Estate Tax Exemption Sunset 2026

The Estate Tax Exemption, a crucial component of the US tax system, has been a topic of discussion and concern for many Americans, particularly as it relates to the potential sunset of this exemption in 2026. This article aims to delve into the intricacies of the Estate Tax Exemption, its historical context, the impact of its impending expiration, and the potential future implications for individuals and families.

Understanding the Estate Tax Exemption

The Estate Tax Exemption, officially known as the Federal Estate Tax Exclusion, is a provision in the US tax code that allows individuals to pass on a certain amount of their estate to their heirs without incurring federal estate taxes. This exemption has been a vital tool for families to preserve wealth and ensure a smooth transition of assets from one generation to the next.

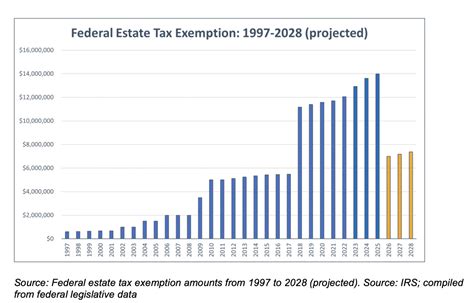

The concept of estate taxes dates back to the early 20th century, with the modern estate tax system taking shape in the 1920s. Over the years, the exemption amount has fluctuated, often as a result of legislative changes and economic considerations. The current exemption level, set at $12.06 million per individual for the tax year 2023, is one of the highest in history.

The exemption is designed to shield a significant portion of an individual's estate from taxation, thereby reducing the burden on heirs and ensuring that wealth is not diminished by tax obligations upon the death of the estate owner. It is a complex area of tax law, with various rules and regulations governing how the exemption is applied and calculated.

| Year | Exemption Amount ($) |

|---|---|

| 2023 | 12,060,000 |

| 2022 | 12,060,000 |

| 2021 | 11,700,000 |

| 2020 | 11,580,000 |

| 2019 | 11,400,000 |

The exemption is particularly beneficial for individuals with substantial assets, such as real estate, investments, and businesses. Without this exemption, the federal estate tax could significantly reduce the value of an estate, potentially leading to the sale of assets or the imposition of heavy financial burdens on heirs.

The Sunset Clause: A Looming Deadline

The current Estate Tax Exemption is set to expire or “sunset” on December 31, 2025, unless Congress acts to extend or modify it. This sunset provision was part of the Tax Cuts and Jobs Act of 2017, which temporarily increased the exemption level and introduced the expiration date.

The impending sunset has created a sense of urgency for many individuals and families, particularly those with estates valued at or near the exemption threshold. The potential for a substantial tax liability in 2026 and beyond is a significant concern, leading many to consider estate planning strategies to mitigate this risk.

One strategy that has gained attention is lifetime gifting, where individuals transfer assets to their heirs during their lifetime to take advantage of the current exemption levels. This approach can reduce the value of an estate and, consequently, the potential tax liability. However, it requires careful planning and consideration of other tax implications, such as gift taxes.

Potential Impact and Future Implications

The expiration of the Estate Tax Exemption could have far-reaching consequences for individuals, families, and even the broader economy.

Wealth Transfer and Tax Burden

Without the exemption, the transfer of wealth from one generation to the next could become significantly more complex and costly. Estates valued above the new, lower exemption level could face substantial tax liabilities, potentially forcing heirs to sell assets or incur significant debt to pay these taxes.

For example, consider a scenario where an individual dies in 2027 with an estate valued at $10 million. If the exemption level reverts to its pre-2018 level, approximately $5.4 million would be subject to federal estate tax at a rate of up to 40%. This could result in a tax liability of up to $2.16 million, a substantial sum that could have a significant impact on the financial stability of the heirs.

Estate Planning Strategies

The impending sunset has prompted many individuals to reconsider their estate planning strategies. Some may choose to implement more aggressive strategies, such as irrevocable trusts or charitable giving, to reduce the value of their estate and potential tax liability. Others may focus on optimizing their estate plan to maximize the benefit of the current exemption levels.

Trusts, in particular, have become a popular tool for estate planning. By transferring assets into a trust, individuals can maintain control over the distribution of their wealth while potentially reducing tax liabilities. Charitable giving, especially through private foundations or donor-advised funds, can also provide tax benefits and allow individuals to support causes that are important to them.

Legislative and Political Considerations

The future of the Estate Tax Exemption is closely tied to political and legislative decisions. While some policymakers advocate for the permanent extension of the current exemption levels, others favor a return to lower thresholds or the elimination of the estate tax altogether. The outcome of these debates could have significant implications for individuals and families across the country.

For instance, if the exemption level is reduced, it could affect a broader range of individuals, not just those with substantial wealth. This could lead to increased tax burdens for middle-class families who own homes, businesses, or other assets that collectively exceed the lower exemption threshold.

Impact on Wealth Distribution

The potential changes to the Estate Tax Exemption could also influence wealth distribution in the United States. Without the exemption, wealth transfer could become more concentrated among those with the highest net worth, potentially exacerbating wealth inequality. On the other hand, a lower exemption level could encourage more equitable distribution by incentivizing wealthier individuals to donate to charitable causes or distribute their wealth more broadly.

Conclusion

The Estate Tax Exemption Sunset in 2026 is a critical issue that demands attention and thoughtful planning. For individuals and families with significant assets, the potential expiration of this exemption could have profound financial implications. As such, it is imperative to stay informed about the latest developments and consult with professionals to ensure that estate plans are well-prepared and adaptable to future changes in tax law.

The impending sunset serves as a reminder of the importance of proactive estate planning. By understanding the potential impact of the Estate Tax Exemption Sunset and taking appropriate action, individuals can ensure that their wealth is transferred smoothly and efficiently to future generations.

What is the current Estate Tax Exemption amount for 2023?

+The current Estate Tax Exemption amount for 2023 is $12.06 million per individual.

When is the Estate Tax Exemption set to expire or “sunset”?

+The Estate Tax Exemption is set to expire on December 31, 2025, unless Congress acts to extend or modify it.

What are some strategies to mitigate the impact of the Estate Tax Exemption Sunset?

+Strategies to mitigate the impact include lifetime gifting, establishing trusts, and charitable giving. It’s crucial to consult with professionals to tailor these strategies to your specific circumstances.