Missouri Personal Property Tax

Missouri's personal property tax is a significant aspect of the state's revenue generation system, impacting both individuals and businesses. This tax is applied to various tangible assets owned by individuals and businesses, contributing to the state's overall tax structure. Understanding the intricacies of this tax is crucial for Missouri residents and businesses to ensure compliance and optimize their financial strategies.

Understanding Missouri’s Personal Property Tax

The personal property tax in Missouri is levied on tangible personal property, which includes a wide range of assets. These assets can be anything from vehicles and machinery to furniture and equipment. The tax is a crucial source of revenue for the state, counties, and municipalities, and it plays a vital role in funding essential public services and infrastructure development.

Unlike some other states, Missouri's personal property tax is not limited to businesses alone. Individuals are also responsible for paying this tax on their personal assets. This inclusive approach ensures a broader base for tax revenue, contributing to the state's fiscal stability.

Taxable Assets and Exclusions

The scope of taxable personal property in Missouri is extensive, encompassing a wide range of tangible assets. These include vehicles such as cars, trucks, and motorcycles, as well as various types of machinery and equipment used in businesses. Additionally, personal property tax extends to household items like furniture and appliances, making it an all-encompassing tax on personal belongings.

However, it's important to note that not all personal property is subject to this tax. Certain exclusions apply, such as inventory held for sale or lease, as well as certain types of agricultural equipment and tools. Additionally, personal property that is integral to the production of electricity, including generating plants and transmission lines, is exempt from this tax.

Furthermore, the tax does not apply to intangible assets like stocks, bonds, and intellectual property. These exclusions are designed to encourage investment and innovation, while ensuring that the tax burden is fairly distributed among Missouri residents and businesses.

| Taxable Assets | Exclusions |

|---|---|

| Vehicles (cars, trucks, motorcycles) | Inventory for sale or lease |

| Machinery and Equipment | Agricultural Equipment (certain types) |

| Household Items (furniture, appliances) | Tools used in agricultural production |

| Business Assets (computers, office furniture) | Electricity generation and transmission assets |

Tax Assessment and Valuation

The assessment and valuation process for Missouri’s personal property tax is a critical aspect of the tax system. It ensures that the tax burden is distributed fairly among taxpayers and that the state, counties, and municipalities receive adequate revenue for essential services.

Assessment Process

The assessment process begins with the identification and classification of taxable personal property. This is typically done by local assessors, who are responsible for determining the value of the property for tax purposes. The assessors consider various factors, including the age, condition, and market value of the assets, to arrive at a fair assessment.

Once the property is assessed, the assessor's office issues a tax notice to the property owner. This notice details the assessed value of the property and the corresponding tax amount. The property owner has the right to appeal the assessment if they believe it is inaccurate or unfair.

Valuation Methods

Missouri employs several valuation methods to determine the taxable value of personal property. These methods include the cost approach, income approach, and market approach. The cost approach considers the original cost of the property, depreciation, and any improvements made. The income approach focuses on the income-generating potential of the property, while the market approach looks at recent sales of similar properties to determine value.

For vehicles, the state uses a specific valuation schedule based on the vehicle's make, model, and year. This schedule is updated annually to reflect changes in the market value of vehicles. For other types of personal property, such as machinery and equipment, the state often relies on the cost approach, taking into account the original cost and any depreciation.

It's important to note that the valuation process is not a one-size-fits-all approach. Different types of personal property may be valued using different methods, and the assessor's office has the discretion to choose the most appropriate method based on the nature of the property.

| Valuation Method | Description |

|---|---|

| Cost Approach | Considers original cost, depreciation, and improvements |

| Income Approach | Focuses on income-generating potential |

| Market Approach | Relies on recent sales of similar properties |

Tax Rates and Exemptions

The tax rate for Missouri’s personal property tax varies depending on the location of the property. The state sets a base rate, which can be modified by counties and municipalities. This flexibility allows local governments to tailor the tax rate to their specific needs and revenue requirements.

Certain types of personal property are exempt from the tax. These exemptions are designed to provide relief to specific groups or to encourage certain activities. For example, personal property used exclusively for religious worship or educational purposes is often exempt. Additionally, certain agricultural property and property owned by charitable organizations may be exempt from this tax.

Tax Compliance and Administration

Compliance with Missouri’s personal property tax is a critical aspect of responsible citizenship and business ownership. The tax system is designed to be fair and transparent, but it requires active participation from taxpayers to ensure accurate reporting and timely payment.

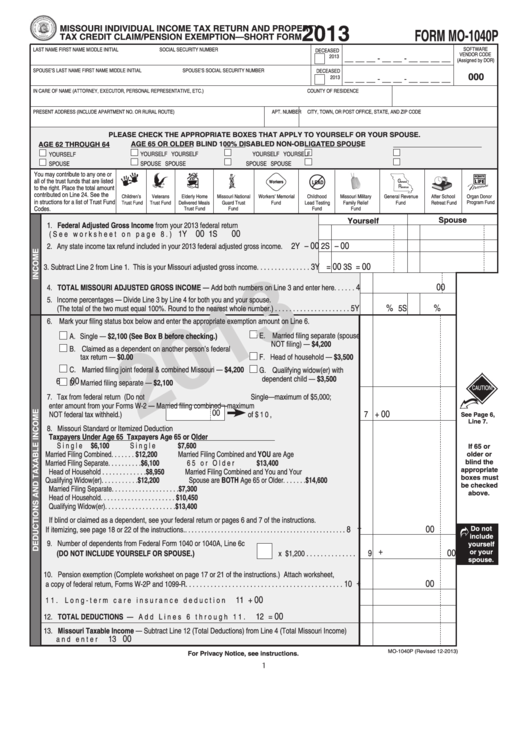

Reporting Requirements

Missouri requires taxpayers to report their personal property annually. This reporting is typically done through a personal property tax return, which must be filed by a specific deadline. The return includes detailed information about the taxpayer’s personal property, such as the type, value, and location of the assets.

For businesses, the reporting process is more complex, as they often have a larger number of assets and more diverse types of personal property. Business owners must ensure that they accurately report all taxable assets, including those used in their operations, to avoid penalties and ensure compliance.

Payment and Penalties

Personal property taxes in Missouri are typically due by a specific date, which varies depending on the location of the property. Failure to pay the tax by the due date may result in penalties and interest, which can accumulate over time. It’s important for taxpayers to be aware of these deadlines and plan their finances accordingly to avoid additional costs.

In cases of non-payment, the state may take legal action to collect the outstanding tax, including placing a lien on the property or seizing assets. It's in the best interest of taxpayers to stay informed about their tax obligations and to seek assistance if they encounter financial difficulties.

Tax Administration and Assistance

The Missouri Department of Revenue is responsible for administering the personal property tax system. They provide resources and guidance to taxpayers to ensure compliance and facilitate the tax payment process. This includes offering online filing and payment options, as well as providing detailed instructions and forms for reporting personal property.

For taxpayers who require assistance, the Department of Revenue offers a range of support services. This includes answering questions about the tax system, providing guidance on filing and payment, and offering assistance to those who may be facing financial hardship.

Additionally, the state encourages taxpayers to take advantage of tax incentives and credits, which can reduce the overall tax burden. These incentives may include deductions for certain types of personal property or tax credits for specific activities, such as investing in renewable energy.

Impact and Future Considerations

Missouri’s personal property tax plays a significant role in the state’s economy and revenue generation. It provides a stable source of funding for public services, infrastructure development, and essential government operations. The tax system is designed to be fair and equitable, ensuring that the tax burden is distributed across individuals and businesses.

Economic Impact

The personal property tax has a direct impact on the economy by influencing investment decisions and business operations. For businesses, the tax can affect their bottom line and impact their financial planning. A well-designed and transparent tax system can encourage investment and economic growth, while a complex or burdensome system may deter businesses from operating in the state.

For individuals, the tax can affect their disposable income and financial planning. The tax burden, when balanced with other taxes and costs, can influence where individuals choose to live and work. A fair and predictable tax system can enhance the state's attractiveness as a place to live and do business.

Future Considerations

As Missouri’s economy and population continue to evolve, the state must consider future adjustments to its personal property tax system. This includes regular reviews of tax rates, valuation methods, and exemptions to ensure the system remains fair and effective.

The state should also consider the impact of technological advancements and changes in business practices. For example, the rise of e-commerce and remote work may impact the types of personal property subject to taxation. The state must adapt its tax system to ensure it remains relevant and effective in the digital age.

Additionally, Missouri should continue to explore tax incentives and credits to encourage specific behaviors and activities. This could include incentives for investing in renewable energy, supporting local businesses, or promoting economic development in underserved areas. By offering targeted incentives, the state can encourage desired behaviors while maintaining a fair and balanced tax system.

Conclusion

Missouri’s personal property tax is a vital part of the state’s revenue generation system, impacting individuals and businesses alike. Understanding the intricacies of this tax, from taxable assets and valuation methods to compliance and future considerations, is crucial for all Missouri residents and businesses.

By ensuring compliance and contributing to the state's fiscal health, taxpayers play a crucial role in the provision of essential public services and the overall well-being of the state. Missouri's personal property tax system, when effectively managed and adapted to changing economic conditions, can contribute to a thriving and prosperous state.

Frequently Asked Questions

What types of personal property are taxable in Missouri?

+

In Missouri, a wide range of tangible personal property is taxable, including vehicles, machinery, equipment, furniture, and appliances. However, certain exclusions apply, such as inventory held for sale or lease, agricultural equipment, and electricity generation assets.

How is the value of personal property determined for tax purposes?

+

Missouri uses various valuation methods, including the cost approach, income approach, and market approach. The specific method used depends on the type of personal property. For vehicles, a specific valuation schedule based on make, model, and year is applied.

Are there any tax exemptions or incentives for personal property in Missouri?

+

Yes, Missouri offers certain exemptions and incentives. For example, personal property used exclusively for religious worship or educational purposes is often exempt. Additionally, there may be tax credits or deductions available for specific activities, such as investing in renewable energy.

What happens if I fail to pay my personal property taxes in Missouri?

+

Failure to pay personal property taxes can result in penalties and interest. In some cases, the state may take legal action to collect the outstanding tax, including placing a lien on the property or seizing assets. It’s important to stay informed about payment deadlines and seek assistance if needed.

Where can I find more information about Missouri’s personal property tax system and compliance requirements?

+

The Missouri Department of Revenue provides extensive resources and guidance on its website. This includes information on tax rates, valuation methods, exemptions, reporting requirements, and payment options. The department also offers assistance to taxpayers who need help understanding their obligations.