Sales Tax In Fremont

Sales tax is an essential component of the tax system in the United States, with each state, county, and city implementing its own unique set of regulations. This article will delve into the specifics of sales tax in Fremont, California, providing an in-depth analysis of the rates, regulations, and implications for both businesses and consumers.

Understanding Sales Tax in Fremont

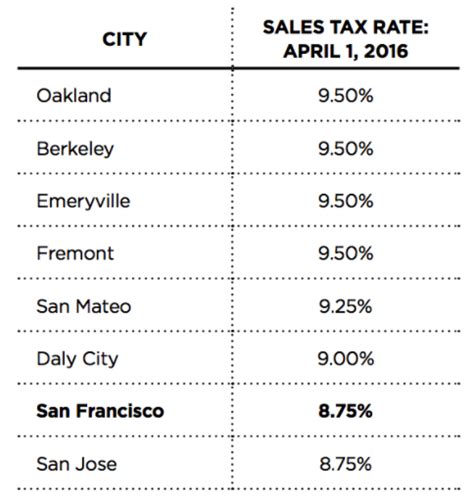

Fremont, located in the heart of the Bay Area, is known for its vibrant economy and diverse population. The city’s sales tax system is a combination of state, county, and city taxes, with each level contributing to the overall rate. As of the most recent data available, the sales tax in Fremont consists of the following:

- State Sales Tax: California imposes a statewide sales tax rate of 7.25%. This is a flat rate applied across the state, ensuring consistency in basic sales tax rates.

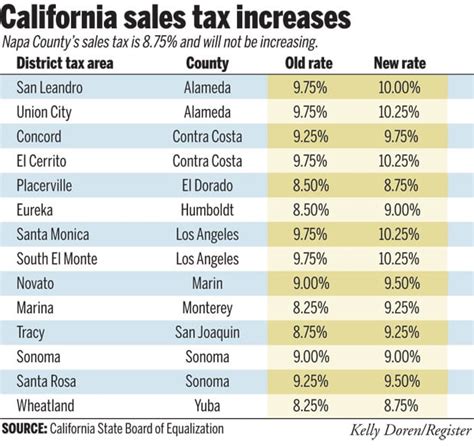

- County Sales Tax: Alameda County, in which Fremont is located, adds an additional 1.00% sales tax. This brings the total county-wide sales tax to 8.25%, covering various county-specific expenses and initiatives.

- City Sales Tax: The city of Fremont imposes a 0.75% sales tax on top of the state and county rates. This additional tax is dedicated to funding local projects and maintaining essential city services. As a result, the total sales tax rate in Fremont stands at 9.00%.

How Sales Tax is Calculated

Sales tax in Fremont is calculated as a percentage of the sale price. When a consumer purchases goods or certain services, the sales tax is applied to the total amount. For example, if an item costs 100, the sales tax in Fremont would amount to 9.00, bringing the final cost to $109.00.

| Sales Tax Rate | Rate (%) |

|---|---|

| State Sales Tax | 7.25 |

| County Sales Tax | 1.00 |

| City Sales Tax | 0.75 |

| Total Sales Tax | 9.00 |

It's important to note that sales tax is applied to the subtotal of the purchase before any discounts or coupons are applied. This means that if a customer has a coupon for 10% off, the sales tax is calculated on the original price, and the discount is applied afterward.

Impact on Businesses and Consumers

The sales tax rate in Fremont has significant implications for both businesses and consumers. For businesses, it represents a cost of doing business in the city. They are responsible for collecting and remitting the sales tax to the appropriate tax authorities. This process involves careful record-keeping and compliance with tax regulations to avoid penalties.

Compliance and Reporting

Businesses operating in Fremont must register with the California Department of Tax and Fee Administration (CDTFA) to obtain a seller’s permit. This permit allows them to collect and remit sales tax on behalf of the state, county, and city. The CDTFA provides guidelines and resources to help businesses understand their tax obligations, including filing deadlines and payment methods.

Businesses are required to file sales tax returns periodically, typically on a monthly, quarterly, or annual basis, depending on their sales volume. These returns detail the sales tax collected and must be accompanied by the corresponding payment. Failure to comply with these requirements can result in penalties and interest charges.

Consumer Perspective

For consumers, the sales tax rate in Fremont can influence purchasing decisions and budget planning. The additional tax burden can make certain items more expensive, especially for big-ticket purchases. However, it’s important to note that sales tax is an essential source of revenue for local governments, funding vital services and infrastructure projects.

Some consumers may choose to shop online or in neighboring cities with lower sales tax rates to save money. However, it's worth considering the convenience and support for local businesses that come with shopping within Fremont. Additionally, certain items, such as groceries and prescription medications, are often exempt from sales tax, providing some relief for essential purchases.

Sales Tax Exemptions and Special Considerations

While the standard sales tax rate in Fremont is 9.00%, there are certain exemptions and special considerations that can reduce the tax burden for specific purchases.

Exempt Items

Certain goods and services are exempt from sales tax in California. These include:

- Grocery items, including staple foods and non-prepared foods.

- Prescription medications and certain medical devices.

- Certain agricultural products and farm equipment.

- Residential rent (although commercial rent is taxable)

- Some educational services and textbooks.

It's important for both businesses and consumers to understand these exemptions to ensure accurate sales tax collection and payment.

Special Considerations for Online Sales

With the rise of e-commerce, sales tax regulations for online sales have become more complex. In general, online retailers are required to collect sales tax from customers in states where they have a physical presence, such as warehouses or distribution centers. This concept, known as “nexus,” has been clarified by the Supreme Court ruling in South Dakota v. Wayfair (2018), which allows states to require remote sellers to collect sales tax.

For online businesses with a significant presence in Fremont, this means they must collect and remit sales tax on online sales to Fremont residents. This can impact both online retailers and consumers, as it may lead to increased prices or a shift in purchasing behavior.

Future Implications and Potential Changes

The sales tax landscape is constantly evolving, and Fremont is no exception. As economic conditions and government priorities shift, there may be proposals to adjust the sales tax rate or implement new tax policies. Here are a few potential future implications and changes to consider:

- Economic Growth and Development: As Fremont's economy continues to thrive, there may be discussions around using sales tax revenue for specific economic development initiatives, such as attracting new businesses or investing in infrastructure projects.

- Revenue Shortfalls: In times of economic downturn or unexpected expenses, there could be proposals to temporarily increase the sales tax rate to generate additional revenue. This could impact both businesses and consumers, potentially leading to a shift in spending habits.

- E-Commerce Expansion: With the continued growth of online shopping, there may be efforts to streamline and simplify sales tax regulations for e-commerce businesses. This could involve implementing new technologies or systems to ensure fair and accurate tax collection.

- Community Initiatives: Sales tax revenue often funds community programs and services. As such, changes in sales tax rates could influence the availability and scope of these initiatives, impacting the overall quality of life in Fremont.

Conclusion

Sales tax in Fremont, California, is a crucial aspect of the city’s economic landscape. It impacts both businesses and consumers, shaping purchasing decisions, budget planning, and revenue allocation. By understanding the current sales tax rates, exemptions, and potential future changes, stakeholders can navigate the tax system more effectively and contribute to the vibrant economy of Fremont.

How often do businesses need to file sales tax returns in Fremont?

+The frequency of filing sales tax returns depends on the business’s sales volume. Typically, businesses with higher sales volumes are required to file more frequently, often on a monthly or quarterly basis. Smaller businesses may file annually. The California Department of Tax and Fee Administration provides guidelines and resources to help businesses determine their filing frequency.

Are there any special sales tax holidays in Fremont or California?

+California, including Fremont, does not have specific sales tax holidays like some other states. However, there are certain periods where sales tax rates may be reduced or eliminated for specific items, such as during back-to-school season for certain school supplies.

How can businesses ensure they are compliant with sales tax regulations in Fremont?

+Businesses can ensure compliance by staying informed about sales tax regulations, registering with the appropriate tax authorities, and using reliable sales tax software or services to calculate and remit taxes accurately. Regularly reviewing sales tax returns and staying updated on any changes in regulations are also essential.