Town Of Babylon Taxes

In the heart of Suffolk County, New York, the Town of Babylon stands as a vibrant municipality with a rich history and a thriving community. As with any local government, the topic of taxes is of paramount importance to residents, businesses, and those considering a move to this picturesque town. This article aims to delve into the intricacies of Babylon's tax structure, providing a comprehensive understanding of the tax landscape and its implications for various stakeholders.

Navigating the Tax System in Babylon: An Overview

The Town of Babylon operates within a complex tax framework, reflecting the diverse needs and responsibilities of its administration. Understanding this system is crucial for residents and businesses alike, as it directly influences their financial obligations and planning.

Property Taxes: A Pillar of Babylon’s Revenue

One of the primary sources of revenue for the Town of Babylon is property taxes. These taxes are levied on both residential and commercial properties, with rates determined by the assessed value of the property and the tax levy set by the town’s governing body.

The assessment process is a crucial aspect of property taxation. In Babylon, property assessments are conducted periodically to ensure that tax liabilities are fair and up-to-date. This process involves evaluating the market value of properties, taking into account factors such as location, size, and recent sales data. Accurate assessments are vital to ensure that taxpayers are not overburdened and that the town receives adequate revenue for essential services.

Babylon’s property tax rates are competitive when compared to neighboring towns. The town strives to maintain a balance between providing essential services and keeping tax burdens reasonable. This commitment to fiscal responsibility has made Babylon an attractive destination for homeowners and businesses seeking a stable and predictable tax environment.

| Tax Year | Residential Tax Rate | Commercial Tax Rate |

|---|---|---|

| 2023 | 15.75 per 1,000 of assessed value | 35.00 per 1,000 of assessed value |

Sales and Use Taxes: Contributing to Local Development

In addition to property taxes, the Town of Babylon imposes sales and use taxes, which play a significant role in funding various initiatives and projects within the community.

Sales taxes are applied to most retail transactions, including goods and certain services. These taxes are typically included in the displayed price of items, with the revenue collected being used to support local infrastructure, education, and other essential services. Babylon’s sales tax rate is in line with the state’s rate, ensuring a consistent and predictable environment for businesses and consumers.

Use taxes, on the other hand, are levied on items purchased outside of the town but used or stored within Babylon’s boundaries. This tax ensures that businesses and individuals contribute to the town’s revenue, even if their purchases are made remotely. It promotes fairness and helps maintain a level playing field for local businesses.

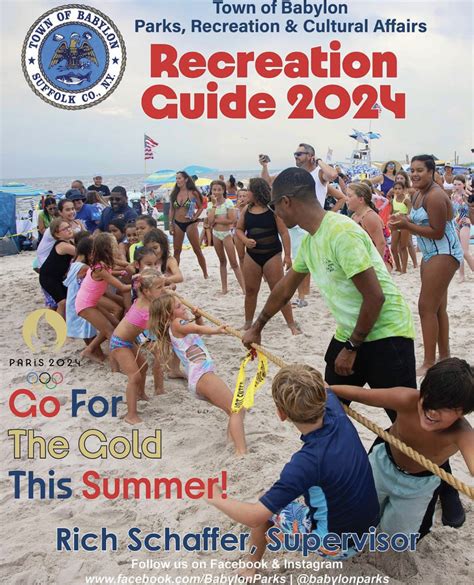

The revenue generated from sales and use taxes is often allocated towards specific projects, such as road improvements, park developments, and community events. This targeted approach allows the town to enhance the quality of life for its residents and create a vibrant and attractive environment for visitors and businesses.

Business Taxes: Supporting a Thriving Economy

The Town of Babylon recognizes the importance of fostering a business-friendly environment. As such, it has implemented a range of business taxes designed to support economic growth while ensuring a fair and competitive business landscape.

One key component of Babylon’s business tax structure is the business privilege tax. This tax is levied on businesses operating within the town’s boundaries, with rates varying based on the type and size of the business. The revenue generated from this tax contributes to the town’s general fund, supporting a wide range of services and initiatives that benefit both residents and businesses.

Babylon also imposes a hotel/motel tax on accommodations within its borders. This tax not only generates revenue for the town but also promotes the development of the tourism industry. The revenue collected from this tax is often reinvested into tourism-related initiatives, such as marketing campaigns and infrastructure improvements, further enhancing Babylon’s appeal as a destination.

For businesses considering a move to Babylon, the town offers a range of incentives and support programs. These initiatives aim to reduce the tax burden on new and expanding businesses, encouraging economic growth and job creation. Babylon’s commitment to supporting entrepreneurship and innovation has led to a thriving business community, contributing to the town’s overall prosperity.

The Impact of Babylon’s Taxes on Residents and Businesses

The tax structure in Babylon has a direct and significant impact on both residents and businesses. Understanding these implications is crucial for individuals and companies considering a long-term presence in the town.

Taxes and the Cost of Living

For residents, the tax landscape in Babylon influences their overall cost of living. Property taxes, in particular, can be a substantial expense for homeowners. However, Babylon’s commitment to maintaining competitive tax rates and regular assessment practices ensures that these costs remain manageable. Additionally, the town’s focus on providing efficient services and infrastructure contributes to an overall high quality of life, making the tax burden more bearable.

Sales and use taxes also affect residents’ purchasing power. While these taxes are a necessary contribution to the town’s revenue, Babylon’s efforts to keep rates in line with the state’s average ensure that residents can still afford essential goods and services. The town’s approach to tax collection aims to strike a balance between generating revenue and maintaining an affordable cost of living.

Business Opportunities and Tax Considerations

Businesses operating in Babylon benefit from a stable and predictable tax environment. The town’s approach to business taxes aims to attract and retain companies, fostering a competitive business climate. The range of tax incentives and support programs available to businesses demonstrates Babylon’s commitment to economic growth and job creation.

The business privilege tax, while contributing to the town’s revenue, is structured to be fair and proportional to a business’s size and operations. This approach encourages businesses to thrive and expand, knowing that their tax obligations are manageable and aligned with their growth trajectory. The hotel/motel tax, too, provides a stable revenue stream for the town, supporting the tourism industry and, by extension, a range of businesses reliant on tourism.

Future Outlook and Tax Strategies

As the Town of Babylon continues to grow and evolve, its tax structure will remain a critical component of its development strategy. The town’s leadership recognizes the importance of a balanced and sustainable tax system, one that supports essential services while promoting economic growth and maintaining a high quality of life.

Looking ahead, Babylon plans to continue its commitment to regular property assessments, ensuring that tax liabilities remain fair and transparent. The town will also explore opportunities to streamline its tax collection processes, making it easier for residents and businesses to fulfill their obligations. Additionally, Babylon aims to maintain its competitive tax rates, keeping the town an attractive destination for homeowners, businesses, and investors.

For those considering a move to Babylon, the town’s tax landscape presents a stable and predictable environment. The combination of reasonable tax rates, a supportive business climate, and a commitment to fiscal responsibility makes Babylon an appealing choice for individuals and businesses seeking a thriving and sustainable community.

Conclusion: Babylon’s Tax Landscape – A Comprehensive Guide

The Town of Babylon’s tax system is a complex yet well-structured framework that supports the town’s operations and development. From property taxes to sales and use taxes, and business-specific levies, each component plays a crucial role in funding essential services and initiatives that benefit the community.

For residents, the tax structure in Babylon offers a balance between contributing to the town’s growth and maintaining a manageable cost of living. Businesses, too, find a supportive environment with a range of tax incentives and a fair tax system that promotes growth and innovation.

As Babylon continues to thrive and evolve, its tax landscape will remain a critical aspect of its success. The town’s commitment to fiscal responsibility, coupled with its efforts to create a vibrant and attractive community, positions Babylon as a destination of choice for those seeking a stable and rewarding living and business environment.

How often are property assessments conducted in Babylon?

+Property assessments in Babylon are typically conducted every five years, ensuring that tax liabilities remain up-to-date and fair.

Are there any tax incentives for new businesses in Babylon?

+Yes, Babylon offers a range of tax incentives and support programs for new and expanding businesses, including reduced tax rates and streamlined licensing processes.

How does Babylon’s sales tax rate compare to neighboring towns?

+Babylon’s sales tax rate is in line with the state’s rate, ensuring a consistent and predictable environment for businesses and consumers. This rate is often lower than that of neighboring towns, making Babylon an attractive destination for retailers.