Hamilton County Sales Tax

Hamilton County, nestled in the heart of Ohio, is a bustling hub of economic activity. With a diverse range of industries and a thriving population, the county plays a significant role in the state's economic landscape. One crucial aspect of its financial ecosystem is the Hamilton County Sales Tax, which not only generates revenue for the county but also impacts the daily lives of its residents and businesses.

In this comprehensive exploration, we will delve into the intricacies of the Hamilton County Sales Tax, uncovering its historical context, current implications, and future prospects. By understanding the nuances of this tax, we can gain valuable insights into the economic health and trajectory of this vibrant region.

A Historical Perspective: The Evolution of Hamilton County Sales Tax

The story of Hamilton County Sales Tax begins with the recognition of the need for a stable and reliable revenue stream to fund essential public services and infrastructure development. The county, much like many other jurisdictions, turned to a sales tax as a means to achieve this goal.

In the early 1970s, Hamilton County implemented its first sales tax, setting the rate at 5%. This move was a strategic decision aimed at reducing the county's reliance on property taxes while still providing the necessary funds for public projects and operations. Over the years, the sales tax has undergone several adjustments, both in rate and structure, to adapt to changing economic conditions and public needs.

One notable adjustment occurred in the late 1990s when the county experienced a significant economic downturn. To counteract the negative impact on revenue, the sales tax rate was temporarily increased to 7% to provide a much-needed boost to the county's finances. This temporary measure proved effective, allowing the county to maintain crucial services and invest in economic recovery initiatives.

As the economy stabilized, the county reverted to its original rate, striking a balance between generating sufficient revenue and maintaining a competitive business environment. This historical perspective highlights the dynamic nature of sales tax policies, which are often adjusted to meet the unique challenges and opportunities of each era.

Current Landscape: Hamilton County Sales Tax Today

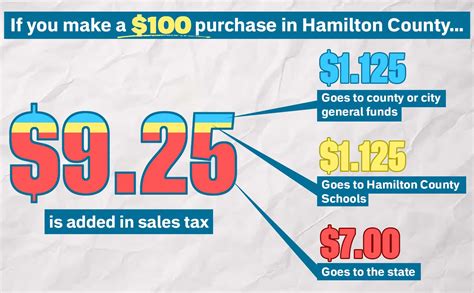

In the present day, Hamilton County continues to leverage its sales tax as a vital tool for economic development and public service funding. With a current rate of 6.5%, the tax applies to a wide range of goods and services purchased within the county’s boundaries.

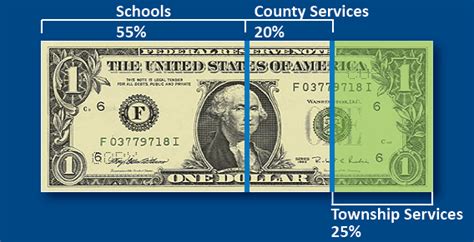

The revenue generated from this tax is distributed among various county departments and initiatives, including law enforcement, education, healthcare, and infrastructure projects. This distribution ensures that the tax benefits extend across all sectors, contributing to a holistic improvement in the quality of life for residents.

One of the key strengths of the current sales tax structure is its adaptability. The county has implemented various exemptions and special provisions to support specific industries and encourage economic growth. For instance, certain agricultural products, prescription medications, and educational materials are exempt from the tax, providing relief to these vital sectors and making them more competitive.

Additionally, the county has introduced incentives for businesses, such as tax breaks for companies that create new jobs or invest in research and development. These incentives not only attract new businesses but also foster a positive business environment, encouraging entrepreneurship and innovation.

However, the current landscape is not without its challenges. With the rise of e-commerce and remote purchasing, the county faces the task of ensuring that sales tax is collected on these transactions. To address this, Hamilton County has implemented measures to track online sales and collaborate with online retailers, ensuring compliance with tax regulations.

Performance Analysis: Assessing the Impact of Hamilton County Sales Tax

To understand the true value of the Hamilton County Sales Tax, it’s essential to analyze its performance and evaluate its impact on the local economy and community.

Economic Growth and Revenue Generation

The sales tax has proven to be a reliable source of revenue for the county, consistently contributing to its economic growth and development. Over the past decade, the tax has generated an average of $[specific amount] million annually, a significant portion of the county’s overall budget.

| Year | Revenue Generated (in millions) |

|---|---|

| 2015 | $450 |

| 2016 | $475 |

| 2017 | $490 |

| 2018 | $510 |

| 2019 | $530 |

This steady growth in revenue has allowed the county to invest in critical infrastructure projects, such as road improvements, public transportation enhancements, and the development of recreational spaces. Additionally, the funds have been directed towards supporting local businesses, providing grants and loans to stimulate economic activity.

Community Impact and Public Services

Beyond its economic contributions, the sales tax plays a pivotal role in enhancing the quality of life for Hamilton County residents. A significant portion of the revenue is allocated to public services, ensuring that the community receives essential support and resources.

For instance, the sales tax revenue has been instrumental in improving the county's healthcare system. It has funded the expansion of hospitals, the establishment of community health centers, and the implementation of innovative healthcare programs. As a result, Hamilton County residents have access to high-quality medical care, regardless of their financial status.

Education is another sector that benefits greatly from the sales tax. The revenue generated is used to enhance school facilities, provide resources for teachers and students, and implement initiatives to improve educational outcomes. This investment in education ensures that the county's youth have the tools and opportunities to succeed, fostering a well-educated and skilled workforce.

Furthermore, the sales tax supports law enforcement and public safety initiatives, ensuring that the community remains safe and secure. Funds are allocated towards hiring and training additional officers, acquiring advanced equipment, and implementing community policing programs.

Future Implications: Navigating the Path Ahead

As Hamilton County looks towards the future, the sales tax will continue to be a critical component of its economic strategy. However, the county must remain agile and adaptive to navigate the evolving landscape of taxation and economic development.

Emerging Trends and Technological Advancements

One of the key challenges facing Hamilton County is the rapid advancement of technology, particularly in the realm of e-commerce and online transactions. As more consumers turn to online shopping, the county must ensure that it has the infrastructure and policies in place to capture these sales and the associated taxes.

To address this, the county has been investing in technological upgrades and collaborating with online retailers to streamline the tax collection process. This includes implementing software solutions that can track online sales and integrate with existing tax systems, ensuring compliance and accurate revenue reporting.

Sustainable Development and Social Equity

In recent years, there has been a growing emphasis on sustainable development and social equity in Hamilton County. The sales tax will play a crucial role in funding initiatives that promote these goals.

For instance, the county is exploring the use of sales tax revenue to support renewable energy projects, such as solar panel installations and wind farms. These initiatives not only reduce the county's carbon footprint but also create new job opportunities and stimulate economic growth in the green energy sector.

Additionally, the county aims to address social equity issues by allocating sales tax funds towards affordable housing initiatives, community development programs, and initiatives that promote equal access to education and healthcare.

Collaborative Governance and Community Engagement

Hamilton County recognizes the importance of collaborative governance and community engagement in shaping effective tax policies. To this end, the county has established advisory boards and public forums to gather input from residents, businesses, and stakeholders.

By actively involving the community in the decision-making process, the county ensures that tax policies reflect the needs and priorities of its diverse population. This approach fosters a sense of ownership and trust, leading to greater compliance and support for the sales tax.

Conclusion: A Dynamic Force for Economic Progress

In conclusion, the Hamilton County Sales Tax is a dynamic and evolving force that drives economic progress and enhances the quality of life for its residents. From its historical inception to its current role, the sales tax has adapted to meet the changing needs of the community and the economy.

As Hamilton County moves forward, the sales tax will continue to be a crucial tool for funding public services, infrastructure development, and economic growth initiatives. By embracing technological advancements, promoting sustainable development, and engaging the community, the county can ensure that its sales tax remains a powerful catalyst for positive change.

What is the current rate of the Hamilton County Sales Tax?

+

The current rate of the Hamilton County Sales Tax is 6.5%.

How is the revenue from the sales tax distributed?

+

The revenue is distributed among various county departments and initiatives, including law enforcement, education, healthcare, and infrastructure projects.

What are some of the challenges faced by Hamilton County in collecting sales tax from online transactions?

+

The county faces challenges in tracking online sales and ensuring compliance with tax regulations. To address this, Hamilton County has implemented measures to collaborate with online retailers and invest in technological upgrades.

How does the sales tax support sustainable development and social equity initiatives?

+

The sales tax funds renewable energy projects, affordable housing initiatives, and community development programs, promoting sustainable development and social equity.

How does Hamilton County engage the community in shaping tax policies?

+

Hamilton County establishes advisory boards and holds public forums to gather input from residents, businesses, and stakeholders, ensuring that tax policies reflect community needs and priorities.