Polk County Tax

Welcome to an in-depth exploration of Polk County Tax, a crucial aspect of financial management and civic responsibility for residents and businesses within Polk County. This comprehensive guide aims to provide an expert-level understanding of the tax system, its workings, and its implications for the community. By delving into the specifics, we aim to empower individuals and entities with the knowledge needed to navigate the tax landscape effectively and make informed decisions.

Understanding Polk County Tax: An Overview

Polk County Tax is a complex system that forms the backbone of the county’s revenue generation and economic sustainability. It encompasses various tax types, each serving a unique purpose and contributing to the overall financial health of the region. From property taxes to sales taxes, each component plays a vital role in funding essential services, infrastructure development, and community initiatives.

At its core, the tax system in Polk County is designed to ensure fairness and transparency. The county government works diligently to establish tax rates and regulations that are equitable, taking into account the diverse needs and circumstances of its residents and businesses. This delicate balance is crucial to fostering a thriving and inclusive community.

Key Components of Polk County Tax

To grasp the intricacies of Polk County Tax, it’s essential to break down its key components and understand their individual functions. Here’s an overview of the primary tax types and their significance:

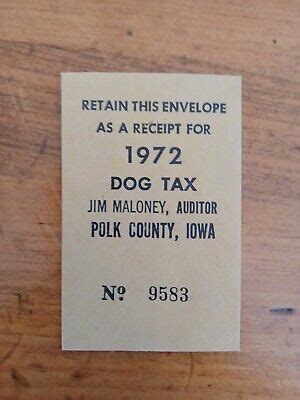

- Property Tax: One of the cornerstone taxes in Polk County, property tax is levied on real estate properties, including land, buildings, and improvements. It forms a significant portion of the county's revenue and is used to support vital services such as education, public safety, and infrastructure maintenance.

- Sales Tax: Sales tax is applied to the purchase of goods and services within the county. It contributes to the overall economic growth by generating revenue from a wide range of transactions. The funds collected through sales tax are often directed towards specific projects or initiatives, ensuring a direct impact on the community's development.

- Income Tax: While less prevalent than property or sales tax, income tax plays a role in Polk County's tax structure. It is typically applied to personal or business income, with rates varying based on factors such as income level and tax brackets.

- Special Assessments: In certain situations, Polk County may impose special assessments to fund specific projects or improvements that benefit a particular area or community. These assessments are targeted and are often used for infrastructure upgrades, environmental initiatives, or community development projects.

Each of these tax components is carefully crafted and administered by the Polk County government, ensuring compliance with state and federal regulations while meeting the unique needs of the local community.

Navigating the Tax Landscape: A Practical Guide

Understanding the theoretical aspects of Polk County Tax is just the beginning. For individuals and businesses, the real challenge lies in navigating the practicalities of tax compliance and optimization. Here, we provide a step-by-step guide to help you tackle the tax landscape with confidence.

Step 1: Familiarize Yourself with Tax Rates and Regulations

The first step in effective tax management is to gain a comprehensive understanding of the tax rates and regulations applicable to your situation. This involves staying updated with the latest tax laws, ordinances, and any changes that may impact your tax obligations. The Polk County government provides resources and guidelines to assist taxpayers in this regard.

For instance, consider the following key tax rates:

| Tax Type | Rate (%) |

|---|---|

| Property Tax | 1.5 |

| Sales Tax | 6.5 |

| Income Tax (Personal) | 3.0 |

| Income Tax (Corporate) | 4.5 |

Note: These rates are for illustrative purposes only and may not reflect the current or accurate tax rates. Always refer to official sources for the most up-to-date information.

Step 2: Determine Your Tax Liability

Once you have a grasp of the tax rates, it’s crucial to calculate your tax liability accurately. This involves assessing your income, assets, and expenses to determine the applicable tax bases and deductions. Various tools and software are available to assist with this process, ensuring precision and compliance.

For example, let's consider a hypothetical scenario where a business owner, Mr. Smith, operates a retail store in Polk County. To determine his tax liability, he would need to consider the following:

- Gross revenue from sales

- Cost of goods sold

- Operating expenses, including rent, utilities, and employee wages

- Any applicable deductions, such as depreciation or tax credits

By carefully analyzing these factors, Mr. Smith can arrive at an accurate assessment of his tax liability, ensuring compliance and avoiding potential penalties.

Step 3: Explore Tax Optimization Strategies

Tax optimization is a vital aspect of financial management, and Polk County offers various opportunities for individuals and businesses to minimize their tax burden while remaining compliant. Here are some strategies to consider:

- Utilize Deductions and Credits: Polk County provides a range of tax deductions and credits that can significantly reduce your tax liability. These may include incentives for energy-efficient improvements, research and development, or charitable contributions. Stay informed about these opportunities to maximize your tax savings.

- Consider Tax-Advantaged Investments: Certain investments, such as retirement accounts or tax-exempt bonds, offer tax benefits. Exploring these options can help you optimize your financial strategy and reduce your overall tax burden.

- Review Tax Filing Status: The tax filing status you choose can impact your tax liability. Whether you file as an individual, joint filer, or business entity, each status comes with its own set of advantages and considerations. Consult with a tax professional to determine the most suitable filing status for your situation.

💡 Pro Tip: Consulting with a tax professional or accountant who specializes in Polk County tax matters can provide invaluable insights and guidance tailored to your specific circumstances.

The Impact of Polk County Tax on Community Development

Beyond its financial implications, Polk County Tax plays a pivotal role in shaping the community’s development and well-being. The revenue generated through various tax types is directed towards initiatives that enhance the quality of life for residents and foster economic growth.

Investing in Education

A significant portion of the tax revenue is allocated to education, ensuring that Polk County’s youth receive a high-quality education. This investment not only benefits the current generation but also lays the foundation for a skilled and knowledgeable workforce, contributing to the county’s long-term prosperity.

Enhancing Public Safety

Tax funds are also directed towards strengthening public safety measures. This includes funding for law enforcement agencies, emergency response teams, and initiatives to combat crime and promote community safety. By investing in these critical services, Polk County ensures a secure environment for its residents and businesses.

Infrastructure Development

Polk County’s tax system plays a crucial role in funding infrastructure projects, ranging from road improvements to public transportation systems. These developments not only enhance connectivity and accessibility but also attract businesses and contribute to the county’s economic growth.

Community Initiatives and Programs

Beyond the core services, tax revenue supports a wide range of community initiatives and programs. This includes funding for arts and culture, recreational facilities, and social services that enhance the overall well-being and quality of life for residents. By investing in these areas, Polk County fosters a vibrant and inclusive community.

The impact of Polk County Tax extends far beyond the realm of finance, shaping the very fabric of the community and its future prospects. By understanding the system's workings and implications, individuals and businesses can actively contribute to this positive trajectory.

Conclusion: Empowering the Community through Tax Awareness

In conclusion, Polk County Tax is not merely a bureaucratic obligation but a vital component of the community’s growth and sustainability. By comprehending the intricacies of the tax system and its impact, individuals and businesses can make informed decisions, optimize their financial strategies, and actively participate in the county’s development.

As we navigate the complex world of taxes, it's essential to stay informed, seek expert guidance, and leverage the opportunities available within the tax landscape. Together, we can ensure a prosperous and vibrant future for Polk County, where tax awareness and compliance go hand in hand with community progress.

How often do tax rates change in Polk County?

+Tax rates in Polk County are subject to periodic reviews and adjustments. While there is no set frequency, changes typically occur annually or bi-annually, depending on various economic and budgetary factors. It is crucial to stay updated with the latest tax rate information to ensure compliance.

Are there any tax incentives for businesses in Polk County?

+Yes, Polk County offers a range of tax incentives to attract and support businesses. These incentives may include tax breaks for job creation, research and development, or investments in renewable energy. It is advisable to consult with a tax professional or review the county’s economic development incentives to explore these opportunities.

How can I stay updated with tax-related news and updates in Polk County?

+Staying informed about tax-related matters is crucial. You can subscribe to the official Polk County website for updates, follow reputable news sources that cover local tax news, or connect with professional organizations that provide tax-related information and resources. Additionally, consider joining local business networks or community forums to stay abreast of relevant discussions.