Sales Tax Westchester Ny

Understanding sales tax in Westchester County, New York, is crucial for both businesses and consumers. This region, nestled in the heart of the Hudson Valley, has a unique sales tax structure that differs from other parts of the state. In this comprehensive guide, we will delve into the specifics of sales tax in Westchester, exploring the rates, applicable goods and services, and the steps businesses and individuals need to take to comply with tax regulations.

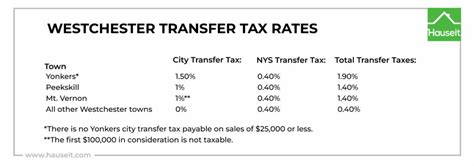

Sales Tax Rates in Westchester County

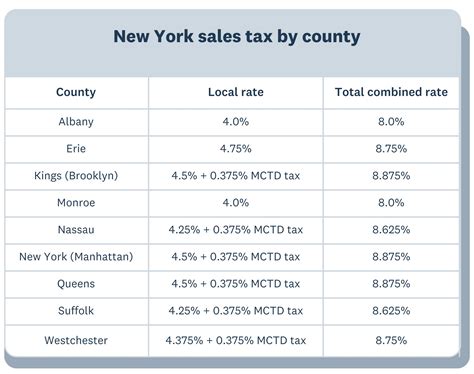

The sales tax rate in Westchester County consists of a combination of state, county, and local taxes. As of the most recent data, the current sales tax rate in Westchester is 8.875%, which is above the average sales tax rate in New York State.

This rate is made up of several components:

- New York State Sales Tax: The base sales tax rate set by the state is 4%.

- Westchester County Sales Tax: An additional 0.375% is added by Westchester County, bringing the total to 4.375%.

- Local Sales Tax: Various local jurisdictions within Westchester County may also impose their own sales taxes. These can vary depending on the municipality, and they are often 0.5% or 1% in addition to the county tax.

For instance, in the city of White Plains, the total sales tax rate is 8.375%, which includes the state, county, and a local tax of 0.5%. On the other hand, in towns like Mount Kisco and Cortlandt, the local sales tax is 1%, resulting in a total sales tax rate of 8.875%.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| New York State | 4% |

| Westchester County | 0.375% |

| White Plains | 0.5% |

| Mount Kisco | 1% |

| Cortlandt | 1% |

| Total | 8.875% |

It's important to note that sales tax rates are subject to change, and it's advisable to check for the most up-to-date information with the New York State Department of Taxation and Finance before making significant purchases.

Goods and Services Subject to Sales Tax

In Westchester County, a wide range of goods and services are subject to sales tax. This includes tangible personal property, such as clothing, electronics, furniture, and vehicles. Additionally, certain services, like repair and installation work, are also taxed.

Some specific examples of taxable items and services in Westchester include:

- Groceries (except for unprepared foods)

- Restaurant meals and catering services

- Hotel and lodging accommodations

- Automotive repairs and maintenance

- Haircuts and salon services

- Sporting goods and recreational equipment

- Artwork and collectibles

However, there are also numerous exemptions to sales tax. For instance, certain medical devices, prescription drugs, and educational materials are typically exempt from sales tax. It's crucial for businesses and consumers alike to be aware of these exemptions to ensure compliance with the law.

Exemptions and Special Cases

Westchester County, like other parts of New York, offers exemptions for specific goods and services. These exemptions can vary depending on the nature of the item or the circumstances of the purchase.

- Prescription Medications: Sales tax is not applied to the purchase of prescription drugs, as they are considered medical necessities.

- Clothing and Shoes: While clothing is generally taxable, there are exceptions. Items of clothing and footwear costing less than $110 per item are exempt from sales tax in New York State.

- Food and Beverages: Prepared foods and beverages sold in restaurants or catering services are taxable. However, unprepared foods, such as those purchased at grocery stores, are exempt from sales tax.

- Educational Materials: Books, maps, globes, and other educational materials are often exempt from sales tax, especially when purchased for educational institutions.

Businesses in Westchester County should be well-versed in these exemptions to avoid overcharging their customers and facing potential penalties. It's a delicate balance between ensuring compliance and providing accurate pricing information to consumers.

Sales Tax Collection and Remittance

For businesses operating in Westchester County, collecting and remitting sales tax is a critical aspect of their financial responsibilities. The process involves several key steps:

Registration

All businesses that make taxable sales in Westchester County must register with the New York State Department of Taxation and Finance. This registration process ensures that the business is officially recognized as a tax-collecting entity and receives the necessary guidance and resources to comply with tax laws.

Sales Tax Calculation

Businesses are required to calculate the sales tax on each taxable transaction. This involves multiplying the sale amount by the applicable sales tax rate for the specific jurisdiction where the sale occurred. For example, if a business sells an item for 100 in White Plains, they would calculate the sales tax as follows: <strong>100 x 8.375% = $8.38.

Collection

Sales tax is typically collected at the point of sale, and it’s the responsibility of the business to ensure that the correct tax is applied and collected from the customer. This tax is then held in trust by the business until it’s remitted to the state and local authorities.

Remittance

Businesses are required to remit the collected sales tax to the New York State Department of Taxation and Finance on a regular basis. The frequency of remittance depends on the business’s sales volume. Larger businesses may be required to remit taxes monthly or even quarterly, while smaller businesses may have the option to remit taxes semi-annually or annually.

It's crucial for businesses to keep accurate records of their sales and the corresponding tax amounts. These records are essential for tax reporting and can be subject to audit by the state.

Sales Tax Audits and Penalties

The New York State Department of Taxation and Finance conducts audits to ensure that businesses are accurately collecting and remitting sales tax. Audits can be random or triggered by suspicious activity, such as inconsistent tax filings or complaints from customers.

If a business is found to be non-compliant during an audit, it may face significant penalties. These penalties can include fines, interest on unpaid taxes, and even criminal charges in severe cases of tax evasion.

To avoid these penalties, businesses should maintain meticulous records, accurately calculate and collect sales tax, and remit taxes in a timely manner. Seeking professional advice from tax consultants or accountants can also help businesses navigate the complex world of sales tax regulations.

Common Audit Findings

Audits often uncover a range of issues, including:

- Underreporting of Sales: This occurs when a business fails to report all taxable sales, resulting in an underpayment of sales tax.

- Incorrect Tax Calculations: Businesses may apply the wrong tax rate or fail to account for exemptions, leading to over- or under-collection of sales tax.

- Late Remittances: Delayed or missed tax payments can trigger penalties and interest charges.

- Lack of Records: Inadequate or missing sales records can make it difficult for auditors to verify a business's tax calculations and collections.

Being proactive and maintaining good record-keeping practices can significantly reduce the risk of audit findings and potential penalties.

Future of Sales Tax in Westchester County

The sales tax landscape in Westchester County is subject to change, influenced by various economic, political, and social factors. While it’s difficult to predict the exact trajectory, certain trends and potential developments can be anticipated.

Economic Factors

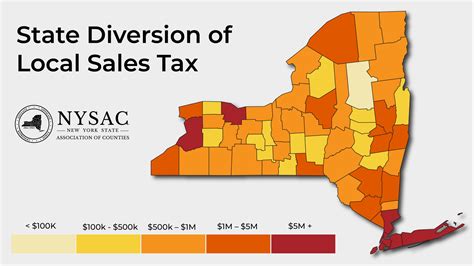

The local economy plays a significant role in shaping sales tax policies. As Westchester County continues to thrive economically, with a diverse range of industries and a strong tourism sector, the demand for public services and infrastructure improvements may lead to calls for increased tax revenue. This could potentially result in higher sales tax rates to fund these initiatives.

Political Landscape

Political decisions at the state and local levels can significantly impact sales tax rates. Elected officials may propose changes to sales tax laws to address budget shortfalls or to incentivize certain economic activities. For instance, they might consider offering sales tax holidays for specific products or providing tax incentives for businesses that invest in the local community.

Social Considerations

The needs and preferences of the local population also influence sales tax policies. For example, if there’s a strong demand for improved public transportation or environmental initiatives, sales tax revenue could be directed towards these causes. Additionally, the introduction of new technologies and e-commerce platforms may necessitate updates to sales tax regulations to ensure fair taxation practices.

In conclusion, understanding and complying with sales tax regulations in Westchester County is essential for both businesses and consumers. With a diverse range of goods and services subject to taxation, it's crucial to stay informed about the latest rates and exemptions. By staying compliant and leveraging available resources, businesses can navigate the complex world of sales tax while contributing to the economic vitality of Westchester County.

How often do sales tax rates change in Westchester County?

+Sales tax rates can change periodically, typically at the beginning of each calendar year. However, changes may also occur due to special legislative actions or local initiatives. It’s essential to stay updated with the latest information to ensure compliance.

Are there any online resources to help businesses calculate and manage sales tax in Westchester County?

+Yes, the New York State Department of Taxation and Finance provides an online Taxpayer Portal where businesses can register, file returns, and make payments. Additionally, there are several third-party software solutions that can assist with sales tax calculations and compliance.

What happens if a business overcharges a customer for sales tax by mistake?

+In such cases, it’s important for the business to promptly refund the overcharged amount to the customer. Additionally, the business should review its sales tax calculations and collection processes to prevent similar mistakes in the future.

Are there any tax incentives or exemptions for certain types of businesses in Westchester County?

+Yes, Westchester County, like other parts of New York, offers various tax incentives and exemptions to promote economic development and support specific industries. These may include tax breaks for manufacturing, research and development, or businesses that create jobs in the community. It’s advisable to consult with tax professionals to explore these opportunities.