Nebraska State Property Tax

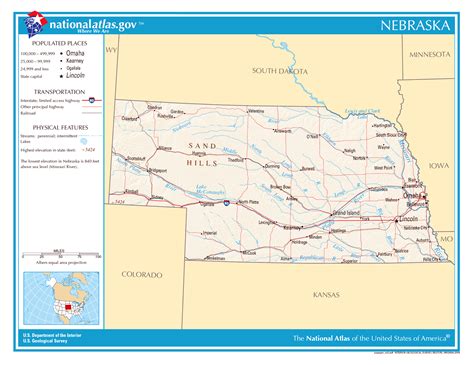

Nebraska, known for its vast landscapes and diverse communities, has a unique approach to property taxation. Understanding the intricacies of property taxes in this midwestern state is crucial for both residents and investors alike. Let's delve into the specifics of Nebraska's property tax system and explore how it impacts landowners and the state's economy.

Unraveling Nebraska’s Property Tax Landscape

Nebraska’s property tax system, while based on the fundamental principle of taxing real estate, offers a nuanced approach that considers various factors. Unlike some states with a singular property tax rate, Nebraska employs a multi-faceted strategy, taking into account the specific characteristics of each property and its location.

Assessed Value and Tax Rates

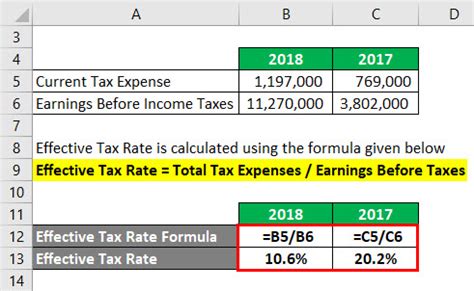

The journey towards understanding Nebraska’s property taxes begins with the concept of assessed value. This value, determined by the county assessor, is a crucial determinant in calculating the property tax liability. It’s a complex process, involving factors like property type, location, and market value fluctuations.

Once the assessed value is established, the tax rate comes into play. This rate, set by local governments, varies across Nebraska’s counties. It’s a dynamic figure, influenced by the budgetary needs of the local government and the state’s overall fiscal policies.

| County | Assessed Value | Tax Rate |

|---|---|---|

| Douglas County | $200,000 | 1.75% |

| Lancaster County | $180,000 | 1.60% |

| Sarpy County | $160,000 | 1.50% |

As illustrated above, the tax rates differ significantly between counties. This variance reflects the unique needs and fiscal responsibilities of each local government.

Exemptions and Credits

Nebraska’s property tax system is not without its relief measures. The state offers a range of exemptions and credits to alleviate the tax burden on certain property owners. These include homestead exemptions, which provide a reduction in taxable value for owner-occupied residences, and veteran exemptions, offering tax relief to those who have served in the military.

Additionally, Nebraska provides property tax credits for renewable energy systems, encouraging the adoption of sustainable practices. These credits can significantly reduce the overall tax liability for property owners who invest in renewable energy technologies.

Tax Relief Programs

To further assist Nebraska’s residents, the state has implemented several tax relief programs. The Property Tax Refund program, for instance, provides refunds to eligible homeowners, helping them offset a portion of their property tax payments. This program is particularly beneficial for low-income households, ensuring that property ownership remains accessible.

Moreover, the Property Tax Relief Credit program offers credits to renters, recognizing that property taxes indirectly impact tenants as well. This credit aims to alleviate the financial burden on renters, fostering a more equitable housing landscape.

Impact on Nebraska’s Economy and Residents

Nebraska’s property tax system plays a pivotal role in shaping the state’s economic landscape. The revenue generated from property taxes contributes significantly to local government budgets, funding essential services such as education, infrastructure development, and public safety.

Education Funding

A substantial portion of property tax revenue is allocated towards education. Nebraska’s commitment to education is evident in its funding structure, where property taxes play a crucial role. This funding ensures that schools across the state receive the necessary resources to provide quality education to students.

Infrastructure Development

Property taxes also drive infrastructure projects, enhancing the state’s roads, bridges, and public spaces. These developments not only improve the quality of life for residents but also attract businesses and investors, fostering economic growth.

For instance, the recent expansion of the Interstate 80 corridor, a significant transportation route, was largely funded through property tax revenues. This project not only benefits commuters but also facilitates the movement of goods, boosting Nebraska’s economy.

Public Safety and Services

The revenue generated from property taxes is a cornerstone of Nebraska’s public safety and service sector. It funds emergency services, law enforcement, and critical social services, ensuring the well-being and security of the state’s residents.

Future Implications and Innovations

As Nebraska navigates the evolving economic landscape, its property tax system is poised for potential reforms and innovations. With a focus on equity and efficiency, the state may explore alternatives to the current system, ensuring that property taxes remain a sustainable and fair revenue source.

Potential Reforms

One potential reform could involve a reevaluation of tax rates and exemptions. By adjusting these factors, Nebraska can ensure that the tax burden is distributed fairly across different property types and income levels. This approach would promote a more equitable tax system, benefiting both homeowners and investors.

Exploring Alternative Tax Systems

Additionally, Nebraska could consider exploring alternative tax systems, such as a land value tax or a flat tax rate. These systems, while different from the current property tax structure, have the potential to simplify tax calculations and reduce administrative burdens.

Conclusion: Navigating Nebraska’s Property Tax Terrain

Understanding Nebraska’s property tax system is essential for anyone navigating the state’s real estate market. With a multifaceted approach, Nebraska ensures that property taxes are tailored to the unique needs of each county and property owner. The system’s impact on education, infrastructure, and public services is undeniable, shaping the state’s economic and social landscape.

As Nebraska continues to evolve, its property tax system will likely undergo reforms and innovations, ensuring a fair and sustainable revenue stream for the state’s future. By staying informed about these dynamics, residents and investors can make informed decisions about property ownership and investment in Nebraska.

How often are property taxes assessed in Nebraska?

+Property taxes in Nebraska are assessed annually. The assessment process involves evaluating the property’s value, taking into account factors like location, improvements, and market conditions. This annual assessment ensures that the property tax liability is based on the most current and accurate information.

Are there any ways to reduce property taxes in Nebraska?

+Absolutely! Nebraska offers several avenues to reduce property taxes. These include homestead exemptions, which reduce the taxable value of owner-occupied residences, and property tax credits for renewable energy systems. Additionally, the state’s Property Tax Refund and Property Tax Relief Credit programs provide direct relief to homeowners and renters, respectively.

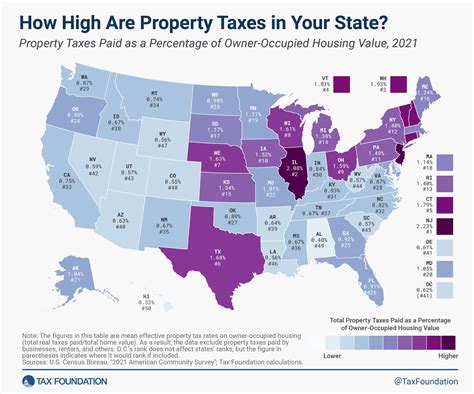

How does Nebraska’s property tax system compare to other states?

+Nebraska’s property tax system stands out for its nuanced approach, considering various factors such as property type, location, and market value. While some states have a single tax rate, Nebraska’s system is more flexible, allowing for variations across counties. This flexibility ensures that local needs and circumstances are taken into account, making it a unique model among state property tax systems.