Connecticut Income Tax

Connecticut's income tax system is a crucial component of the state's revenue generation, impacting the financial well-being of its residents and shaping economic policies. This article delves into the intricacies of Connecticut's income tax structure, offering a comprehensive understanding of its rates, brackets, and implications for individuals and businesses.

Understanding Connecticut’s Income Tax Structure

Connecticut, like many states in the U.S., employs a progressive income tax system, where tax rates increase as taxable income rises. This approach aims to distribute the tax burden equitably, ensuring that higher-income earners contribute a larger share of their income to the state’s revenue.

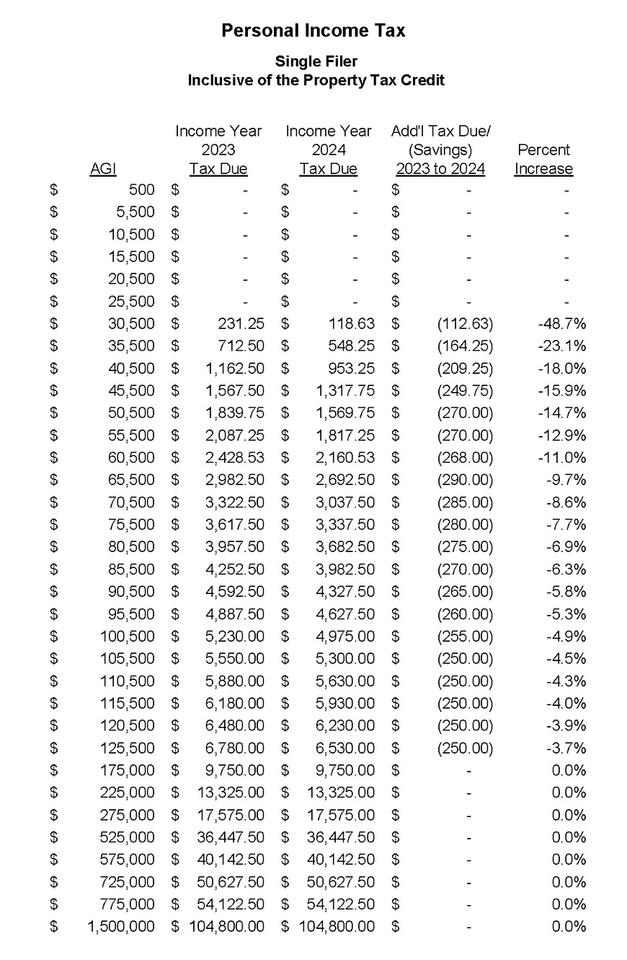

Tax Rates and Brackets

The Connecticut Department of Revenue Services (CT DRS) sets the income tax rates, which are subject to periodic adjustments to account for inflation and economic changes. As of 2023, the state income tax rates range from 3.05% to 6.99% across six tax brackets. These brackets are adjusted annually to reflect the state’s cost-of-living index, ensuring that taxpayers are not pushed into higher brackets solely due to inflation.

| Tax Rate | Income Range |

|---|---|

| 3.05% | $10,000 or less |

| 3.90% | $10,001 - $50,000 |

| 5.00% | $50,001 - $100,000 |

| 5.50% | $100,001 - $200,000 |

| 6.35% | $200,001 - $250,000 |

| 6.99% | Over $250,000 |

These rates are applicable to both single and joint filers, with the income ranges adjusted accordingly for married couples filing jointly. For instance, a married couple with a combined income of $250,000 would fall into the 6.99% tax bracket, paying taxes on their income above $250,000 at this rate.

Income Tax Calculation

The calculation of Connecticut income tax involves a straightforward process. Taxpayers multiply their taxable income by the applicable tax rate for their income bracket. For instance, if an individual’s taxable income falls between 50,000 and 100,000, they would calculate their tax liability as follows: 50,000 - 100,000 x 5.00% = 2,500 - 5,000 in state income tax.

Taxable Income and Deductions

Connecticut’s taxable income is determined by subtracting deductions and exemptions from the taxpayer’s gross income. The state offers various deductions, including those for medical and dental expenses, state and local taxes, and certain business-related expenses. Additionally, Connecticut allows itemized deductions for expenses such as mortgage interest, charitable contributions, and property taxes.

Implications for Residents and Businesses

Connecticut’s income tax system has significant implications for both residents and businesses operating within the state. For individuals, the progressive tax structure ensures that those with higher incomes contribute a larger share of their earnings to the state’s revenue, promoting economic fairness.

Impact on Residents

The income tax rates in Connecticut can influence an individual’s financial planning and decision-making. High-income earners, in particular, may consider the tax implications when deciding on their residency or investment strategies. For instance, individuals with incomes above $250,000 may explore tax-efficient investment options or consider tax-advantaged retirement plans to minimize their tax liability.

Business Considerations

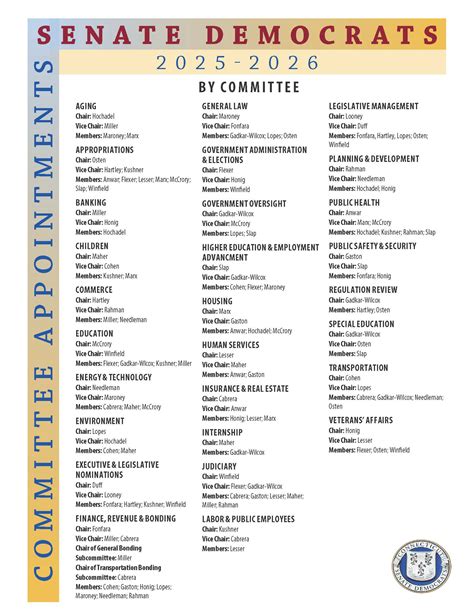

Businesses operating in Connecticut also need to consider the state’s income tax structure when planning their financial strategies. The tax rates can impact a company’s bottom line, especially for larger corporations with substantial income. To mitigate the tax burden, businesses often employ tax planning strategies, such as utilizing tax credits and incentives offered by the state.

Economic Growth and Revenue Generation

Connecticut’s income tax system plays a pivotal role in funding essential state services and infrastructure projects. The revenue generated from income taxes contributes to public education, healthcare, transportation, and other vital areas. By ensuring a robust tax base, the state can maintain a high quality of life for its residents and attract businesses and investments.

Future Outlook and Potential Changes

The Connecticut income tax system, like all state tax structures, is subject to potential changes and reforms. These changes can be driven by economic shifts, political priorities, or the need to address budget deficits. In recent years, discussions have centered around tax reform proposals, including suggestions to flatten the tax structure or introduce new brackets to simplify the system.

One notable proposal is the "Fair Tax Plan," which aims to reduce the number of tax brackets and lower the top tax rate while broadening the tax base. This plan seeks to make the tax system more transparent and predictable for taxpayers, while also ensuring a stable revenue stream for the state.

Potential Benefits and Challenges

Implementing tax reforms can bring both benefits and challenges. On the positive side, simplifying the tax structure could reduce administrative burdens for taxpayers and tax authorities, making the system more efficient. Additionally, lowering the top tax rate could incentivize high-income earners to remain in the state, boosting the economy.

However, challenges may arise in balancing the need for revenue generation with tax fairness. Lowering tax rates could lead to a reduction in state revenue, impacting essential services. As such, any proposed changes must be carefully considered and evaluated to ensure they align with the state's fiscal goals and the well-being of its residents.

How often are Connecticut’s income tax rates adjusted?

+Connecticut’s income tax rates are typically adjusted annually to account for inflation and economic changes. The adjustments are made by the Connecticut Department of Revenue Services (CT DRS) and are based on the state’s cost-of-living index.

Are there any tax incentives or credits available in Connecticut?

+Yes, Connecticut offers various tax incentives and credits to individuals and businesses. These include tax credits for research and development, job creation, and certain energy-efficient improvements. Additionally, there are tax incentives for investing in Connecticut’s distressed communities.

What is the process for filing Connecticut state income taxes?

+Connecticut state income taxes can be filed online through the CT DRS website or by mailing a paper return. The filing deadline is typically April 15th, but it can be extended under certain circumstances. The process involves calculating your taxable income, applying any deductions and credits, and paying the calculated tax amount.