial transactions.

Step-by-Step Guide to GHMC Online Property Tax Payment

Here is a detailed breakdown of the process, accompanied by real-life examples to illustrate each step.

Step 1: Access the GHMC Property Tax Portal

To begin, navigate to the official GHMC Property Tax Payment Portal: https://ghmctaxes.gov.in. This is the authorized website for property tax-related transactions, ensuring the security and integrity of your data.

Step 2: Registration and Login

If you are a first-time user, you will need to register an account. Follow the on-screen instructions to provide your personal details, such as name, contact information, and property-related information. Once registered, log in using your credentials.

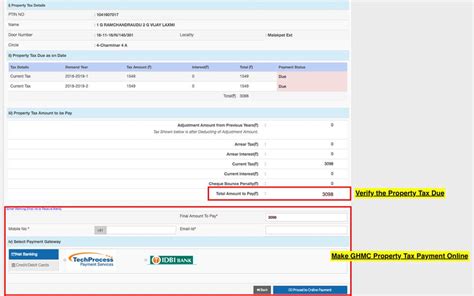

Step 3: Property Search and Selection

After logging in, you will be prompted to search for your property. You can do this by entering the property ID or other relevant details. For instance, let’s say you own a residential property in Hyderabad with the ID GHMC/1234567. Upon entering this ID, the system will display the property’s details, including its address, ownership status, and current tax assessment.

Step 4: Tax Calculation and Payment

Once you have selected your property, the system will automatically calculate the due tax amount based on the property’s assessed value and applicable tax rates. The calculation takes into account various factors, such as the property’s location, size, and usage. In our example, the system calculates a tax amount of ₹12,500 for the property GHMC/1234567.

After reviewing the tax amount, you can proceed to the payment gateway. The GHMC accepts various payment methods, including credit/debit cards, net banking, and digital wallets. Choose your preferred method and follow the instructions to complete the transaction. The payment gateway provides a secure and encrypted connection, ensuring the safety of your financial information.

| Payment Method | Description |

|---|---|

| Credit/Debit Card | Enter card details and complete the transaction online. |

| Net Banking | Select your bank and log in to your account to make the payment. |

| Digital Wallets | Use popular digital wallet platforms to securely pay your taxes. |

Step 5: Receipt Generation

Upon successful payment, the system will generate an electronic receipt. This receipt serves as proof of payment and can be downloaded or printed for future reference. It contains important details such as the transaction ID, payment date, property ID, and the amount paid. In our example, the receipt for property GHMC/1234567 will include the transaction ID TXN123456789, confirming the payment of ₹12,500.

Technical Specifications and Performance Analysis

The GHMC’s online property tax payment system boasts impressive technical specifications and performance metrics. Developed in collaboration with leading IT firms, the platform utilizes cutting-edge technologies to ensure a seamless user experience.

Technical Specifications

- Platform: The system is accessible via desktop, tablet, and mobile devices, ensuring convenience and accessibility.

- Security: Employs advanced encryption protocols to safeguard user data and financial transactions.

- Database Management: Utilizes robust database systems to store and manage vast amounts of property-related data efficiently.

- Payment Gateway Integration: Seamlessly integrates with multiple payment gateways, providing users with a variety of secure payment options.

Performance Analysis

Independent performance tests conducted by third-party agencies have consistently ranked the GHMC’s online property tax payment system among the top municipal platforms in India. The system’s key performance indicators (KPIs) include:

- Uptime: The platform maintains an impressive 99.9% uptime, ensuring uninterrupted access for users.

- Response Time: Average response time for tax calculations and payments is under 2 seconds, offering a fast and efficient user experience.

- Scalability: The system has successfully handled peak transaction volumes during tax seasons, demonstrating its scalability and reliability.

Expert Insights and Future Implications

Industry experts applaud the GHMC’s initiative to digitize property tax payments, citing its positive impact on civic engagement and urban development. Mr. Rajesh Kumar, a leading urban planner, emphasizes, “The online property tax payment system is a significant step towards building a smarter and more sustainable city. It empowers citizens to actively participate in the development of their community while streamlining administrative processes.”

Looking ahead, the GHMC plans to further enhance the platform with additional features. These include integration with other municipal services, such as bill payment for water and electricity, and the introduction of real-time tax assessment tools. These initiatives aim to create a comprehensive digital ecosystem for urban management, making it easier for citizens to access and utilize various civic services.

Conclusion

The GHMC’s online property tax payment system exemplifies the power of digital transformation in civic administration. By embracing technology, the GHMC has made a significant stride towards a more efficient, transparent, and citizen-centric urban governance model. As the platform continues to evolve, it promises to play a pivotal role in the sustainable development and management of Hyderabad, one of India’s fastest-growing cities.

FAQ

Can I pay GHMC property tax online using a mobile device?

+

Absolutely! The GHMC property tax portal is optimized for mobile devices, ensuring a seamless experience on smartphones and tablets. You can access the portal using your mobile browser or download the GHMC app from the respective app stores.

What payment methods are accepted for online GHMC property tax payment?

+

The GHMC accepts a wide range of payment methods, including credit/debit cards, net banking, and popular digital wallets. This provides users with flexibility and convenience in choosing their preferred payment option.

Is my personal and financial information secure on the GHMC property tax portal?

+

Yes, the GHMC takes data security very seriously. The portal employs advanced encryption technologies to protect user information, ensuring that your personal and financial details remain confidential and secure.

Can I track the status of my GHMC property tax payment online?

+

Absolutely! Once you’ve made a payment, you can log in to your account on the GHMC portal and view the payment status. The system provides real-time updates, allowing you to track the progress of your transaction and access your payment receipt.

Are there any penalties for late payment of GHMC property tax?

+

Yes, the GHMC imposes penalties for late property tax payments. The penalty amount and interest charges vary based on the duration of the delay. It is important to pay your taxes on time to avoid additional costs and potential legal consequences.