Is Fein Same As Tax Id

Understanding the distinction between different identification systems is crucial, especially when dealing with financial and legal matters. In the context of business and taxation, the terms "Fein" and "Tax ID" are often used interchangeably, but they refer to slightly different concepts. Let's delve into the specifics to provide a comprehensive understanding.

What is a Fein Number?

A Fein number, which stands for Federal Employer Identification Number, is a unique nine-digit identifier assigned to businesses by the Internal Revenue Service (IRS) in the United States. It serves as a means to identify a business entity for tax purposes. Every business, regardless of its legal structure or size, requires a Fein number if it has employees, operates as a corporation, or engages in specific activities that necessitate tax reporting.

Fein numbers are essential for various business operations, including payroll tax reporting, filing tax returns, opening business bank accounts, applying for loans or permits, and establishing credit. They ensure that businesses can be easily identified and tracked by the IRS, facilitating accurate tax administration and compliance.

The Role of Tax ID Numbers

A Tax ID number, or Taxpayer Identification Number, is a broader term encompassing several types of identification used for tax purposes. While the Fein number is a specific type of Tax ID, there are other variations as well.

The most common Tax ID numbers include:

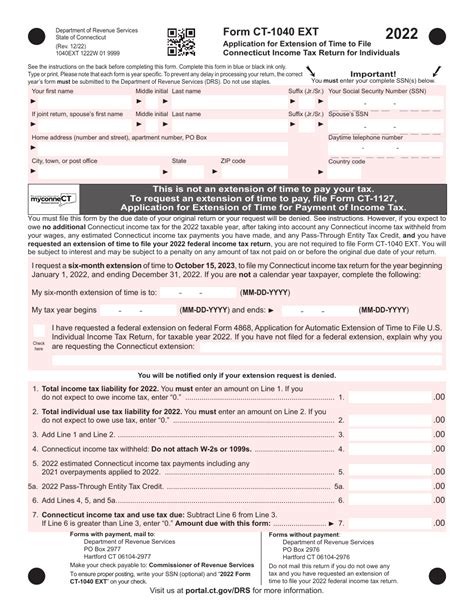

- Social Security Number (SSN): A nine-digit number issued to U.S. citizens, permanent residents, and eligible non-citizens by the Social Security Administration. It is used for personal tax purposes and is often required when opening bank accounts, applying for credit, and for employment.

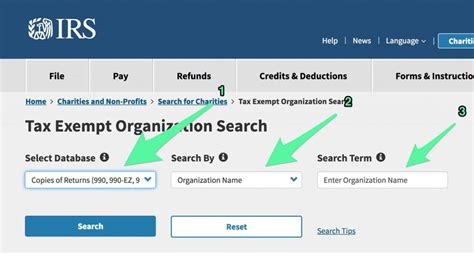

- Individual Taxpayer Identification Number (ITIN): A processing code issued by the IRS to individuals who are required to have a U.S. taxpayer identification number but do not qualify for an SSN. This includes foreign nationals and their spouses, as well as dependents of foreign nationals.

- Employer Identification Number (EIN): Synonymous with the Fein number, this is assigned to businesses by the IRS. It is used to identify the business entity for tax purposes and is necessary for entities with employees, certain partnerships, corporations, and trusts.

The Difference: Fein vs. Tax ID

While the terms “Fein” and “Tax ID” are often used interchangeably, there is a subtle difference in their scope. A Fein number is a specific type of Tax ID, tailored for business entities. It is primarily used for business tax reporting and identification. On the other hand, the term “Tax ID” encompasses a broader range of identification numbers used for both personal and business tax purposes.

In summary, every business in the United States should have a Fein number if it meets certain criteria, such as having employees or being structured as a corporation. However, when referring to personal tax identification, the term "Tax ID" is more appropriate, as it can refer to an SSN or ITIN, depending on the individual's circumstances.

Importance of Accurate Identification

Proper identification is crucial for both individuals and businesses when it comes to tax and financial matters. Misidentification can lead to significant legal and financial consequences. For businesses, an incorrect Fein number can result in misreported taxes, delayed payments, or even penalties. Similarly, individuals using the wrong Tax ID number may face issues with tax filing, credit applications, or employment.

Therefore, it is essential to understand the specific identification requirements for your business or personal circumstances. Whether it's a Fein number for your business or an SSN for personal tax purposes, accurate identification ensures smooth financial operations and compliance with legal obligations.

Frequently Asked Questions

Can I use my Social Security Number as my Tax ID for business purposes?

+No, a Social Security Number (SSN) is intended for personal tax purposes. If you are operating a business, you need to obtain a separate Employer Identification Number (EIN), also known as a Fein number, to identify your business for tax purposes.

Do I need a Tax ID if I’m a sole proprietor with no employees?

+As a sole proprietor, you may not be required to have a separate Tax ID (EIN/Fein) if you have no employees and do not need to file specific tax forms. However, it’s essential to consult with a tax professional or the IRS to ensure you’re compliant with all relevant regulations.

What happens if I use the wrong Tax ID number on my tax forms?

+Using the wrong Tax ID number can lead to errors in tax reporting, which may result in penalties or audits. It’s crucial to double-check the accuracy of your Tax ID numbers to avoid these issues and maintain compliance with tax regulations.