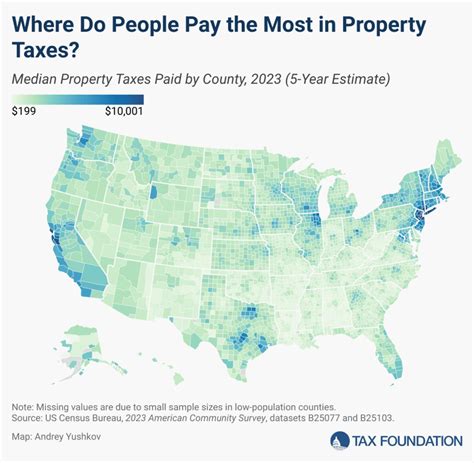

Ventura County Property Taxes

In Ventura County, California, property taxes are a significant aspect of homeownership and real estate investments. These taxes contribute to the county's revenue and fund essential services, making it an important topic for residents, investors, and those considering a move to the area. Understanding the property tax system in Ventura County is crucial for making informed financial decisions and managing one's real estate portfolio effectively.

Ventura County’s Property Tax Landscape

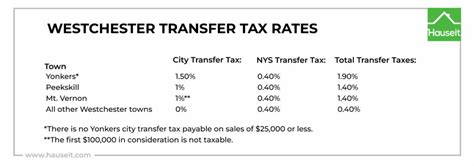

Ventura County’s property tax system operates under the guidelines set by the State of California. The primary property tax rate is set at 1%, as mandated by Proposition 13, a landmark legislation passed in 1978. This proposition limits property tax increases to a maximum of 2% per year, ensuring stability for homeowners. However, additional taxes may be levied by local governments and special districts to fund specific services or infrastructure projects.

Assessment Process

The assessment of property values in Ventura County is carried out by the County Assessor’s Office. They are responsible for determining the taxable value of each property, which serves as the basis for calculating property taxes. Assessments are typically done every year, and the assessed value cannot increase by more than 2% unless there is a change in ownership or new construction.

When a property changes hands, it undergoes a "reassessment," where the new purchase price becomes the basis for the taxable value. This reassessment can result in a higher tax bill for the new owner, as the property's value may exceed the previous assessed value due to market appreciation or improvements made to the property.

| Property Tax Rate | 1% + Additional Levies |

|---|---|

| Assessed Value Increase Limit | 2% Annually or Upon Change of Ownership |

| Average Property Tax as % of Home Value | 0.77% (as of 2021) |

Taxable Value and Exemptions

The taxable value of a property is calculated based on its assessed value. However, there are certain exemptions that can reduce the taxable value. For instance, homeowners aged 55 and older can transfer the assessed value of their current home to a new home within the same county, ensuring they do not face a higher tax burden upon moving. Additionally, there are exemptions for disabled veterans and survivors of military personnel.

Revenue Distribution

The revenue generated from property taxes in Ventura County is distributed to various entities. A significant portion goes to the county’s general fund, which supports essential services like law enforcement, public health, and social services. Local school districts also receive a share, contributing to the funding of public education. Special districts, such as water and fire protection agencies, receive their allocated funds for specific infrastructure and service needs.

Managing Property Taxes: Strategies and Insights

For homeowners and real estate investors in Ventura County, managing property taxes is a critical aspect of financial planning. Here are some strategies and insights to navigate the property tax landscape effectively.

Understanding Tax Bills

Property tax bills can be complex, with various components and charges. It’s essential to review these bills carefully to understand the breakdown of taxes. The bill typically includes the assessed value, any applicable exemptions, and the calculated tax amount. If you notice discrepancies or have questions, the County Assessor’s Office can provide clarification.

Tax Payment Options

Ventura County offers various payment options for property taxes. Homeowners can pay in full or choose to make two equal installments, typically due in February and November. Online payment portals and automated payment plans are available for convenience. It’s crucial to note that late payments may incur penalties and interest.

Appealing Assessments

If you believe your property’s assessed value is inaccurate, you have the right to appeal. The assessment appeal process allows homeowners to challenge the assessed value if they believe it exceeds the property’s actual market value. It’s essential to gather evidence, such as recent sales of comparable properties, to support your case. The County Assessment Appeals Board will review the appeal and make a determination.

Tax Benefits and Incentives

Ventura County, like many other jurisdictions, offers tax benefits and incentives to certain groups. As mentioned earlier, seniors and disabled veterans have access to property tax exemptions. Additionally, the county may provide tax incentives for energy-efficient upgrades or renovations that improve the sustainability of homes.

Long-Term Planning

For real estate investors, long-term planning is crucial. While the 2% annual increase cap provides stability, it’s important to consider the impact of reassessments, especially in a rising real estate market. Investors should factor in potential tax increases when calculating returns on investment. Additionally, staying informed about proposed infrastructure projects and special levies is essential, as these can affect property tax rates.

The Impact of Property Taxes on Real Estate

Property taxes in Ventura County play a significant role in shaping the real estate market. Here’s an in-depth look at their impact.

Influence on Home Prices

Property taxes are a recurring cost associated with homeownership, and buyers often consider them when evaluating the affordability of a property. High property taxes can make a home less attractive to potential buyers, potentially impacting its sale price. Conversely, lower property taxes can make a home more competitive in the market.

Investment Strategies

For real estate investors, property taxes are a critical consideration when evaluating investment properties. Investors often seek properties with lower tax burdens, as this can increase cash flow and improve the overall return on investment. Additionally, understanding the potential for tax increases due to reassessments is vital when projecting future cash flows.

Community Development

Property taxes are a significant source of revenue for local governments and communities. The funds generated contribute to essential services and infrastructure projects, which can enhance the overall quality of life in Ventura County. This, in turn, can attract businesses and residents, further stimulating economic growth.

Future Outlook and Potential Changes

While Ventura County’s property tax system is stable, there are always possibilities for future changes and reforms. Here are some potential developments to watch.

Proposition 13 Reform

Proposition 13, the landmark legislation that set the property tax rate at 1%, has been a subject of debate and potential reform. Some propose changes to the assessment process, suggesting adjustments to the 2% annual increase cap or the reassessment rules. While any reforms would require significant legislative action, it’s important for homeowners and investors to stay informed about these discussions.

Infrastructure Funding

Ventura County, like many other areas, faces the challenge of funding infrastructure projects and maintaining essential services. The need for additional revenue streams could lead to proposals for special levies or taxes. Homeowners and investors should monitor local government initiatives and ballot measures related to infrastructure funding.

Economic Factors

Economic conditions can influence property tax rates. During economic downturns, property values may decline, leading to reduced tax revenue. Conversely, a robust economy can drive property values up, potentially resulting in higher tax assessments. Staying abreast of economic trends and their potential impact on property taxes is crucial for long-term financial planning.

How are property taxes calculated in Ventura County?

+Property taxes in Ventura County are calculated based on the assessed value of the property, which is determined by the County Assessor’s Office. The primary tax rate is 1%, as mandated by Proposition 13, with additional levies imposed by local governments and special districts. The assessed value cannot increase by more than 2% annually unless there is a change in ownership or new construction.

Are there any tax exemptions in Ventura County?

+Yes, Ventura County offers several tax exemptions. Homeowners aged 55 and older can transfer their assessed value to a new home within the county. Disabled veterans and survivors of military personnel may also be eligible for exemptions. It’s advisable to consult with the County Assessor’s Office or a tax professional for specific details.

What payment options are available for property taxes?

+Ventura County offers various payment options for property taxes. Homeowners can pay in full or opt for two equal installments, due in February and November. Online payment portals and automated payment plans are available. Late payments may incur penalties and interest, so it’s important to stay informed about due dates.